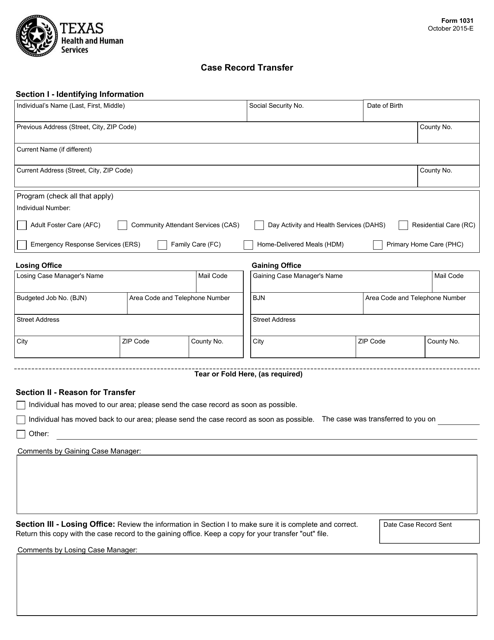

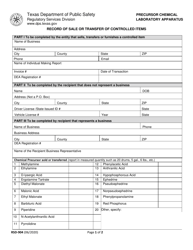

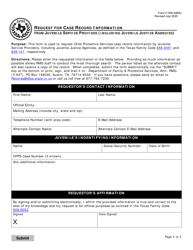

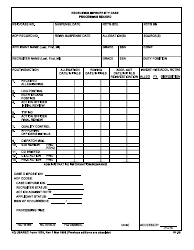

Form 1031 Case Record Transfer - Texas

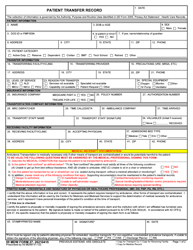

What Is Form 1031?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1031?

A: Form 1031 is a federal tax form used for deferring capital gains taxes on the sale of investment or business property.

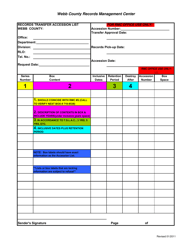

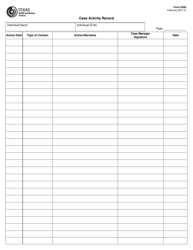

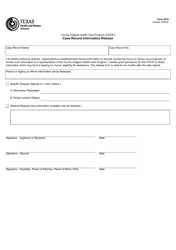

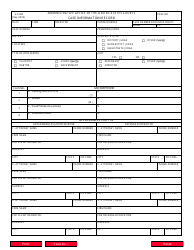

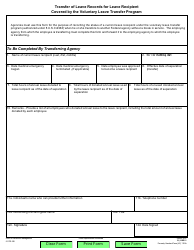

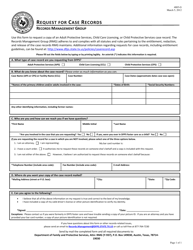

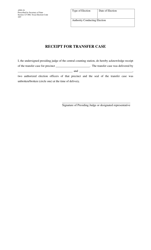

Q: What is a case record transfer?

A: A case record transfer is the process of transferring records from one location to another, typically within a government agency or organization.

Q: Is the Form 1031 Case Record Transfer specific to Texas?

A: Yes, the Form 1031 Case Record Transfer is specific to Texas.

Q: Who uses the Form 1031 Case Record Transfer?

A: Government agencies and organizations in Texas use the Form 1031 Case Record Transfer.

Q: How can I obtain Form 1031 Case Record Transfer?

A: You can obtain Form 1031 Case Record Transfer by contacting the relevant Texas government agency or organization.

