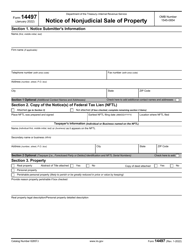

Sales or Property Tax Refund for Senior Citizens & Citizens With Disabilities - South Dakota

Sales or Senior Citizens & Citizens With Disabilities is a legal document that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota.

FAQ

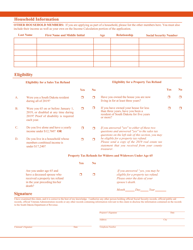

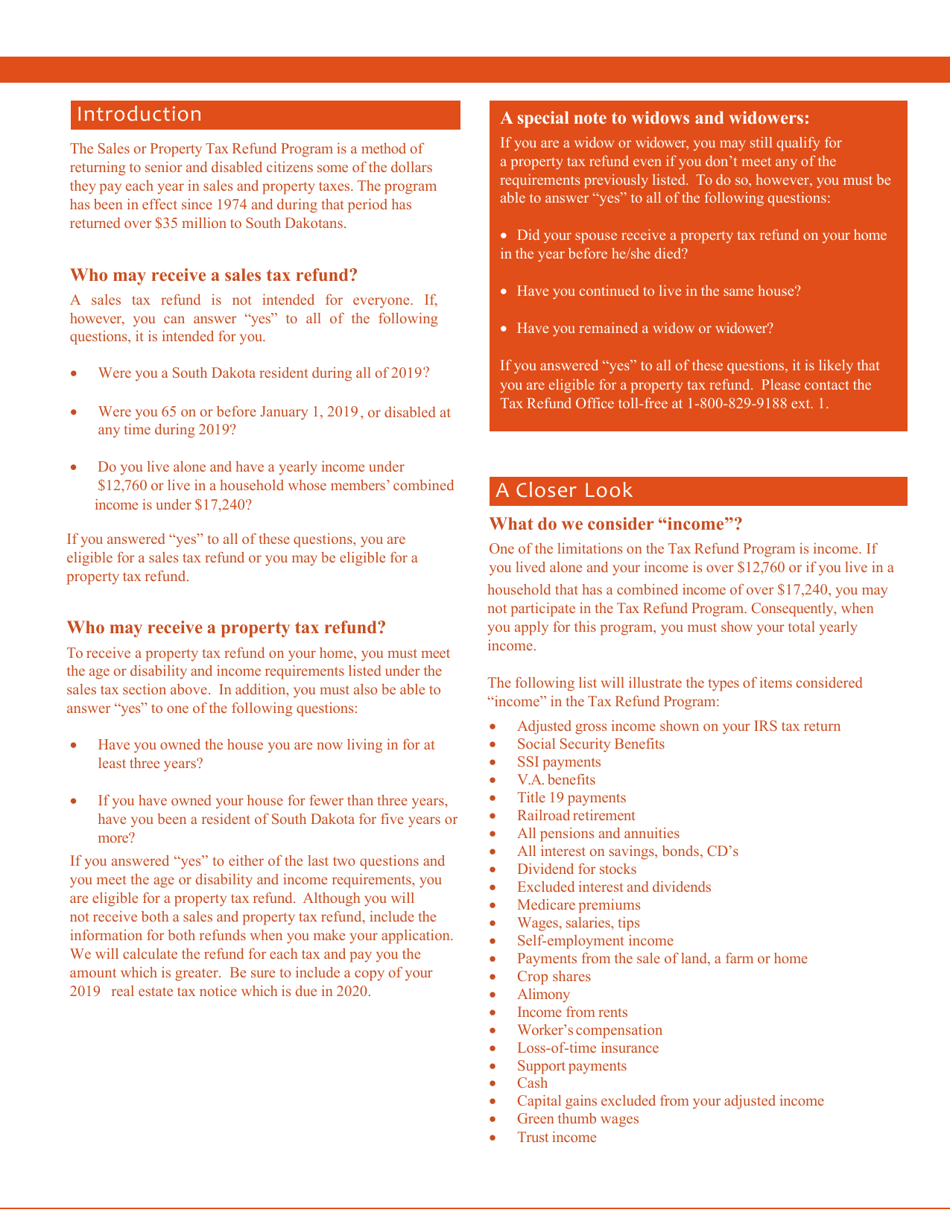

