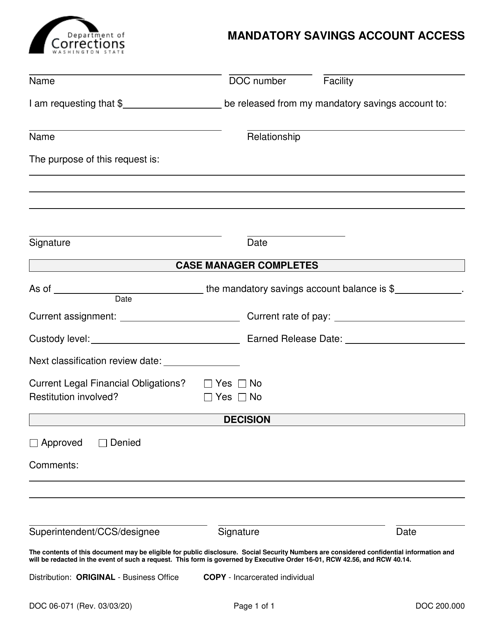

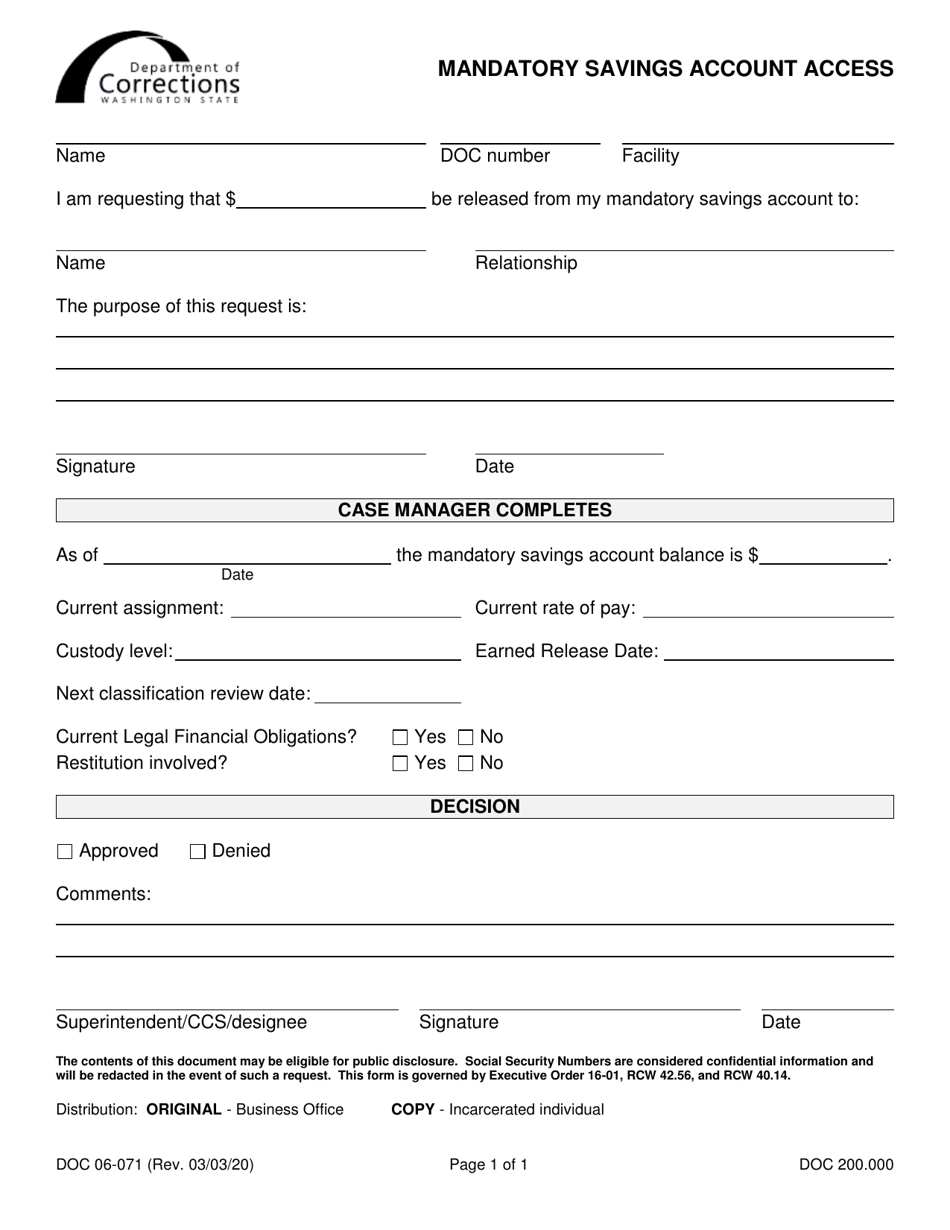

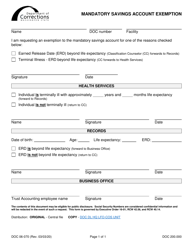

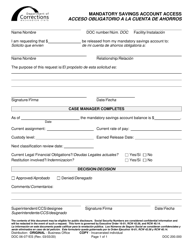

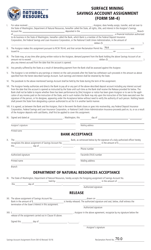

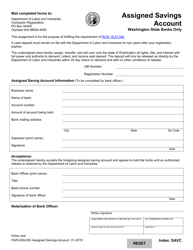

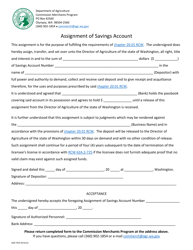

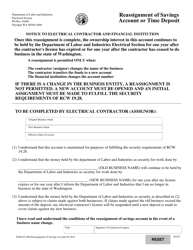

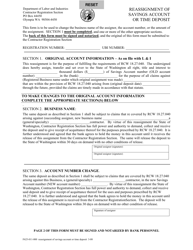

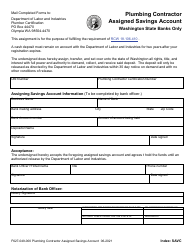

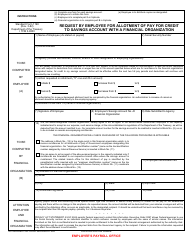

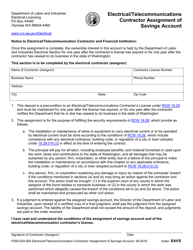

Form DOC06-071 Mandatory Savings Account Access - Washington

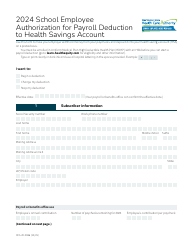

What Is Form DOC06-071?

This is a legal form that was released by the Washington State Department of Corrections - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DOC06-071 Mandatory Savings Account Access?

A: DOC06-071 Mandatory Savings Account Access is a document related to Washington state mandatory savings account access.

Q: What is a mandatory savings account?

A: A mandatory savings account is a type of account where individuals are required by law to deposit a certain amount of their earnings for future use.

Q: Who is required to have a mandatory savings account in Washington state?

A: In Washington state, certain employees with specific types of employers are required to have a mandatory savings account.

Q: What is the purpose of a mandatory savings account?

A: The purpose of a mandatory savings account is to encourage individuals to save money for their future financial needs.

Q: What are the benefits of having a mandatory savings account?

A: Having a mandatory savings account provides individuals with a financial safety net and the ability to save for important future expenses.

Q: How much money do individuals have to deposit into a mandatory savings account?

A: The amount of money individuals have to deposit into a mandatory savings account may vary depending on their income and employment status.

Q: Can individuals access the funds in their mandatory savings account?

A: Yes, individuals can access the funds in their mandatory savings account under certain circumstances.

Q: Are mandatory savings accounts taxed in Washington state?

A: Mandatory savings accounts in Washington state are subject to certain tax regulations.

Form Details:

- Released on March 3, 2020;

- The latest edition provided by the Washington State Department of Corrections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DOC06-071 by clicking the link below or browse more documents and templates provided by the Washington State Department of Corrections.