This version of the form is not currently in use and is provided for reference only. Download this version of

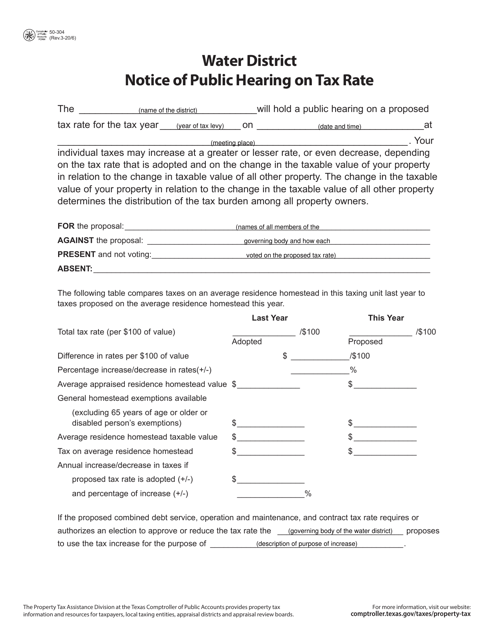

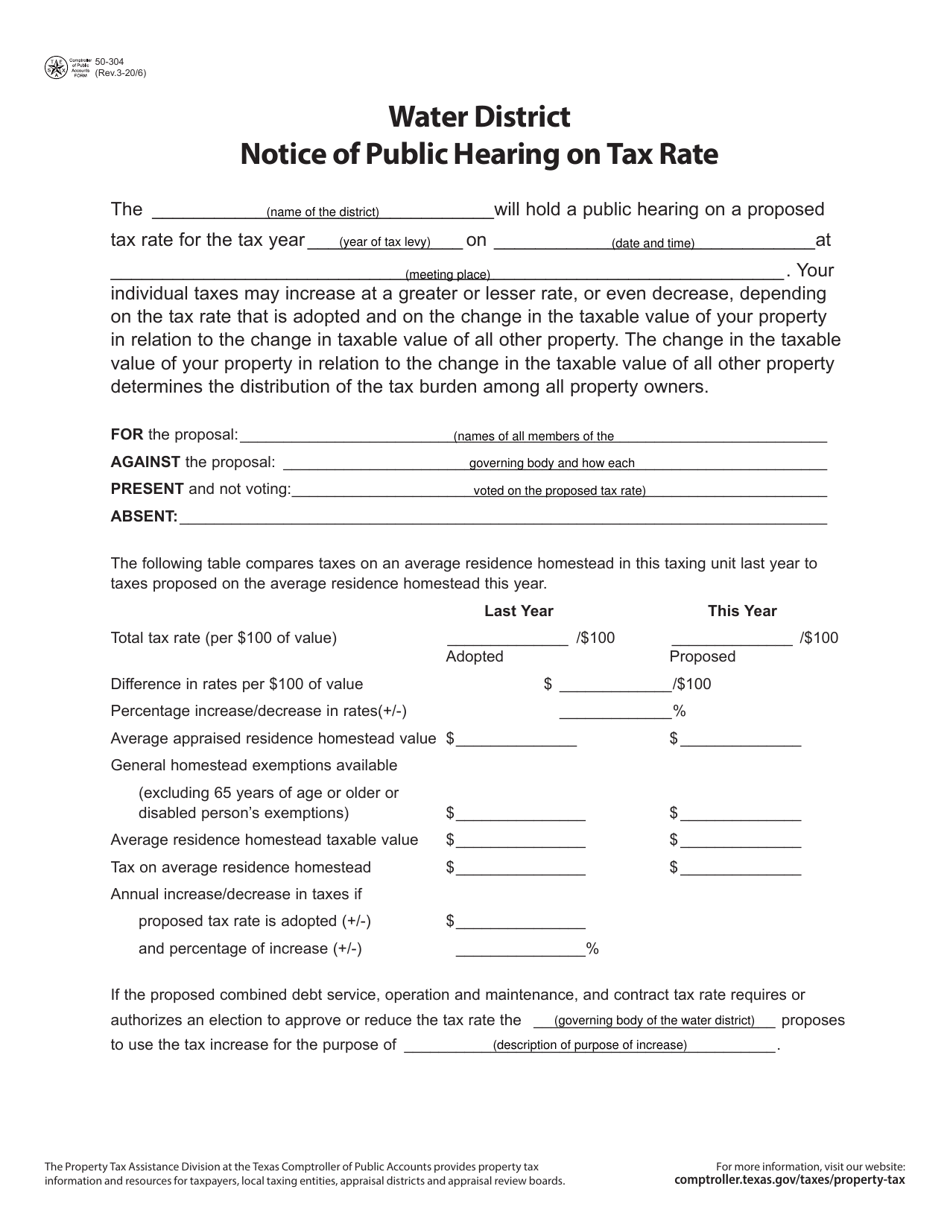

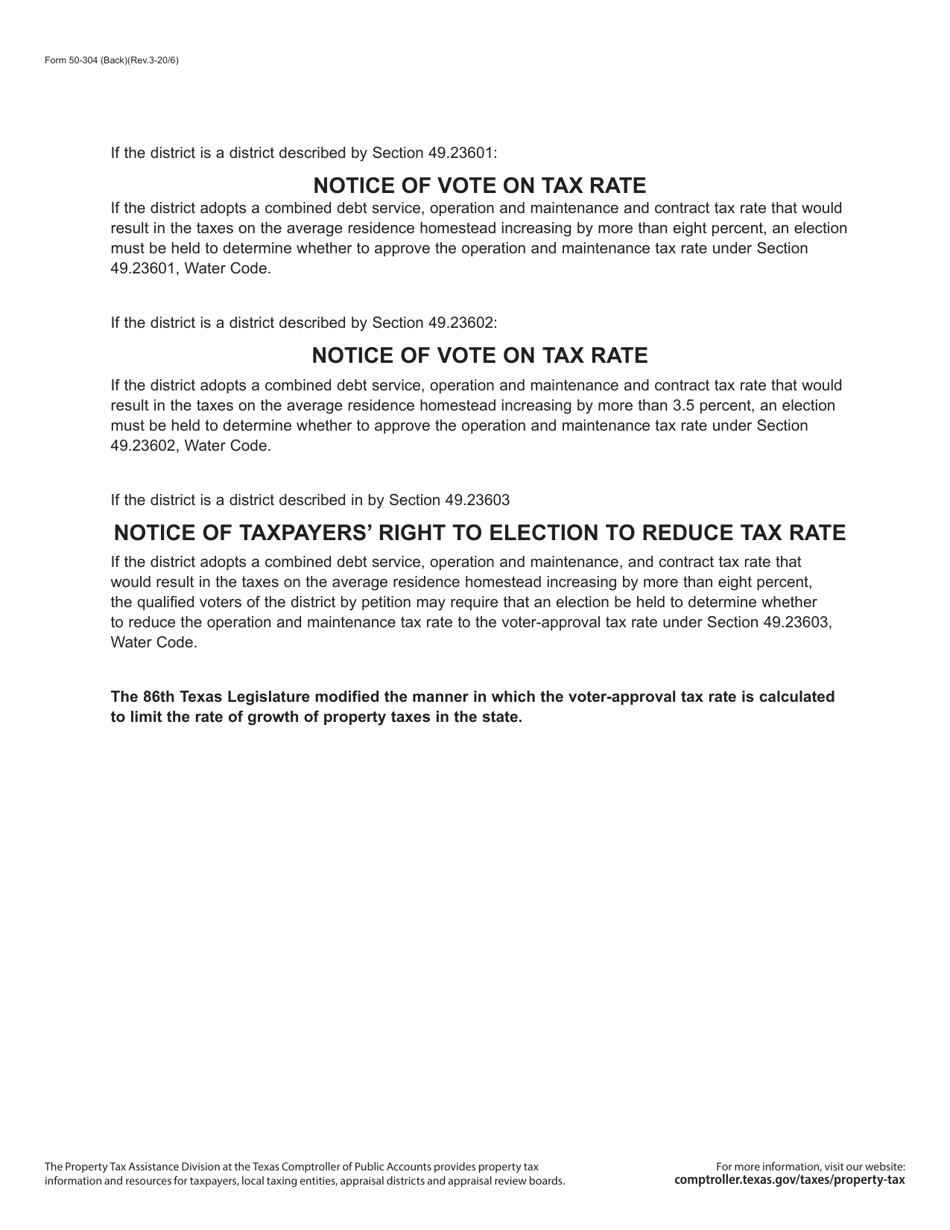

Form 50-304

for the current year.

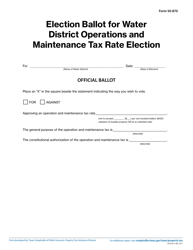

Form 50-304 Water District Notice of Public Hearing on Tax Rate - Texas

What Is Form 50-304?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-304?

A: Form 50-304 is titled 'Water District Notice of Public Hearing on Tax Rate'.

Q: What is the purpose of form 50-304?

A: The purpose of form 50-304 is to give notice of a public hearing on the tax rate of a water district in Texas.

Q: Who needs to fill out form 50-304?

A: Water districts in Texas are required to fill out form 50-304 to give notice of the public hearing on their tax rate.

Q: What information is required on form 50-304?

A: Form 50-304 requires information such as the name of the water district, contact information, the date and time of the public hearing, and the proposed tax rate.

Q: When should form 50-304 be filed?

A: Form 50-304 should be filed at least 15 days before the public hearing on the tax rate of the water district.

Q: What is the purpose of the public hearing mentioned in form 50-304?

A: The public hearing allows members of the community to provide input and ask questions about the proposed tax rate of the water district.

Q: Is there a fee to file form 50-304?

A: There is no fee to file form 50-304.

Q: What happens after the public hearing mentioned in form 50-304?

A: After the public hearing, the water district will determine the final tax rate based on the feedback received and any necessary adjustments.

Q: What if I have more questions about form 50-304?

A: If you have more questions about form 50-304, you can contact the Texas Comptroller of Public Accounts for assistance.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-304 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.