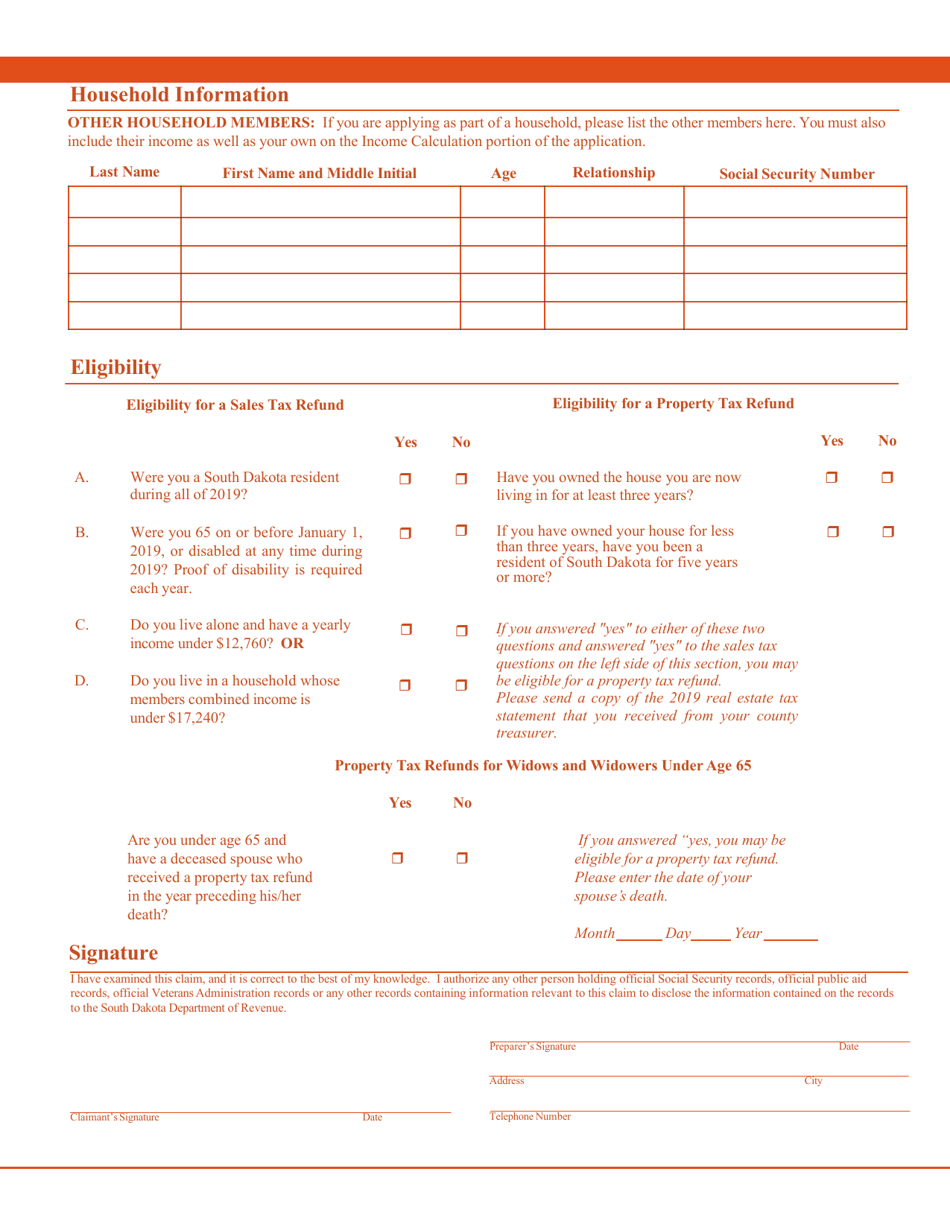

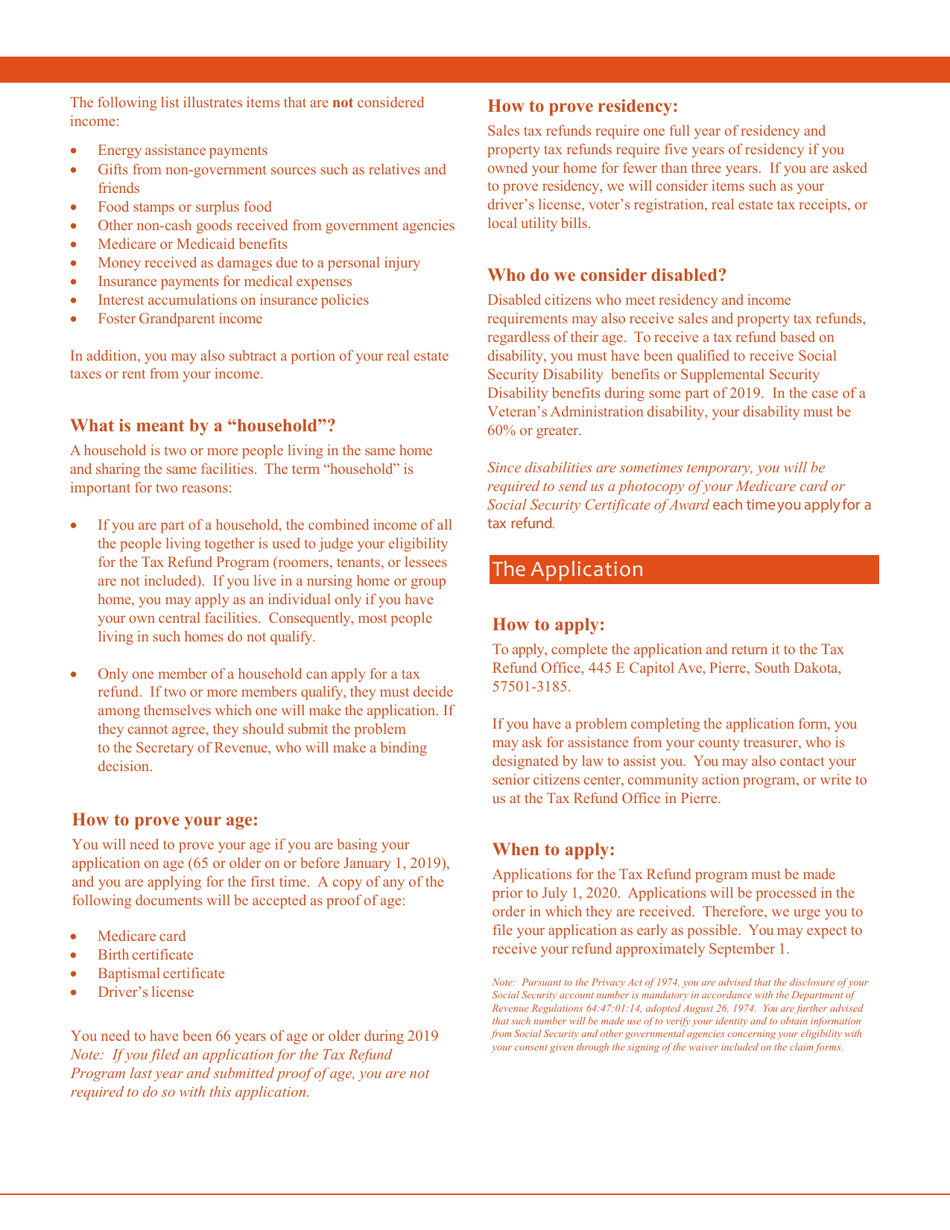

Q: Who is eligible for senior citizens and citizens with disabilities tax refund in South Dakota?

A: Senior citizens and citizens with disabilities who meet certain income requirements are eligible for the tax refund in South Dakota.

Q: What is the purpose of the tax refund?

A: The tax refund program in South Dakota is designed to assist senior citizens and citizens with disabilities by providing them with financial relief through sales or property tax refunds.

Q: What taxes are covered under the refund program?

A: The tax refund program in South Dakota covers sales tax or property tax.

