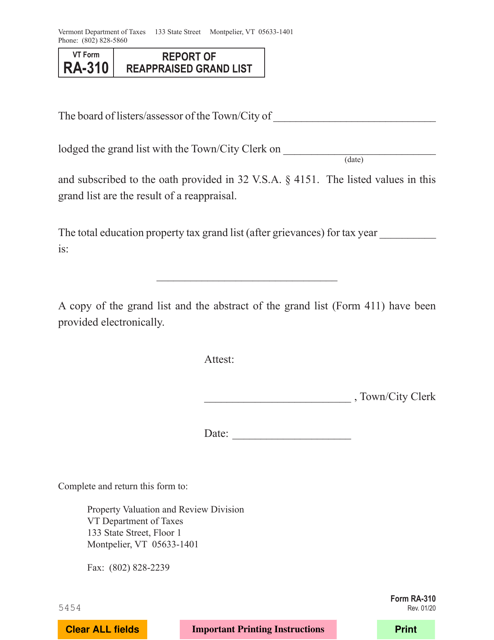

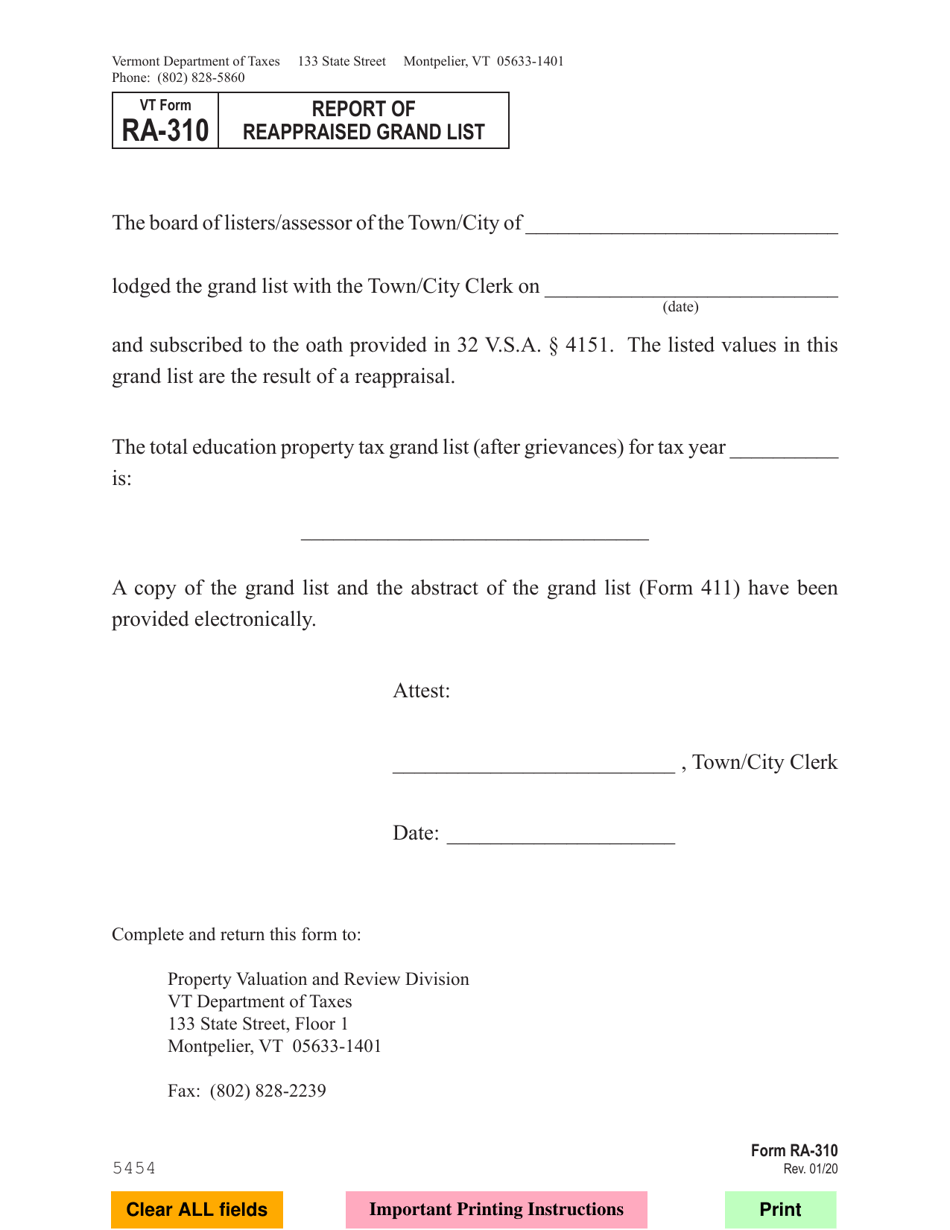

Form RA-310 Report of Reappraised Grand List - Vermont

What Is Form RA-310?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RA-310?

A: Form RA-310 is the Report of Reappraised Grand List in Vermont.

Q: What is the purpose of Form RA-310?

A: The purpose of Form RA-310 is to report the reappraised grand list in Vermont.

Q: Who needs to file Form RA-310?

A: Municipalities in Vermont need to file Form RA-310.

Q: When is Form RA-310 due?

A: The deadline for filing Form RA-310 varies and is determined by the Vermont Department of Taxes.

Q: Are there any penalties for not filing Form RA-310?

A: There may be penalties for late or non-filing of Form RA-310, as determined by the Vermont Department of Taxes.

Q: Is Form RA-310 applicable only to Vermont?

A: Yes, Form RA-310 is specific to the state of Vermont.

Q: What information is required on Form RA-310?

A: Form RA-310 requires information about the reappraised grand list, including property values and assessments.

Q: Are there any instructions available for filling out Form RA-310?

A: Yes, the Vermont Department of Taxes provides instructions for filling out Form RA-310.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RA-310 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.