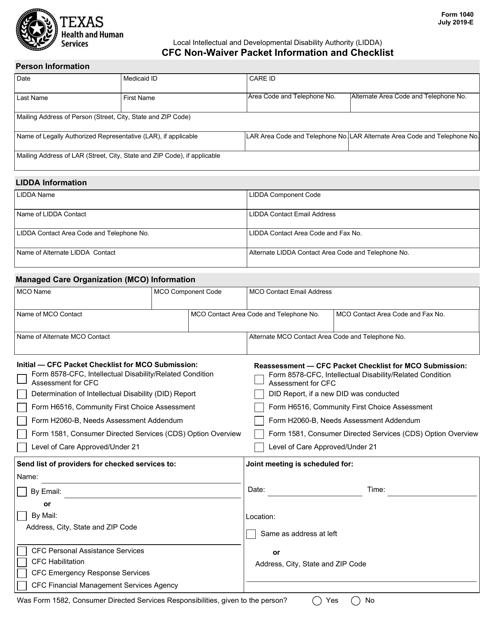

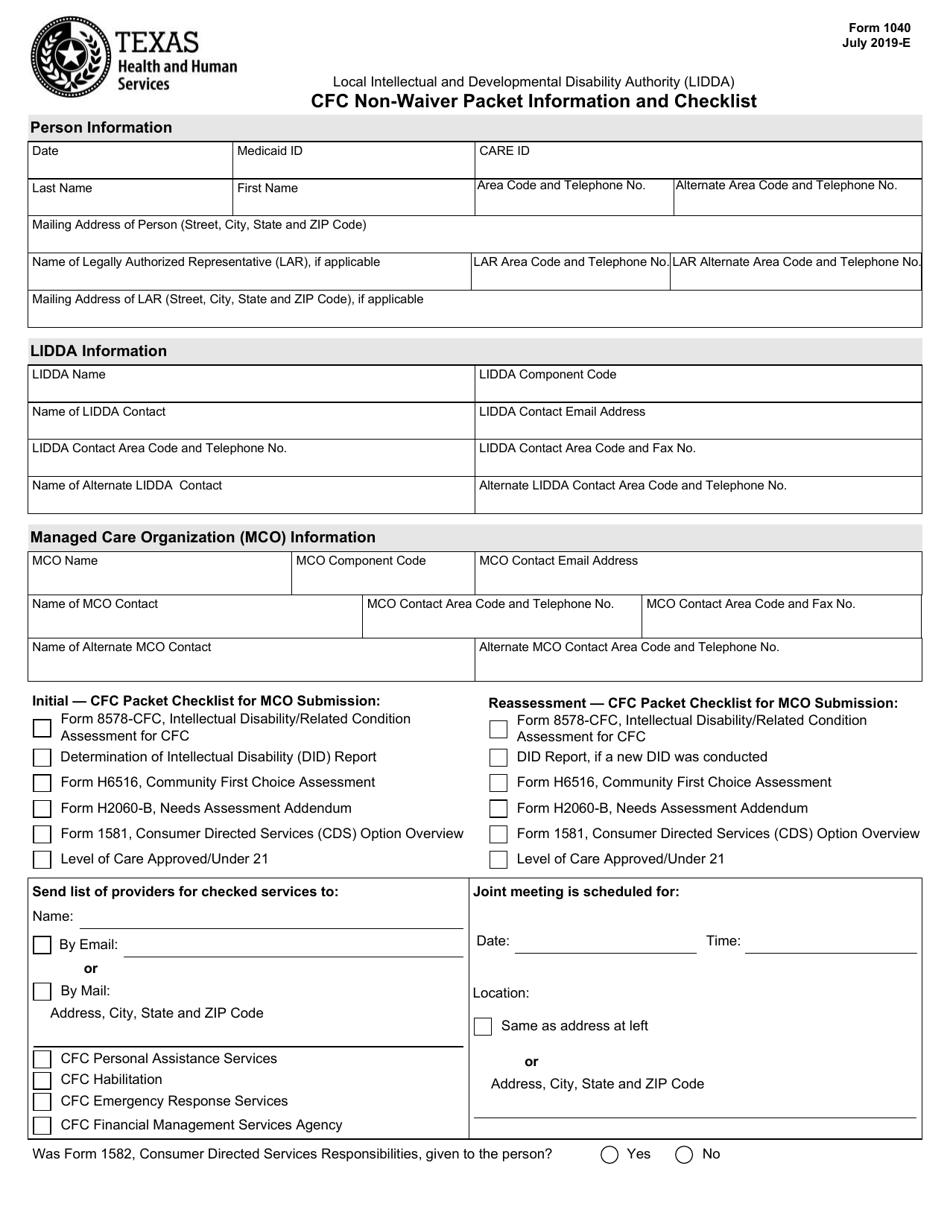

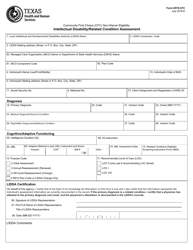

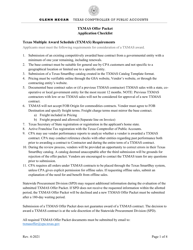

Form 1040 Cfc Non-waiver Packet Information and Checklist - Texas

What Is Form 1040?

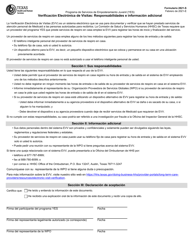

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

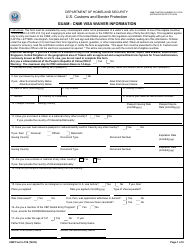

Q: What is Form 1040 CFC?

A: Form 1040 CFC is a tax form used to report income from controlled foreign corporations.

Q: What is a controlled foreign corporation (CFC)?

A: A controlled foreign corporation (CFC) is a company located outside of the United States that is controlled by U.S. shareholders.

Q: Who needs to file Form 1040 CFC?

A: U.S. shareholders who own a certain percentage of a controlled foreign corporation (CFC) must file Form 1040 CFC.

Q: What information do I need to include on Form 1040 CFC?

A: You will need to provide information about the controlled foreign corporation (CFC), including its name, address, and income details.

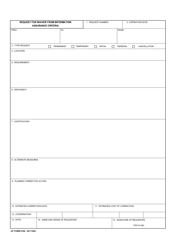

Q: What is a non-waiver packet?

A: A non-waiver packet is a collection of documents and information that you need to submit along with Form 1040 CFC.

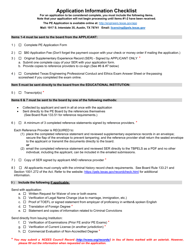

Q: What should be included in a non-waiver packet for Form 1040 CFC?

A: A non-waiver packet for Form 1040 CFC should include a completed Form 1040 CFC, supporting documents, and any additional required forms or schedules.

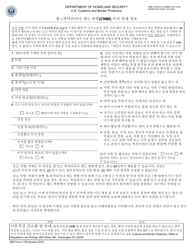

Q: Is the Form 1040 CFC non-waiver packet specific to Texas?

A: No, the Form 1040 CFC non-waiver packet is not specific to Texas. It is used by U.S. shareholders nationwide.

Q: Are there any penalties for not filing Form 1040 CFC?

A: Yes, there are penalties for not filing Form 1040 CFC, including potential fines and interest on unpaid taxes.

Q: How often do I need to file Form 1040 CFC?

A: Form 1040 CFC should be filed annually, usually along with your individual income tax return.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.