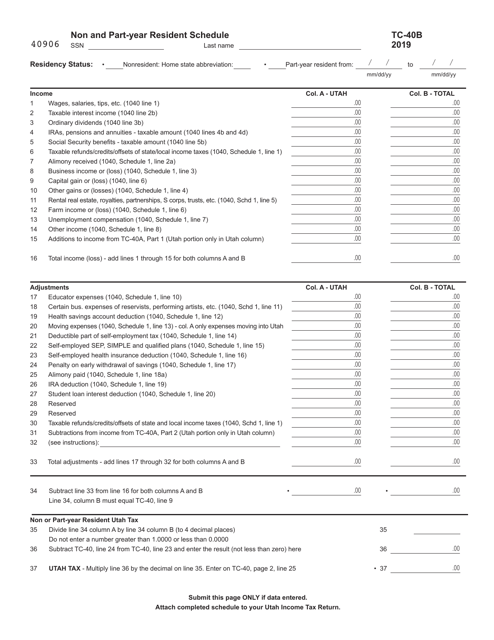

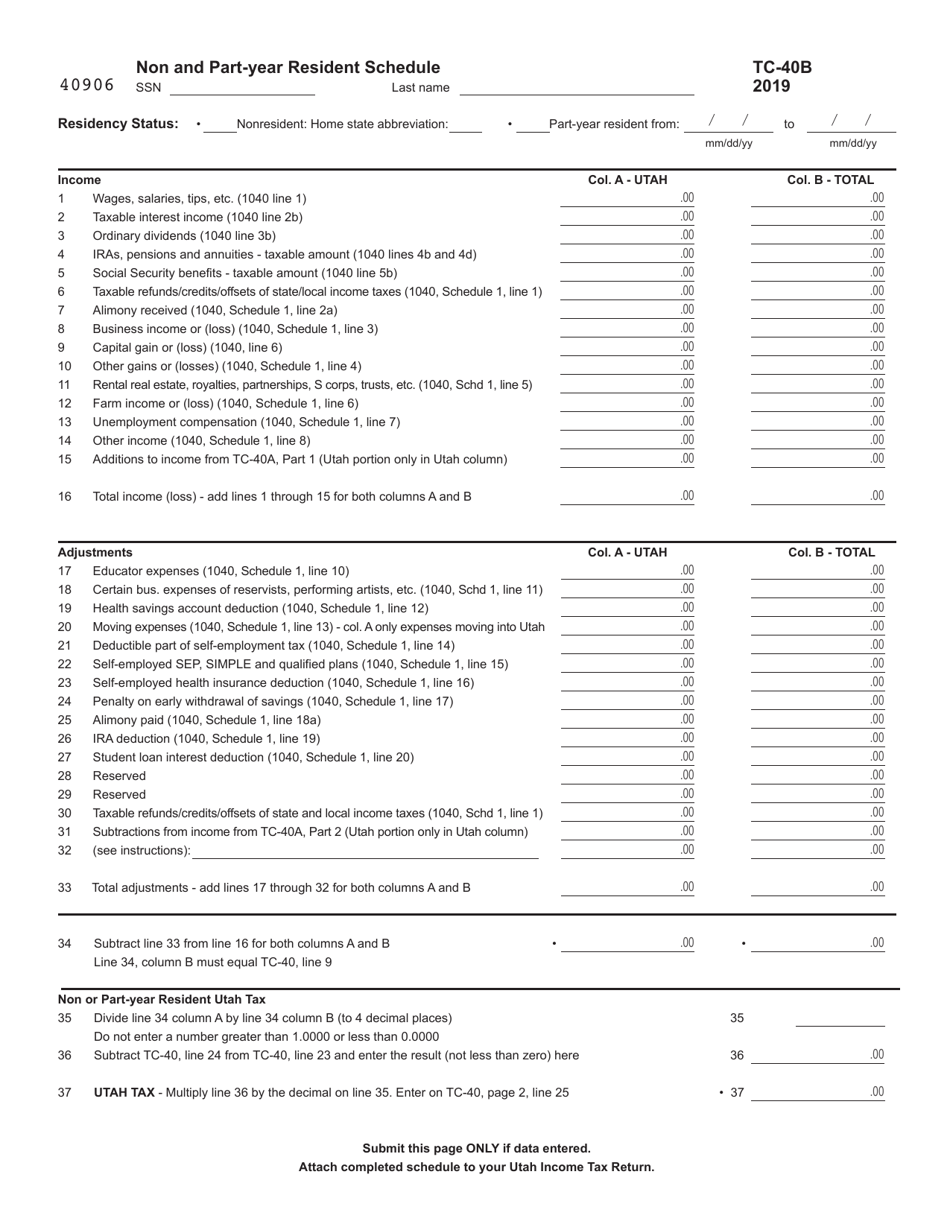

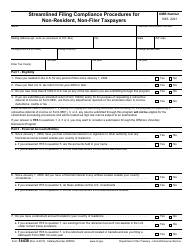

Form TC-40B Schedule B Non and Part-Year Resident Schedule - Utah

What Is Form TC-40B Schedule B?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-40B Schedule B?

A: TC-40B Schedule B is a tax form used by non-residents and part-year residents of Utah to report their income and calculate their tax liability.

Q: Who needs to file TC-40B Schedule B?

A: Non-residents and part-year residents of Utah who have income sourced from Utah need to file TC-40B Schedule B.

Q: What information is required on TC-40B Schedule B?

A: TC-40B Schedule B requires information about the taxpayer's income, deductions, and credits for the period they were a non-resident or part-year resident of Utah.

Q: When is the deadline to file TC-40B Schedule B?

A: The deadline to file TC-40B Schedule B is the same as the deadline for filing your Utah individual income tax return, which is usually April 15th.

Q: Are there any penalties for late filing of TC-40B Schedule B?

A: Yes, if you fail to file TC-40B Schedule B by the deadline, you may be subject to penalties and interest on any unpaid tax liability.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40B Schedule B by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.