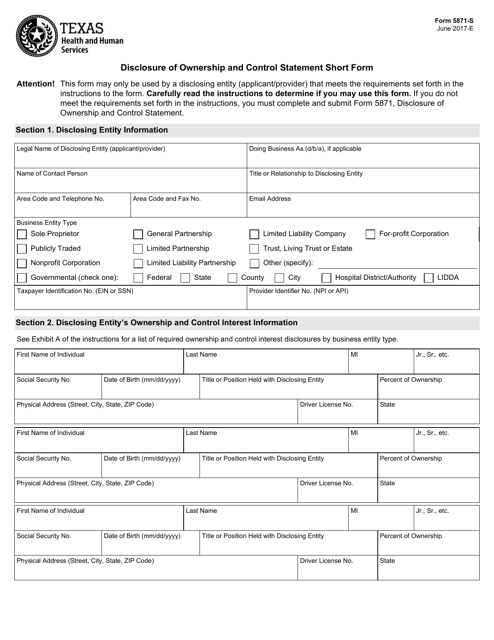

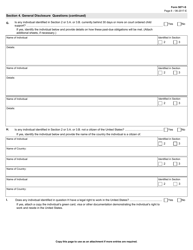

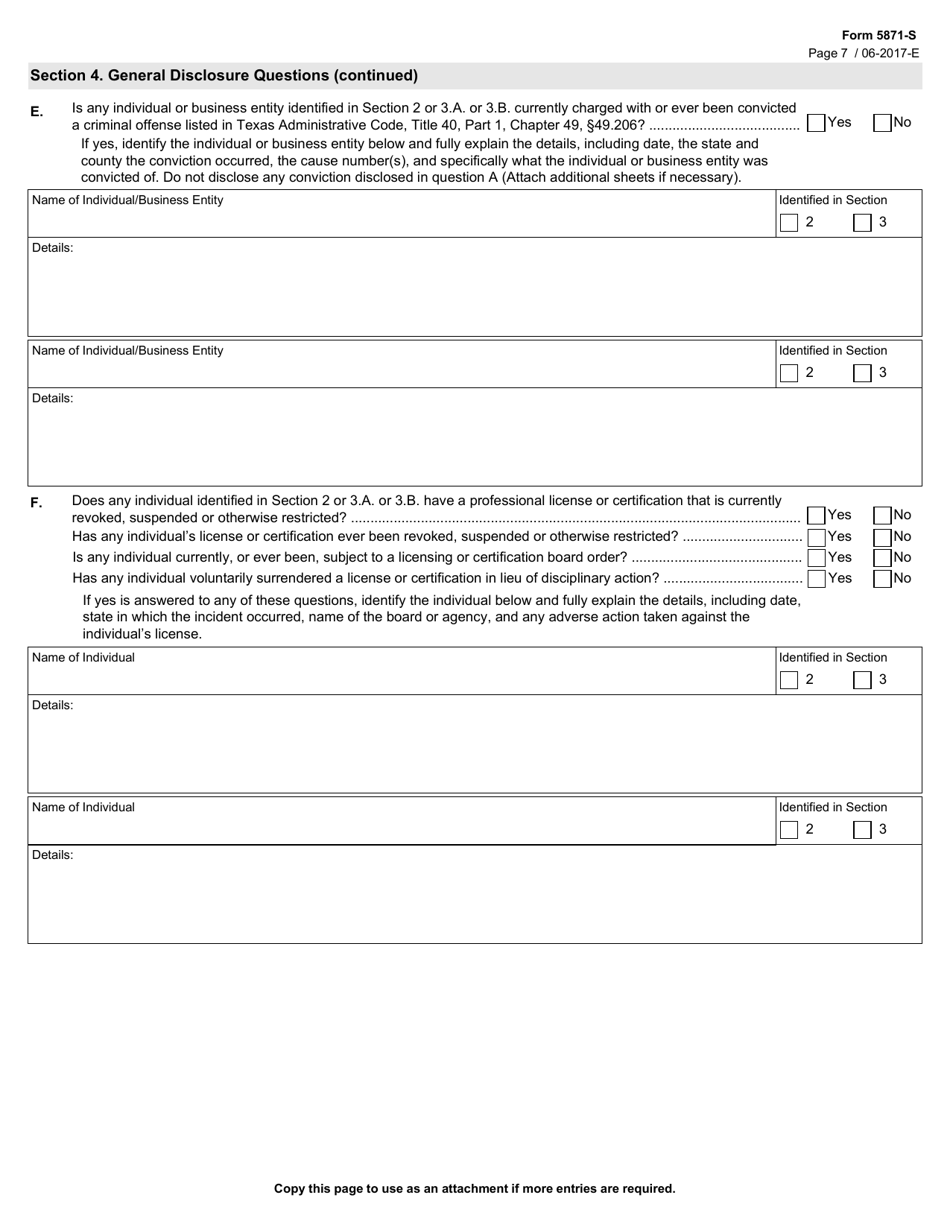

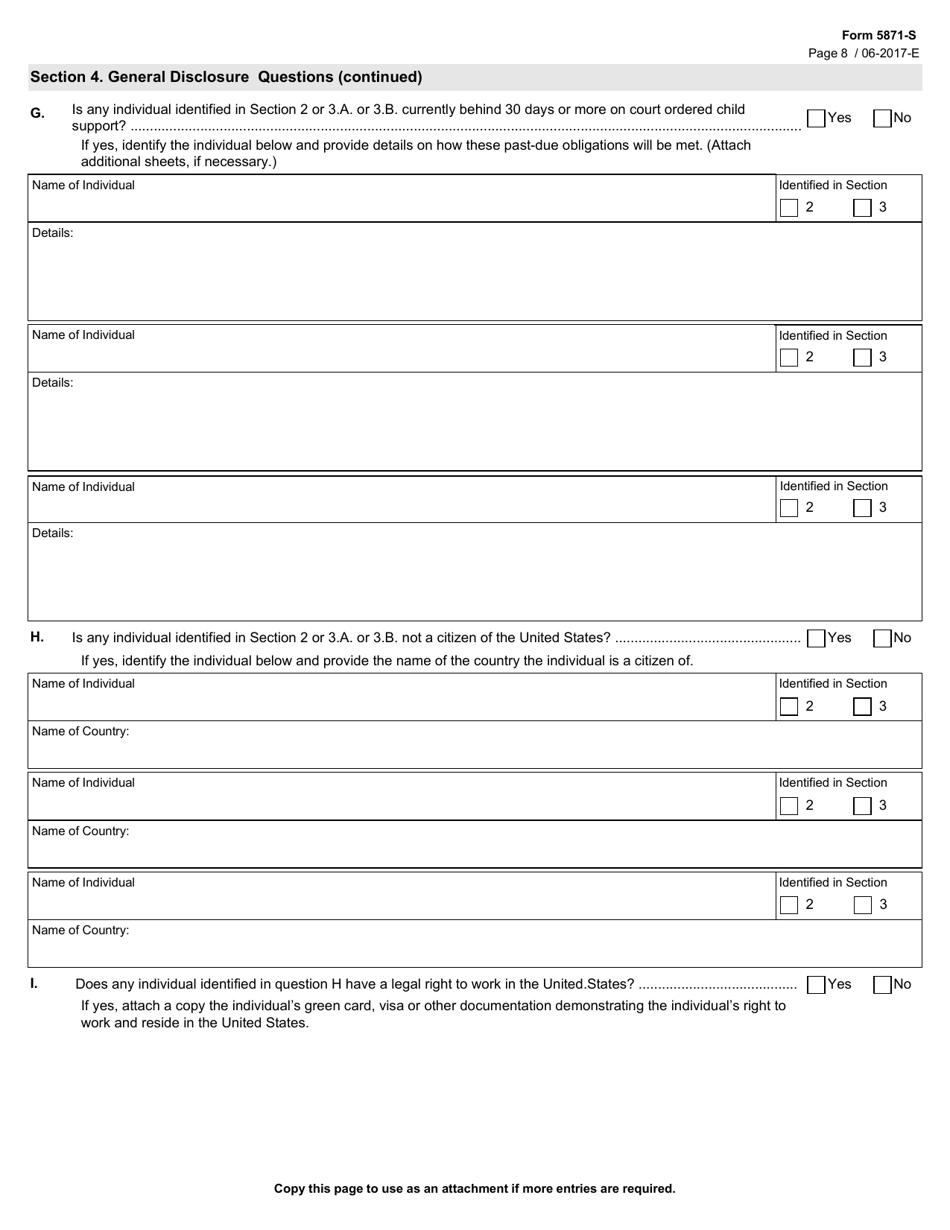

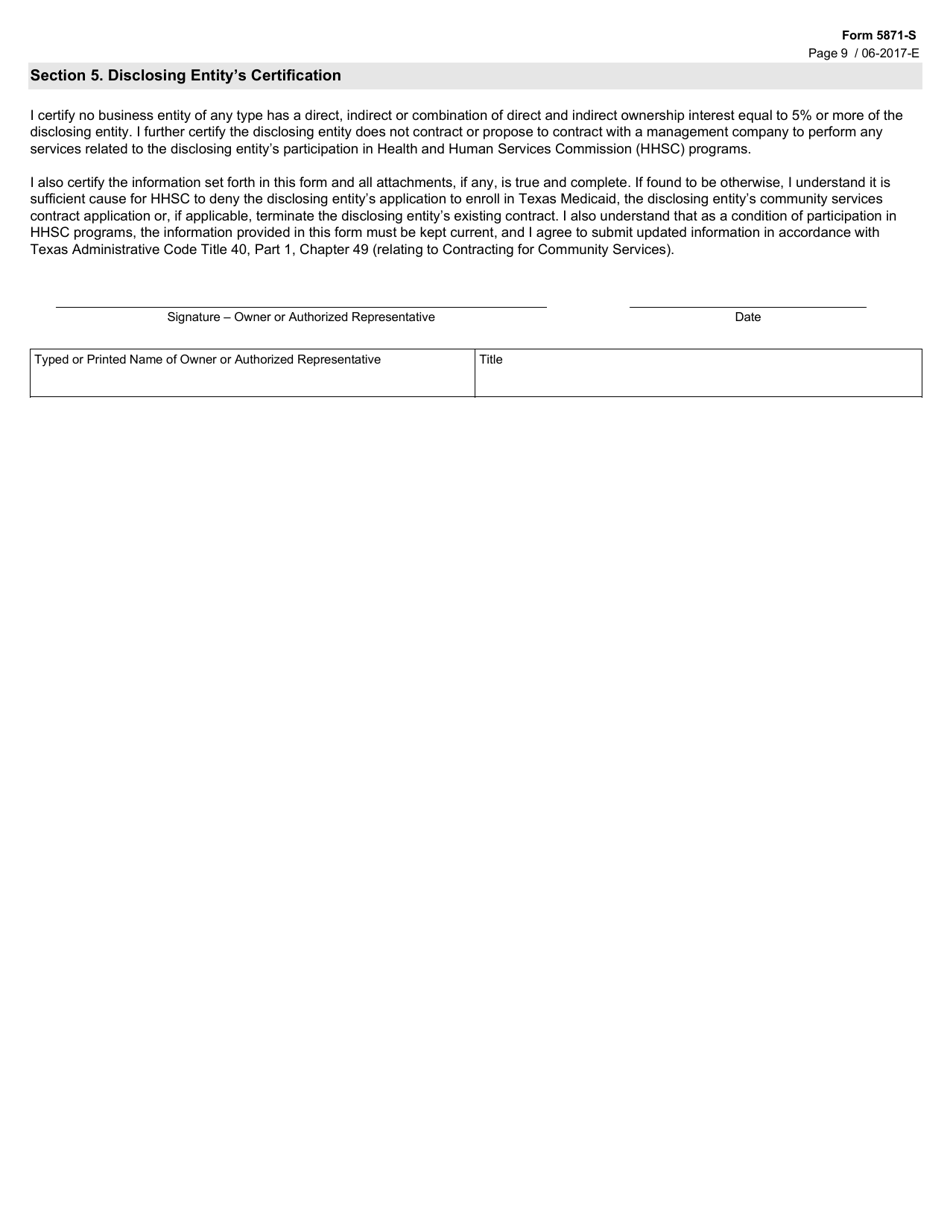

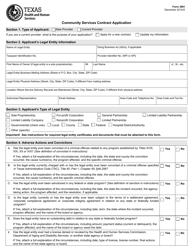

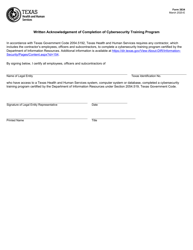

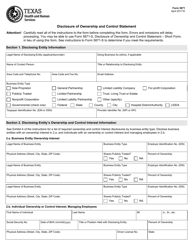

Form 5871-S Disclosure of Ownership and Control Statement Short Form - Texas

What Is Form 5871-S?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5871-S?

A: Form 5871-S is the Disclosure of Ownership and Control Statement Short Form.

Q: What is the purpose of Form 5871-S?

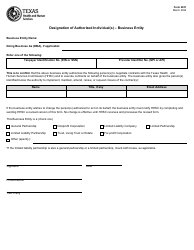

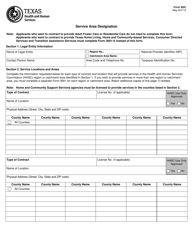

A: The purpose of Form 5871-S is to provide information about the ownership and control of a business entity.

Q: What is the jurisdiction of Form 5871-S?

A: Form 5871-S is specific to the state of Texas.

Q: Who is required to file Form 5871-S?

A: Certain business entities in Texas are required to file Form 5871-S.

