This version of the form is not currently in use and is provided for reference only. Download this version of

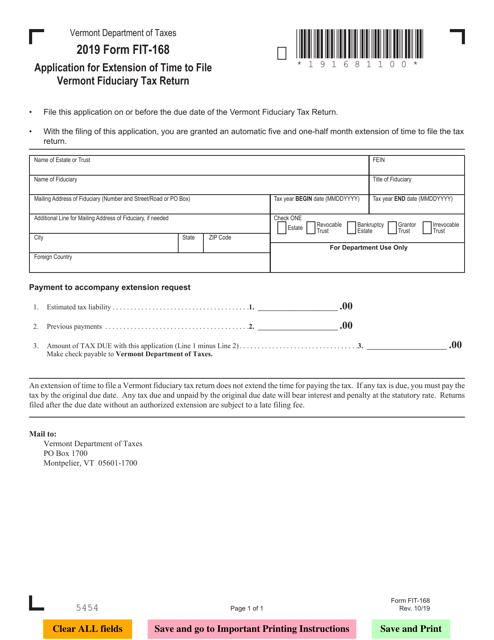

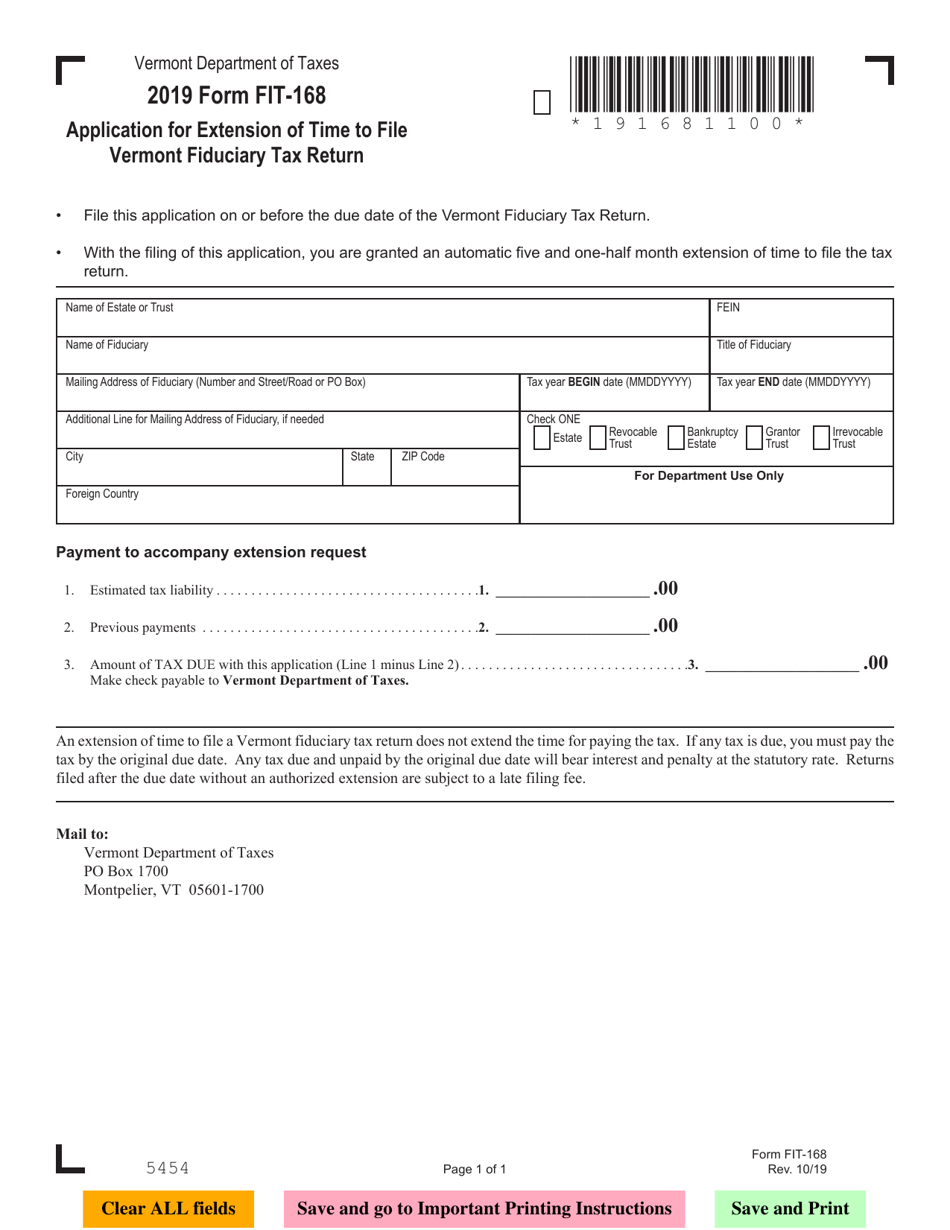

Form FIT-168

for the current year.

Form FIT-168 Application for Extension of Time to File Vermont Fiduciary Tax Return - Vermont

What Is Form FIT-168?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT-168?

A: Form FIT-168 is the Application for Extension of Time to File Vermont Fiduciary Tax Return.

Q: What is the purpose of Form FIT-168?

A: The purpose of Form FIT-168 is to request an extension of time to file the Vermont Fiduciary Tax Return.

Q: Who should file Form FIT-168?

A: Form FIT-168 should be filed by the fiduciary or trustee of a Vermont estate or trust who needs additional time to file their tax return.

Q: What is the deadline for filing Form FIT-168?

A: The deadline for filing Form FIT-168 is the original due date of the Vermont Fiduciary Tax Return, which is the 15th day of the fourth month following the close of the tax year.

Q: How long of an extension does Form FIT-168 provide?

A: Form FIT-168 provides a six-month extension of time to file the Vermont Fiduciary Tax Return.

Q: Is there a penalty for filing Form FIT-168?

A: No, there is no penalty for filing Form FIT-168 as long as the tax liability is paid by the original due date.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-168 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.