This version of the form is not currently in use and is provided for reference only. Download this version of

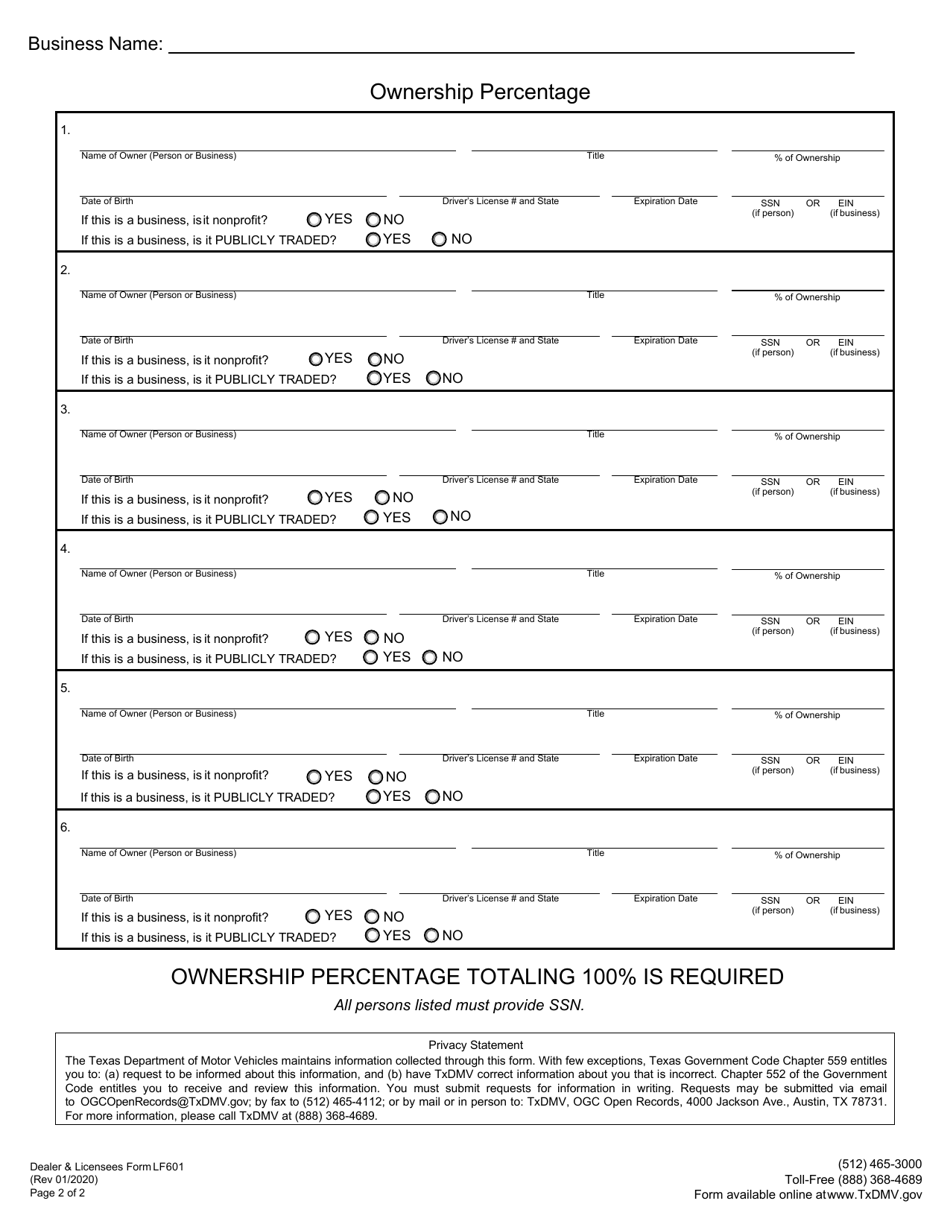

Form LF601

for the current year.