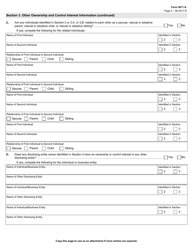

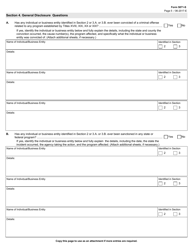

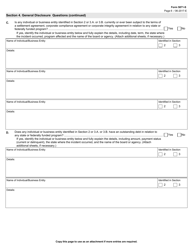

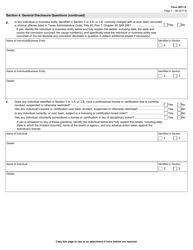

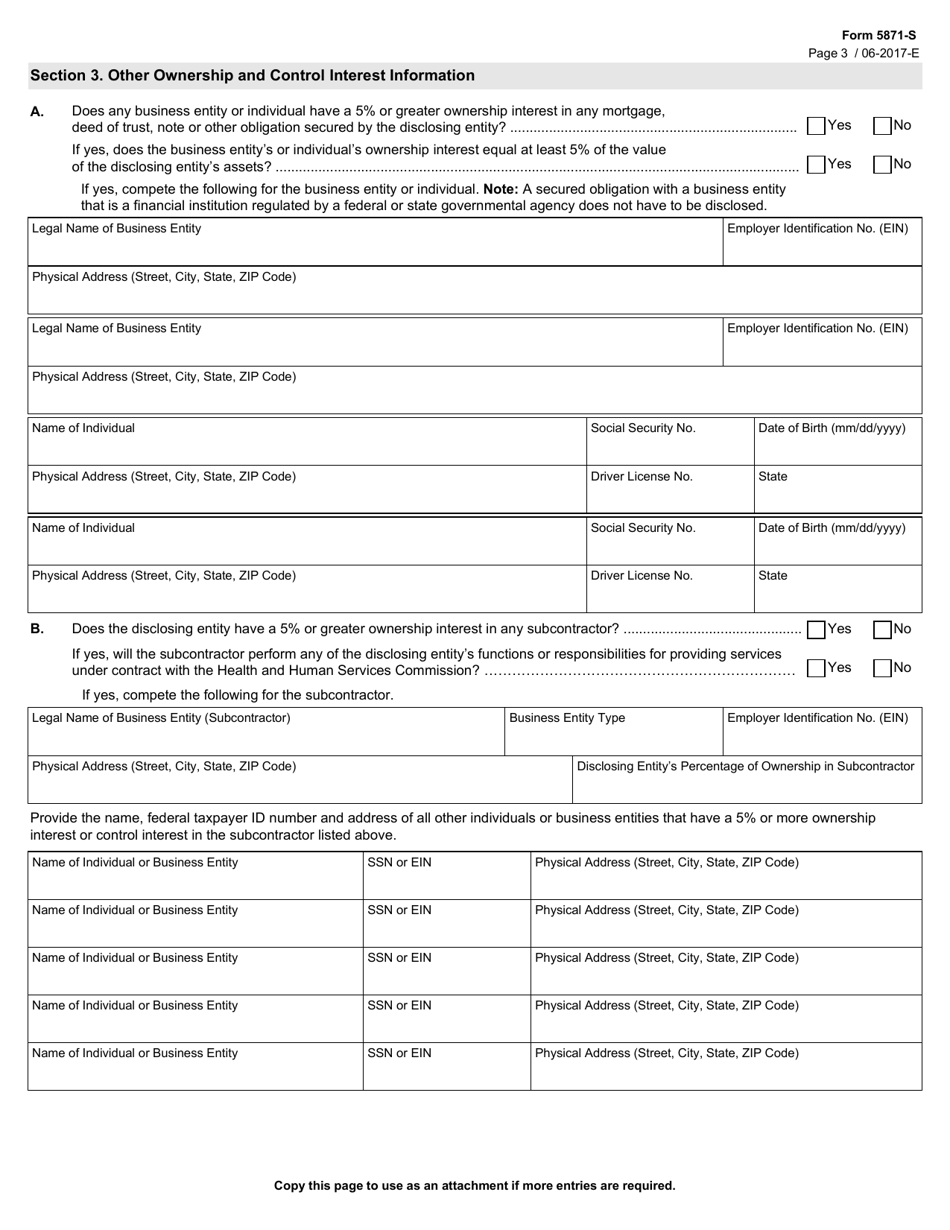

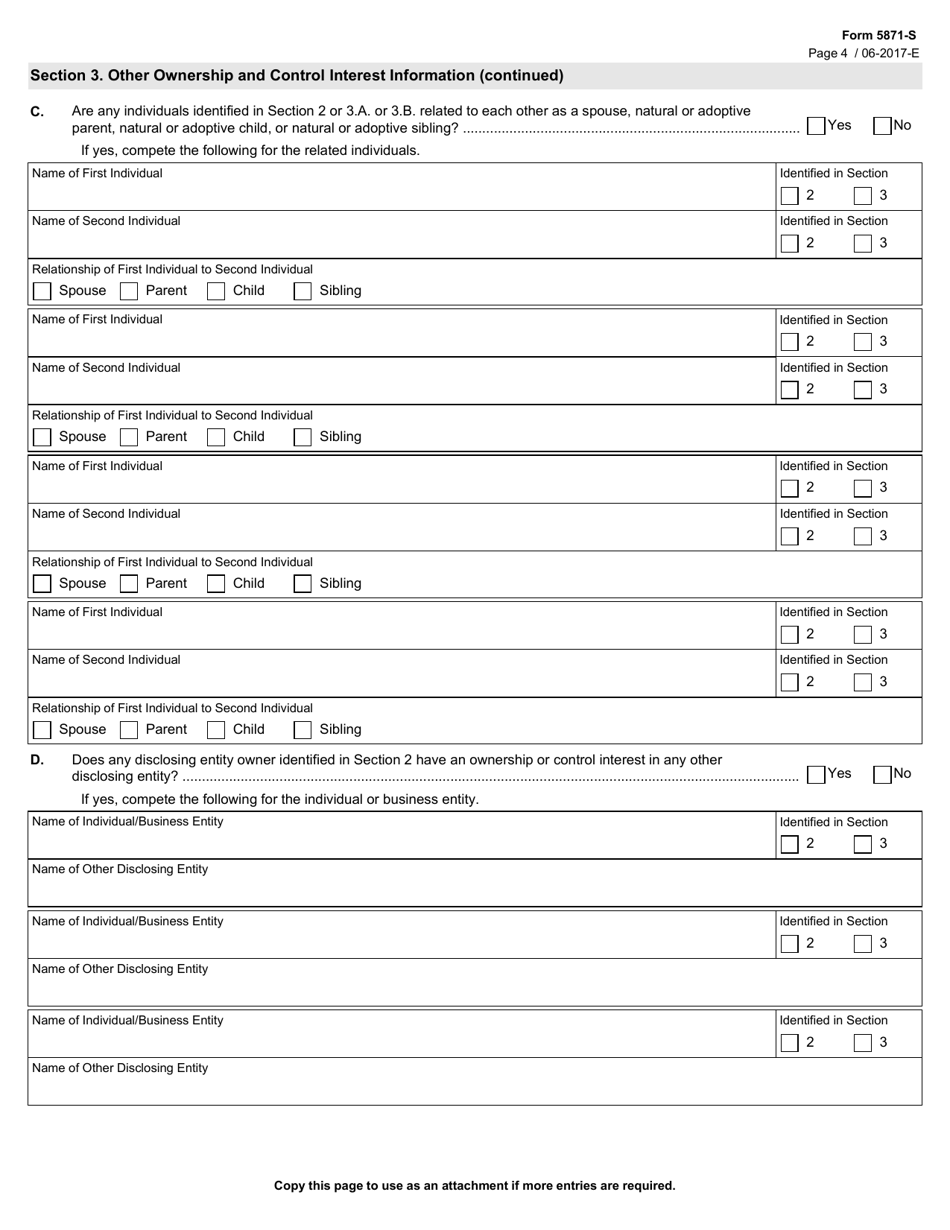