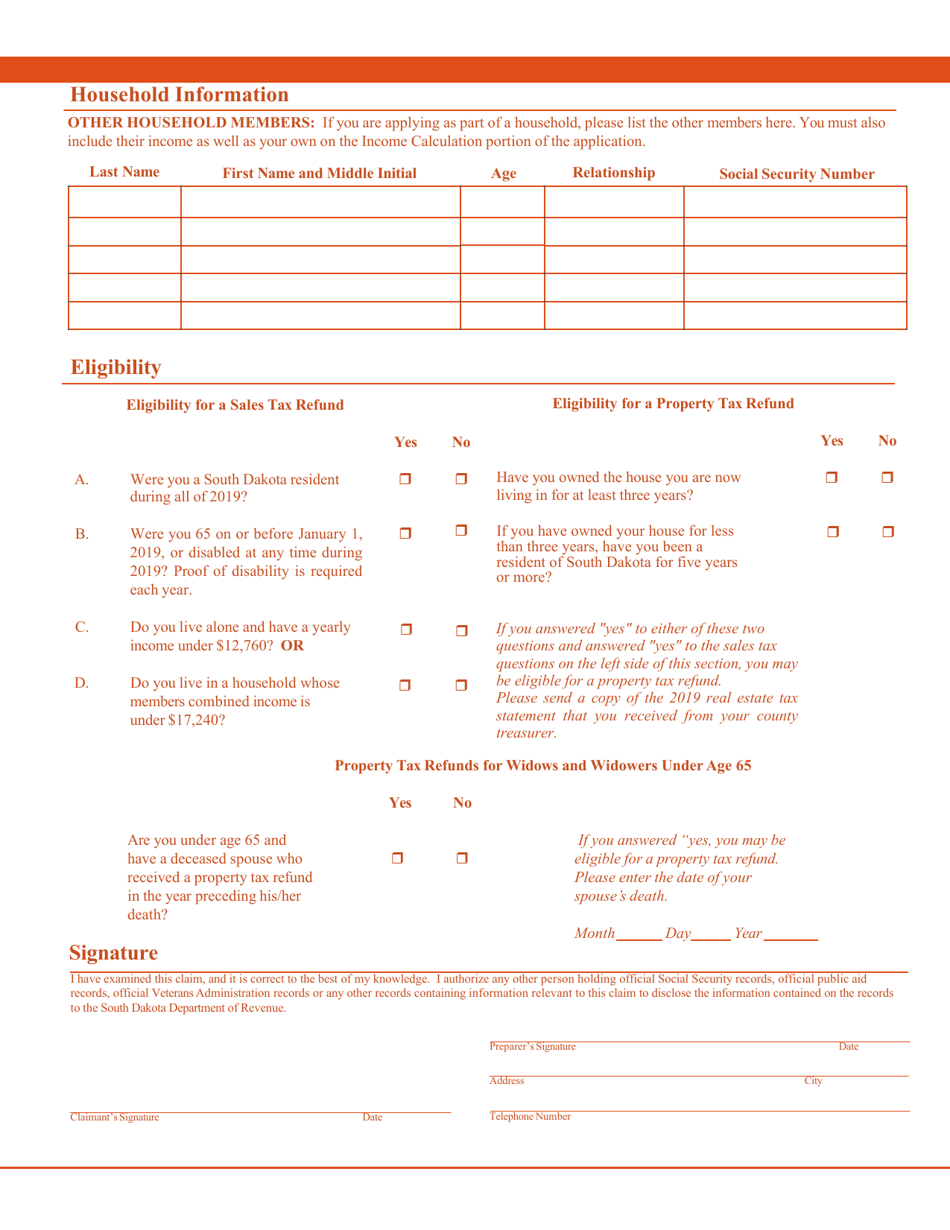

