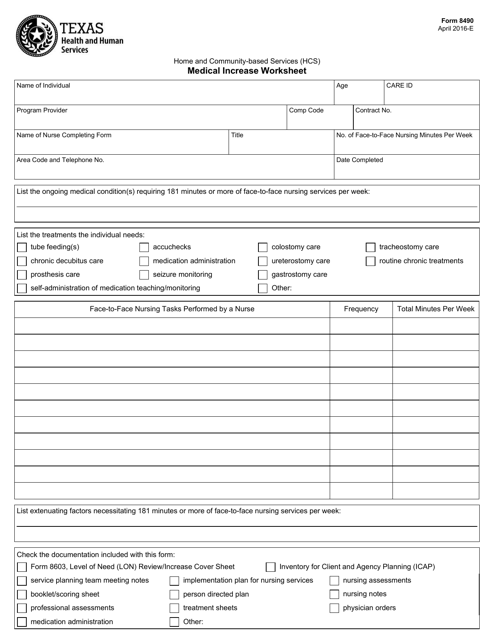

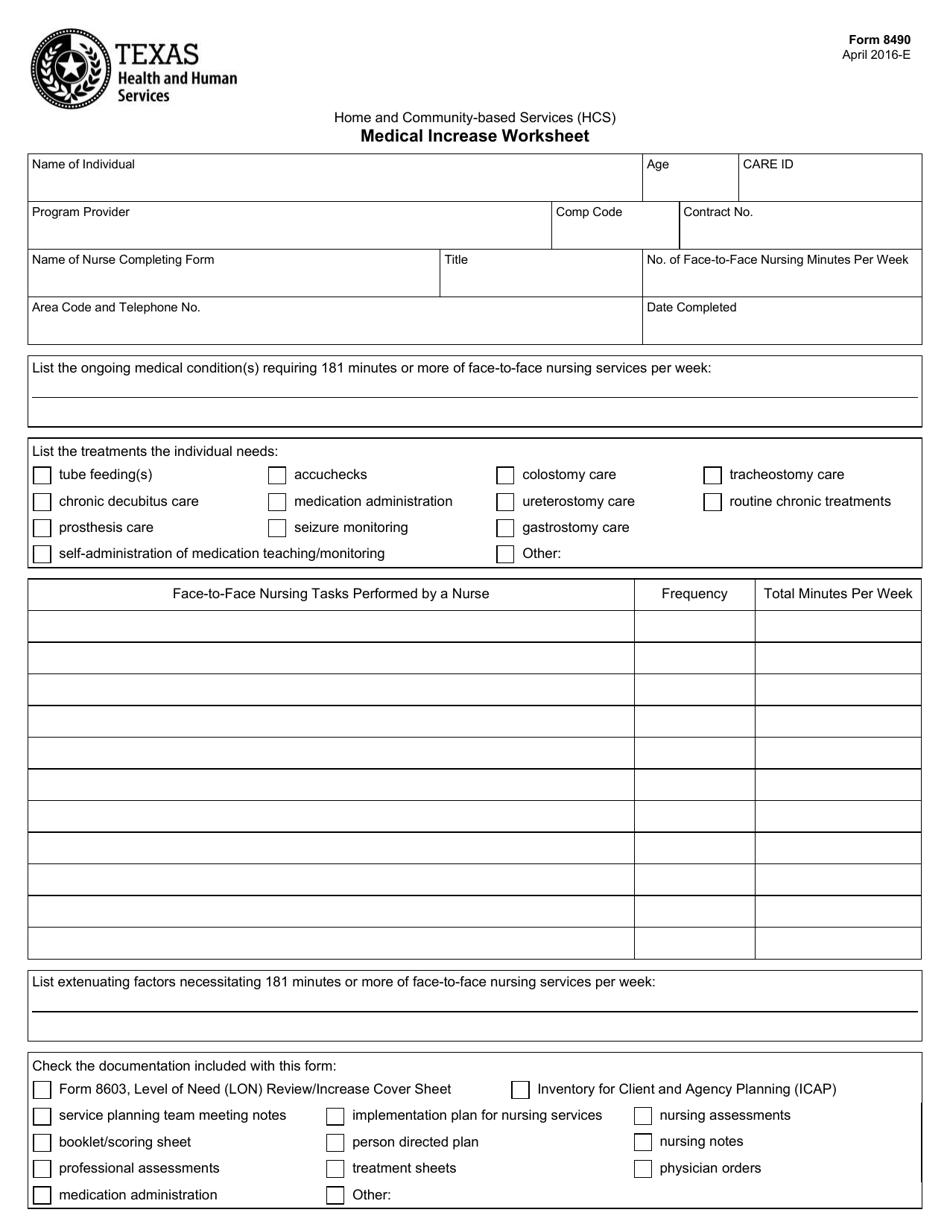

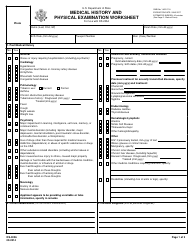

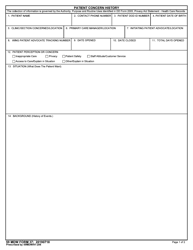

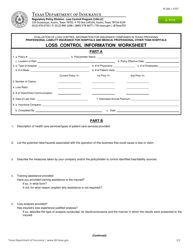

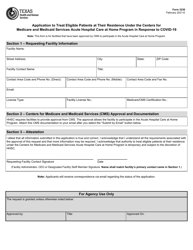

Form 8490 Medical Increase Worksheet - Texas

What Is Form 8490?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8490?

A: Form 8490 is the Medical Increase Worksheet.

Q: Is Form 8490 specific to Texas?

A: No, Form 8490 is used nationwide.

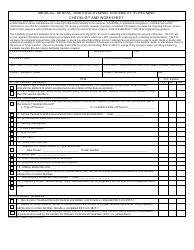

Q: What is the purpose of Form 8490?

A: The purpose of Form 8490 is to calculate the medical increase for tax purposes.

Q: Who should fill out Form 8490?

A: Form 8490 should be filled out by individuals who want to calculate their medical increase.

Q: Are there any specific instructions for filling out Form 8490?

A: Yes, the IRS provides instructions on how to fill out Form 8490.

Q: Are there any deadlines for submitting Form 8490?

A: The deadline for submitting Form 8490 is usually the same as the deadline for filing your tax return.

Q: Is Form 8490 required for everyone?

A: No, Form 8490 is only required for individuals who want to calculate their medical increase.

Q: Can Form 8490 be filed electronically?

A: Yes, Form 8490 can be filed electronically if you are e-filing your tax return.

Q: What should I do if I have questions about Form 8490?

A: If you have questions about Form 8490, you should reach out to the IRS or consult with a tax professional.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8490 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.