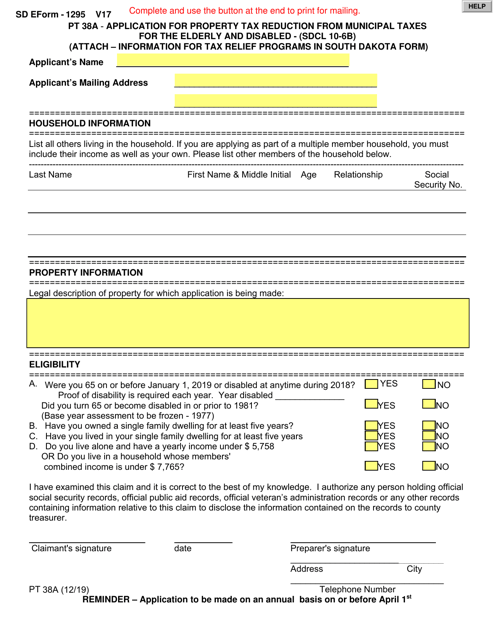

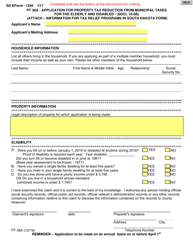

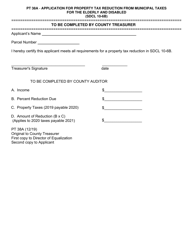

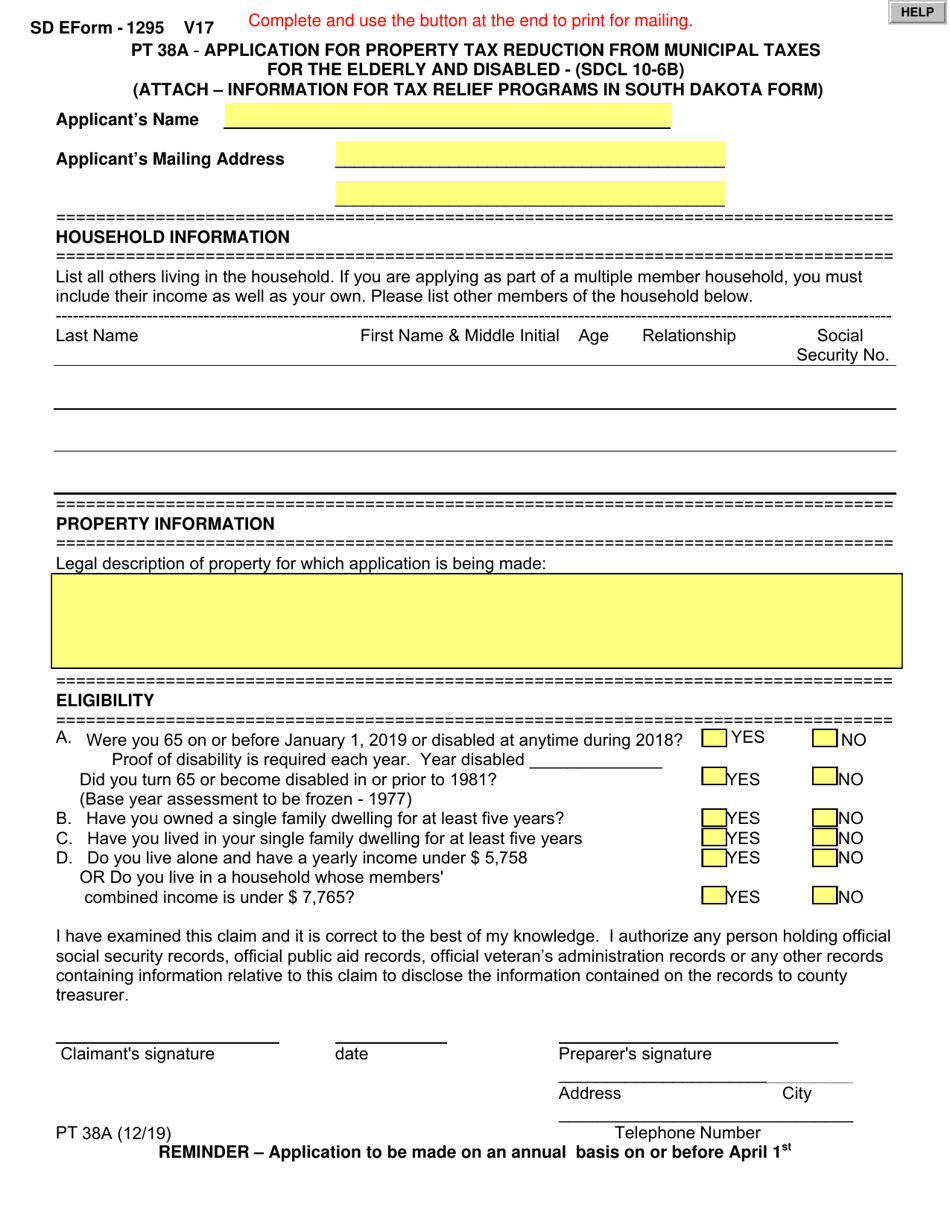

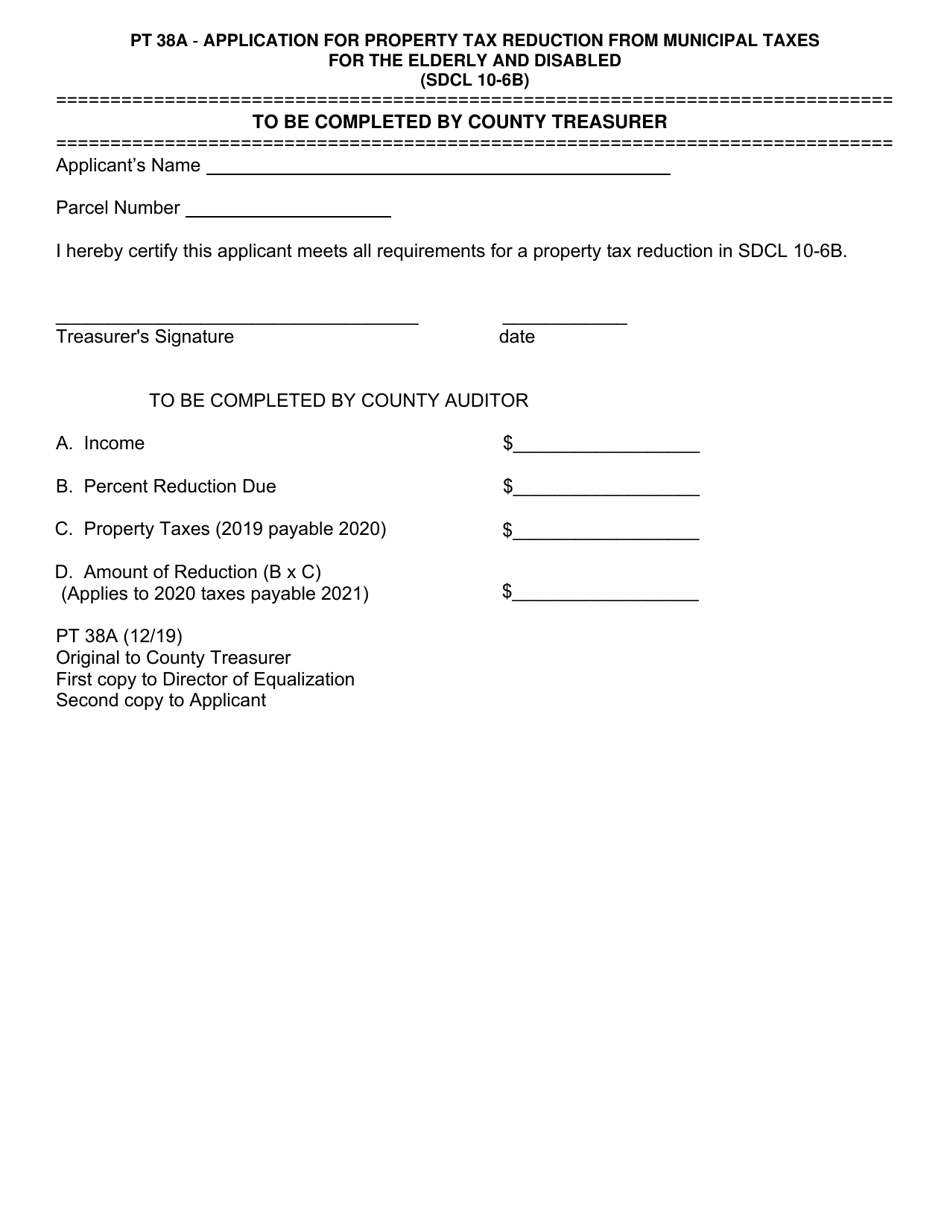

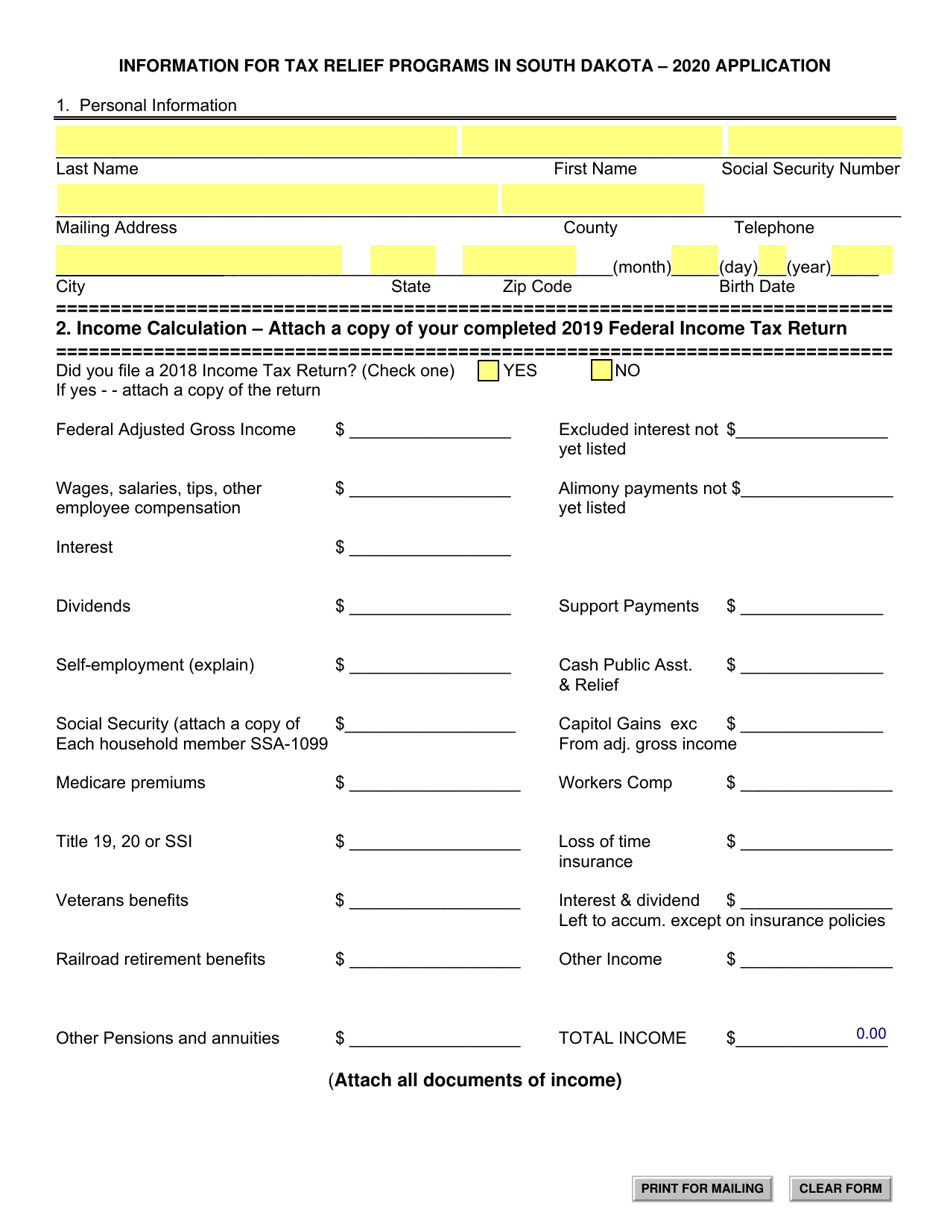

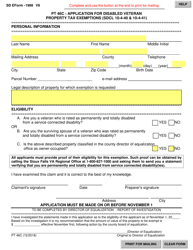

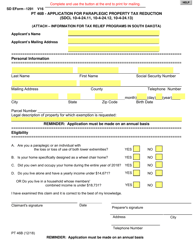

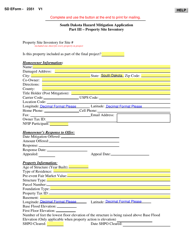

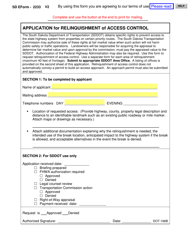

SD Form 1295 (PT38A) Application for Property Tax Reduction From Municipal Taxes for the Elderly and Disabled - South Dakota

