This version of the form is not currently in use and is provided for reference only. Download this version of

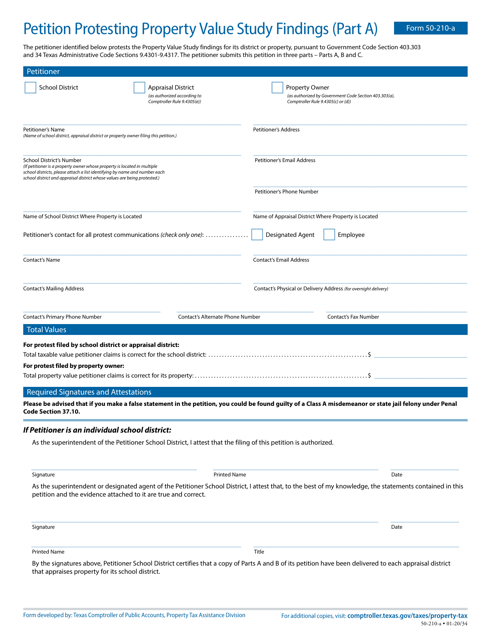

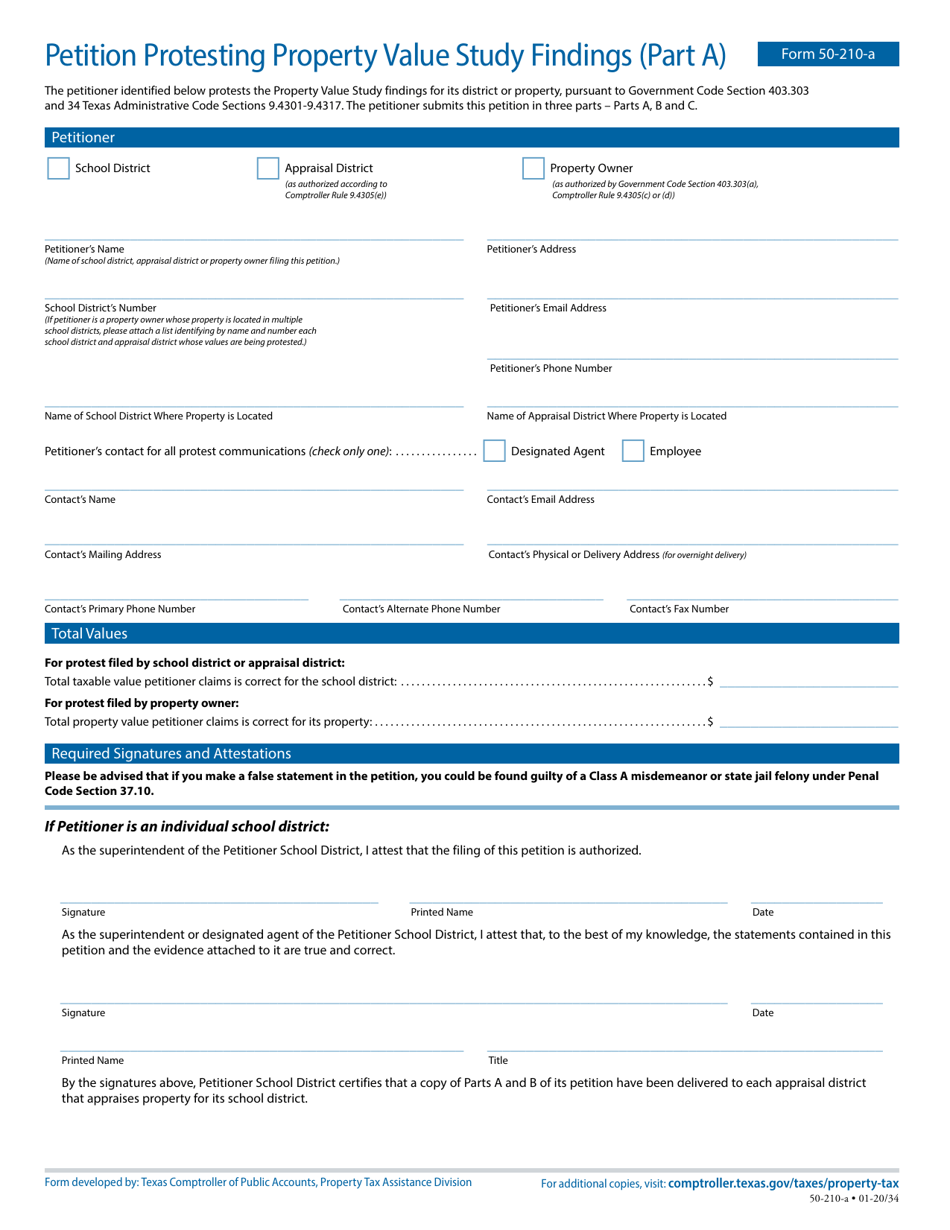

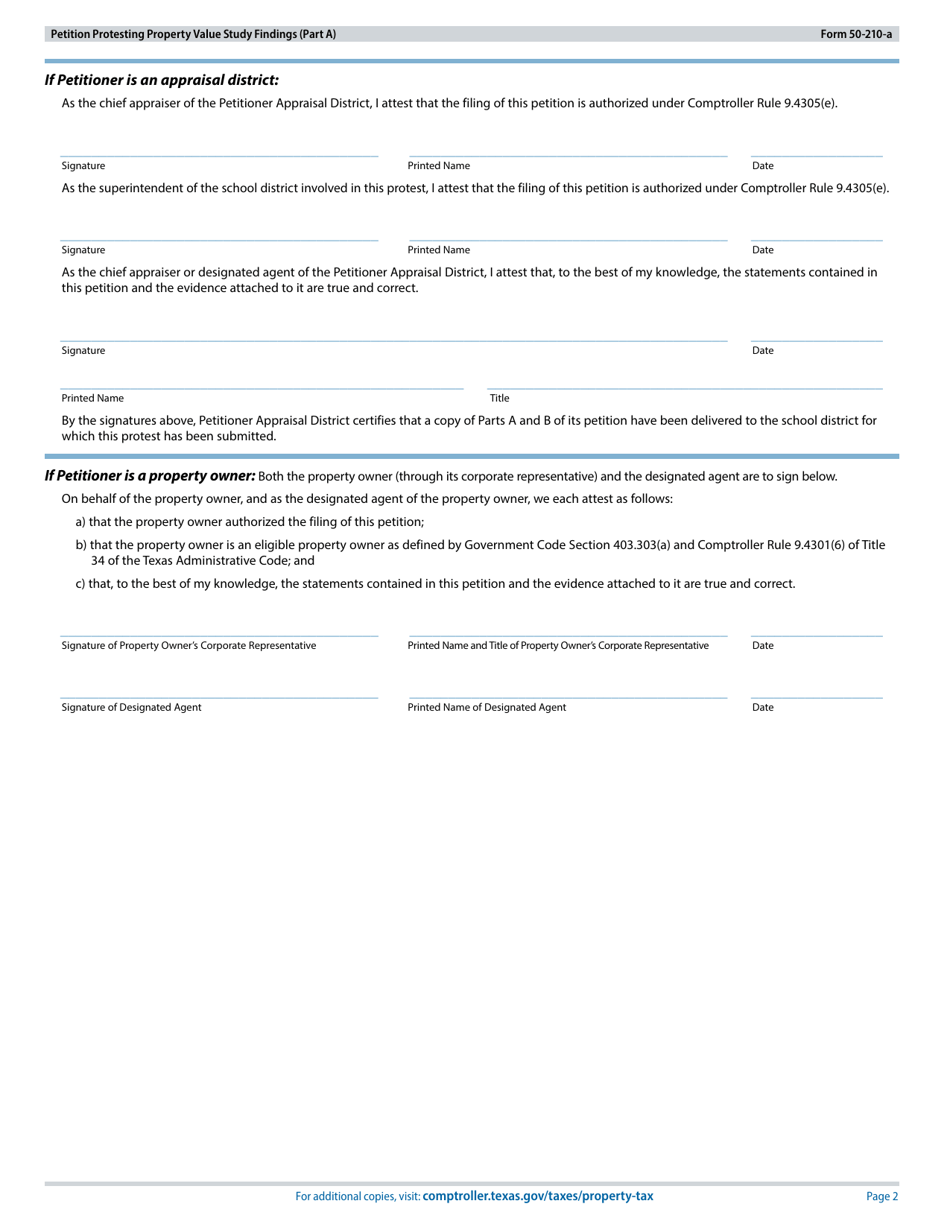

Form 50-210-A Part A

for the current year.

Form 50-210-A Part A Petition Protesting Property Value Study Findings - Texas

What Is Form 50-210-A Part A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas.The document is a supplement to Form 50-210-A, Petition Protesting Property Value Study Findings (Part a). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-210-A Part A?

A: Form 50-210-A Part A is a petition used in Texas to protest the findings of a property value study.

Q: What is a property value study?

A: A property value study is an assessment conducted by the appraisal district to determine the value of a property for tax purposes.

Q: Why would someone protest the findings of a property value study?

A: Someone might protest the findings of a property value study if they believe the assessed value is too high, which could lead to higher property taxes.

Q: Who can file a petition using Form 50-210-A Part A?

A: Any property owner in Texas who disagrees with the findings of a property value study can file this petition.

Q: How do I file a petition using Form 50-210-A Part A?

A: To file the petition, you will need to complete the form and submit it to the county appraisal review board (ARB) within the specified deadline.

Q: What information is required on Form 50-210-A Part A?

A: The form requires information such as the property owner's name, property address, account number, and a detailed explanation of the reasons for the protest.

Q: What happens after filing the petition?

A: After filing the petition, the county appraisal review board (ARB) will schedule a hearing to review the protest and make a determination.

Q: What is the deadline for filing the petition?

A: The deadline for filing the petition is typically May 15th or 30 days after the notice of appraised value is mailed, whichever is later.

Q: Can I file a petition if I missed the deadline?

A: If you miss the deadline, you may not be able to file the petition for that tax year. It's important to file on time to preserve your rights.

Q: Is there a fee for filing the petition?

A: There is usually no fee for filing the petition, but it's best to check with the county appraisal district to confirm.

Q: What happens if my petition is successful?

A: If your petition is successful, the county appraisal review board (ARB) will adjust the assessed value of your property, potentially lowering your property taxes.

Q: What if I disagree with the ARB's decision?

A: If you disagree with the decision of the county appraisal review board (ARB), you may have the option to further appeal the decision to a district court.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-210-A Part A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.