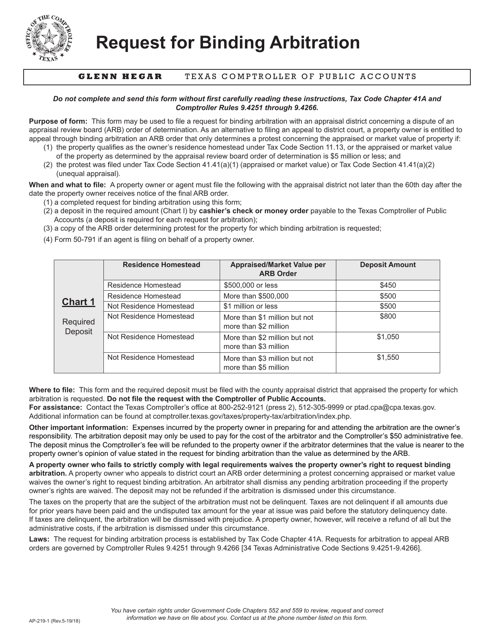

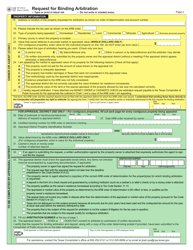

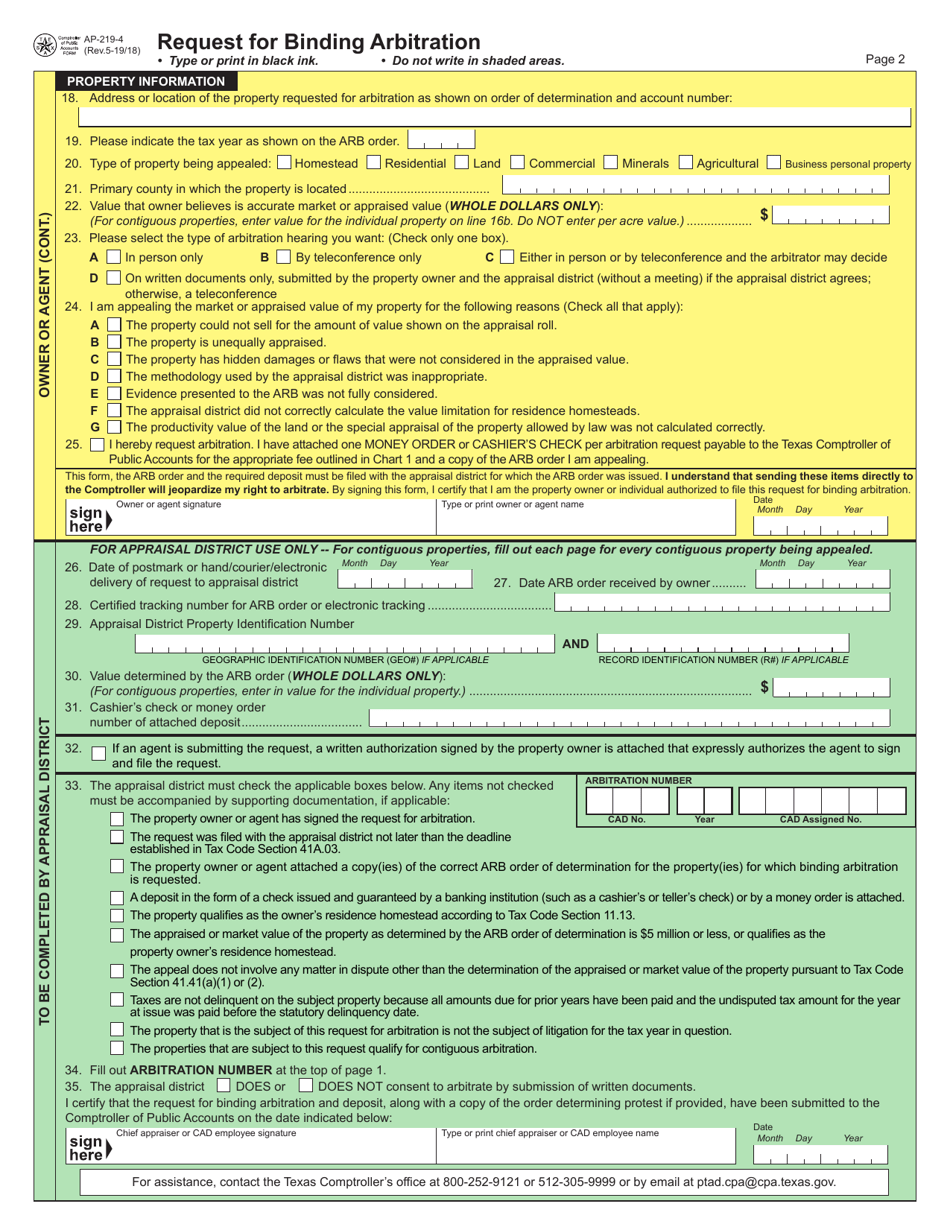

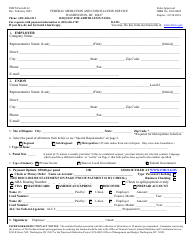

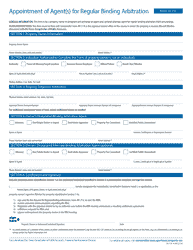

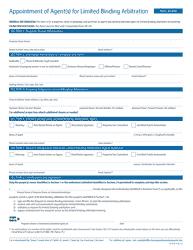

Form AP-219 Request for Binding Arbitration - Texas

What Is Form AP-219?

