This version of the form is not currently in use and is provided for reference only. Download this version of

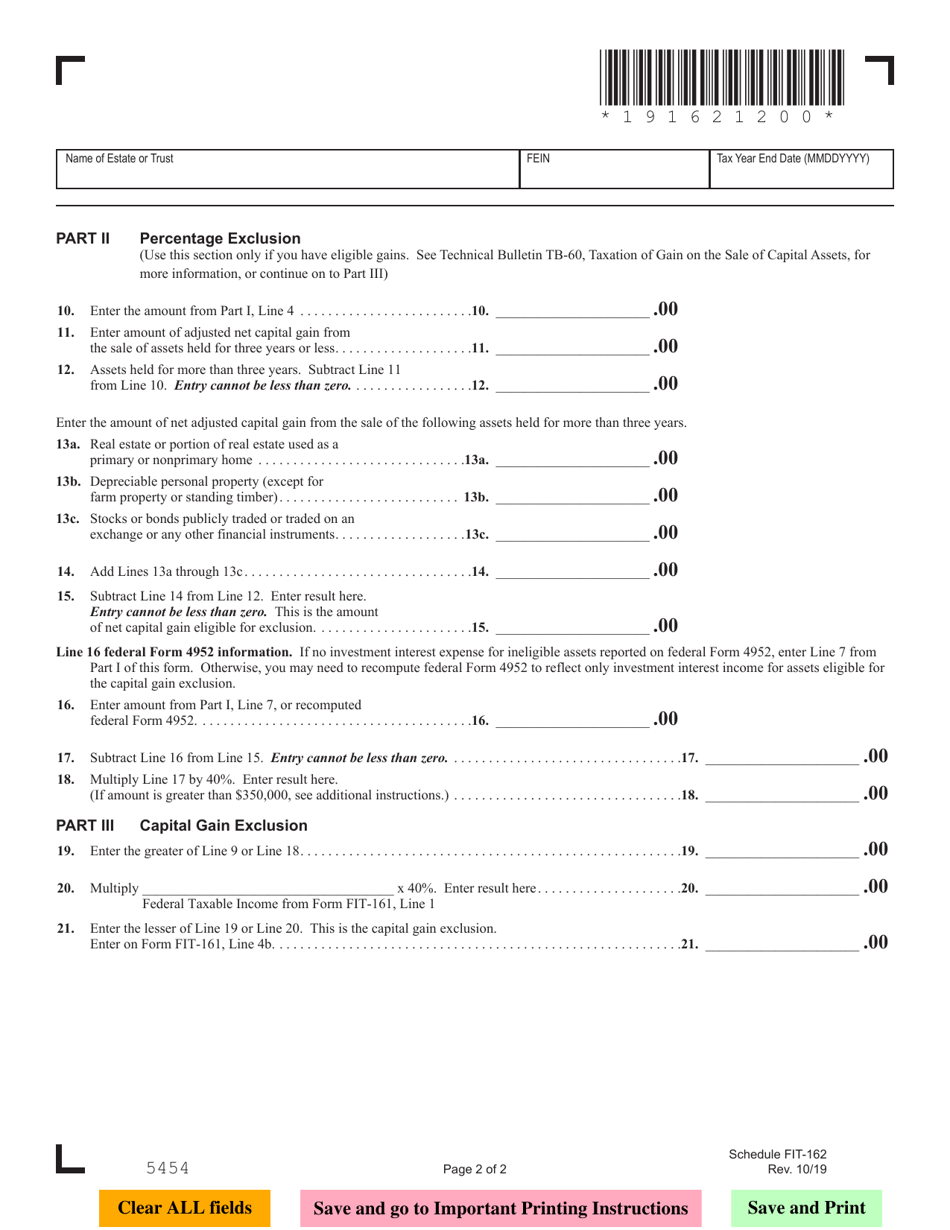

Schedule FIT-162

for the current year.