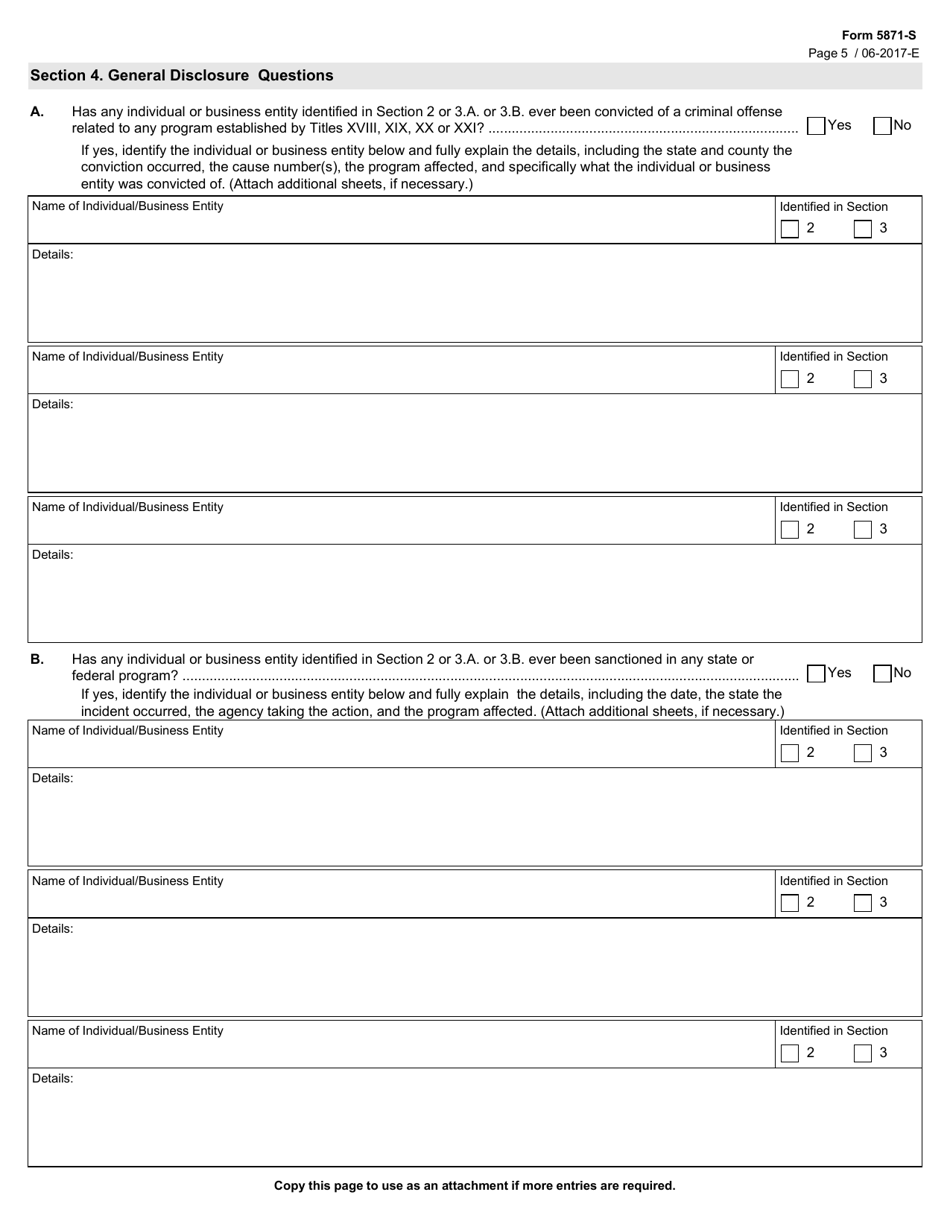

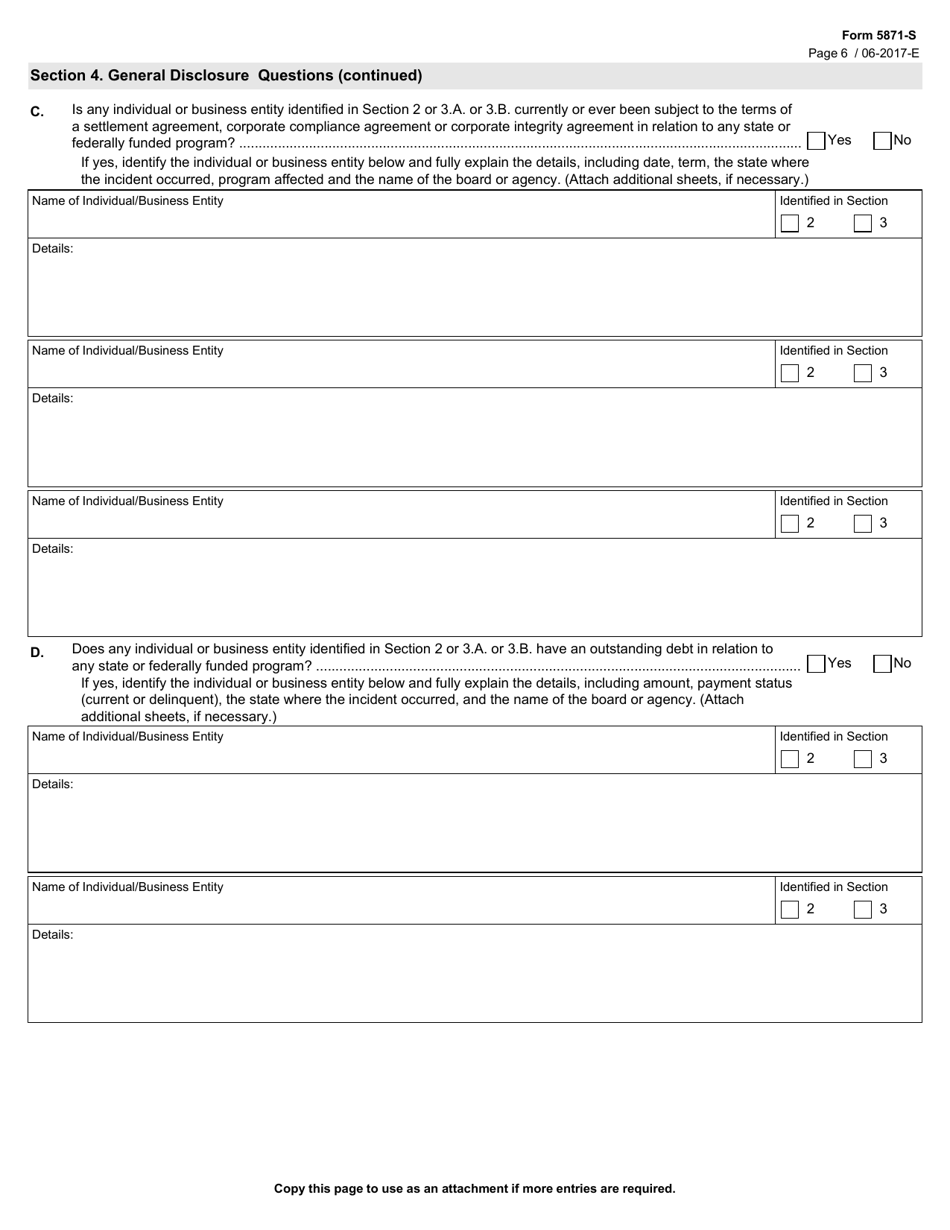

Q: What information is required on Form 5871-S?

