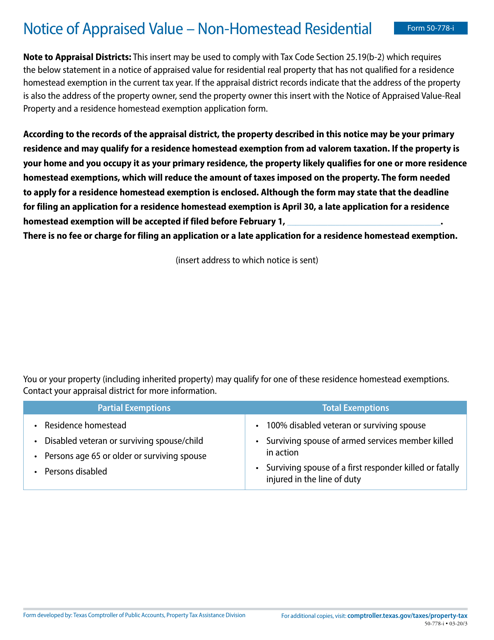

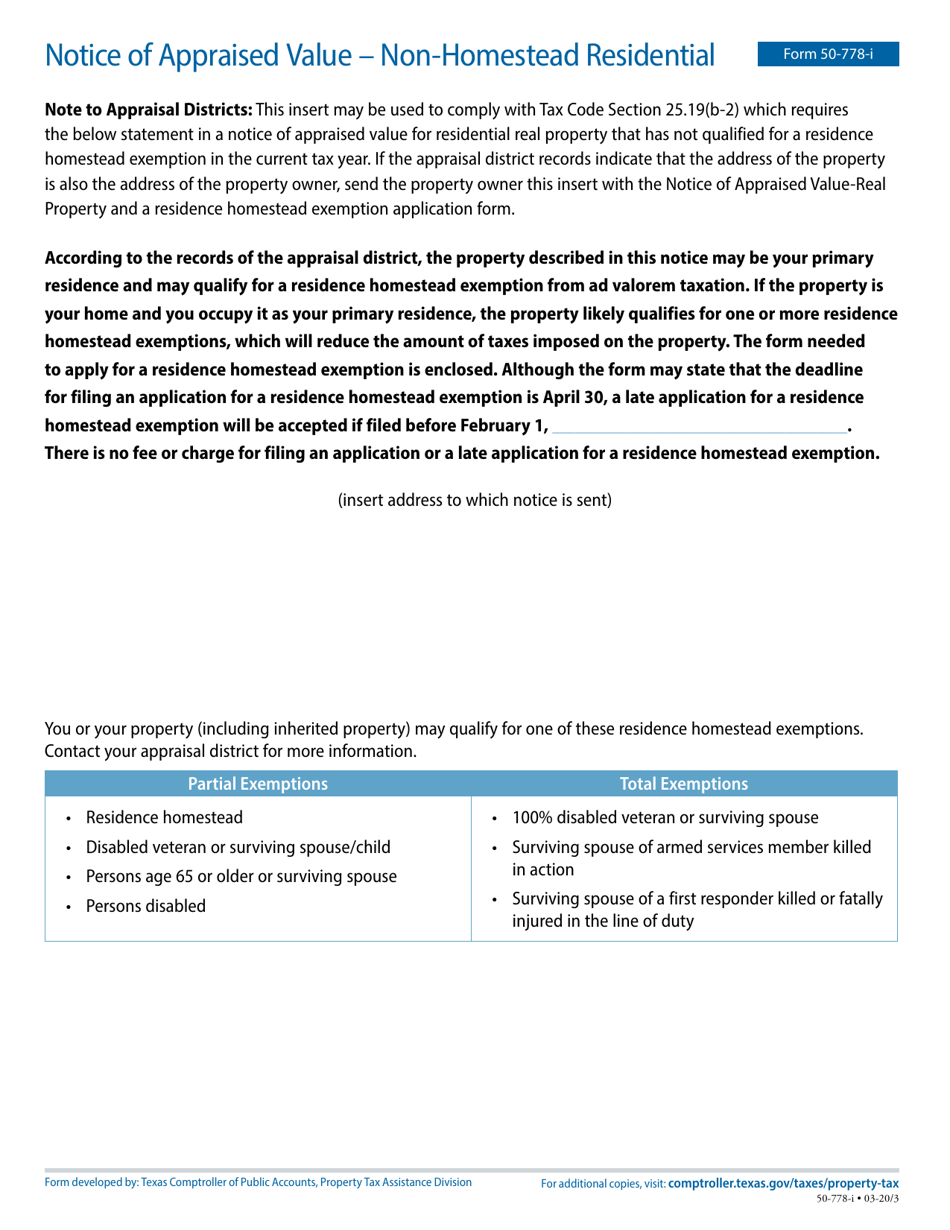

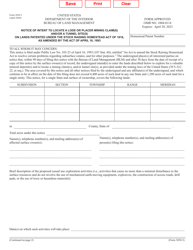

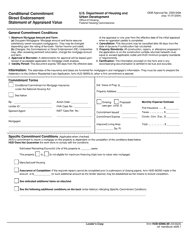

Form 50-778-I Notice of Appraised Value - Non-homestead Residential - Texas

What Is Form 50-778-I?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-778-I?

A: Form 50-778-I is the Notice of Appraised Value for Non-homestead Residential properties in Texas.

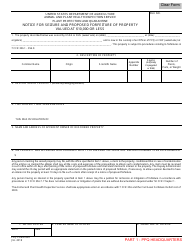

Q: What is the purpose of Form 50-778-I?

A: The purpose of Form 50-778-I is to inform property owners of the appraised value of their non-homestead residential property in Texas.

Q: Who needs to file Form 50-778-I?

A: Property owners of non-homestead residential properties in Texas need to receive Form 50-778-I from the appraisal district.

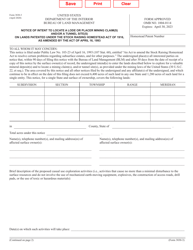

Q: When is Form 50-778-I filed?

A: Form 50-778-I is typically filed annually and is sent to property owners by the appraisal district.

Q: Can I appeal the appraised value on Form 50-778-I?

A: Yes, property owners have the right to appeal the appraised value shown on Form 50-778-I.

Q: How do I appeal the appraised value on Form 50-778-I?

A: To appeal the appraised value on Form 50-778-I, property owners should follow the instructions provided on the form or contact their local appraisal district for more information.

Q: Are there any deadlines to appeal the appraised value on Form 50-778-I?

A: Yes, property owners must file their appeal before the deadline specified on the form or as instructed by their local appraisal district.

Q: What happens if I do not receive Form 50-778-I?

A: If you do not receive Form 50-778-I, you should contact your local appraisal district to ensure you are receiving the necessary appraisal information for your property.

Q: Is Form 50-778-I specific to Texas?

A: Yes, Form 50-778-I is specific to the state of Texas and the appraisal process for non-homestead residential properties.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-778-I by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.