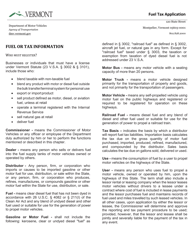

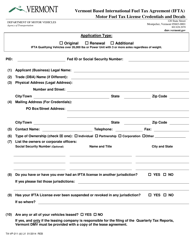

Form CVO-101 Fuel Tax Surety Bond - Vermont

What Is Form CVO-101?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

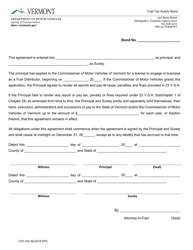

Q: What is a CVO-101 Fuel Tax Surety Bond?

A: A CVO-101 Fuel Tax Surety Bond is a type of bond required by the state of Vermont for carriers transporting fuel in commercial vehicles.

Q: Why do I need a CVO-101 Fuel Tax Surety Bond?

A: The CVO-101 Fuel Tax Surety Bond ensures that carriers comply with the state's fuel tax laws and regulations, guaranteeing payment of the required taxes.

Q: Who needs to obtain a CVO-101 Fuel Tax Surety Bond?

A: Carriers transporting fuel in commercial vehicles in Vermont are required to obtain a CVO-101 Fuel Tax Surety Bond.

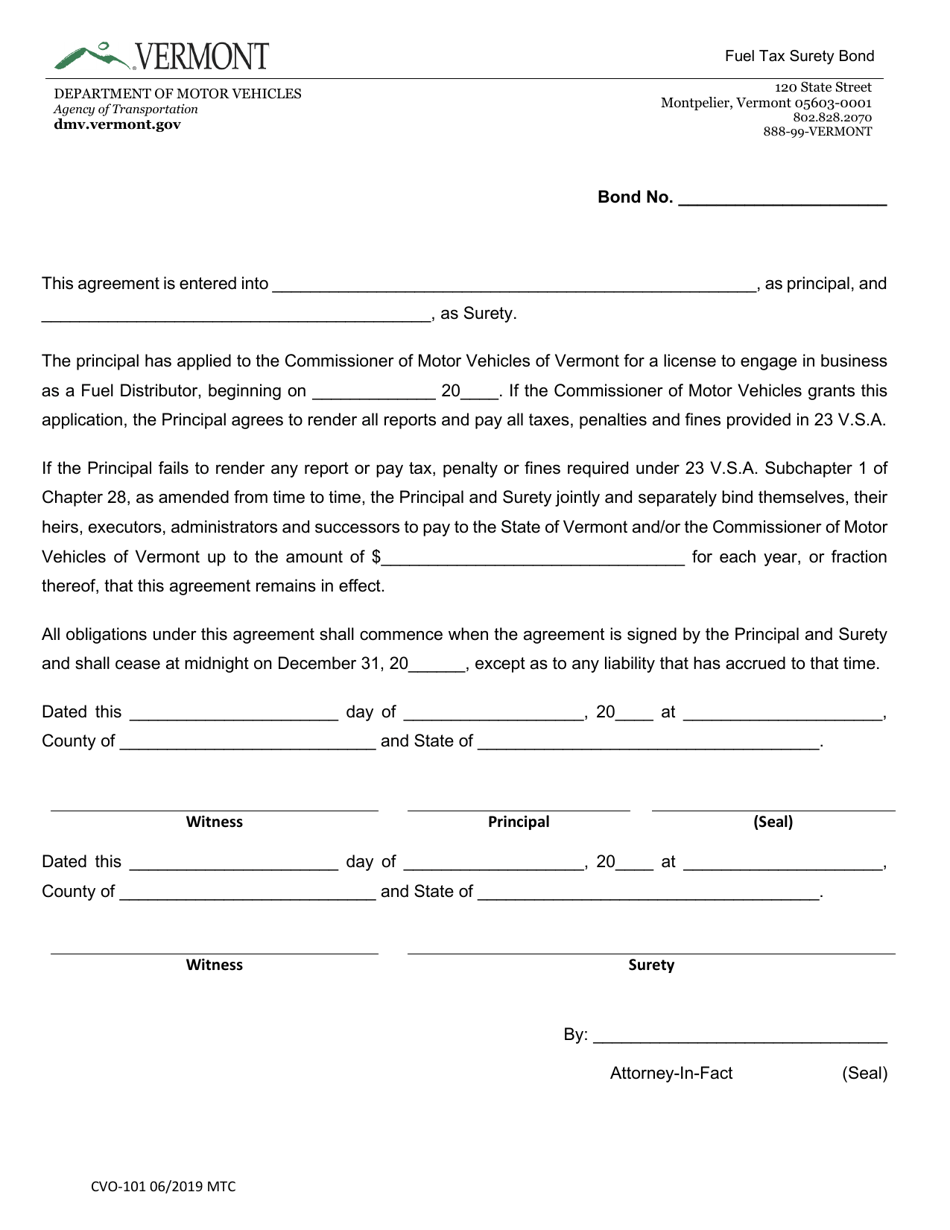

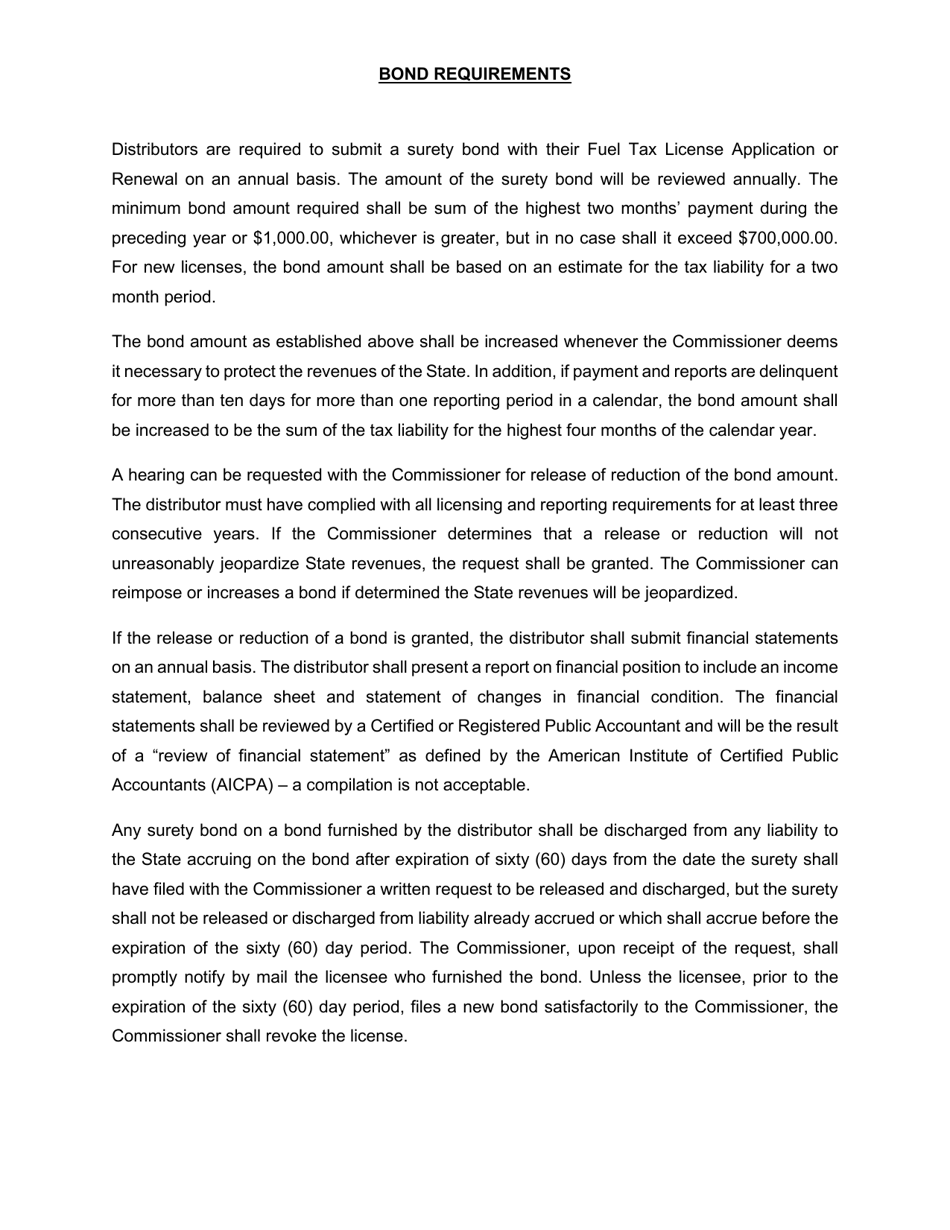

Q: How much does a CVO-101 Fuel Tax Surety Bond cost?

A: The cost of a CVO-101 Fuel Tax Surety Bond can vary depending on several factors, including the carrier's financial stability and the bond amount required by the state.

Q: How long does a CVO-101 Fuel Tax Surety Bond remain valid?

A: CVO-101 Fuel Tax Surety Bonds typically remain valid for one year, but the specific duration may vary depending on the requirements of the state.

Q: What happens if I don't have a CVO-101 Fuel Tax Surety Bond?

A: Failure to have a CVO-101 Fuel Tax Surety Bond can result in penalties, fines, and the suspension or revocation of the carrier's operating authority in Vermont.

Q: Can I cancel a CVO-101 Fuel Tax Surety Bond?

A: CVO-101 Fuel Tax Surety Bonds can usually be canceled by providing written notice to the bonding company. However, cancellation may result in penalties or the loss of operating authority in Vermont.

Q: Can I transfer a CVO-101 Fuel Tax Surety Bond from another state?

A: It is generally not possible to transfer a CVO-101 Fuel Tax Surety Bond from another state. A bond specific to Vermont's requirements will need to be obtained.

Q: Are there alternatives to a CVO-101 Fuel Tax Surety Bond?

A: In some cases, carriers may be able to provide an alternative form of financial security, such as a letter of credit or a cash deposit, instead of a CVO-101 Fuel Tax Surety Bond. However, the availability of alternatives may vary depending on state requirements.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CVO-101 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.