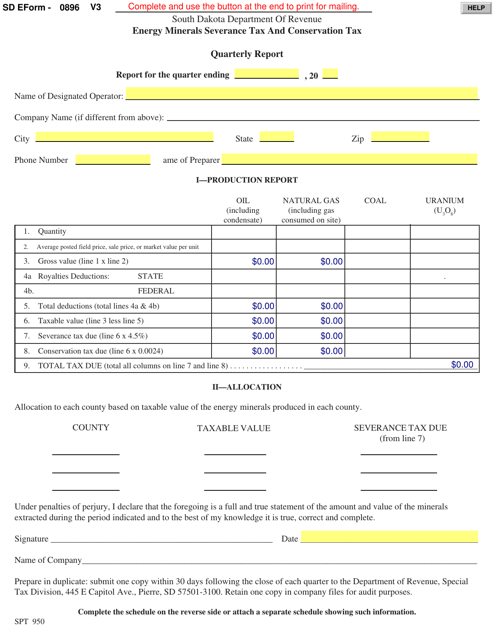

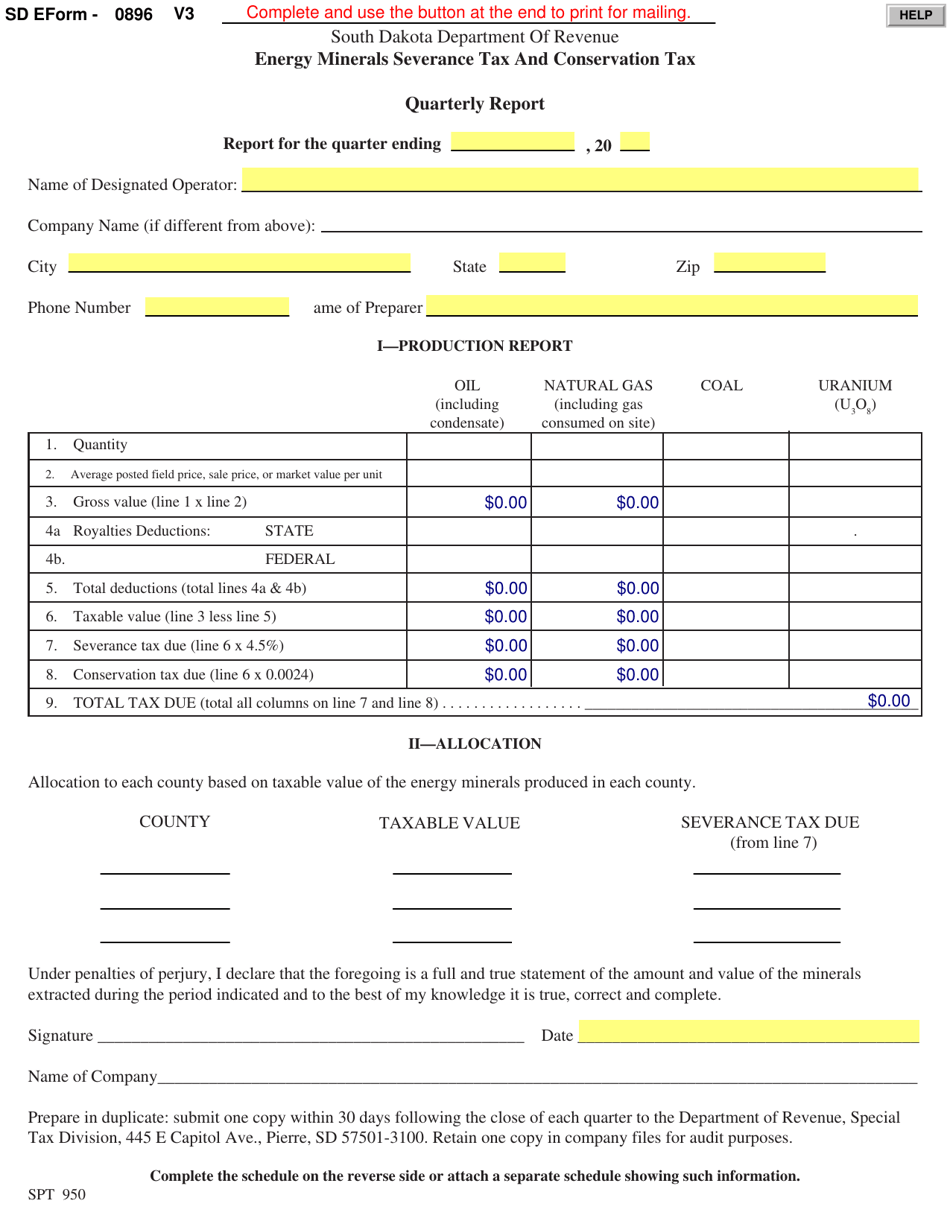

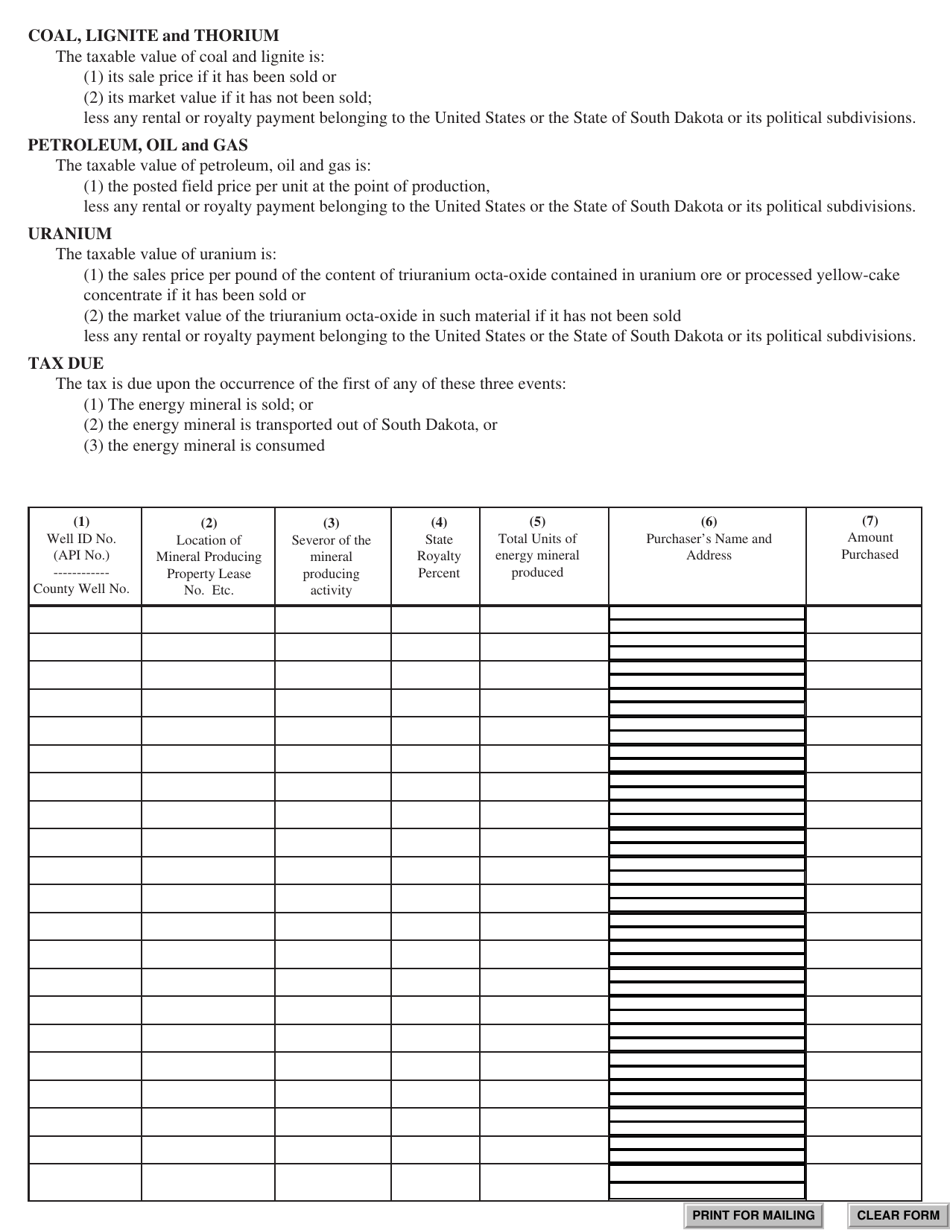

SD Form 0896 Energy Minerals Severance Tax and Conservation Tax Quarterly Report - South Dakota

What Is SD Form 0896?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 0896?

A: SD Form 0896 is the Energy Minerals Severance Tax and Conservation Tax Quarterly Report in South Dakota.

Q: What is the purpose of SD Form 0896?

A: The purpose of SD Form 0896 is to report energy mineralsseverance tax and conservation tax in South Dakota on a quarterly basis.

Q: Who needs to file SD Form 0896?

A: Anyone engaged in the extraction of energy minerals in South Dakota needs to file SD Form 0896.

Q: When is SD Form 0896 due?

A: SD Form 0896 is due on the 25th day of the month following the end of each quarter.

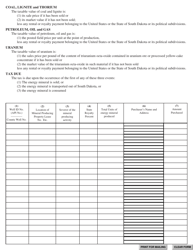

Q: What information is required on SD Form 0896?

A: SD Form 0896 requires information such as total production of energy minerals, tax rates, conservation tax credits, and any refunds or overpayments.

Form Details:

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 0896 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.