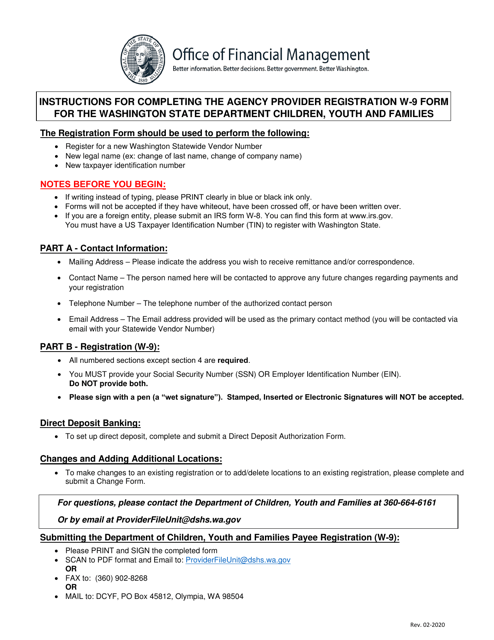

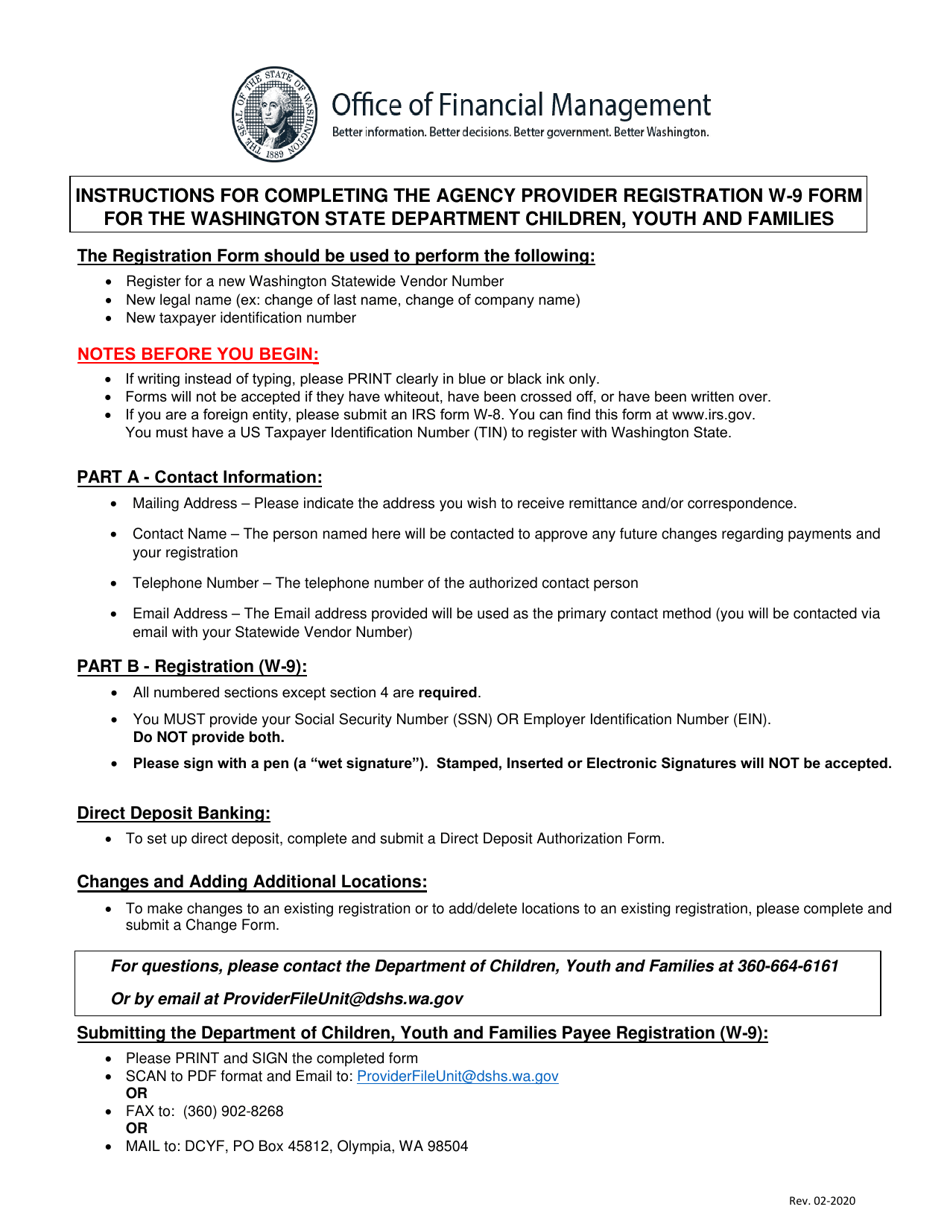

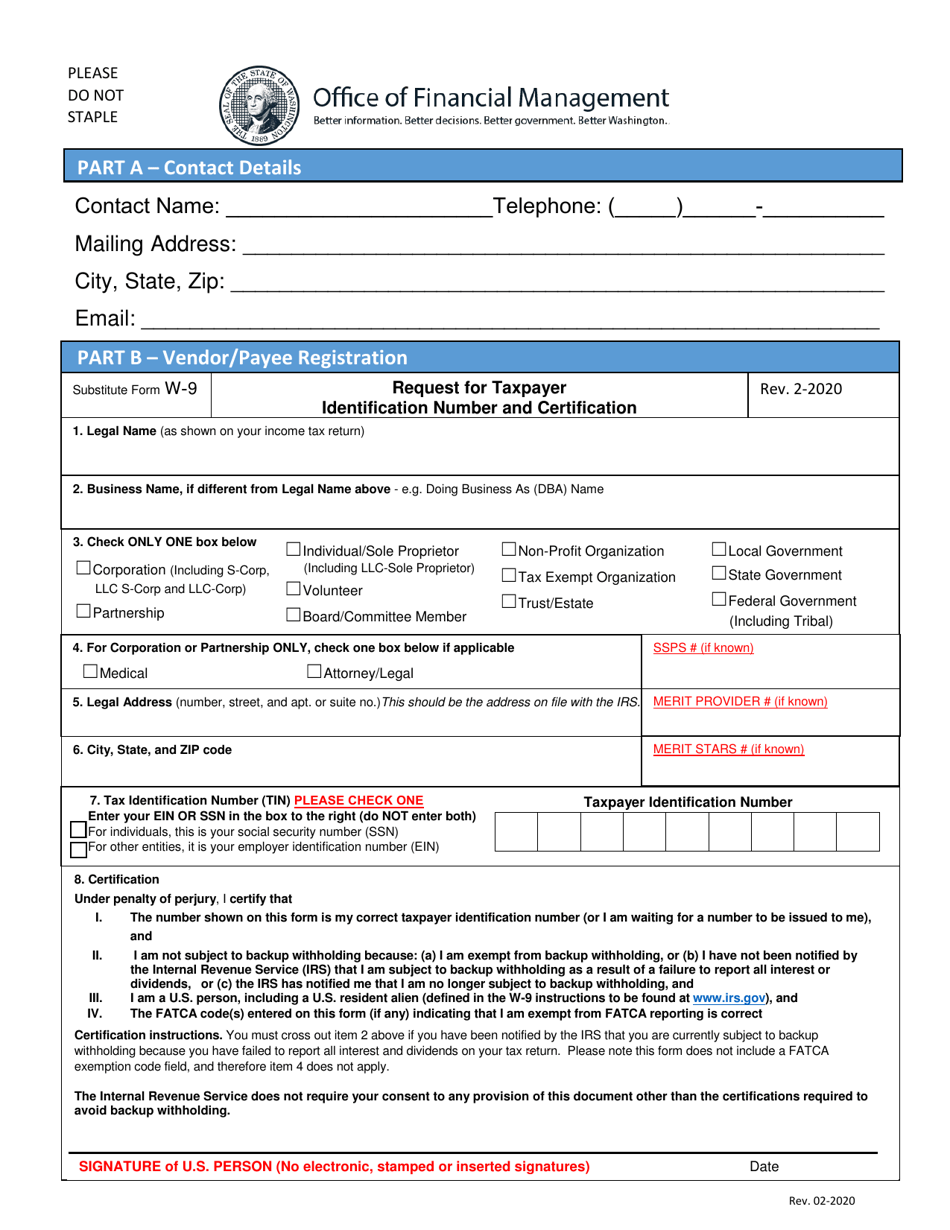

Form W-9 Provider Registration Form - Washington

What Is Form W-9?

This is a legal form that was released by the Washington State Department of Children, Youth, and Families - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

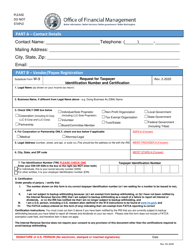

Q: What is Form W-9?

A: Form W-9 is a tax form used by individuals or businesses to provide their taxpayer identification number (TIN) to another party, such as a client or employer.

Q: What is the purpose of Form W-9?

A: The purpose of Form W-9 is to request the TIN from the payee, which is needed for filing certain U.S. tax forms, such as 1099-MISC.

Q: When should I use Form W-9?

A: You should use Form W-9 when you are asked by another party, such as a client or employer, to provide your TIN for tax reporting purposes.

Q: Who needs to fill out Form W-9?

A: Individuals or businesses who are being asked to provide their TIN to another party should fill out Form W-9.

Q: Is Form W-9 specific to Washington state?

A: No, Form W-9 is a federal tax form and is used throughout the United States, not just in Washington state.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Washington State Department of Children, Youth, and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-9 by clicking the link below or browse more documents and templates provided by the Washington State Department of Children, Youth, and Families.