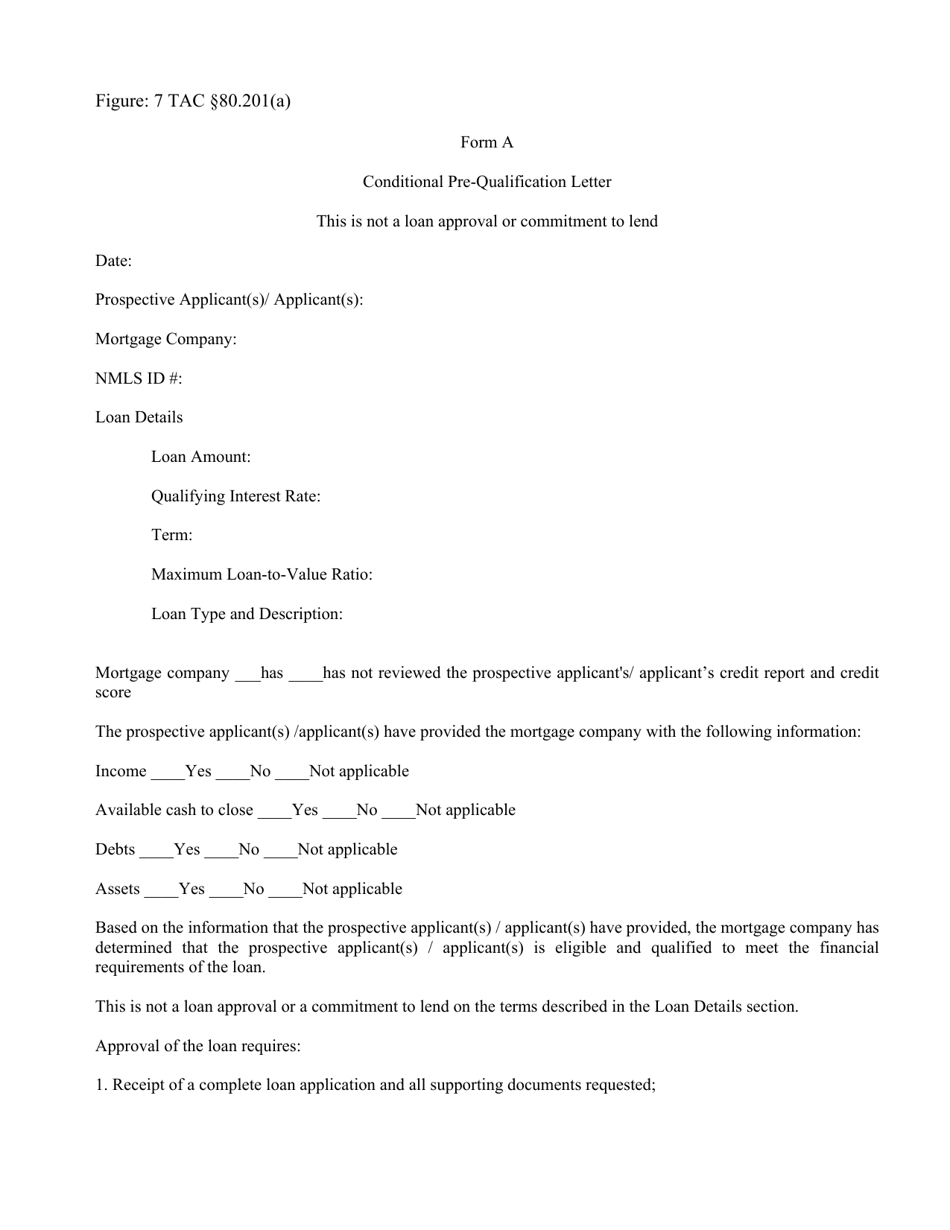

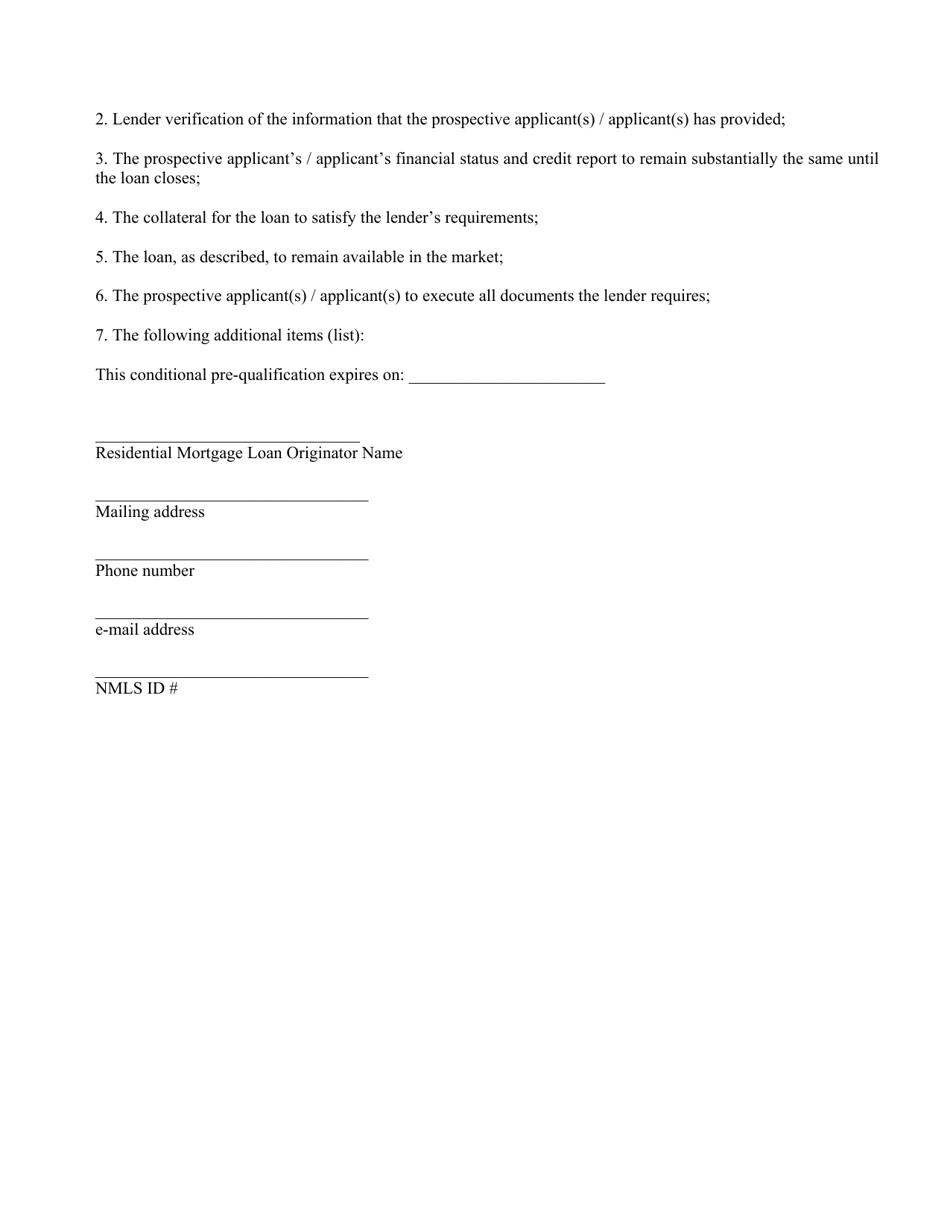

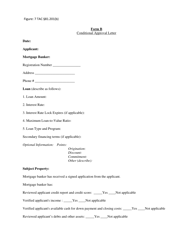

Form A Conditional Pre-qualification Letter - Texas

What Is Form A?

This is a legal form that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a pre-qualification letter?

A: A pre-qualification letter is a document that indicates the amount of money a lender is willing to lend to a potential borrower.

Q: Why is a pre-qualification letter important?

A: A pre-qualification letter is important because it shows sellers that you are a serious buyer and that you have the financial means to purchase a property.

Q: What is a conditional pre-qualification letter?

A: A conditional pre-qualification letter is a pre-qualification letter that is subject to certain conditions being met, such as verification of income and employment.

Q: How do I form a conditional pre-qualification letter in Texas?

A: To form a conditional pre-qualification letter in Texas, you will need to contact a lender and provide them with your financial information and documentation, such as tax returns and pay stubs.

Q: Who issues a conditional pre-qualification letter?

A: A conditional pre-qualification letter is typically issued by a lender or mortgage broker.

Q: What information do I need to provide to get a conditional pre-qualification letter?

A: To get a conditional pre-qualification letter, you will need to provide your financial information, such as income, assets, and debts, as well as supporting documentation.

Q: How long is a conditional pre-qualification letter valid for?

A: The validity of a conditional pre-qualification letter can vary, but it is typically valid for around 60 to 90 days.

Q: Can I use a conditional pre-qualification letter to make an offer on a house?

A: Yes, you can use a conditional pre-qualification letter to make an offer on a house. However, keep in mind that it is still subject to the conditions outlined in the letter.

Q: Does a conditional pre-qualification letter guarantee a loan?

A: No, a conditional pre-qualification letter does not guarantee a loan. It is only an indication of the amount a lender is willing to lend, subject to certain conditions being met.

Q: What should I do after receiving a conditional pre-qualification letter?

A: After receiving a conditional pre-qualification letter, you should continue with the mortgage application process and provide any additional documentation or information requested by the lender.

Form Details:

- The latest edition provided by the Texas Department of Savings and Mortgage Lending;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form A by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.