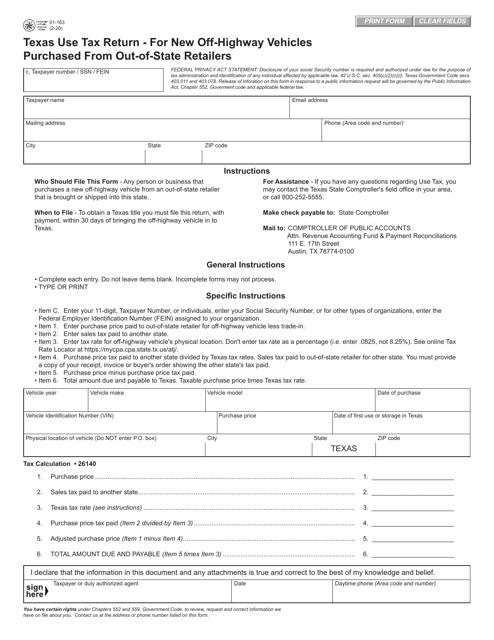

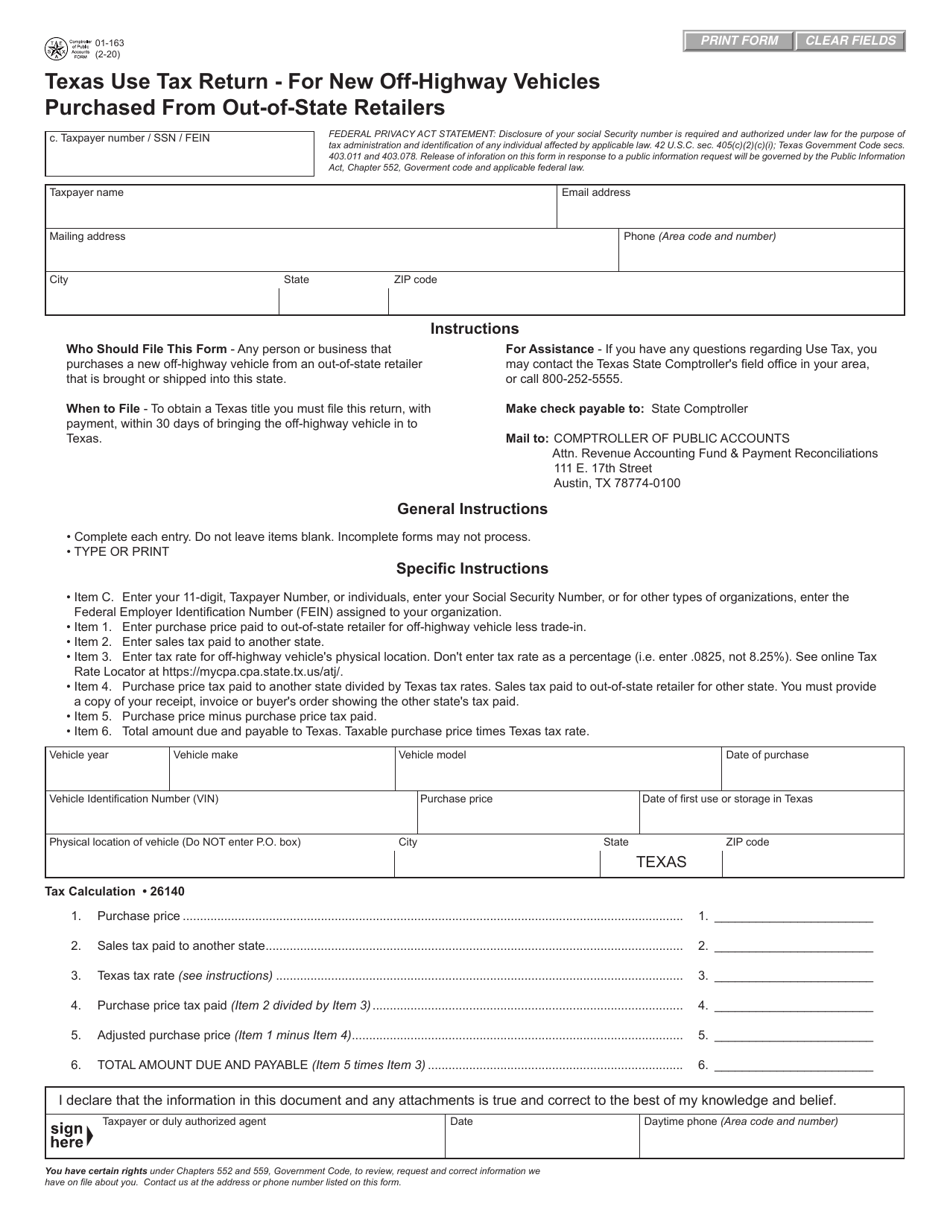

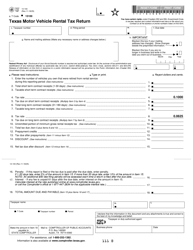

Form 01-163 Texas Use Tax Return - for New Off-Highway Vehicles Purchased From Out-of-State Retailers - Texas

What Is Form 01-163?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-163?

A: Form 01-163 is the Texas Use Tax Return for New Off-Highway Vehicles Purchased From Out-of-State Retailers.

Q: Who needs to fill out Form 01-163?

A: Anyone who purchases a new off-highway vehicle from an out-of-state retailer and brings it into Texas needs to fill out this form.

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of tangible personal property purchased for use in Texas.

Q: What is an off-highway vehicle?

A: An off-highway vehicle refers to motor vehicles designed for off-road use, such as all-terrain vehicles (ATVs), utility vehicles (UTVs), and off-road motorcycles.

Q: Do I need to pay use tax if I purchased the off-highway vehicle from an in-state retailer?

A: No, if you purchased the off-highway vehicle from an in-state retailer, you will not need to pay use tax.

Q: When do I need to file Form 01-163?

A: Form 01-163 should be filed within 30 days of bringing the off-highway vehicle into Texas.

Q: Are there any penalties for not filing Form 01-163?

A: Yes, failure to file Form 01-163 may result in penalties and interest charges.

Q: Do I need to include payment with Form 01-163?

A: Yes, you will need to include payment for the use tax owed along with the completed form.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-163 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.