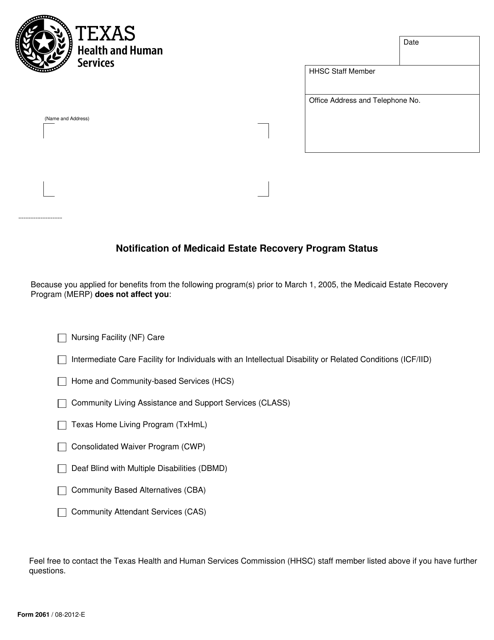

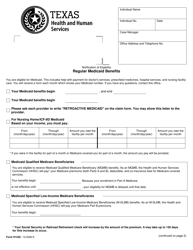

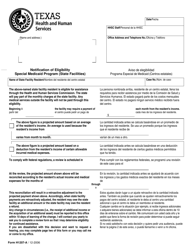

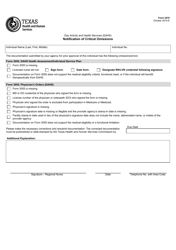

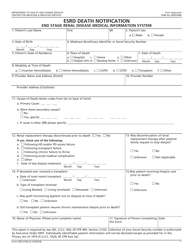

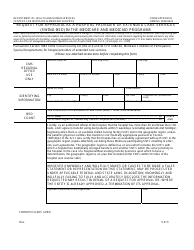

Form 2061 Notification of Medicaid Estate Recovery Program Status - Texas

What Is Form 2061?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2061?

A: Form 2061 is the Notification of Medicaid Estate Recovery Program Status in Texas.

