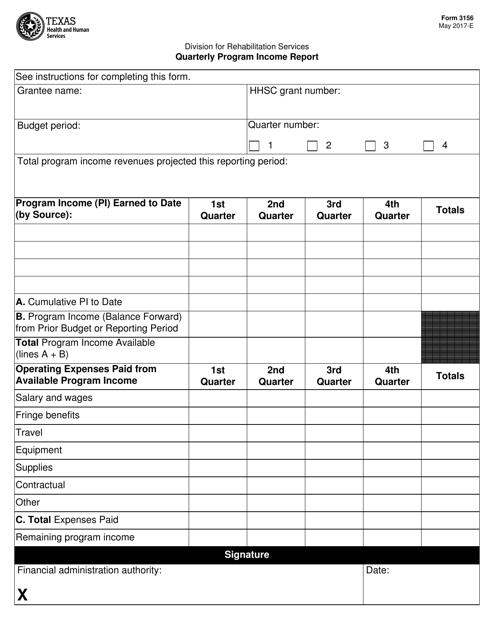

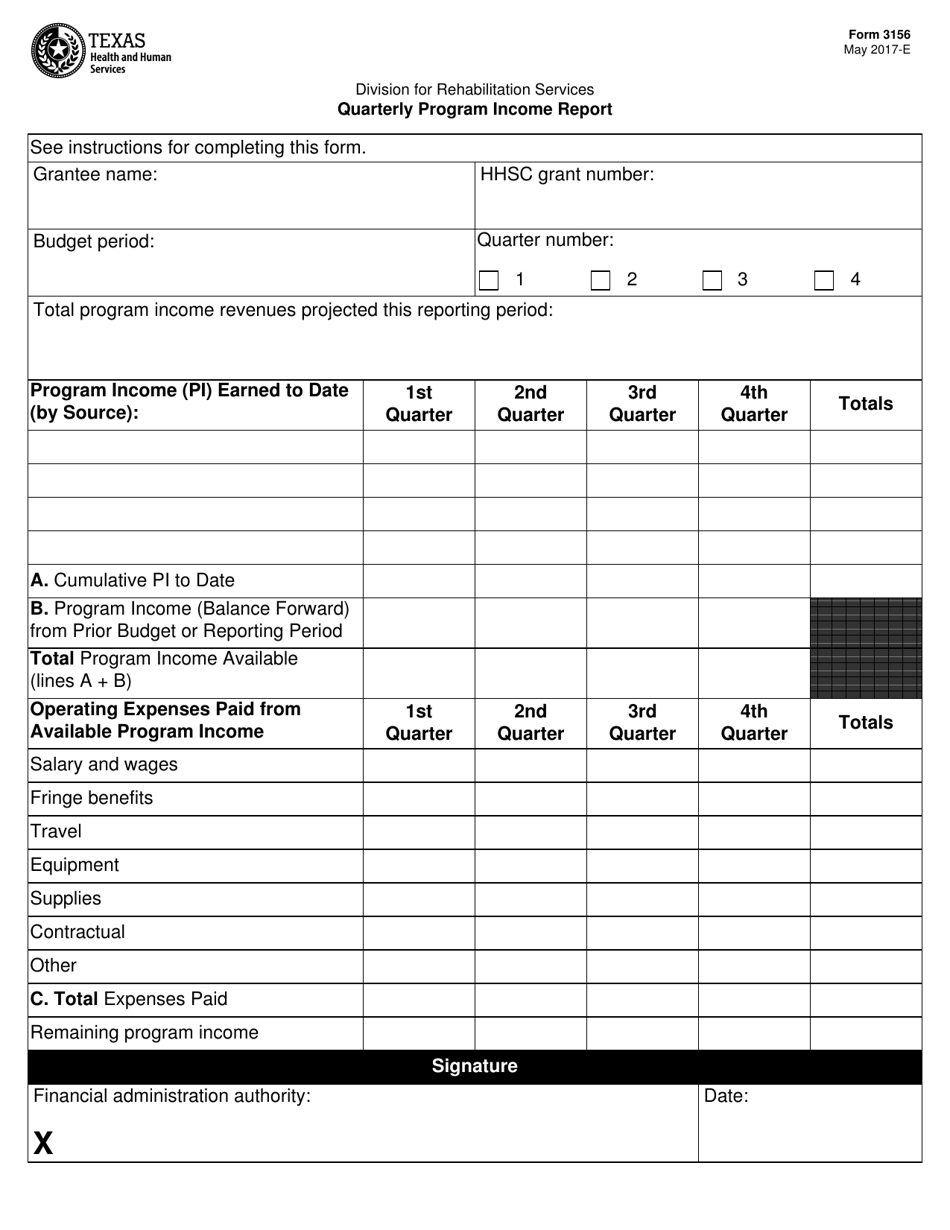

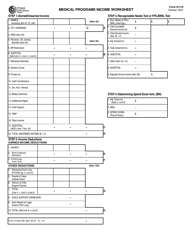

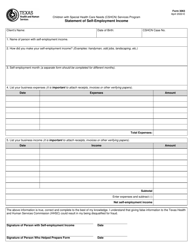

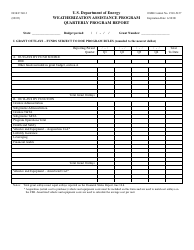

Form 3156 Quarterly Program Income Report - Texas

What Is Form 3156?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3156?

A: Form 3156 is the Quarterly Program Income Report for Texas.

Q: Who is required to file Form 3156?

A: Entities in Texas that receive program income are required to file Form 3156.

Q: What is program income?

A: Program income refers to funds generated by activities that are supported by federal grants or other assistance.

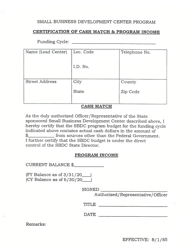

Q: What information is required on Form 3156?

A: Form 3156 requires information on the amount of program income received during the quarter, the source of the income, and the intended use of the funds.

Q: When is Form 3156 due?

A: Form 3156 is due within 30 days after the end of the quarter.

Q: How can Form 3156 be submitted?

A: Form 3156 can be submitted electronically or by mail.

Q: Are there any penalties for not filing Form 3156?

A: Failure to file Form 3156 may result in penalties or loss of federal funding.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3156 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.