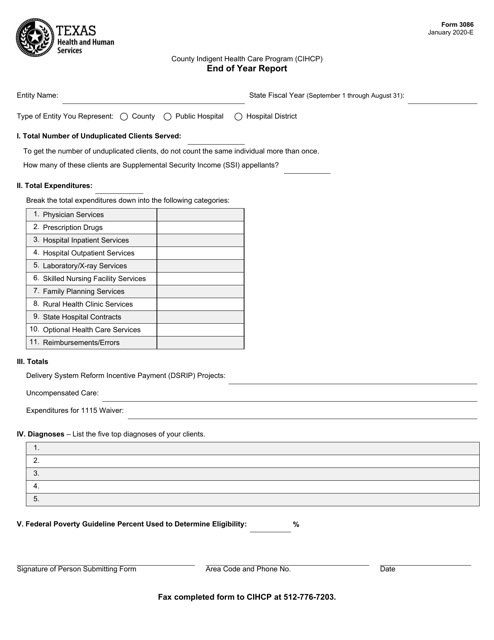

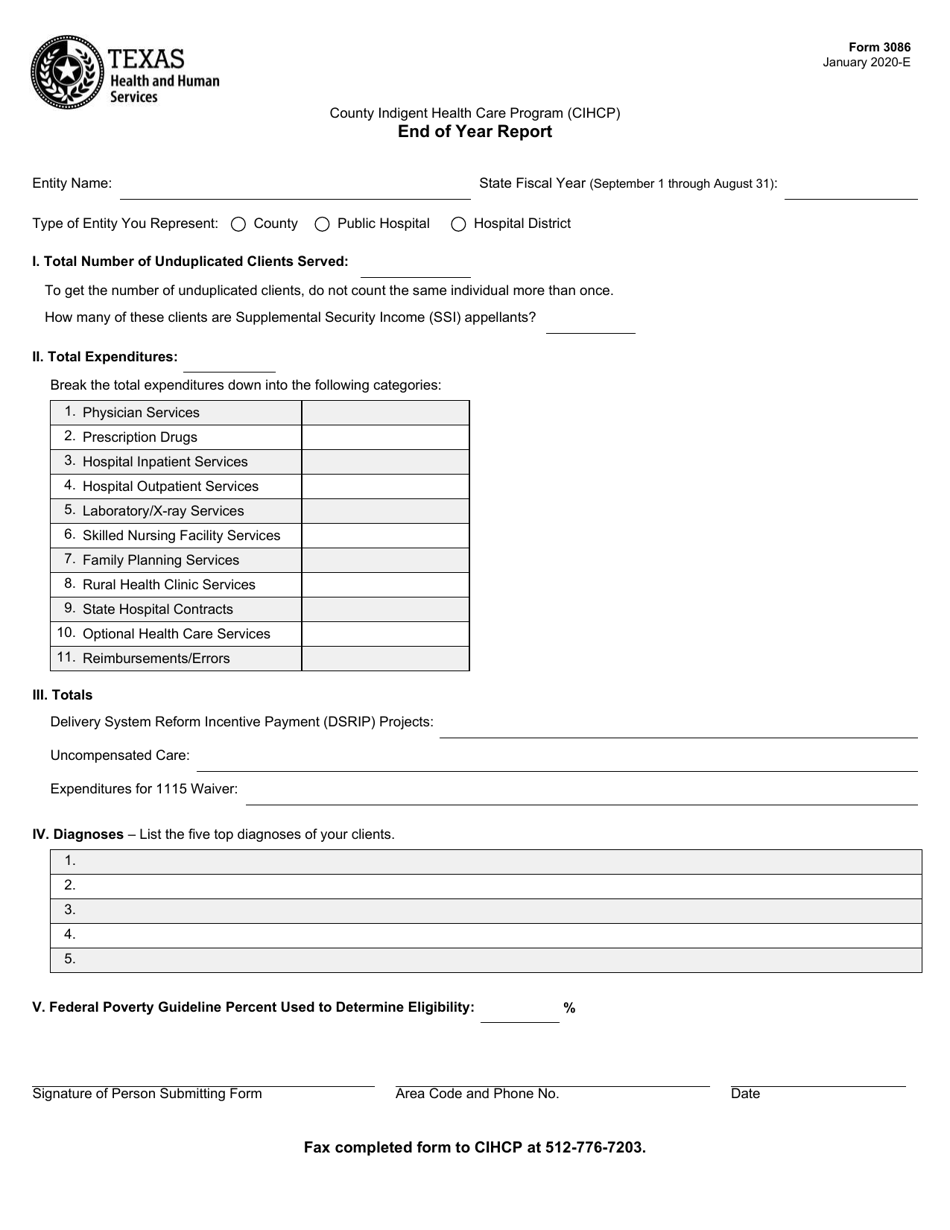

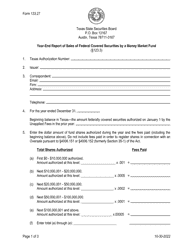

Form 3086 End of Year Report - Texas

What Is Form 3086?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

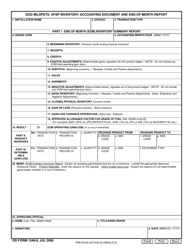

Q: What is Form 3086?

A: Form 3086 is the End of Year Report in Texas.

Q: Who needs to file Form 3086?

A: Individuals or businesses operating in Texas that meet certain criteria need to file Form 3086.

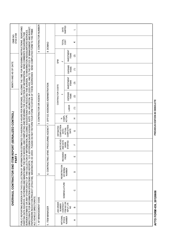

Q: What is the purpose of Form 3086?

A: Form 3086 is used to report various tax-related information for the end of the year in Texas.

Q: When is the deadline to file Form 3086?

A: The deadline to file Form 3086 in Texas varies and depends on the specific tax year.

Q: Are there any penalties for not filing Form 3086?

A: Yes, there may be penalties for not filing Form 3086 or for filing it late in Texas.

Q: What information do I need to complete Form 3086?

A: You will need various tax-related information, such as income, expenses, and deductions, to complete Form 3086.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3086 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.