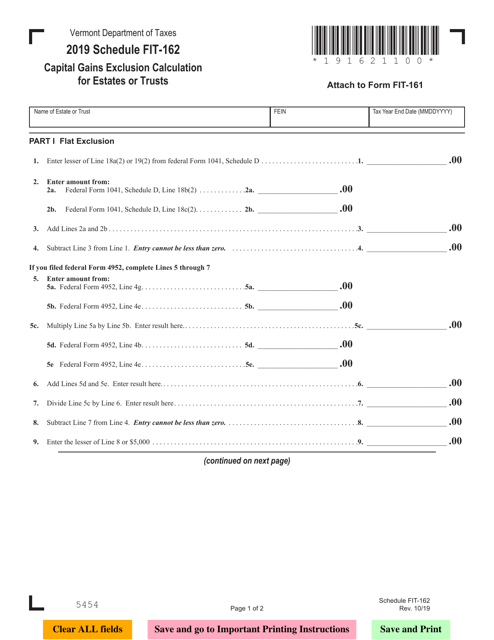

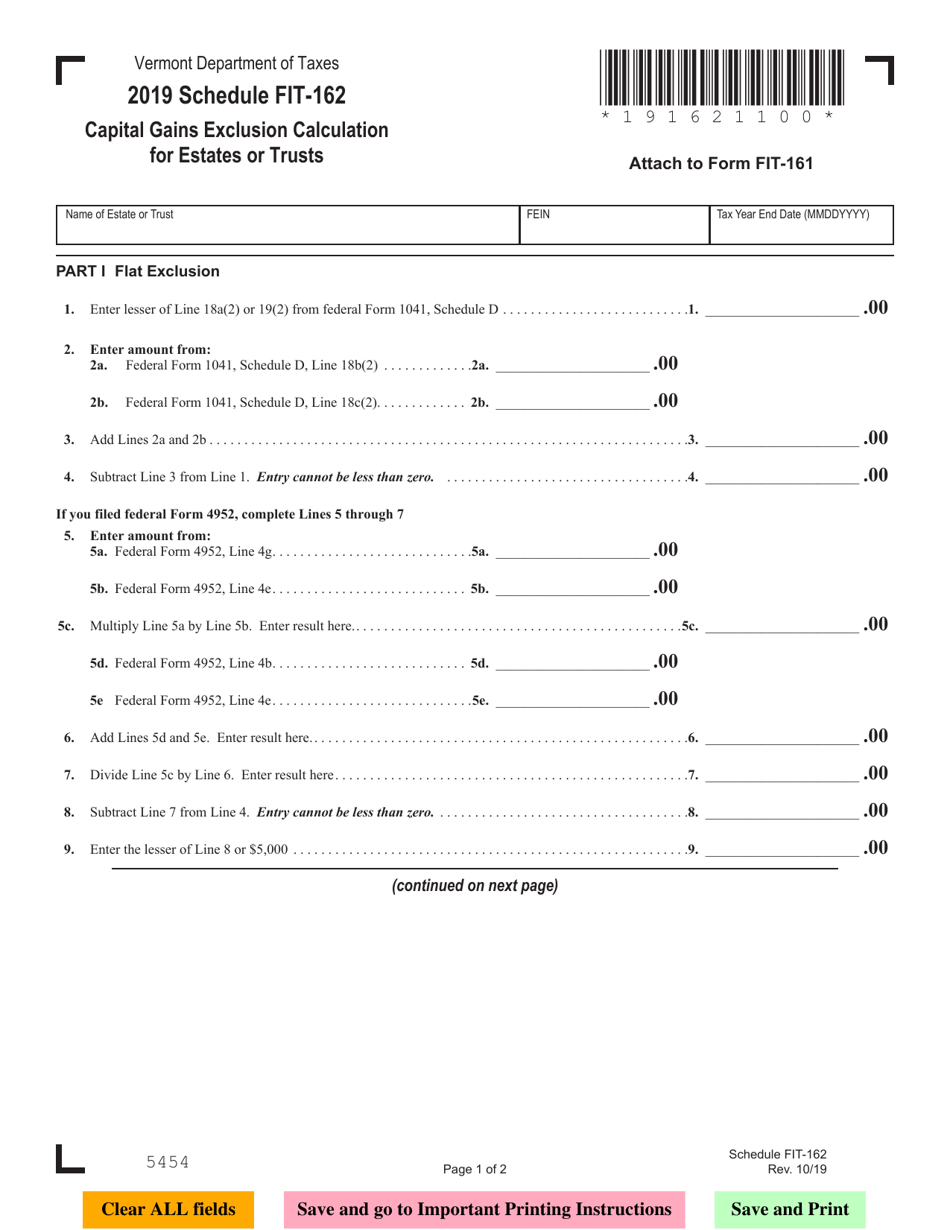

Schedule FIT-162 Capital Gains Exclusion Calculation for Estates or Trusts - Vermont

What Is Schedule FIT-162?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FIT-162?

A: FIT-162 is a schedule that is used to calculate the Capital Gains Exclusion for Estates or Trusts in Vermont.

Q: Who needs to file FIT-162?

A: Estates or Trusts in Vermont that have capital gains need to file FIT-162.

Q: What is the Capital Gains Exclusion?

A: The Capital Gains Exclusion is a deduction that can be claimed on certain capital gains to reduce the taxable income.

Q: How do I calculate the Capital Gains Exclusion?

A: You can calculate the Capital Gains Exclusion using the instructions provided with the FIT-162 schedule.

Q: Is there a deadline to file FIT-162?

A: The deadline to file FIT-162 is the same as the deadline for filing the estate or trust income tax return, which is typically April 15th.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule FIT-162 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.