This version of the form is not currently in use and is provided for reference only. Download this version of

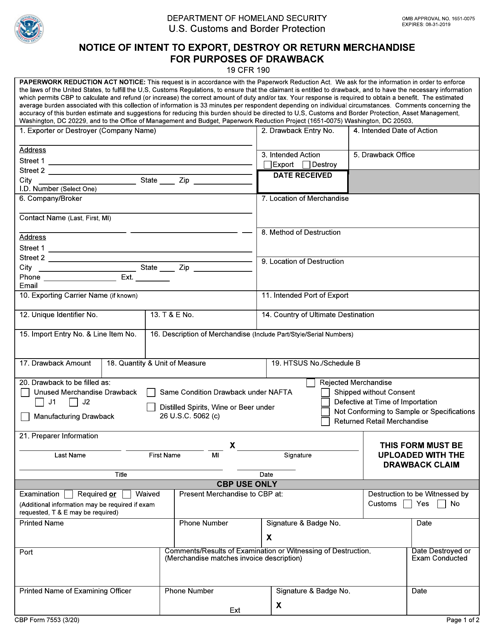

CBP Form 7553

for the current year.

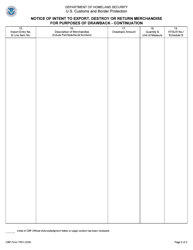

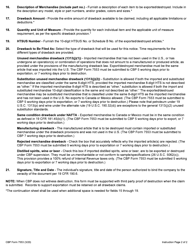

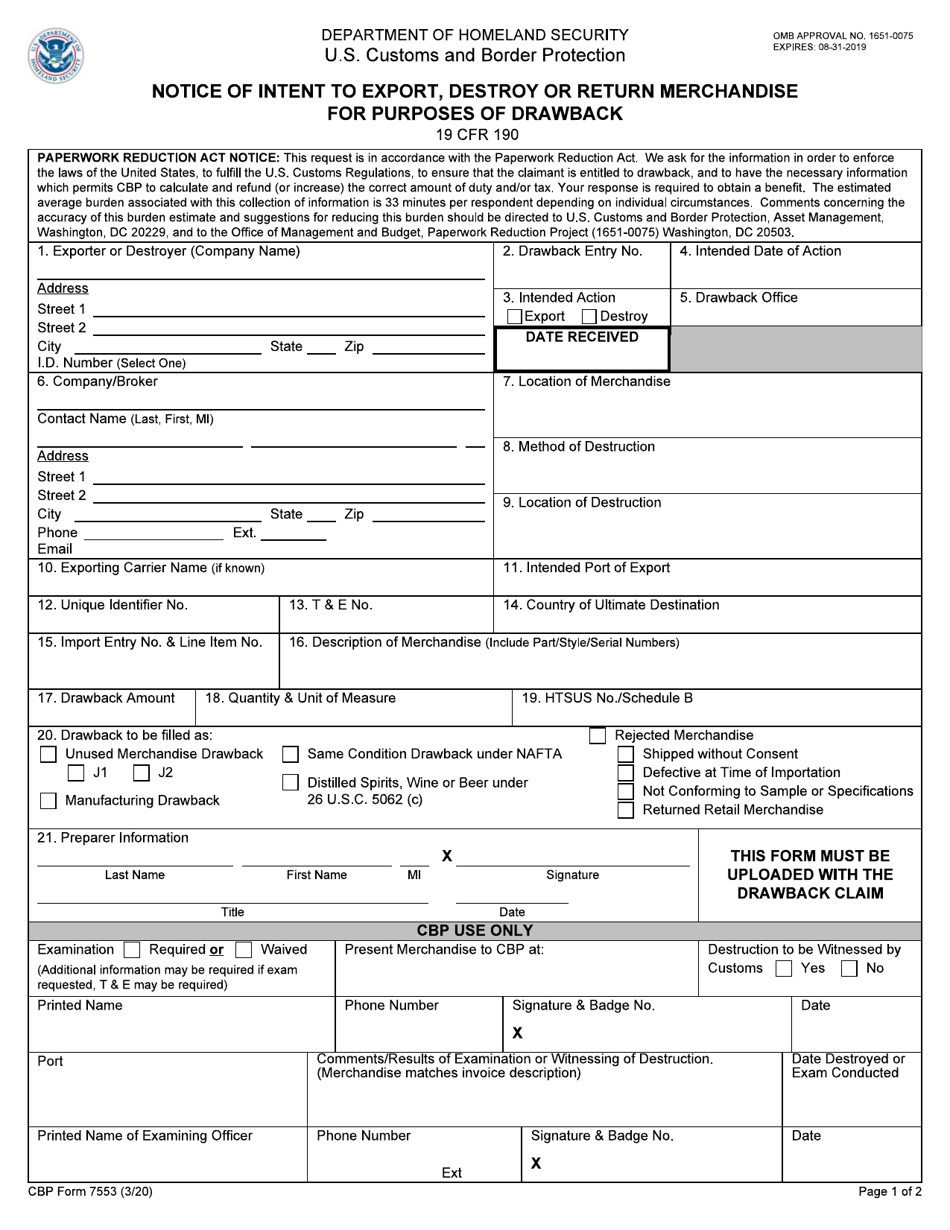

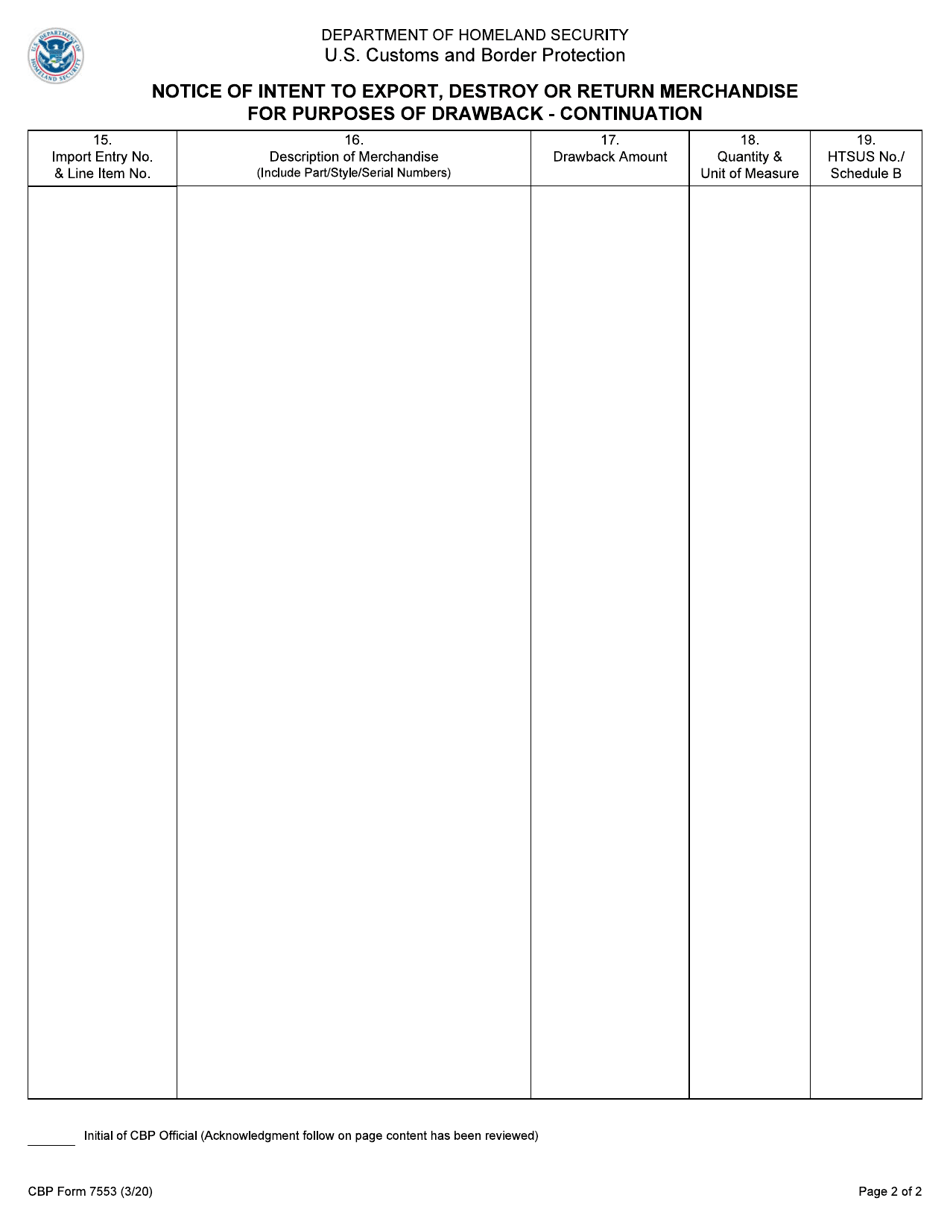

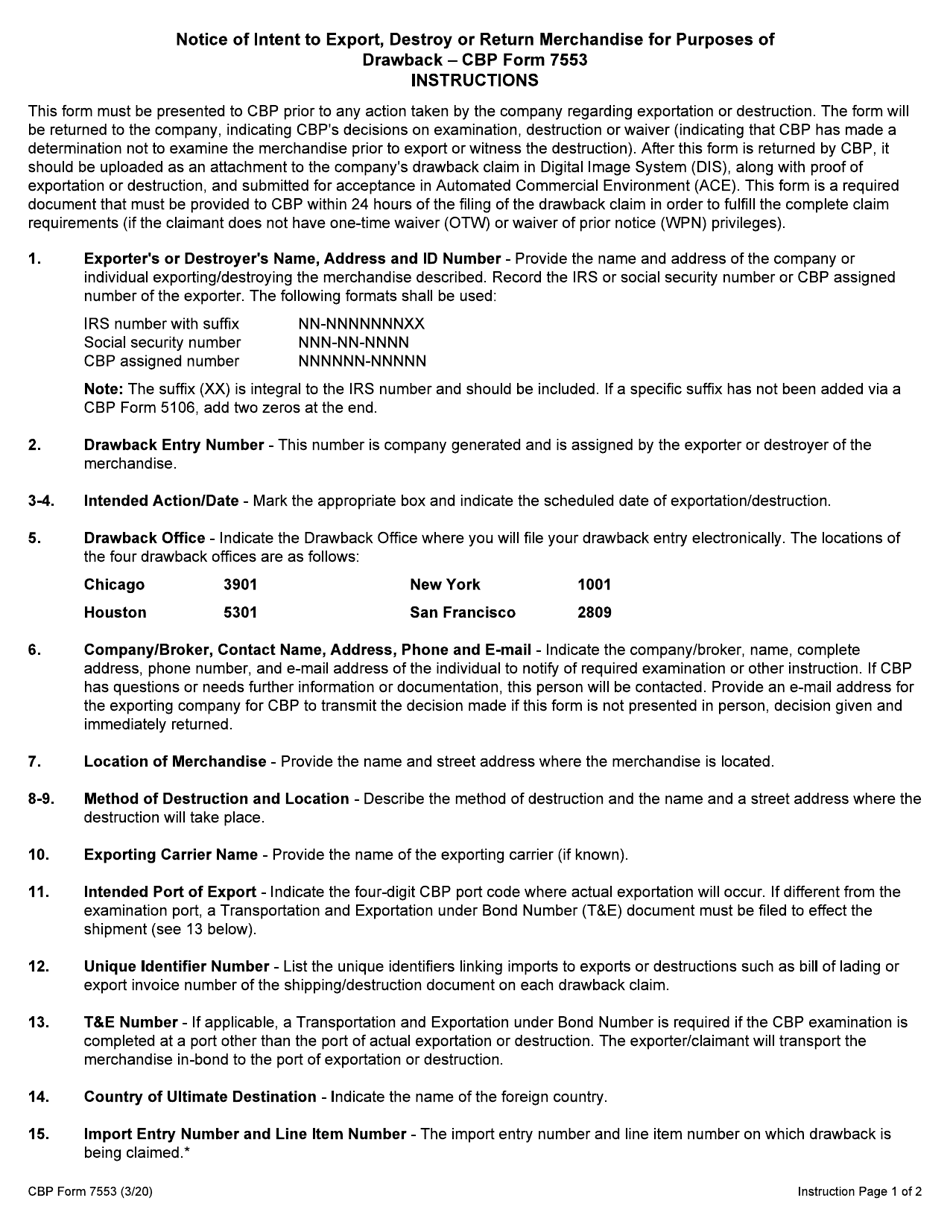

CBP Form 7553 Notice of Intent to Export, Destroy or Return Merchandise for Purposes of Drawback

What Is CBP Form 7553?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on March 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 7553?

