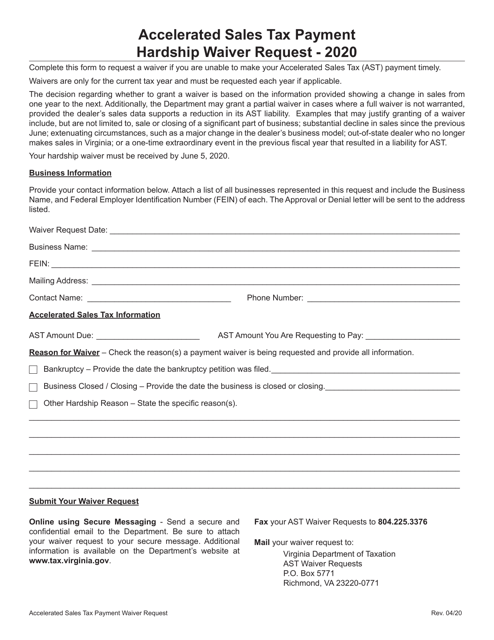

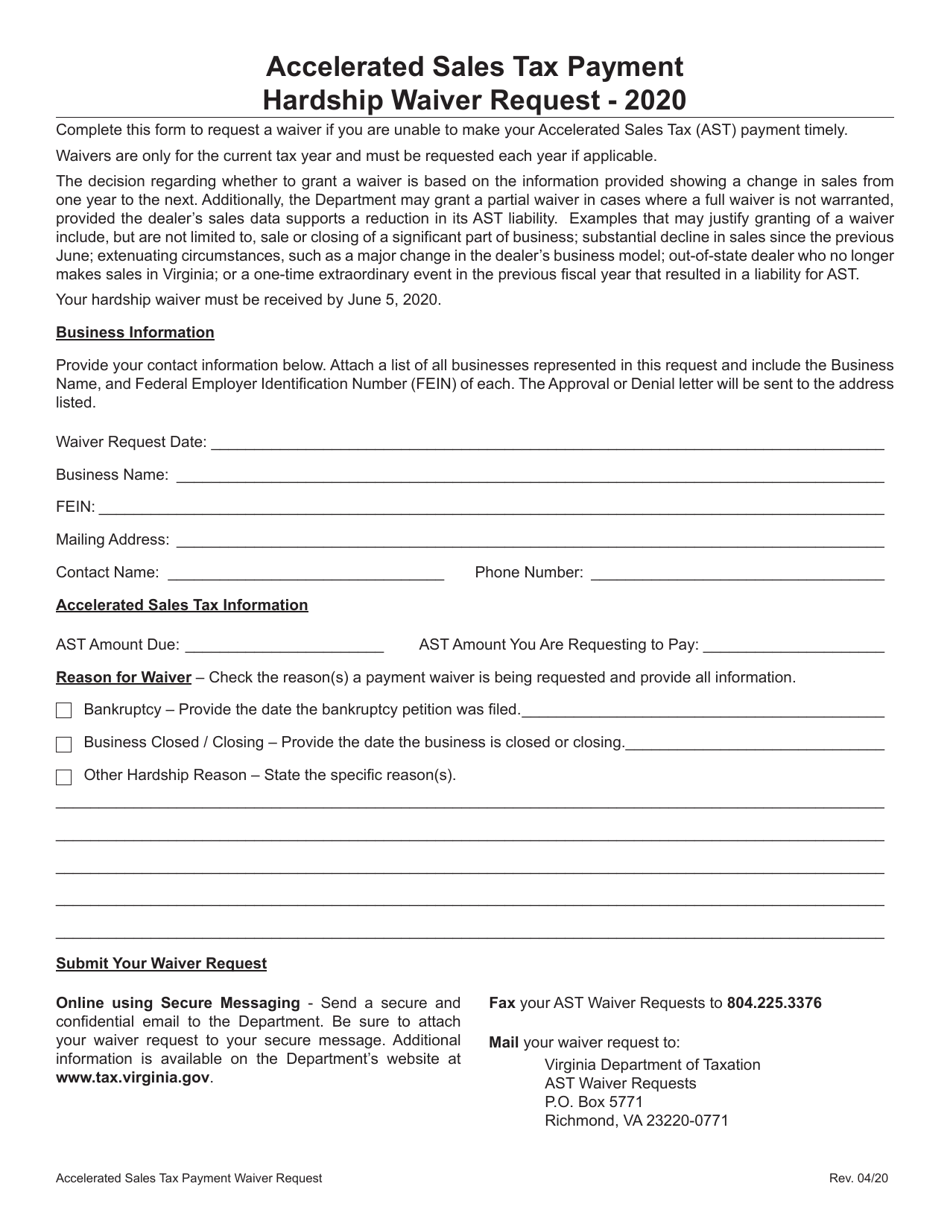

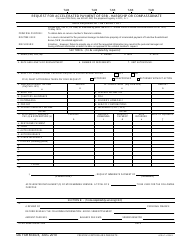

Form ST-APC Accelerated Sales Tax Payment Hardship Waiver Request - Virginia

What Is Form ST-APC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ST-APC Accelerated Sales Tax Payment Hardship Waiver?

A: ST-APC Accelerated Sales Tax Payment Hardship Waiver is a request form in Virginia that allows businesses to request a waiver from making accelerated sales tax payments.

Q: Who can submit the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request?

A: Businesses in Virginia can submit the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request if they are facing financial hardship and are unable to make the accelerated sales tax payments.

Q: Why would a business need to submit the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request?

A: A business would need to submit the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request if they are facing financial hardship and are unable to make the accelerated sales tax payments on time.

Q: What is the purpose of the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request?

A: The purpose of the ST-APC Accelerated Sales Tax Payment Hardship Waiver Request is to provide relief to businesses in Virginia that are facing financial hardship and are unable to make the accelerated sales tax payments on time.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-APC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.