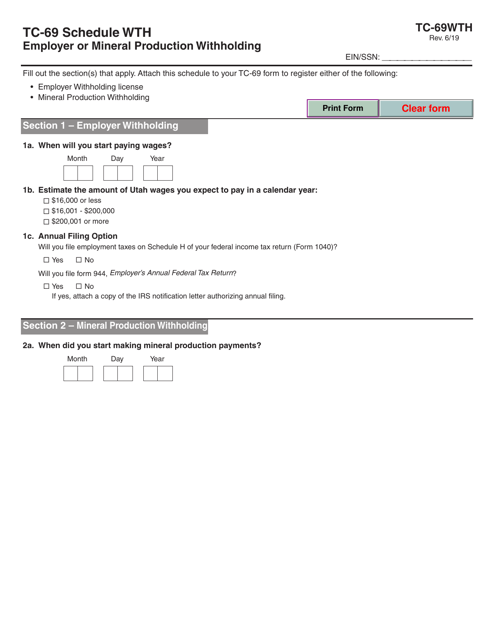

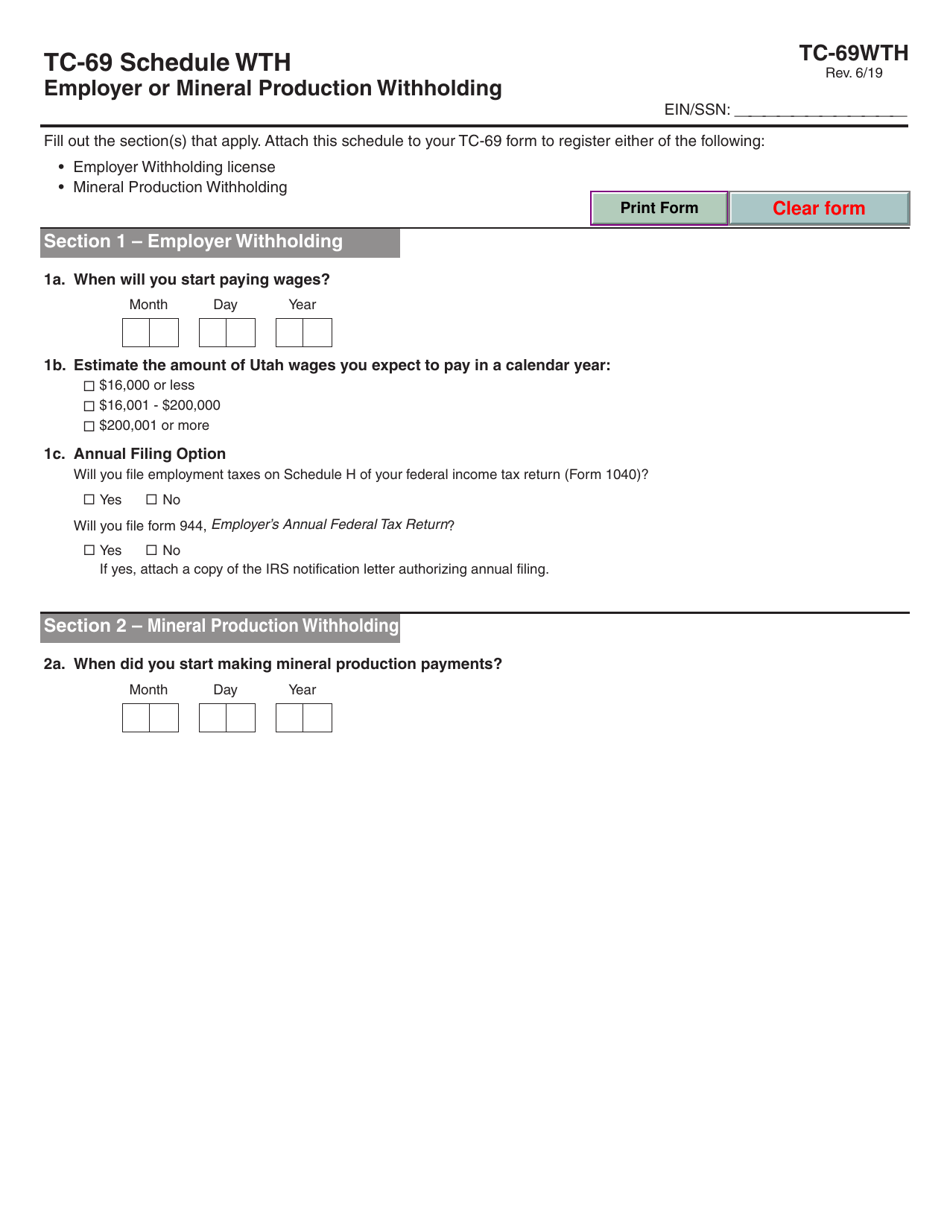

Form TC-69 Schedule WTH Employer or Mineral Production Withholding - Utah

What Is Form TC-69 Schedule WTH?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-69, Utah State Business and Tax Registration. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-69 Schedule WTH?

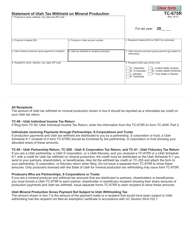

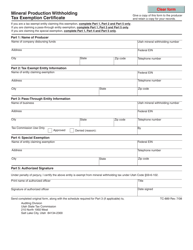

A: TC-69 Schedule WTH is a form used in Utah to report employer or mineral production withholding.

Q: Who needs to file TC-69 Schedule WTH?

A: Employers or businesses engaged in mineral production are required to file TC-69 Schedule WTH in Utah.

Q: What information is required on TC-69 Schedule WTH?

A: TC-69 Schedule WTH requires information about the employer or business, as well as details about the withholding payments.

Q: How often is TC-69 Schedule WTH filed?

A: TC-69 Schedule WTH is generally filed on a monthly or quarterly basis, depending on the withholding amount.

Q: Is there a deadline for filing TC-69 Schedule WTH?

A: Yes, TC-69 Schedule WTH must be filed by the due date specified by the Utah State Tax Commission.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 Schedule WTH by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.