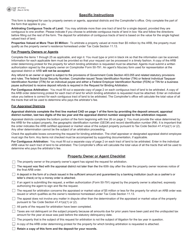

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

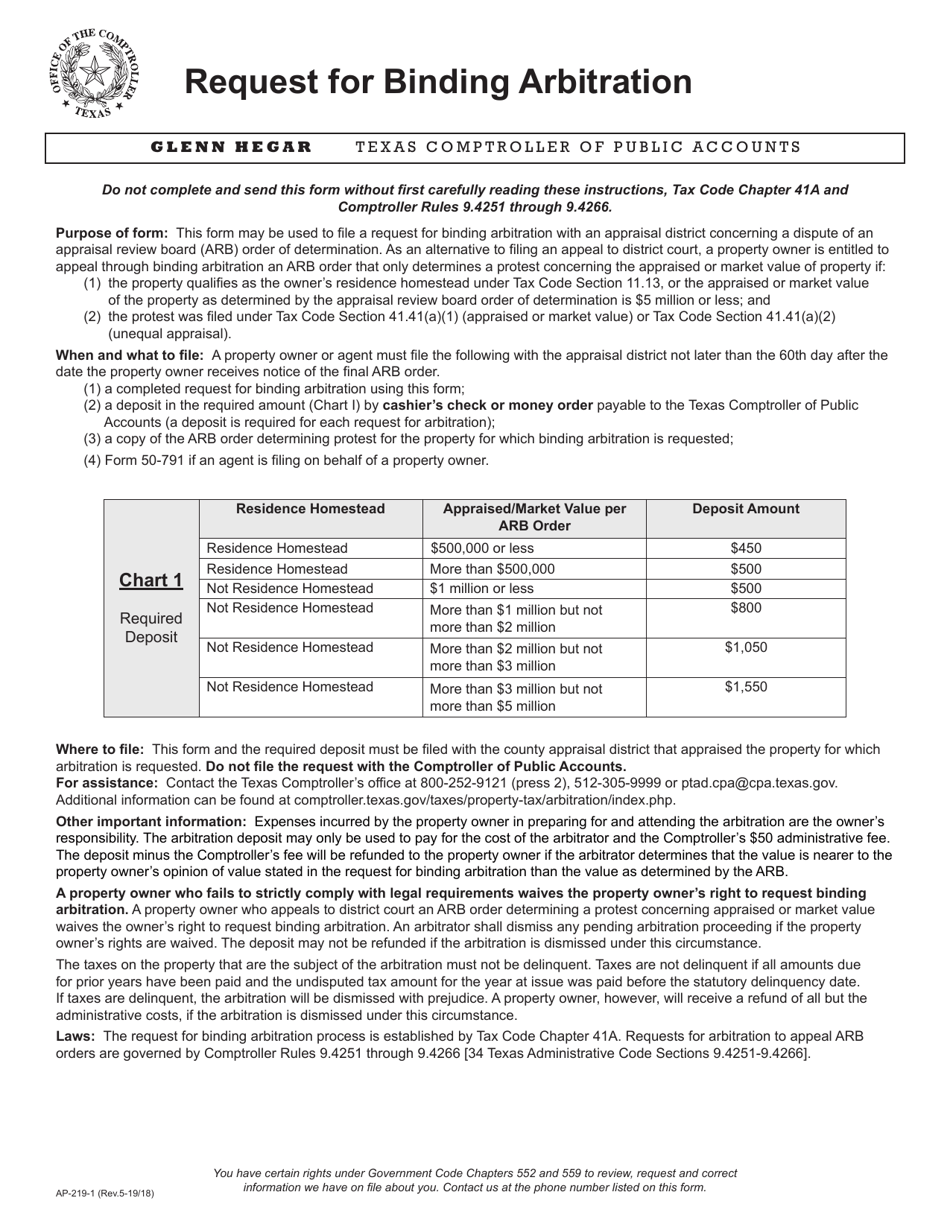

Q: What is Form AP-219?

A: Form AP-219 is a request for binding arbitration in the state of Texas.

Q: What is binding arbitration?

A: Binding arbitration is a legal process where a neutral third party, called an arbitrator, reviews the case and makes a final decision that is legally binding on all parties involved.

Q: When would someone use Form AP-219?

A: Form AP-219 is used when someone wants to request binding arbitration in Texas.

Q: What is the purpose of using binding arbitration?

A: The purpose of using binding arbitration is to resolve disputes outside of court in a faster and more cost-effective manner.

Q: Who can use Form AP-219?

A: Form AP-219 can be used by individuals, businesses, or organizations that want to resolve a dispute through binding arbitration in Texas.

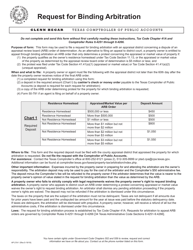

Q: Is there a fee for filing Form AP-219?

A: There may be a filing fee associated with submitting Form AP-219. You should check with the specific court or arbitration organization for information on fees.

Q: Do I need an attorney to fill out Form AP-219?

A: It is not required to have an attorney to fill out Form AP-219, but it may be helpful to consult with one, especially if you are unfamiliar with the arbitration process.

Q: How long does the arbitration process usually take?

A: The length of the arbitration process can vary depending on the complexity of the case and the availability of the arbitrator. It can range from a few months to a year or more.

Q: Can the decision made in binding arbitration be appealed?

A: In general, the decision made in binding arbitration cannot be appealed, as it is meant to be final and binding. However, there may be limited circumstances where an appeal is possible based on specific legal grounds.

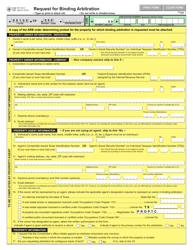

Form Details:

- Released on May 18, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-219 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.