This version of the form is not currently in use and is provided for reference only. Download this version of

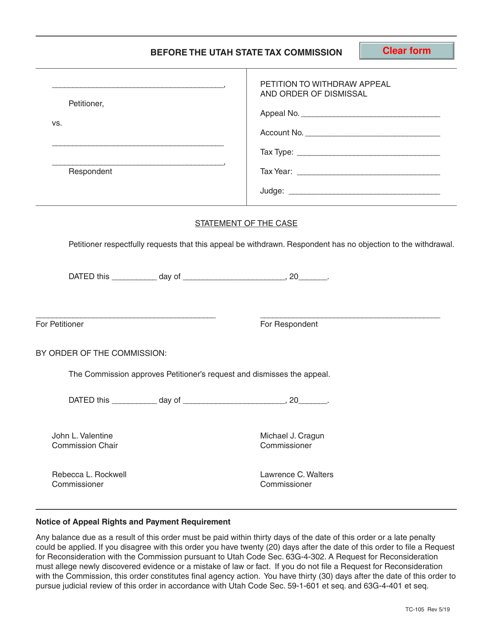

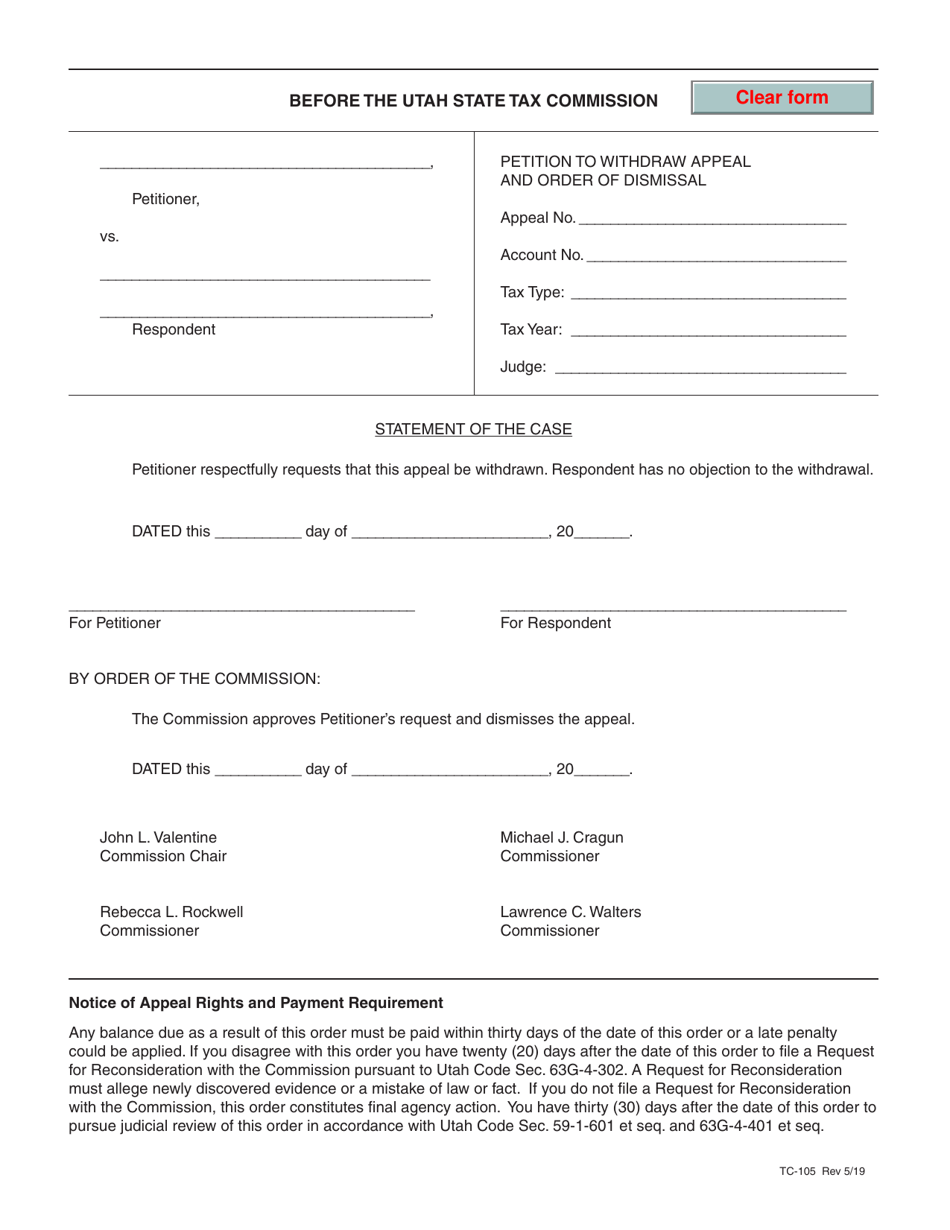

Form TC-105

for the current year.

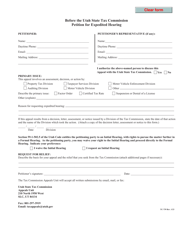

Form TC-105 Petition to Withdraw Appeal and Order of Dismissal - Utah

What Is Form TC-105?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-105?

A: Form TC-105 is a petition to withdraw appeal and order of dismissal form in Utah.

Q: How can I use Form TC-105?

A: You can use Form TC-105 to request the withdrawal of your appeal and obtain an order of dismissal in Utah.

Q: What is the purpose of Form TC-105?

A: The purpose of Form TC-105 is to formally request the withdrawal of an appeal and obtain an order of dismissal in Utah.

Q: What information do I need to provide on Form TC-105?

A: You will need to provide your case number, the court where your case is being heard, and your reasons for requesting the withdrawal of the appeal.

Q: What should I do after completing Form TC-105?

A: After completing Form TC-105, you should file it with the court clerk and make a copy for your records.

Q: Can I withdraw my appeal at any time?

A: In most cases, you can withdraw your appeal at any time before a final decision is made by the court.

Q: What happens after I file Form TC-105?

A: After you file Form TC-105, the court will review your request and may grant the withdrawal of the appeal and issue an order of dismissal.

Q: Can I change my mind after filing Form TC-105?

A: If you change your mind after filing Form TC-105, you should notify the court as soon as possible to avoid any further proceedings.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-105 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.