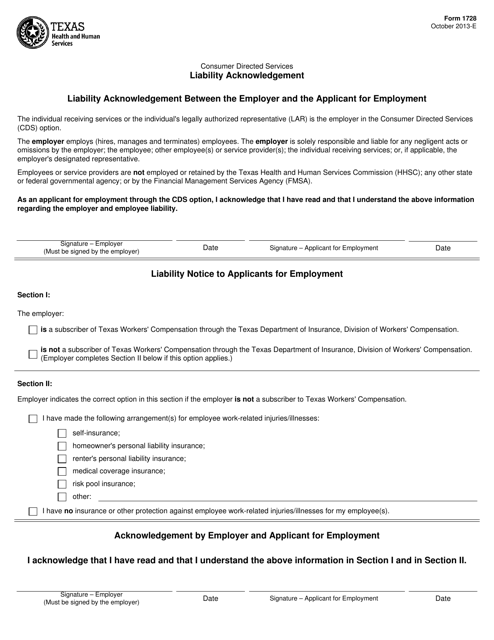

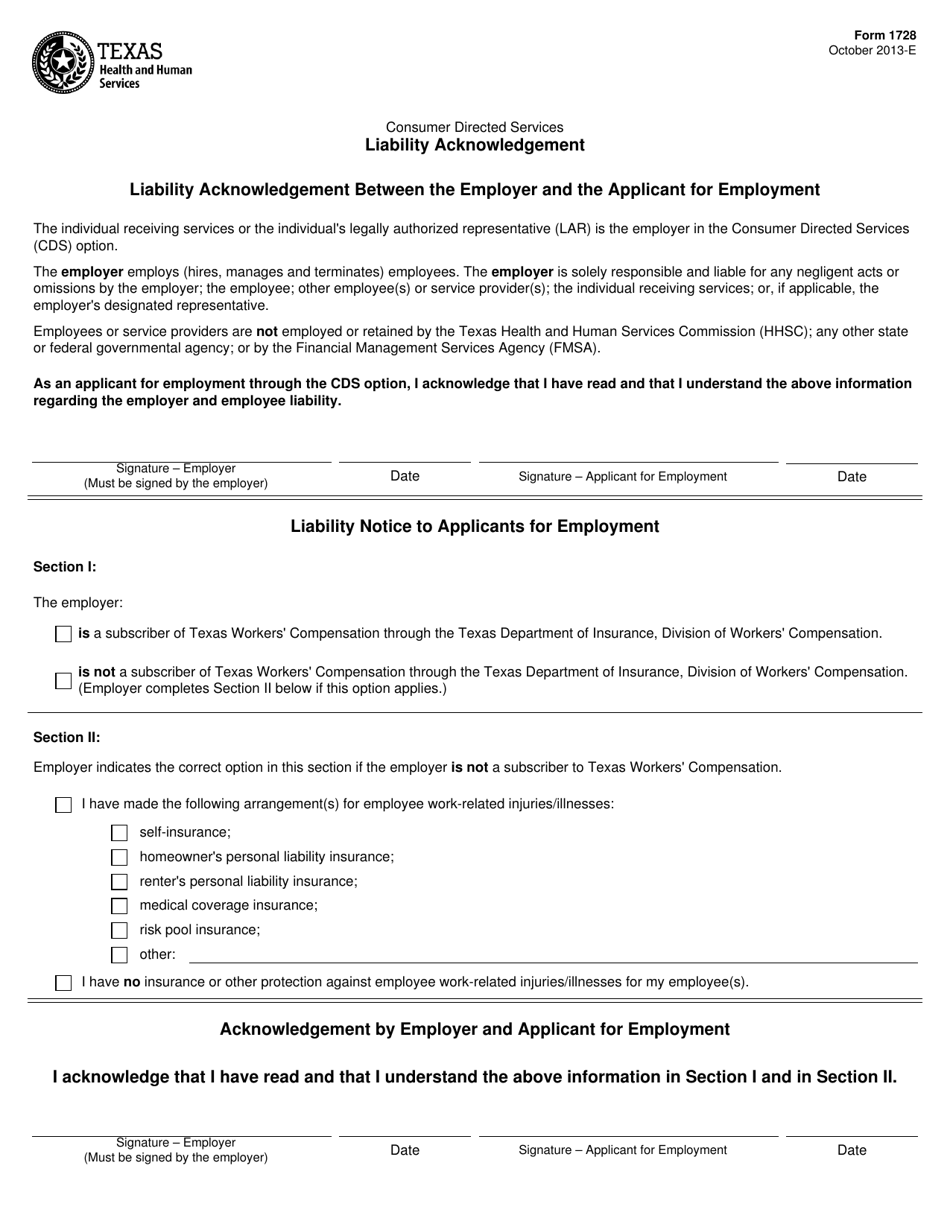

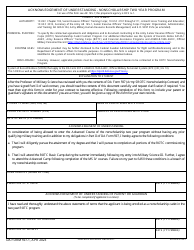

Form 1728 Liability Acknowledgement - Texas

What Is Form 1728?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

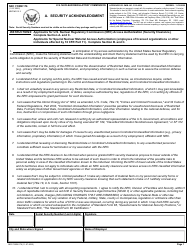

Q: What is Form 1728 Liability Acknowledgement?

A: Form 1728 Liability Acknowledgement is a document used in Texas to acknowledge liability for taxes owed.

Q: Who needs to file Form 1728 Liability Acknowledgement?

A: Any individual or business that owes taxes in Texas may be required to file this form.

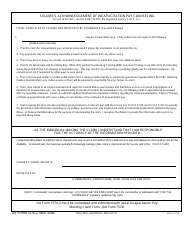

Q: When is Form 1728 Liability Acknowledgement due?

A: The due date for filing this form depends on the individual's or business's tax obligations and will be specified by the Texas Comptroller.

Q: What happens if I don't file Form 1728 Liability Acknowledgement?

A: Failure to file Form 1728 Liability Acknowledgement may result in penalties and could potentially lead to further actions by the Texas Comptroller to collect the owed taxes.

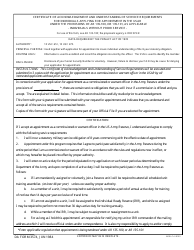

Q: Is Form 1728 Liability Acknowledgement only for Texas residents?

A: No, Form 1728 Liability Acknowledgement may also need to be filed by individuals or businesses outside of Texas that owe taxes to the state.

Q: What information is required on Form 1728 Liability Acknowledgement?

A: Form 1728 Liability Acknowledgement requires basic information such as taxpayer's name, address, tax identification number, and the amount of taxes owed.

Q: Can I amend Form 1728 Liability Acknowledgement?

A: If you need to make changes to a previously filed Form 1728 Liability Acknowledgement, you should contact the Texas Comptroller's office for guidance on how to proceed.

Q: Does filing Form 1728 Liability Acknowledgement mean I have paid my taxes?

A: No, filing Form 1728 Liability Acknowledgement only acknowledges the liability for the taxes owed. Payment of taxes still needs to be made separately.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1728 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.