What Is SD Form 1295 (PT38A)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1295 (PT38A)?

A: SD Form 1295 (PT38A) is an application for property tax reduction from municipal taxes for the elderly and disabled in South Dakota.

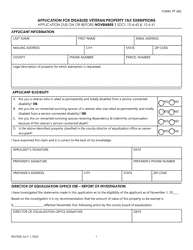

Q: Who is eligible for property tax reduction with SD Form 1295 (PT38A)?

A: The elderly and disabled residents of South Dakota are eligible for property tax reduction with SD Form 1295 (PT38A).

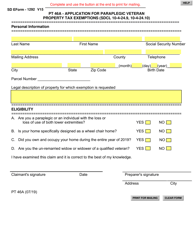

Q: What does SD Form 1295 (PT38A) do?

A: SD Form 1295 (PT38A) allows eligible individuals to apply for a reduction in their property taxes from municipal taxes.

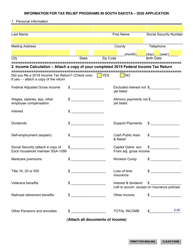

Q: What are the requirements for SD Form 1295 (PT38A) application?

A: The requirements for the SD Form 1295 (PT38A) application include meeting the age or disability criteria and providing necessary supporting documentation.

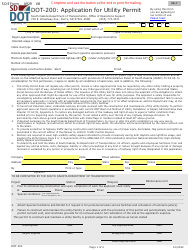

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1295 (PT38A) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.