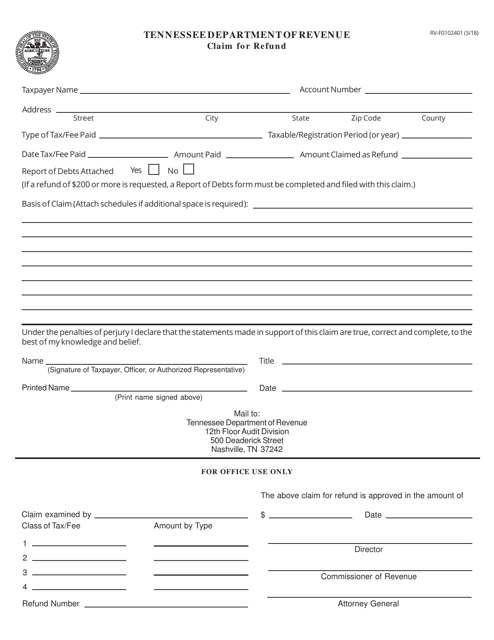

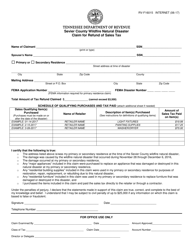

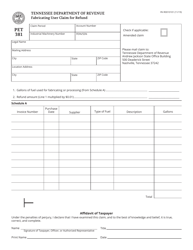

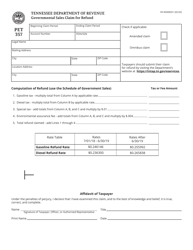

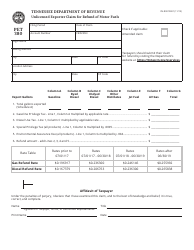

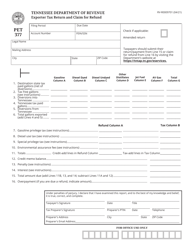

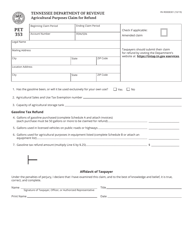

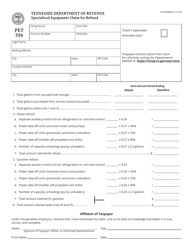

Form RV-F0102401 Claim for Refund - Tennessee

What Is Form RV-F0102401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RV-F0102401?

A: Form RV-F0102401 is a Claim for Refund form specific to the state of Tennessee.

Q: Who can use form RV-F0102401?

A: Form RV-F0102401 can be used by individuals or businesses who want to request a refund of sales and use tax paid to the state of Tennessee.

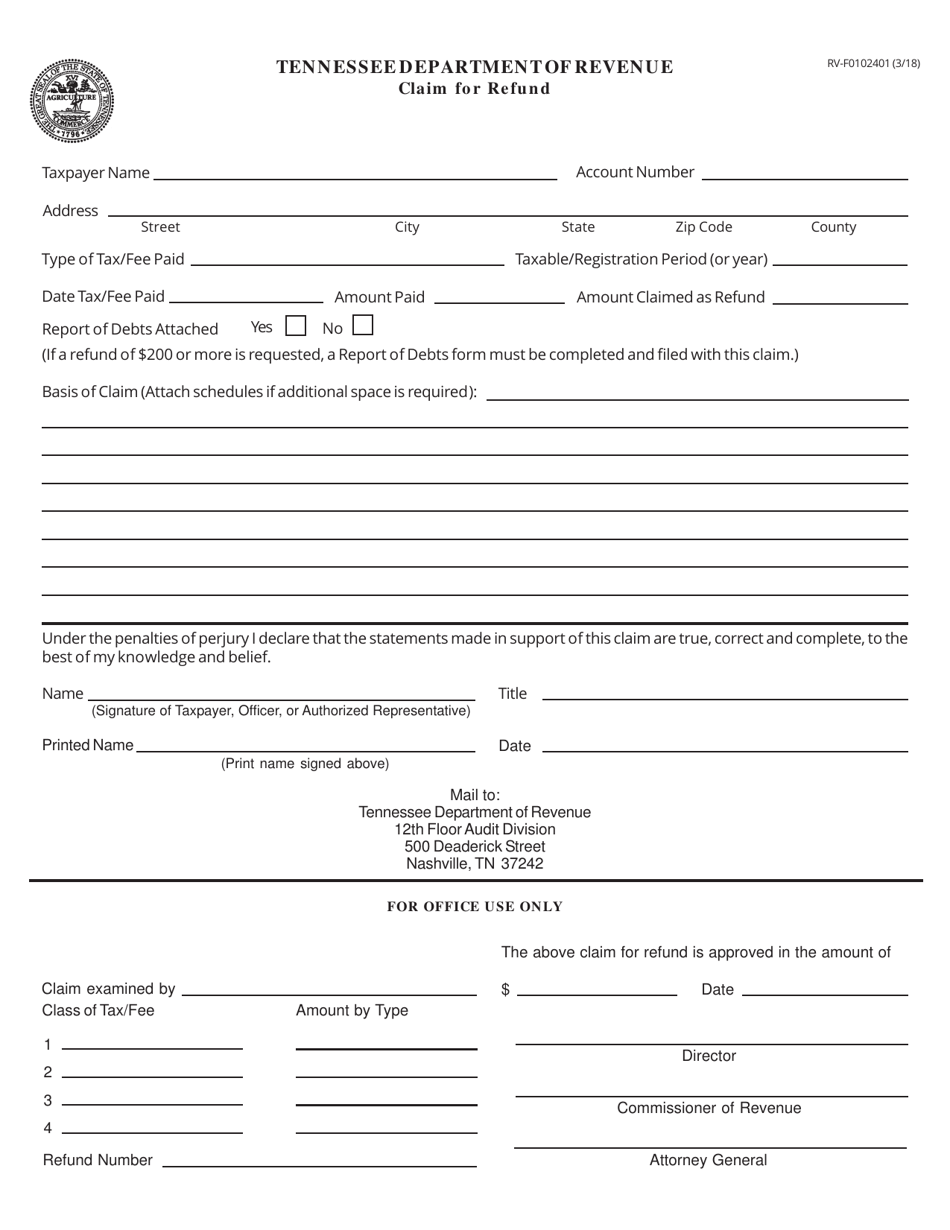

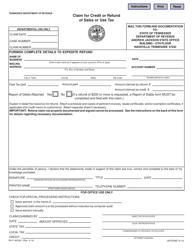

Q: What kind of taxes can be refunded using form RV-F0102401?

A: Form RV-F0102401 can be used to request a refund of sales and use tax paid to the state of Tennessee.

Q: What information is required in form RV-F0102401?

A: Form RV-F0102401 requires information such as the taxpayer's name, address, social security number or federal identification number, and details of the claimed refund.

Q: Are there any filing fees for form RV-F0102401?

A: No, there are no filing fees for submitting form RV-F0102401 to the Tennessee Department of Revenue.

Q: How long does it take to process a refund claim using form RV-F0102401?

A: The processing time for a refund claim using form RV-F0102401 can vary, but it typically takes several weeks to several months.

Q: Can form RV-F0102401 be submitted electronically?

A: No, form RV-F0102401 cannot be submitted electronically. It must be printed, signed, and mailed to the Tennessee Department of Revenue.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F0102401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.