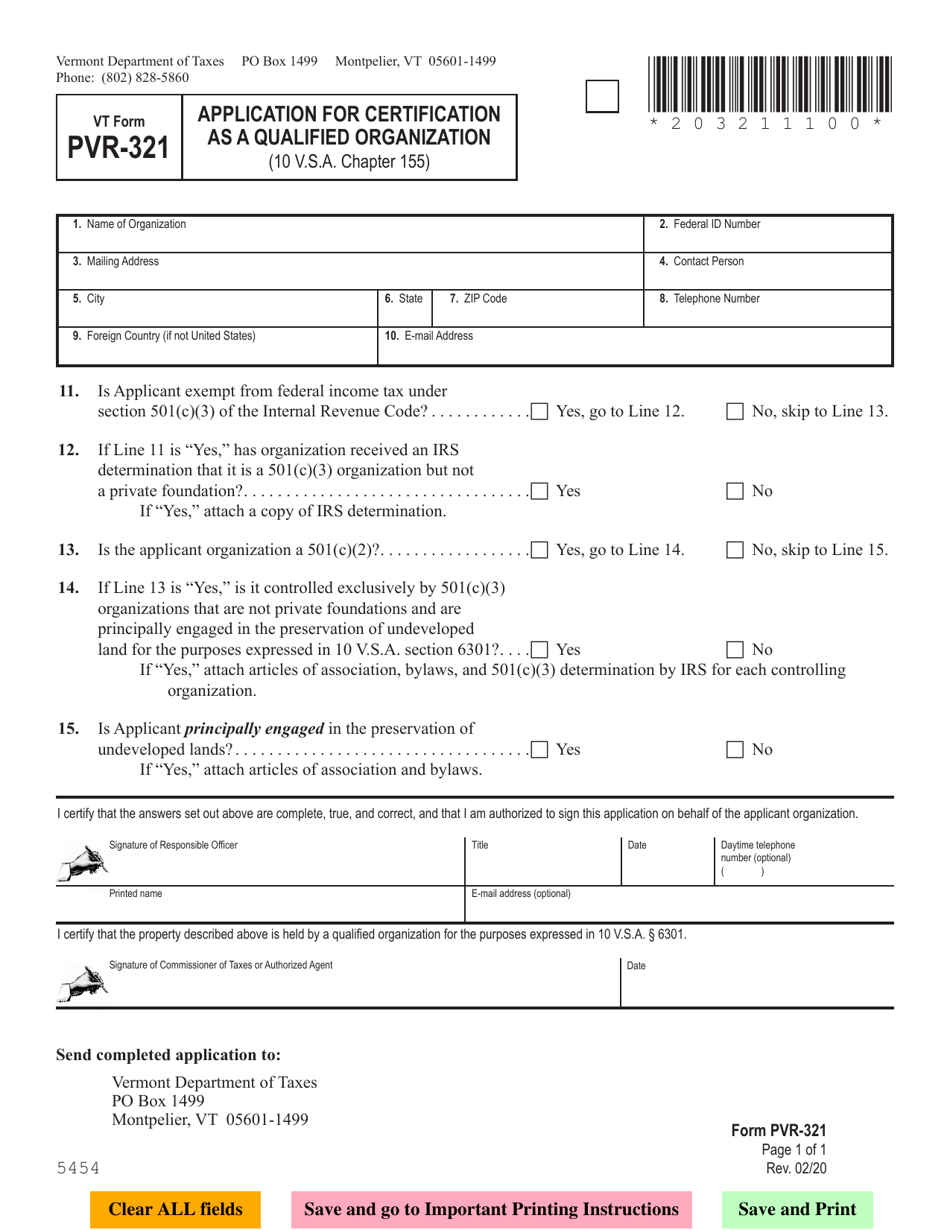

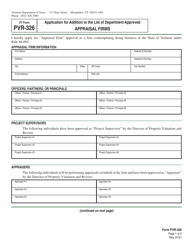

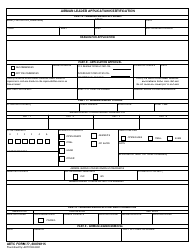

Form PVR-321 Application for Certification as a Qualified Organization - Vermont

What Is Form PVR-321?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PVR-321?

A: Form PVR-321 is an application for certification as a Qualified Organization in Vermont.

Q: Who can use Form PVR-321?

A: Non-profit organizations can use Form PVR-321 to apply for certification as a Qualified Organization in Vermont.

Q: What is a Qualified Organization?

A: A Qualified Organization is a non-profit organization that is eligible to conduct legal gambling activities in Vermont.

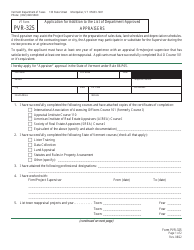

Q: What are the requirements to become a Qualified Organization?

A: To become a Qualified Organization, you must meet certain criteria such as being a non-profit organization, having a charitable purpose, and being in compliance with various state laws.

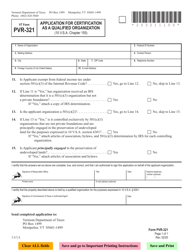

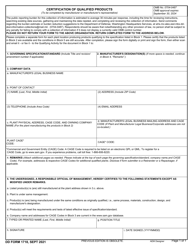

Q: What supporting documents do I need to submit with Form PVR-321?

A: You will need to submit various supporting documents such as financial statements, articles of incorporation, and other relevant documentation depending on your organization's circumstances.

Q: How long does it take to process Form PVR-321?

A: The processing time for Form PVR-321 can vary, but it generally takes several weeks for the Vermont Department of Taxes to review and approve the application.

Q: What happens after my organization is certified as a Qualified Organization?

A: Once your organization is certified as a Qualified Organization, you will be eligible to conduct legal gambling activities in Vermont.

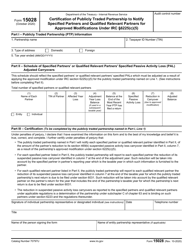

Q: Are there any reporting requirements for Qualified Organizations?

A: Yes, Qualified Organizations are required to submit regular reports to the Vermont Department of Taxes regarding their gambling activities and financial operations.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PVR-321 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.