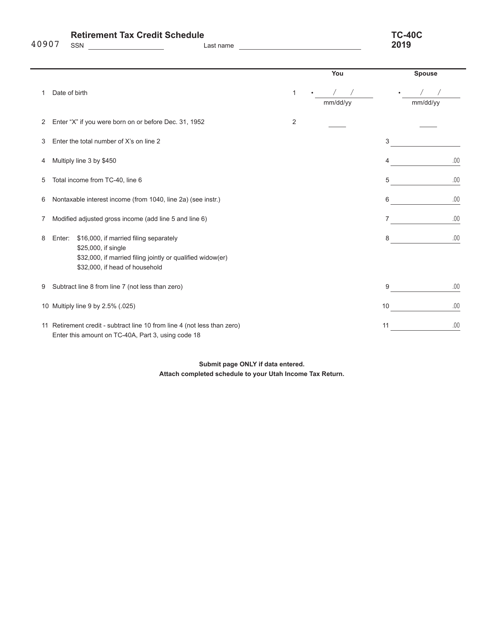

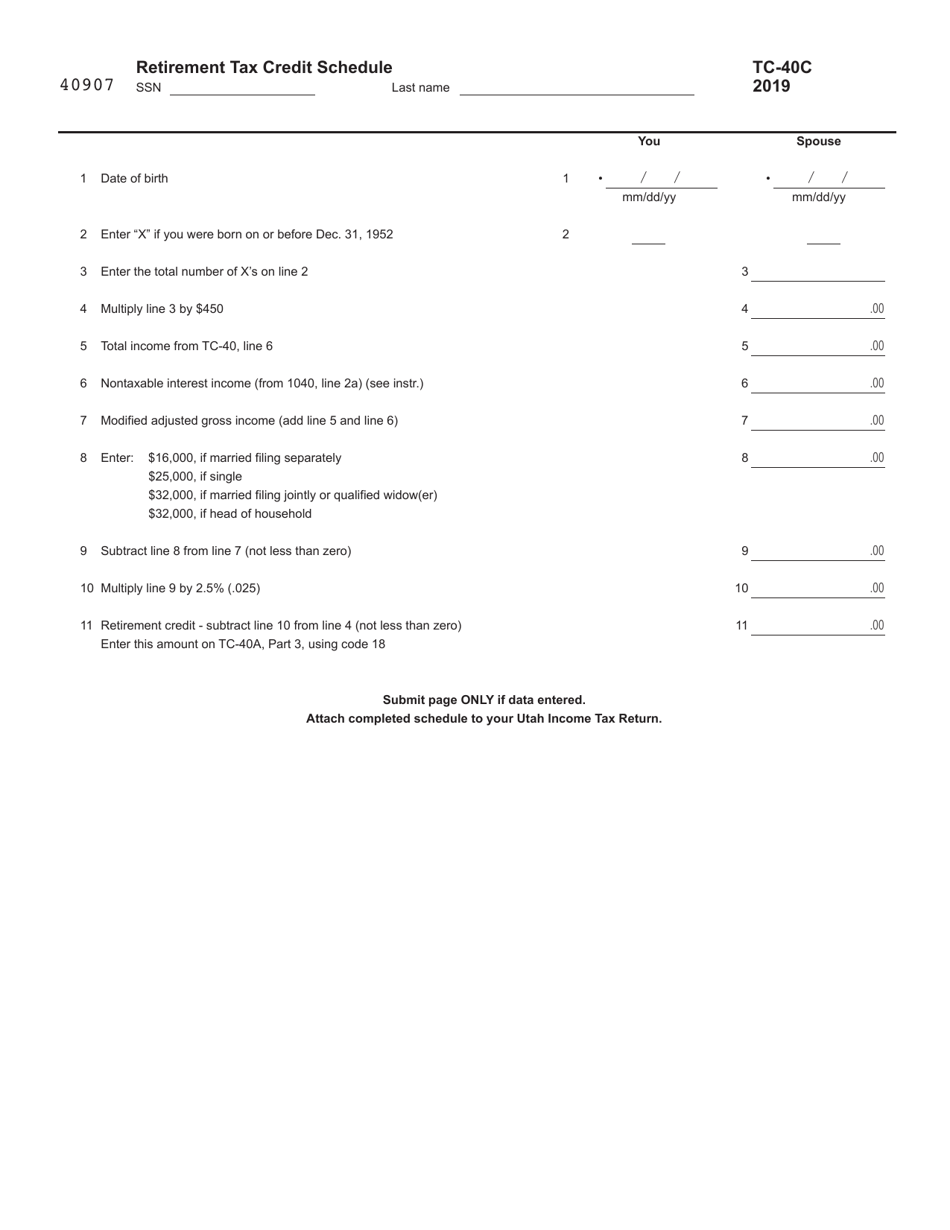

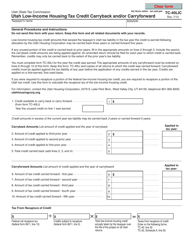

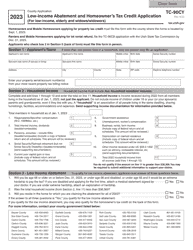

Form TC-40C Schedule C Retirement Tax Credit Schedule - Utah

What Is Form TC-40C Schedule C?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TC-40C Schedule C?

A: TC-40C Schedule C is a retirement tax credit schedule for Utah residents.

Q: Who is eligible to use TC-40C Schedule C?

A: Utah residents who qualify for the retirement tax credit.

Q: What is the purpose of TC-40C Schedule C?

A: The purpose of TC-40C Schedule C is to calculate and claim the retirement tax credit in Utah.

Q: How do I complete TC-40C Schedule C?

A: You need to follow the instructions provided by the Utah State Tax Commission to complete TC-40C Schedule C.

Q: What information do I need to complete TC-40C Schedule C?

A: You will need information about your retirement income and any other required documentation, as specified in the instructions for TC-40C Schedule C.

Q: What if I have questions or need assistance with TC-40C Schedule C?

A: If you have questions or need assistance, you can contact the Utah State Tax Commission or seek help from a tax professional.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40C Schedule C by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.