This version of the form is not currently in use and is provided for reference only. Download this version of

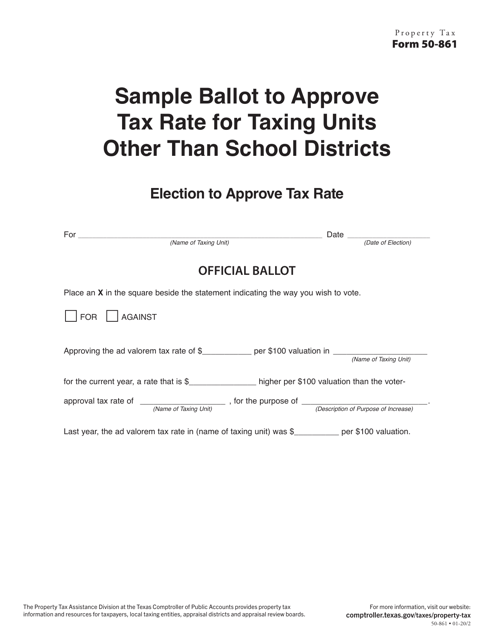

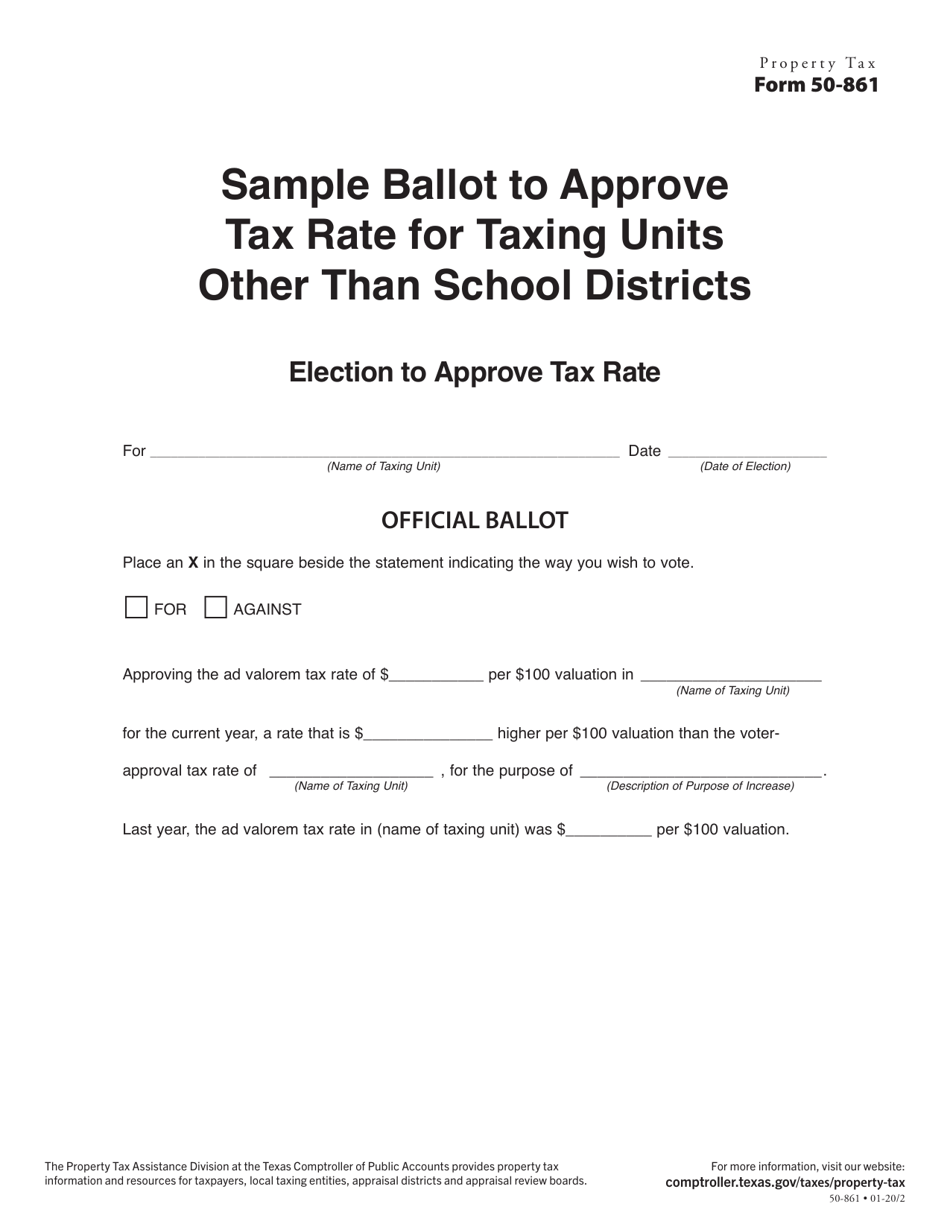

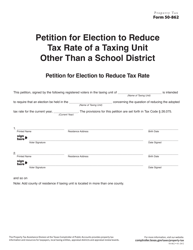

Form 50-861

for the current year.

Form 50-861 Sample Ballot to Approve Tax Rate for Taxing Units Other Than School Districts - Texas

What Is Form 50-861?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-861?

A: Form 50-861 is a Sample Ballot to Approve Tax Rate for Taxing Units Other Than School Districts in Texas.

Q: What is the purpose of Form 50-861?

A: The purpose of Form 50-861 is to seek approval for the tax rate for taxing units other than school districts in Texas.

Q: Who needs to fill out Form 50-861?

A: Form 50-861 needs to be filled out by taxing units other than school districts in Texas seeking approval for their tax rate.

Q: What information is required on Form 50-861?

A: Form 50-861 requires information such as the name of the taxing unit, proposed tax rate, and contact information of the person authorized to represent the taxing unit.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-861 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.