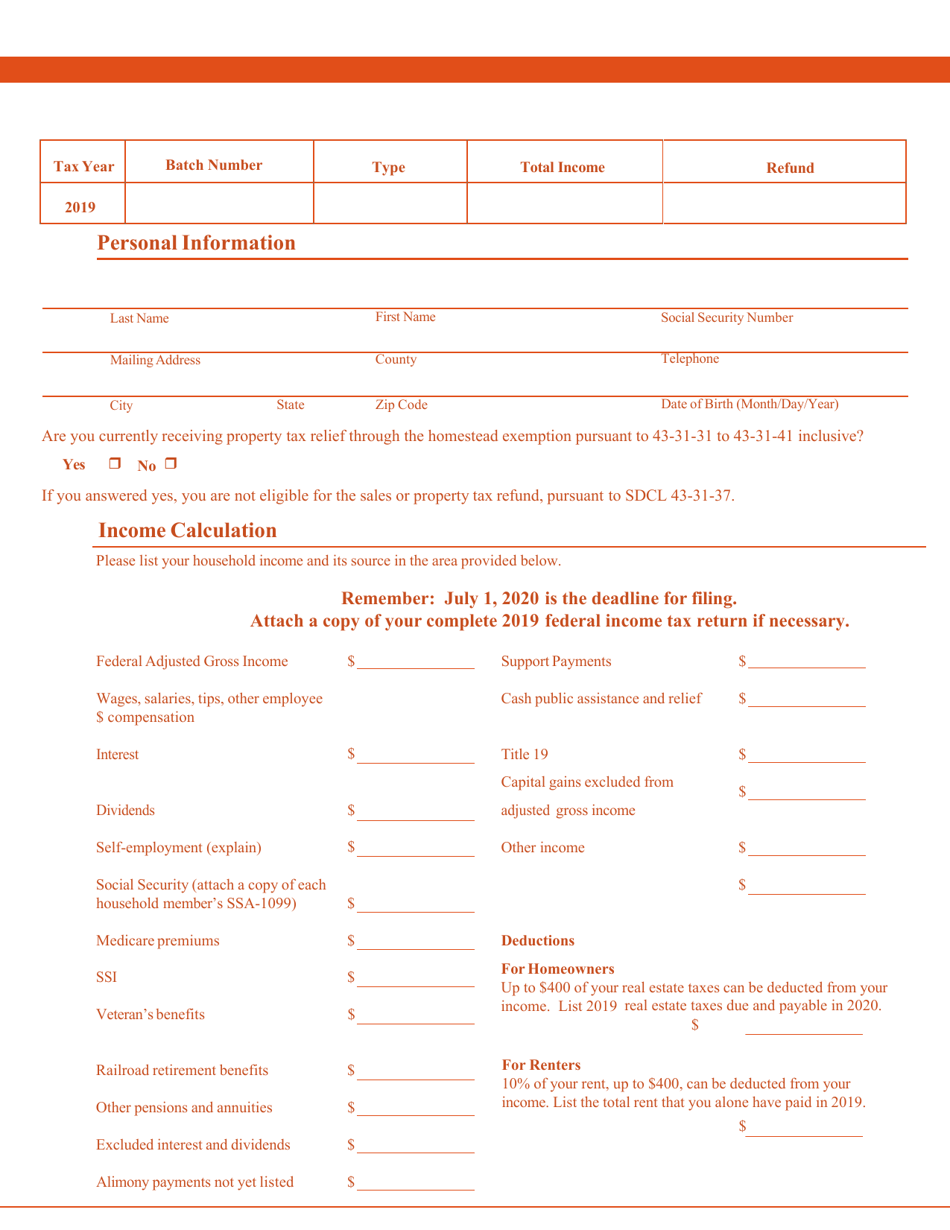

Q: How do I apply for the tax refund?