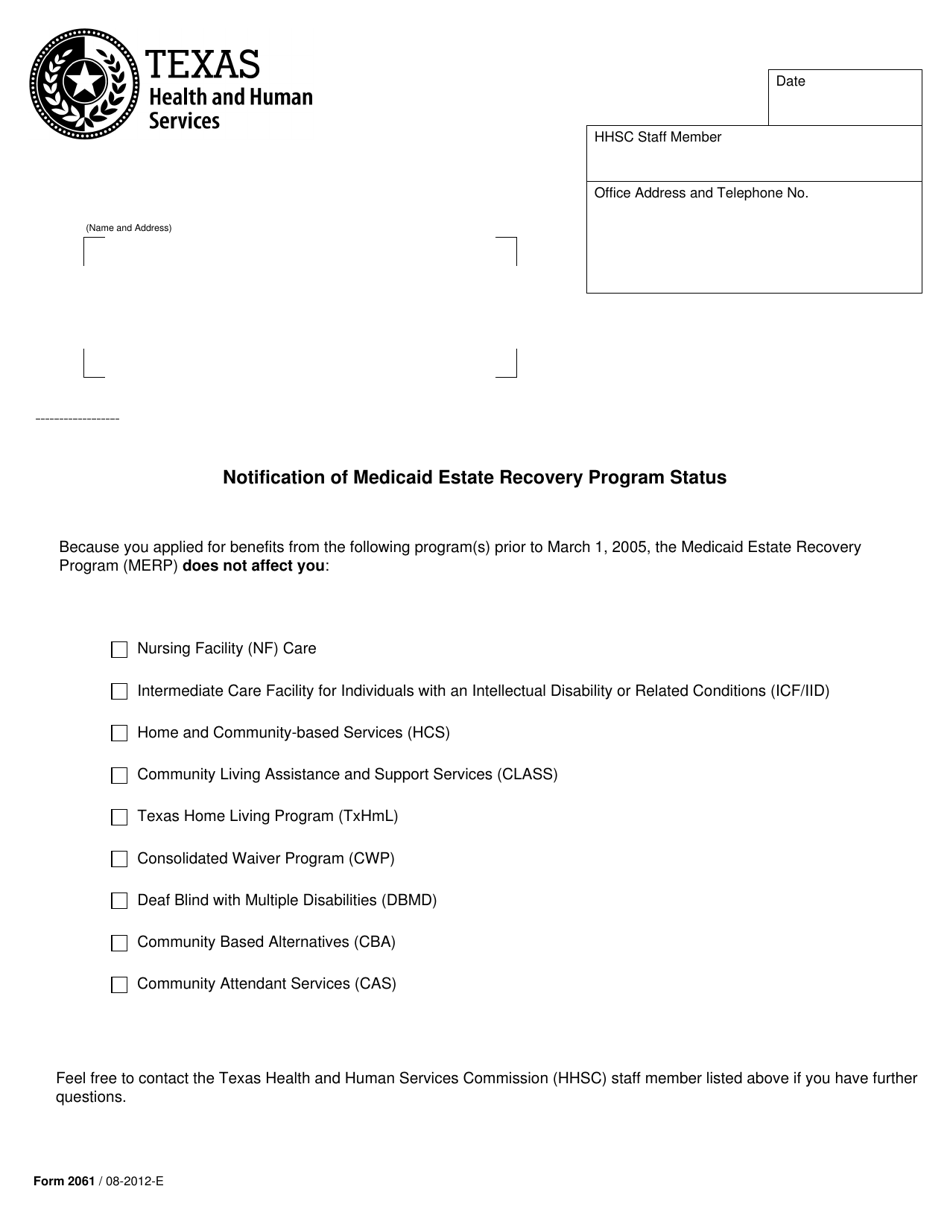

Q: What is the Medicaid Estate Recovery Program?

A: The Medicaid Estate Recovery Program is a program in Texas that aims to recover long-term care costs paid by Medicaid from the estates of deceased individuals.

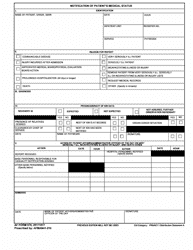

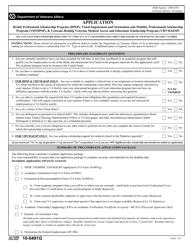

Q: Who is required to fill out Form 2061?

A: Form 2061 must be completed by the personal representative or executor of the estate upon the death of a Medicaid recipient.

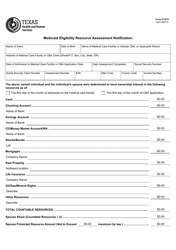

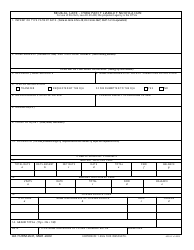

Q: What information is included in Form 2061?

A: Form 2061 includes information about the deceased individual, their Medicaid eligibility, and any potential exemptions or waivers.

Q: What happens after Form 2061 is submitted?

A: After Form 2061 is submitted, the Texas Health and Human Services Commission will determine if estate recovery is applicable and notify the personal representative or executor.

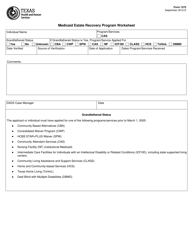

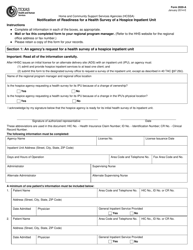

Q: Is estate recovery always required?

A: No, estate recovery is not always required. There are exemptions and waivers available based on certain circumstances, such as surviving spouses or minor children.

Q: What if the deceased individual had no assets to recover?

A: If the deceased individual had no assets to recover, the estate recovery program will be closed and no recovery will be pursued.

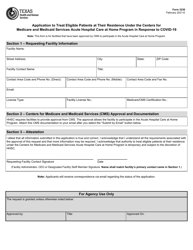

Q: What is the deadline for submitting Form 2061?

A: There is no specific deadline for submitting Form 2061, but it is recommended to submit it as soon as possible after the death of the Medicaid recipient.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2061 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.