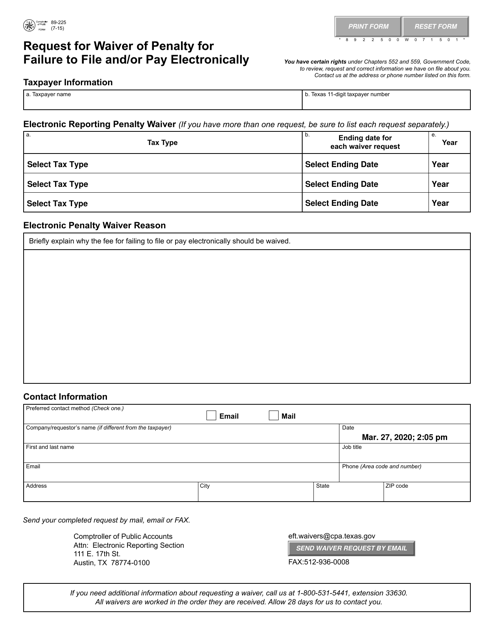

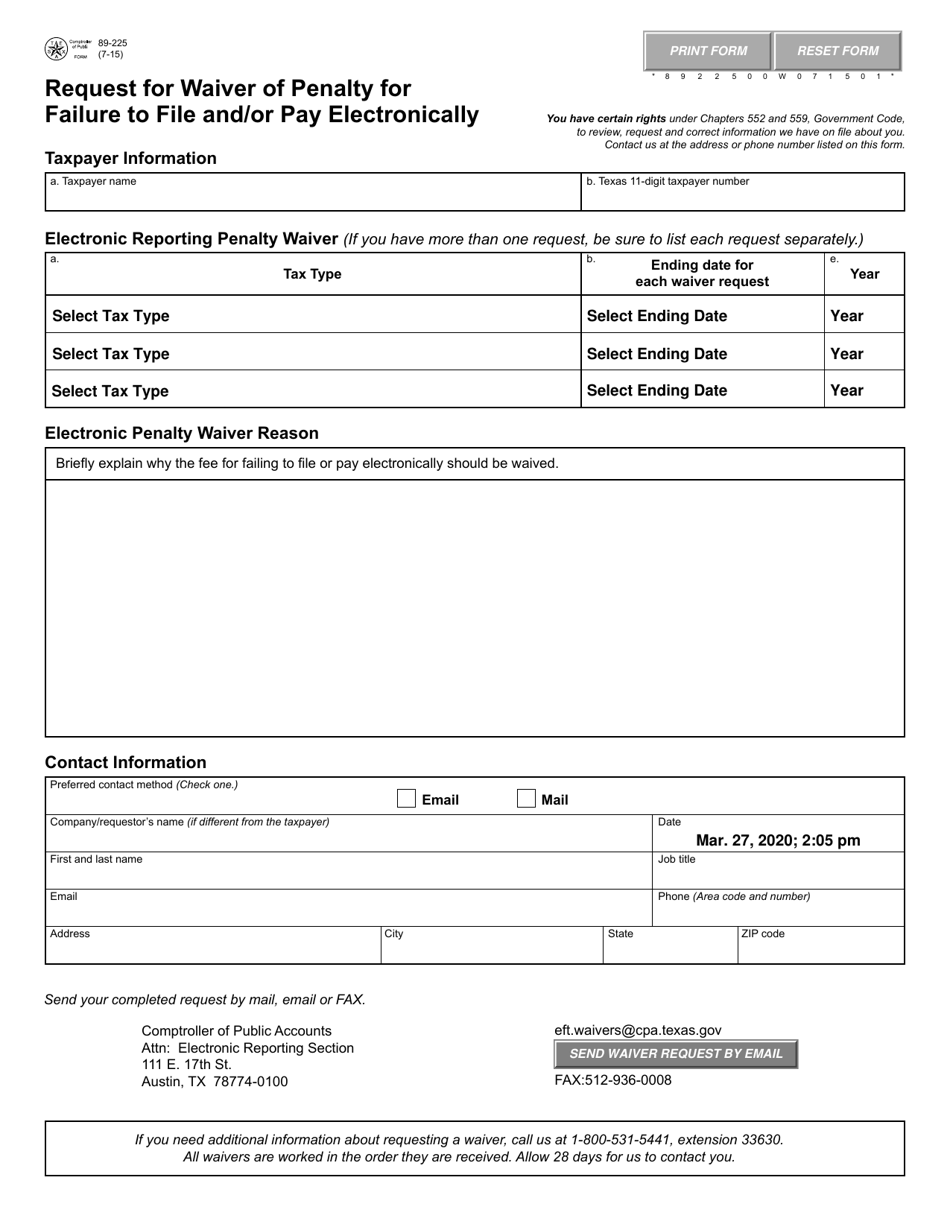

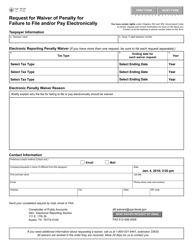

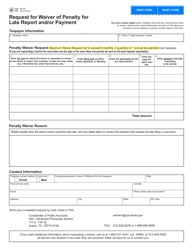

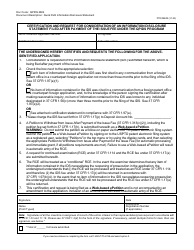

Form 89-225 Request for Waiver of Penalty for Failure to File and / or Pay Electronically - Texas

What Is Form 89-225?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 89-225?

A: Form 89-225 is a request for waiver of penalty for failure to file and/or pay electronically in Texas.

Q: When should Form 89-225 be used?

A: Form 89-225 should be used when requesting a waiver of penalty for failure to file and/or pay electronically in Texas.

Q: What is the purpose of Form 89-225?

A: The purpose of Form 89-225 is to request a waiver of penalty for failure to file and/or pay electronically in Texas.

Q: What information is required on Form 89-225?

A: Form 89-225 requires information such as taxpayer details, tax period, and reason for requesting the waiver.

Q: How can I submit Form 89-225?

A: You can submit Form 89-225 electronically by logging into your Texas Comptroller account.

Q: Is there a deadline for submitting Form 89-225?

A: Yes, Form 89-225 must be submitted within 30 days from the date of the penalty notice.

Q: Can I request a waiver of penalty for multiple tax periods on a single Form 89-225?

A: Yes, you can request a waiver of penalty for multiple tax periods on a single Form 89-225.

Q: Will my request for waiver of penalty be automatically approved?

A: No, your request for waiver of penalty will be reviewed by the Texas Comptroller before a decision is made.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 89-225 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.