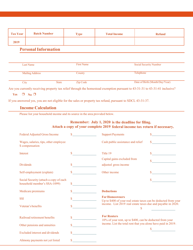

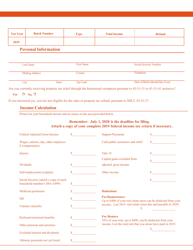

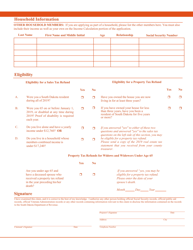

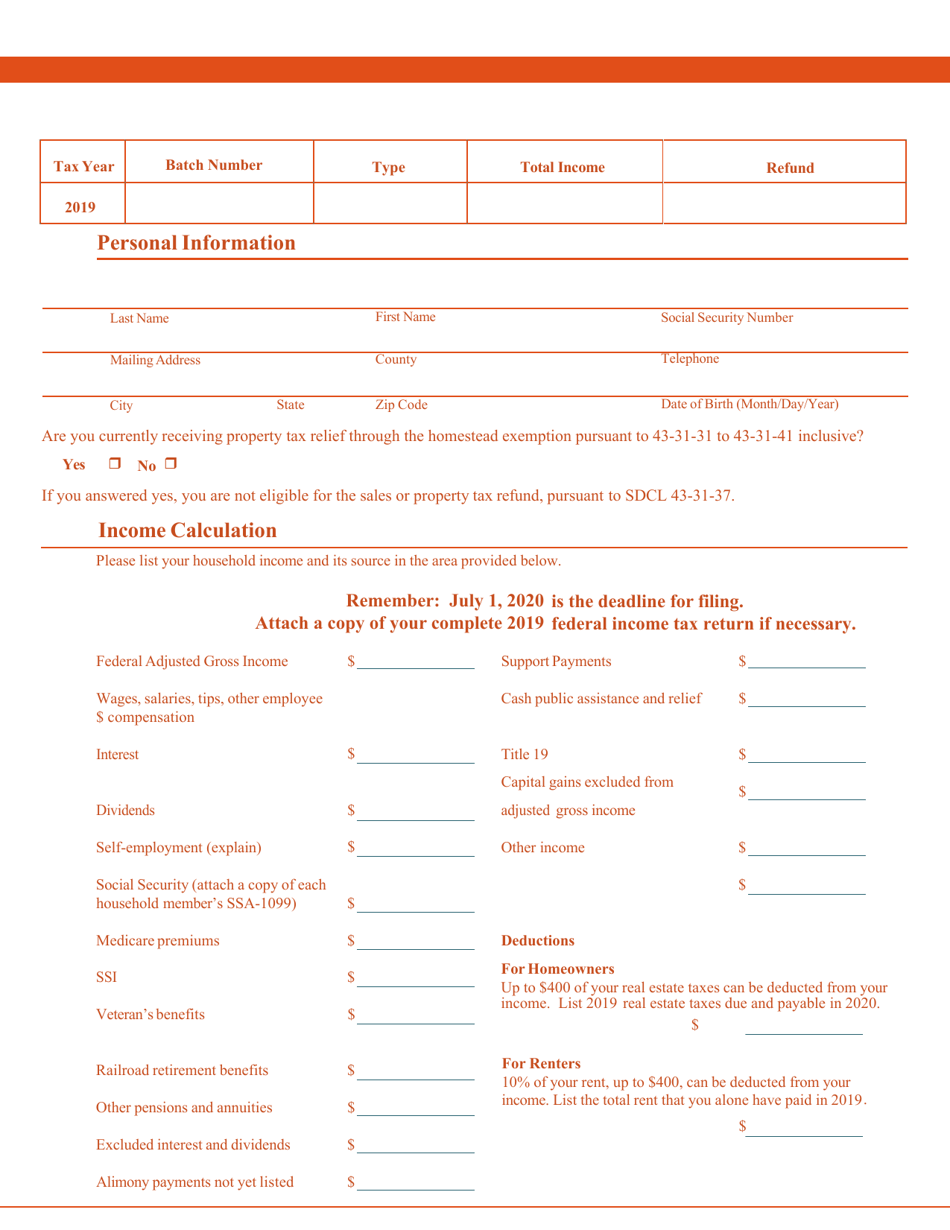

A: To apply for the tax refund, you must complete an application form and submit it to the South Dakota Department of Revenue.

Q: What are the income requirements for eligibility?

A: The income requirements for eligibility vary based on whether you are applying for sales tax or property tax refund. It's best to contact the South Dakota Department of Revenue for specific details.

Q: Is there a deadline to apply for the tax refund?

A: Yes, there is a deadline to apply for the tax refund in South Dakota. The application must be submitted by April 1st of the year following the year in which the taxes were paid.

Q: How much money can I expect to receive through the tax refund program?

A: The amount of money you can receive through the tax refund program varies depending on your income and the taxes paid. It's best to contact the South Dakota Department of Revenue for specific details.

Q: Can I apply for both sales tax and property tax refund?

A: Yes, you can apply for both sales tax and property tax refund if you meet the eligibility criteria for both programs.

Q: Are there any other requirements to be eligible for the tax refund?

A: In addition to meeting the income requirements, you must also be a resident of South Dakota and meet certain age or disability criteria to be eligible for the tax refund.

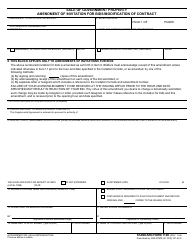

Form Details:

- The latest edition currently provided by the South Dakota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.