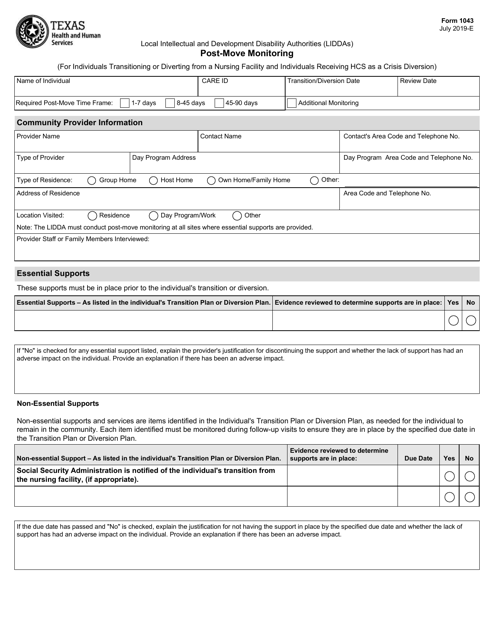

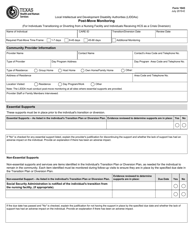

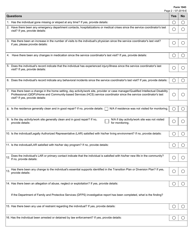

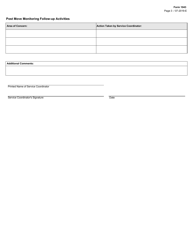

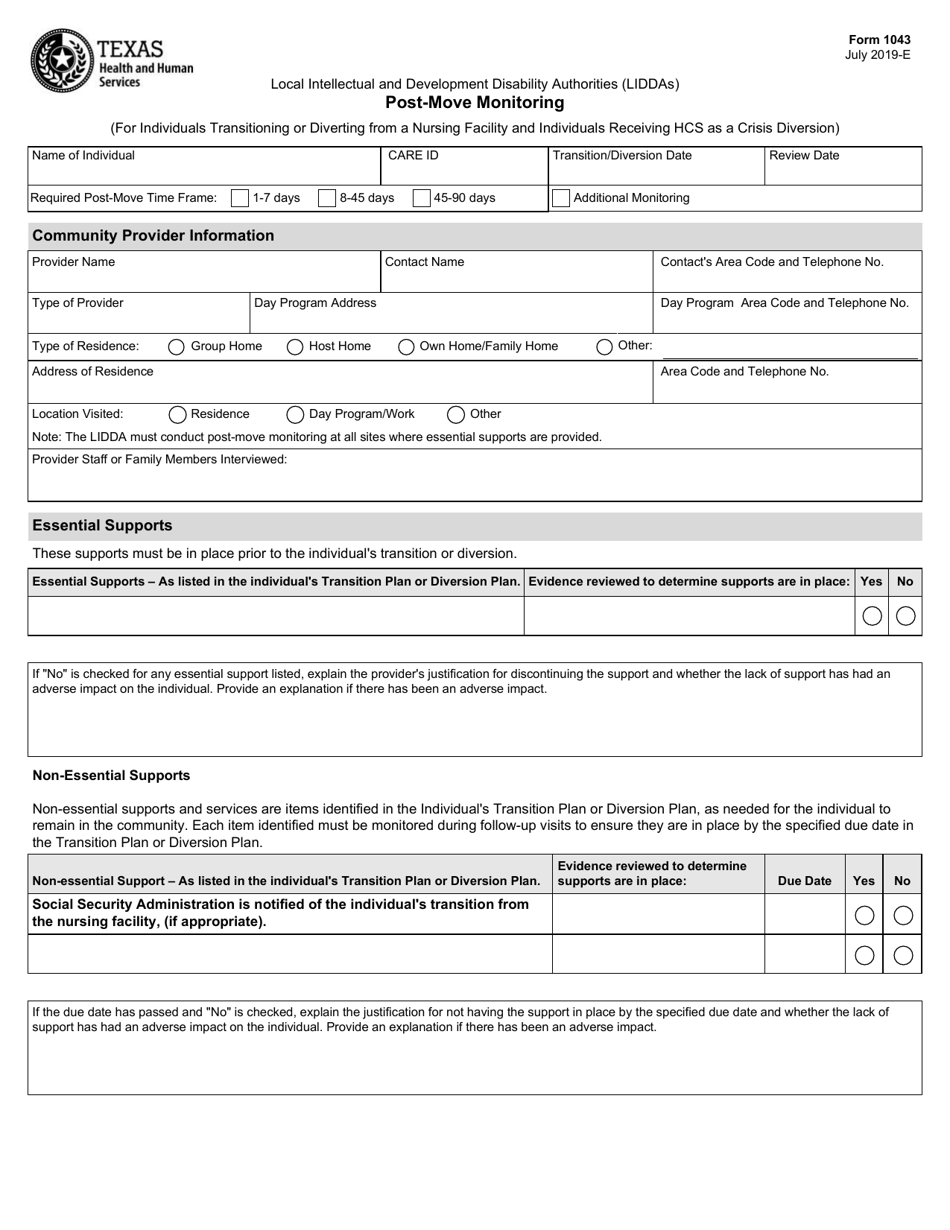

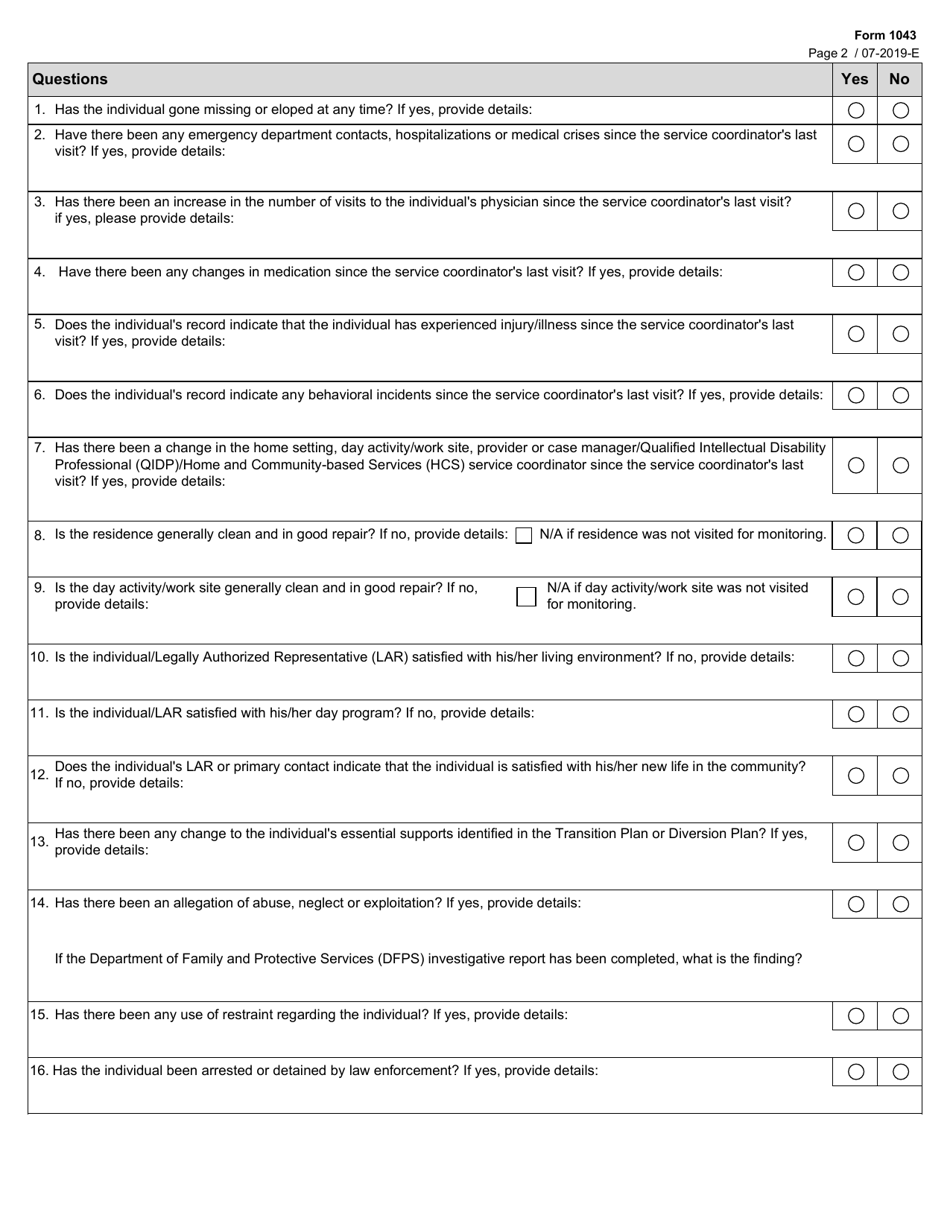

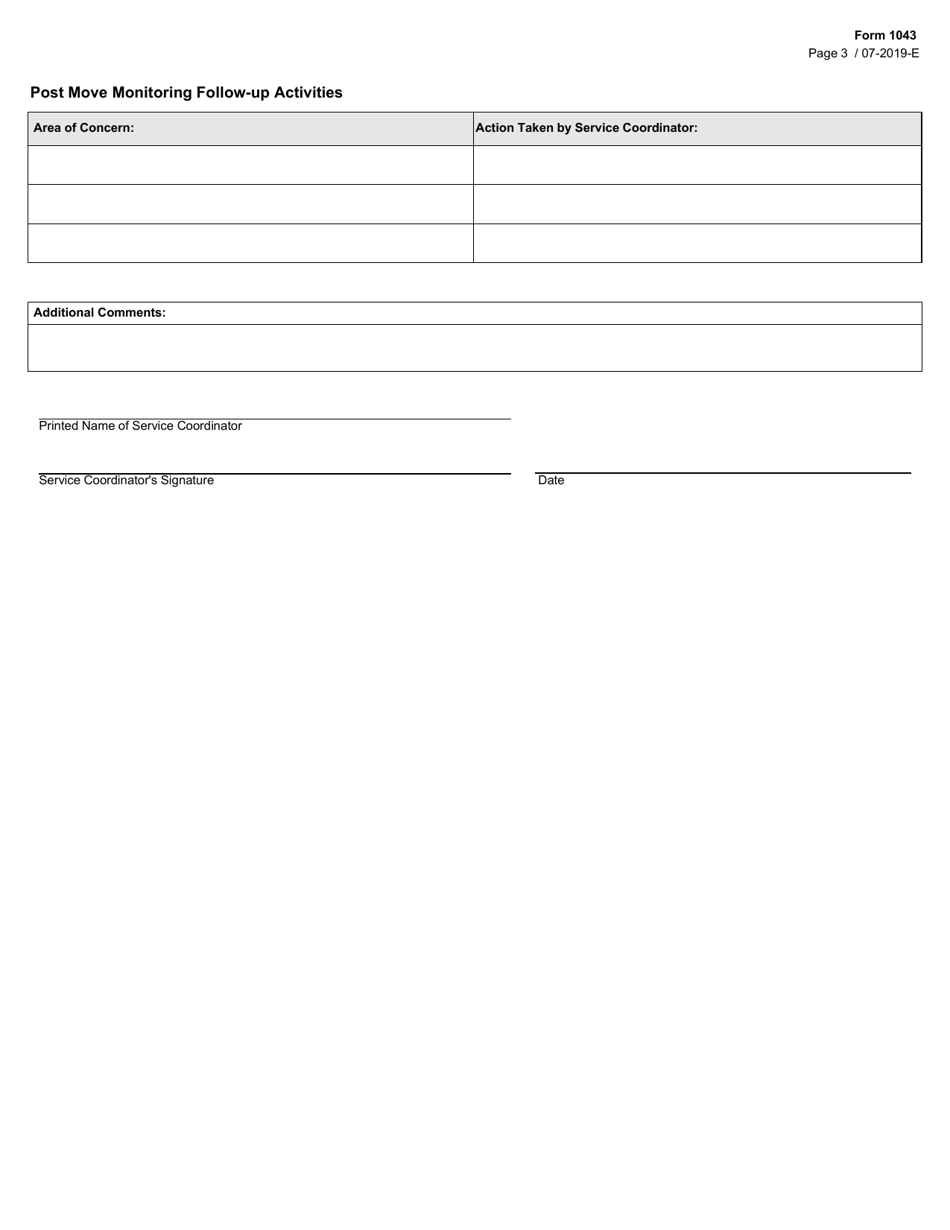

Form 1043 Post-move Monitoring - Texas

What Is Form 1043?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1043?

A: Form 1043 is a post-move monitoring form.

Q: What is Post-move Monitoring?

A: Post-move monitoring is a process to ensure compliance with certain tax requirements after a move.

Q: Who needs to file Form 1043?

A: Individuals or families who have moved from one state to another, particularly to Texas, may be required to file Form 1043.

Q: What information is required on Form 1043?

A: Form 1043 requires information about the taxpayer's previous state of residence, the date of the move, and other related details.

Q: Why is Post-move Monitoring important?

A: Post-move monitoring ensures that taxpayers meet their tax obligations in both their previous and new state of residence.

Q: When should Form 1043 be filed?

A: Form 1043 should be filed within a certain time frame after the move, as specified by the state.

Q: Are there any penalties for not filing Form 1043?

A: Penalties may apply for failure to comply with post-move monitoring requirements, including not filing Form 1043.

Q: Is post-move monitoring only required in Texas?

A: No, post-move monitoring may be required in other states as well.

Q: Can I get help with filing Form 1043?

A: Yes, you can seek assistance from a tax professional or contact the state tax agency for guidance on filing Form 1043.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1043 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.