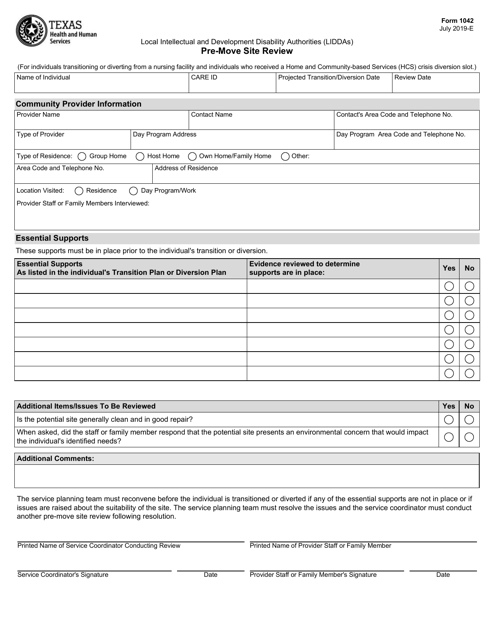

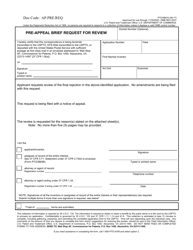

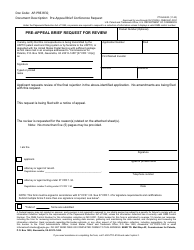

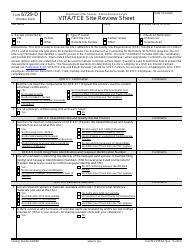

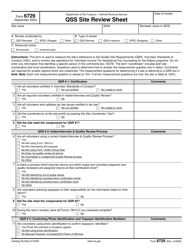

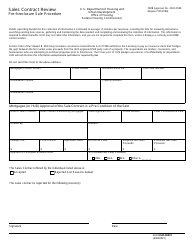

Form 1042 Pre-move Site Review - Texas

What Is Form 1042?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1042?

A: Form 1042 is an information return filed with the IRS by withholding agents to report certain income paid to non-U.S. residents.

Q: What is a pre-move site review?

A: A pre-move site review is a process where a company evaluates a potential location before moving its operations there.

Q: Why is a pre-move site review important?

A: A pre-move site review helps a company assess factors such as logistics, infrastructure, and workforce availability to determine if a location is suitable for their operations.

Q: What is the purpose of conducting a pre-move site review in Texas?

A: The purpose of conducting a pre-move site review in Texas is to evaluate the state as a potential location for business operations, taking into account factors specific to the state.

Q: Who typically conducts a pre-move site review?

A: A team from the company or a hired consultant specializing in site selection typically conducts a pre-move site review.

Q: What factors are evaluated during a pre-move site review?

A: During a pre-move site review, factors such as infrastructure, transportation, workforce availability, tax incentives, and regulatory environment are typically evaluated.

Q: What are the benefits of conducting a pre-move site review?

A: The benefits of conducting a pre-move site review include informed decision-making, cost savings, and minimizing risks associated with relocating operations to a new location.

Q: Are there any specific considerations for conducting a pre-move site review in Texas?

A: Yes, some specific considerations for conducting a pre-move site review in Texas may include the state's business-friendly environment, access to markets, and available incentives.

Q: What is the timeline for conducting a pre-move site review?

A: The timeline for conducting a pre-move site review can vary depending on the complexity of the evaluation and the company's specific requirements.

Q: Can a company file Form 1042 after conducting a pre-move site review?

A: Yes, if a company determines that it will have income subject to withholding under U.S. tax laws, they may need to file Form 1042 as part of their compliance obligations.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1042 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.