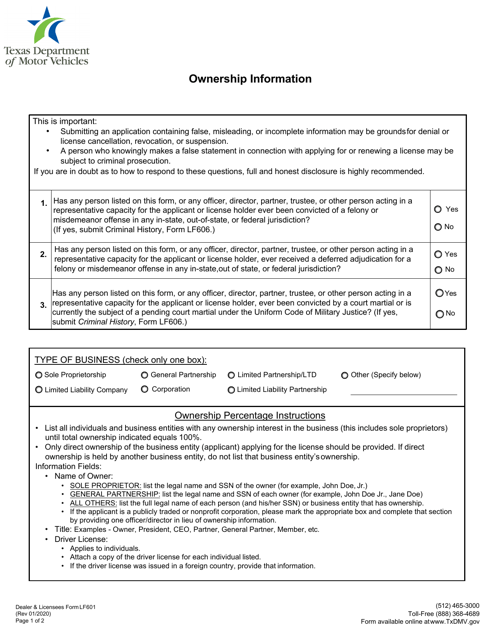

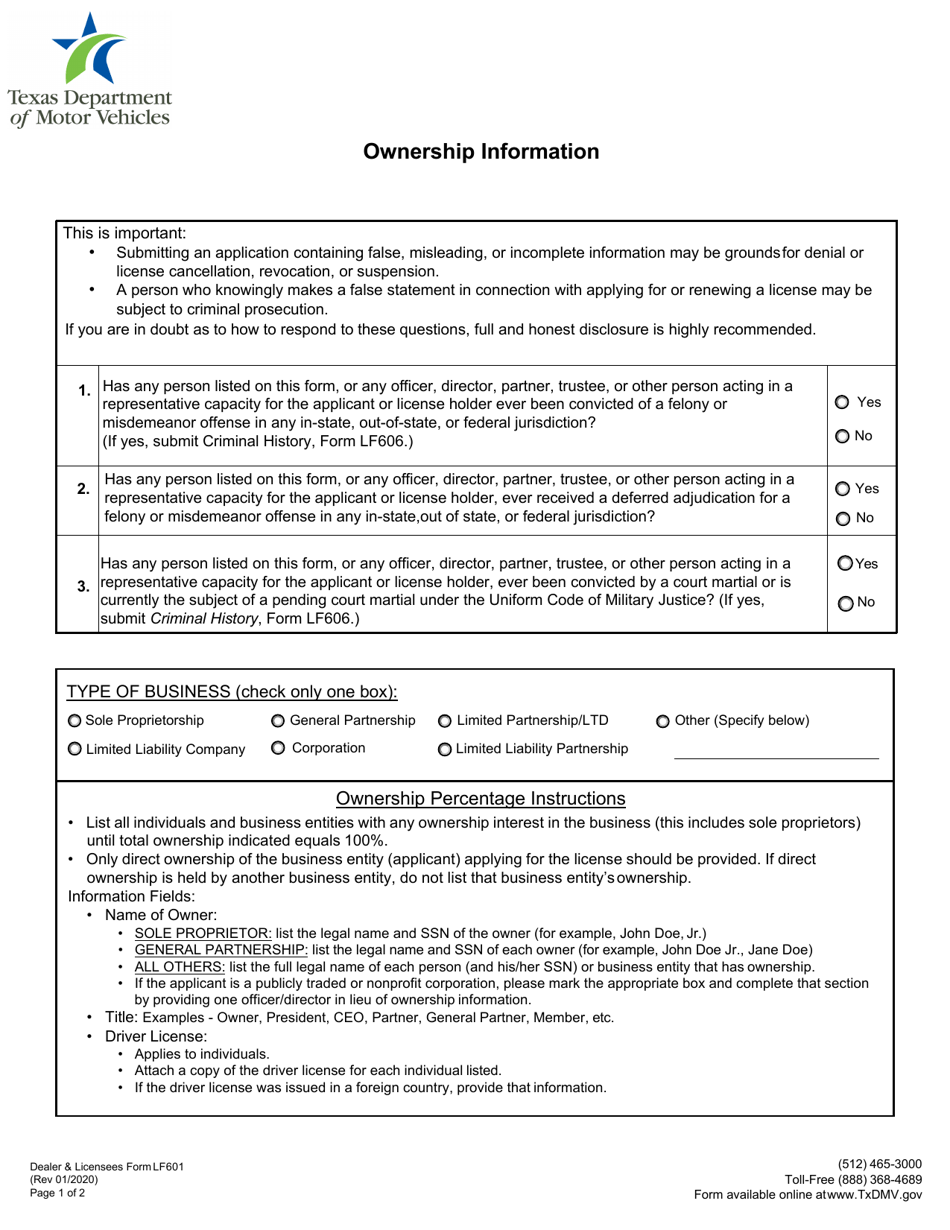

Form LF601 Ownership Information - Texas

What Is Form LF601?

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form LF601?

A: Form LF601 is a document used to provide ownership information in Texas.

Q: Who needs to fill out form LF601?

A: Any individual or entity that owns and operates oil, gas, or geothermal well(s) in Texas needs to fill out form LF601.

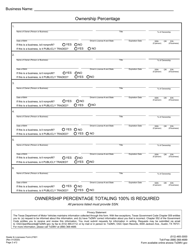

Q: What information is required in form LF601?

A: Form LF601 requires the disclosure of the owner's legal name, social security number or taxpayer ID, mailing address, and contact information.

Q: Is there a fee for filing form LF601?

A: No, there is no fee for filing form LF601.

Q: Are there any penalties for not filing form LF601?

A: Yes, failure to file form LF601 or providing false or misleading information can result in penalties and legal consequences.

Q: Is form LF601 specific to Texas?

A: Yes, form LF601 is specific to Texas and is used to report ownership information for wells in the state.

Q: What is the purpose of collecting ownership information for wells?

A: Collecting ownership information allows for transparency and accountability in the oil, gas, and geothermal industries, and helps ensure compliance with regulations.

Q: Who regulates the filing of form LF601?

A: The Railroad Commission of Texas regulates the filing of form LF601.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LF601 by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.