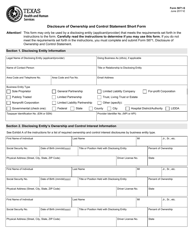

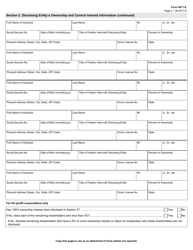

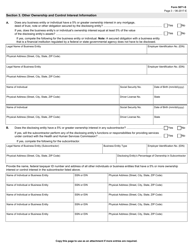

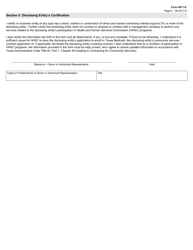

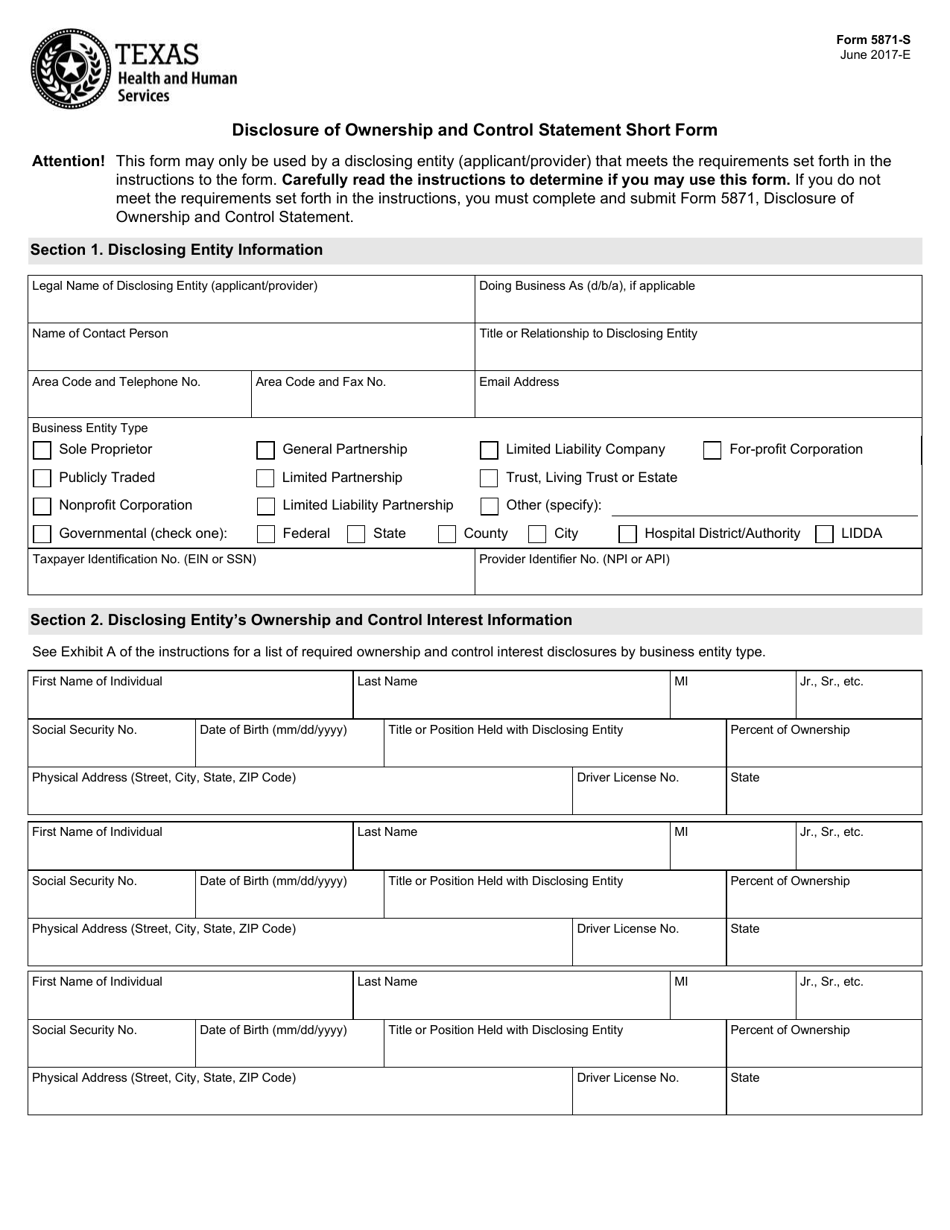

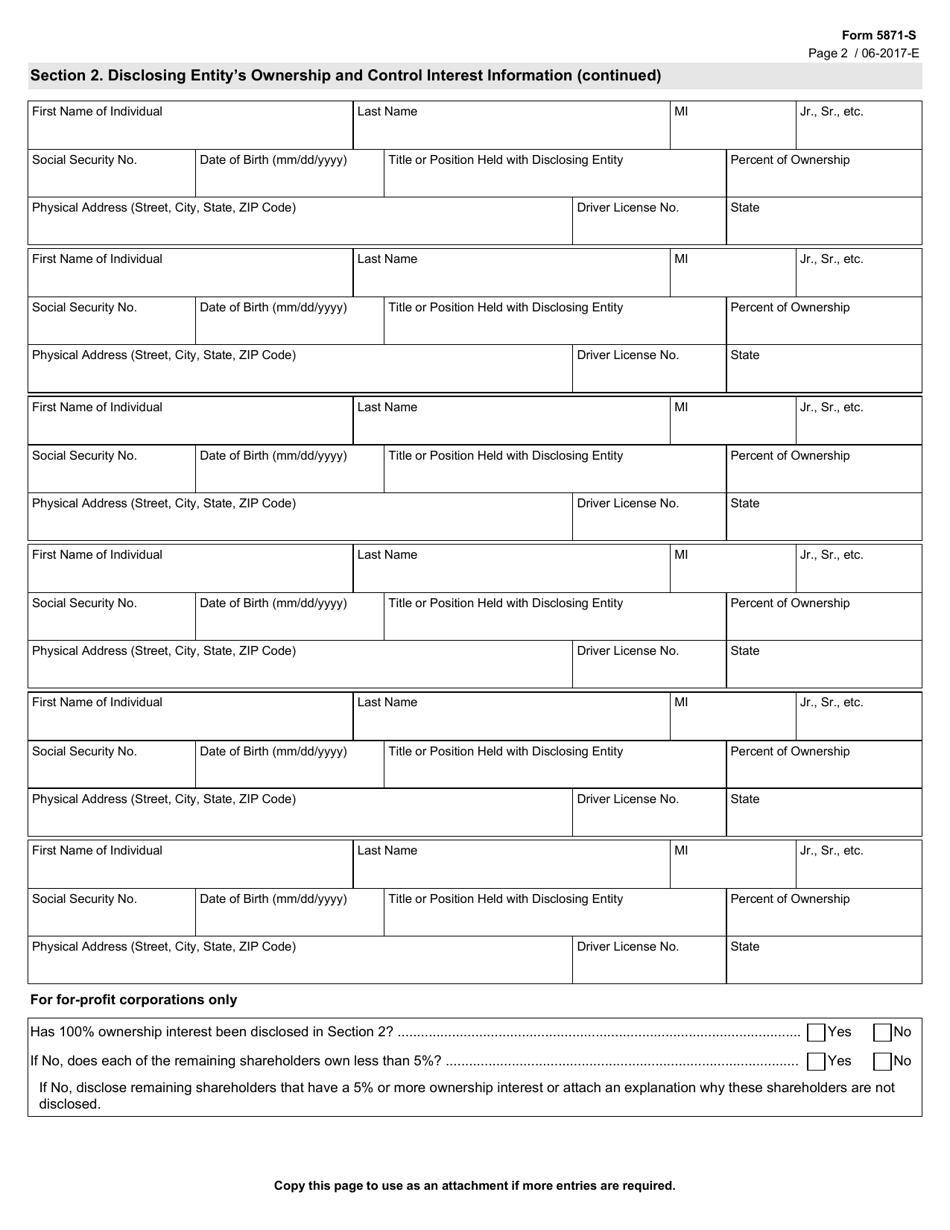

A: Form 5871-S requires information about the entity's ownership structure and identifying information for individuals with ownership or control.

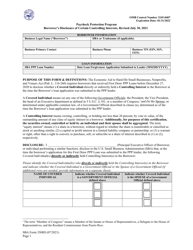

Q: Are there any filing fees for Form 5871-S?

A: Yes, there are filing fees associated with Form 5871-S. The fees vary depending on the type of entity and the number of owners.

Q: When is Form 5871-S due?

A: Form 5871-S is typically due at the time of formation or registration of the entity, and then annually thereafter.

Q: What happens if I don't file Form 5871-S?

A: Failure to file Form 5871-S or provide accurate information can result in penalties or the revocation of the entity's authority to do business in Texas.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5871-S by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.