This version of the form is not currently in use and is provided for reference only. Download this version of

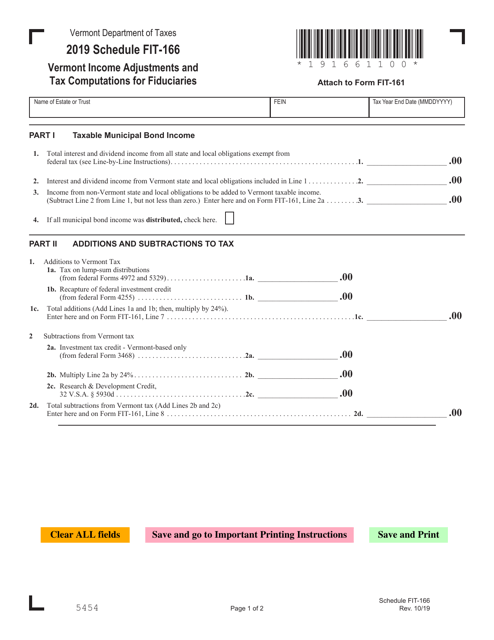

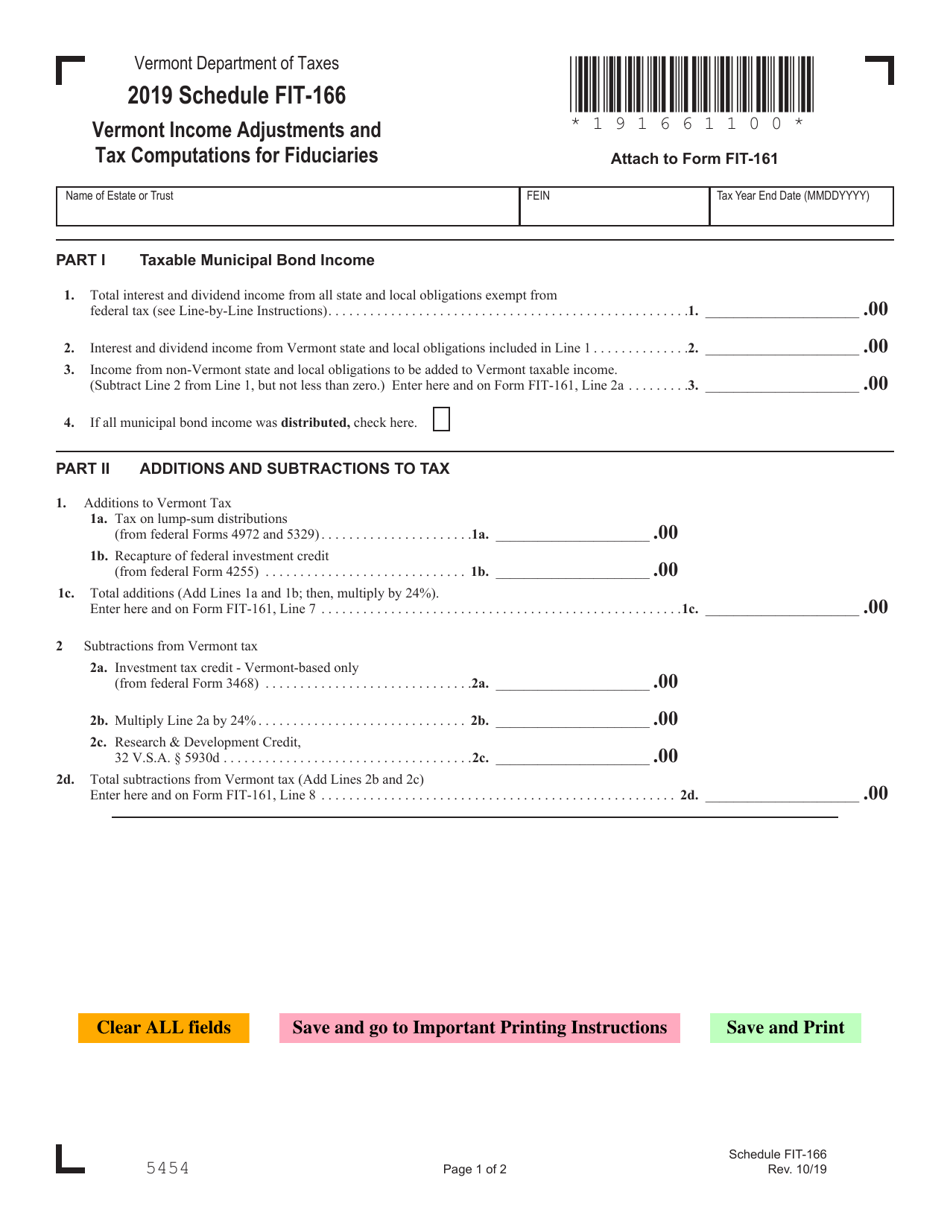

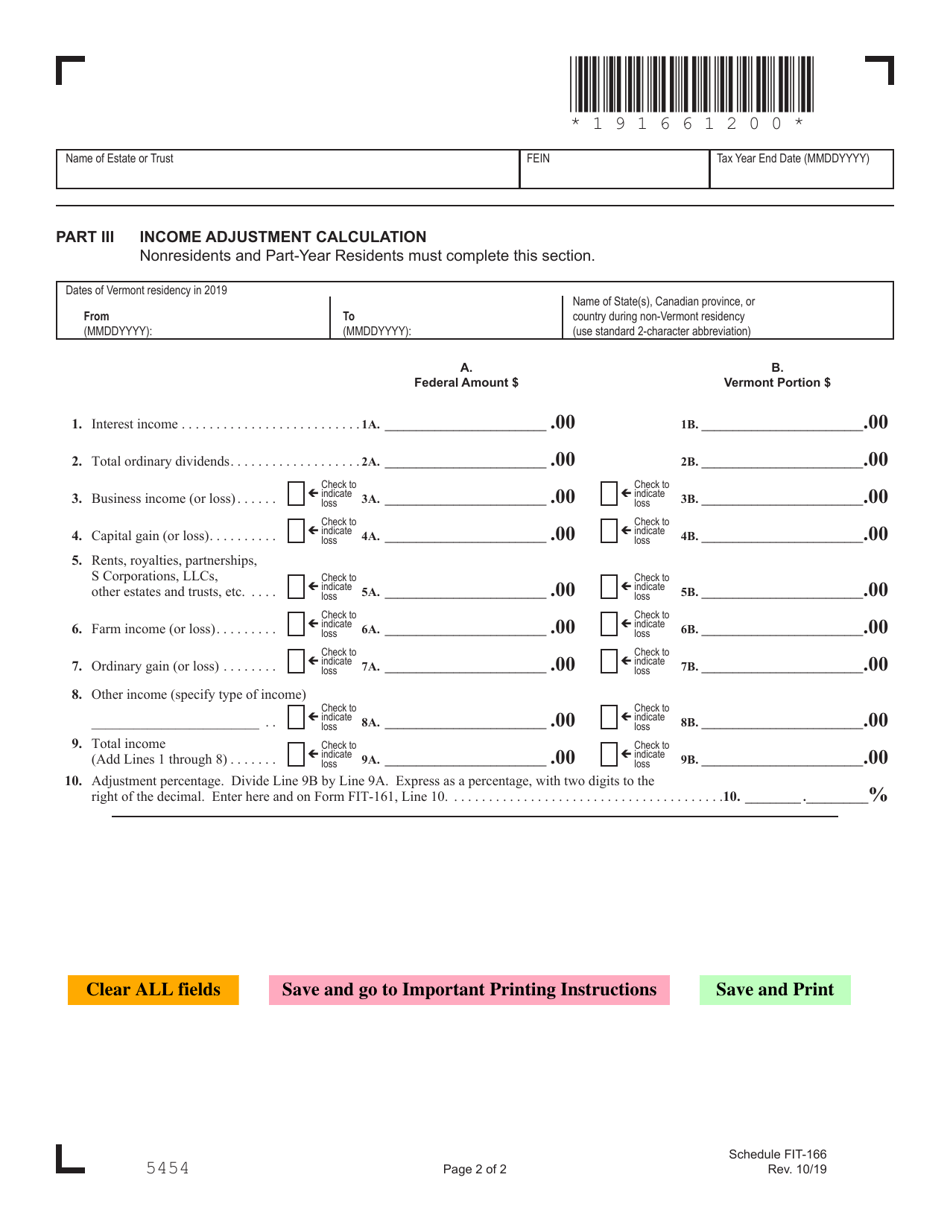

Schedule FIT-166

for the current year.

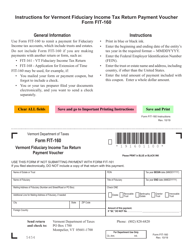

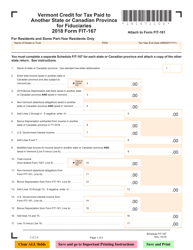

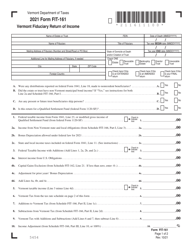

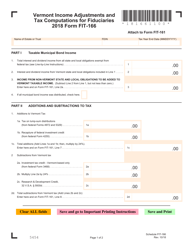

Schedule FIT-166 Vermont Income Adjustments and Tax Computations for Fiduciaries - Vermont

What Is Schedule FIT-166?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FIT-166?

A: FIT-166 is a schedule used for reporting income adjustments and tax computations for fiduciaries in Vermont.

Q: Who needs to file FIT-166?

A: Fiduciaries who are responsible for managing the income and assets of a trust or estate in Vermont need to file FIT-166.

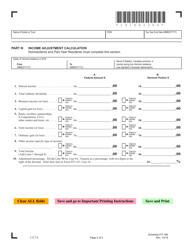

Q: What does FIT-166 include?

A: FIT-166 includes information about income adjustments and tax computations for fiduciaries, including details on deductions, exemptions, and tax credits.

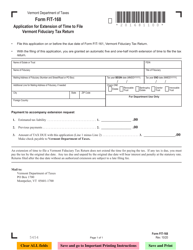

Q: When is the deadline for filing FIT-166?

A: The deadline for filing FIT-166 for fiduciaries in Vermont is the same as the deadline for filing the Vermont Fiduciary Income Tax Return, which is generally April 15th or the next business day.

Q: Are there any penalties for not filing FIT-166?

A: Yes, there may be penalties for not filing FIT-166 or filing it late, including interest charges on any unpaid tax amounts.

Q: Do I need to include supporting documents with FIT-166?

A: It is recommended to keep supporting documents related to FIT-166, but they do not need to be filed with the form unless requested by the department.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule FIT-166 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.