A: CBP Form 7553 is a form used for notifying the U.S. Customs and Border Protection (CBP) about the intent to export, destroy, or return merchandise for purposes of drawback.

Q: What is the purpose of CBP Form 7553?

A: The purpose of CBP Form 7553 is to inform CBP about the intention to export, destroy, or return merchandise for purposes of drawback.

Q: Who needs to fill out CBP Form 7553?

A: Anyone who intends to export, destroy, or return merchandise for purposes of drawback needs to fill out CBP Form 7553.

Q: What is merchandise drawback?

A: Merchandise drawback is a refund of certain duties, taxes, and fees paid on imported merchandise when it is exported, destroyed, or used in the production of other goods.

Q: Are there any fees associated with filing CBP Form 7553?

A: No, there are no fees associated with filing CBP Form 7553.

Q: Is it mandatory to fill out CBP Form 7553?

A: Yes, it is mandatory to fill out CBP Form 7553 when intending to export, destroy, or return merchandise for purposes of drawback.

Q: What should I do after filling out CBP Form 7553?

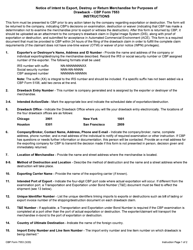

A: After filling out CBP Form 7553, you should submit it to the CBP office at the port of export, destruction, or return, as specified in the form instructions.

Form Details:

- Released on March 1, 2020;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 7553 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.