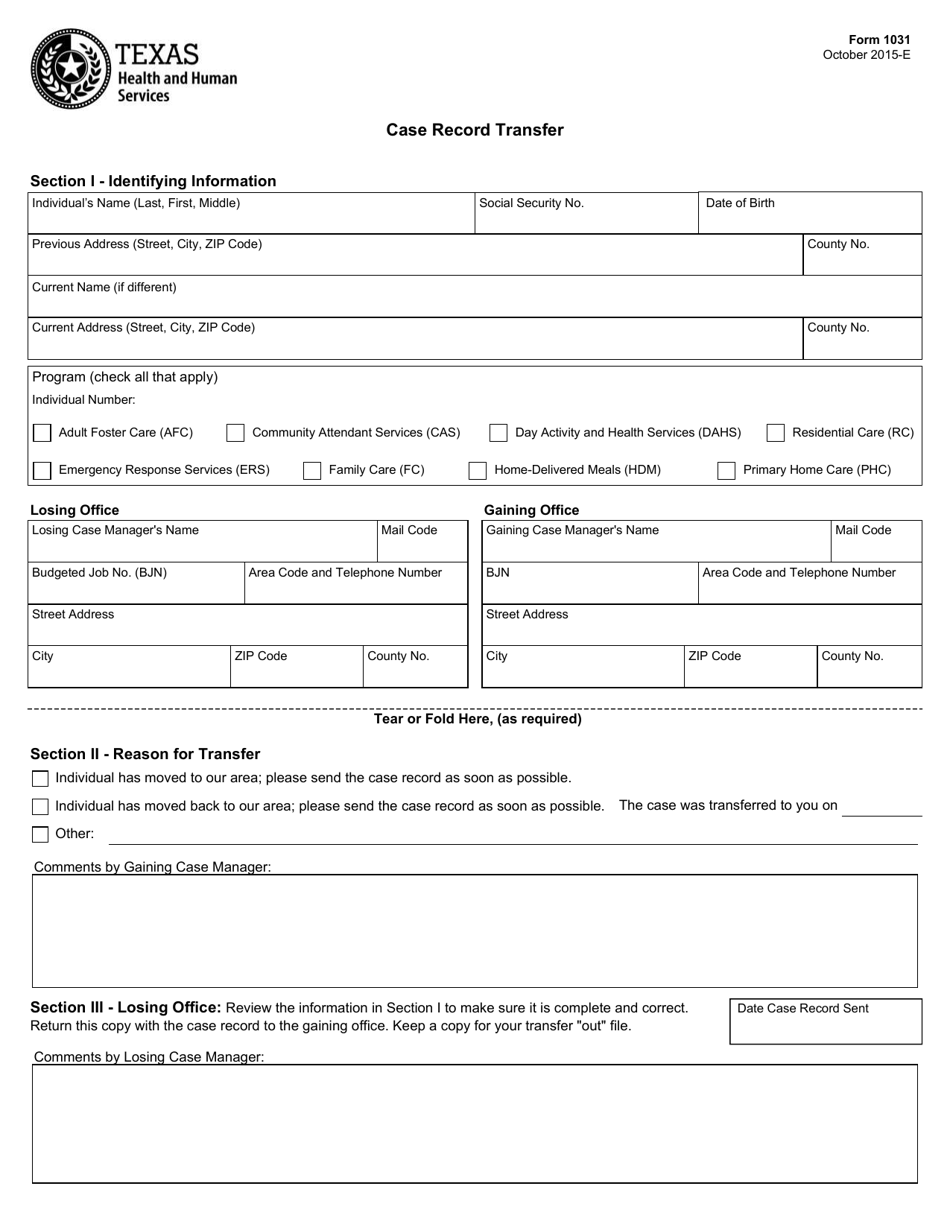

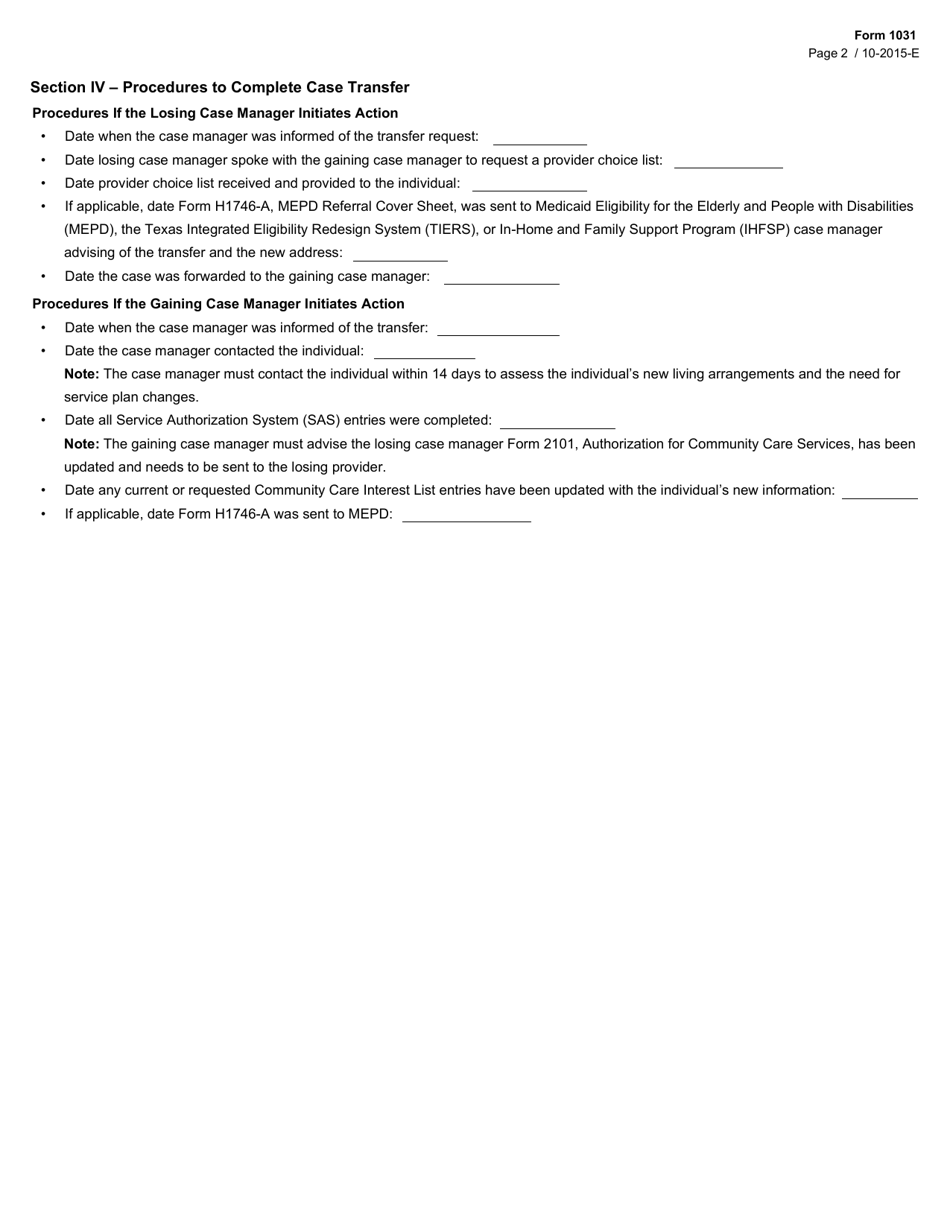

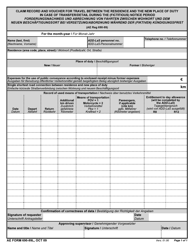

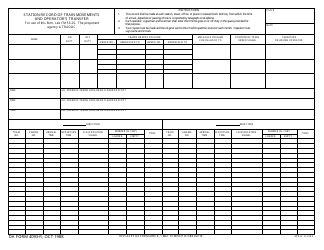

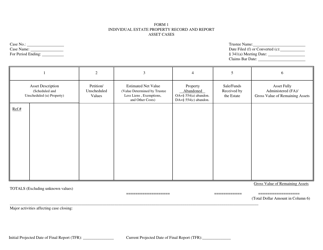

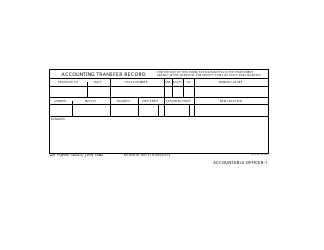

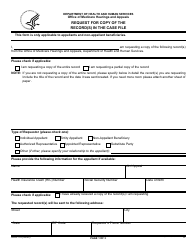

Q: What information is required on Form 1031 Case Record Transfer?

A: The specific information required on Form 1031 Case Record Transfer may vary, but it typically includes details about the case and the transfer process.

Q: Is there a fee for filing Form 1031 Case Record Transfer?

A: The presence of a fee for filing Form 1031 Case Record Transfer may vary depending on the government agency or organization.

Q: Can I use Form 1031 Case Record Transfer for personal purposes?

A: No, Form 1031 Case Record Transfer is typically used for government purposes and not for personal use.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1031 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.