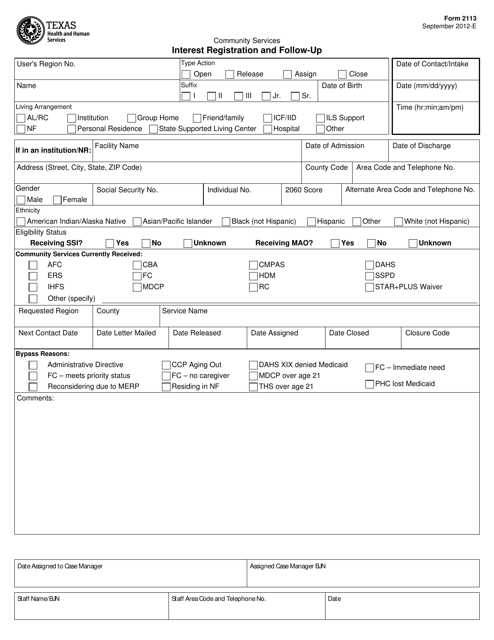

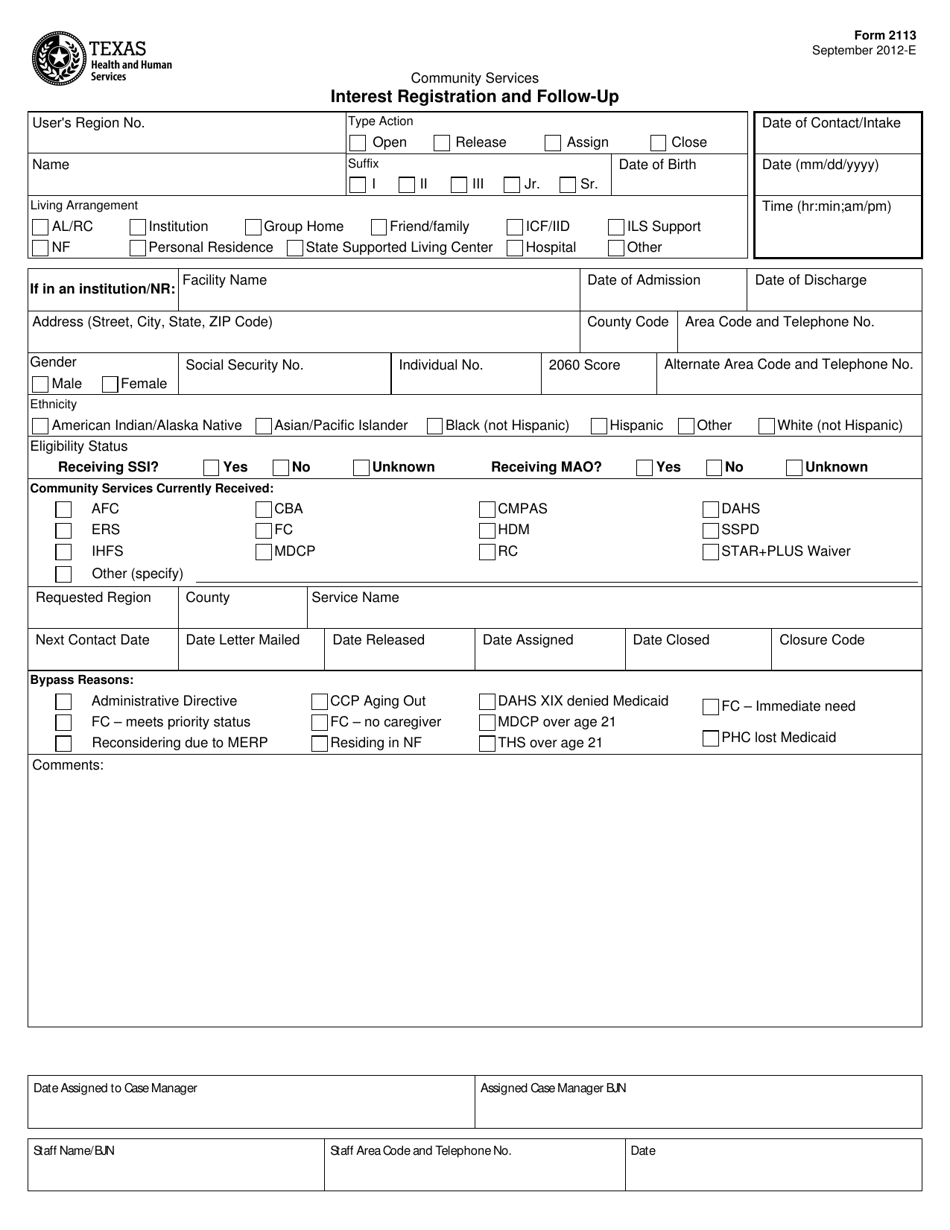

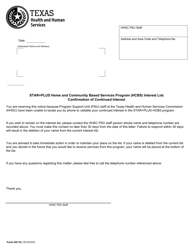

Form 2113 Interest Registration and Follow-Up - Texas

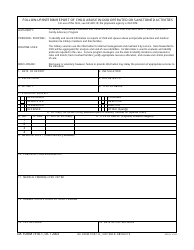

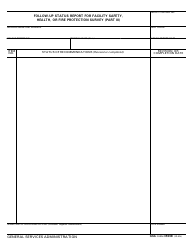

What Is Form 2113?

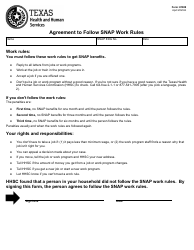

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2113?

A: Form 2113 is the Interest Registration and Follow-Up form in Texas.

Q: How do I use Form 2113?

A: Form 2113 is used to register interests or claims on real property.

Q: What information is required on Form 2113?

A: Form 2113 requires information such as the name of the claimant, description of the interest, and legal description of the property.

Q: Is there a fee for filing Form 2113?

A: Yes, there is a fee for filing Form 2113. The fee varies by county.

Q: What happens after I file Form 2113?

A: After filing Form 2113, the claim or interest will be recorded in the county records and may affect future transactions on the property.

Q: How long does Form 2113 remain valid?

A: Form 2113 remains valid for 10 years from the date of filing, unless a renewal is filed.

Q: Can I revoke or modify a filed Form 2113?

A: Yes, a filed Form 2113 can be revoked or modified by filing a new form with the county clerk.

Q: What is the purpose of Form 2113?

A: The purpose of Form 2113 is to provide notice to potential buyers or lenders about existing claims or interests on a property.

Q: Do I need a lawyer to fill out Form 2113?

A: It is not required to have a lawyer to fill out Form 2113, but legal advice may be helpful to ensure accuracy and compliance with the law.

Form Details:

- Released on September 1, 2012;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2113 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.