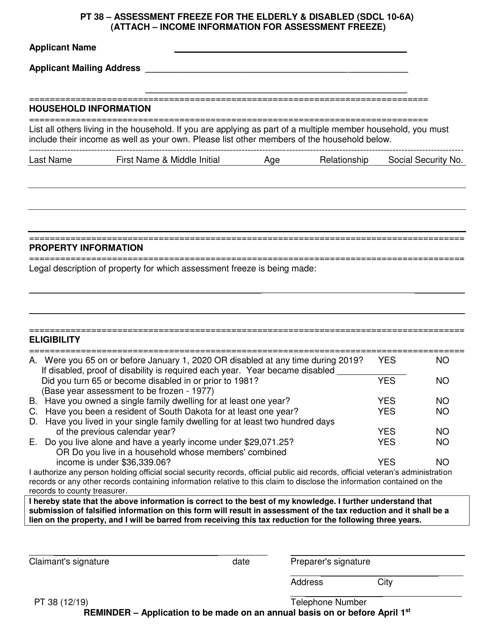

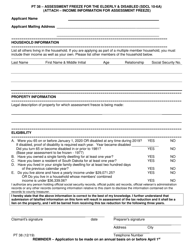

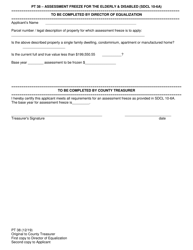

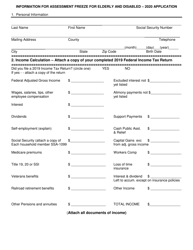

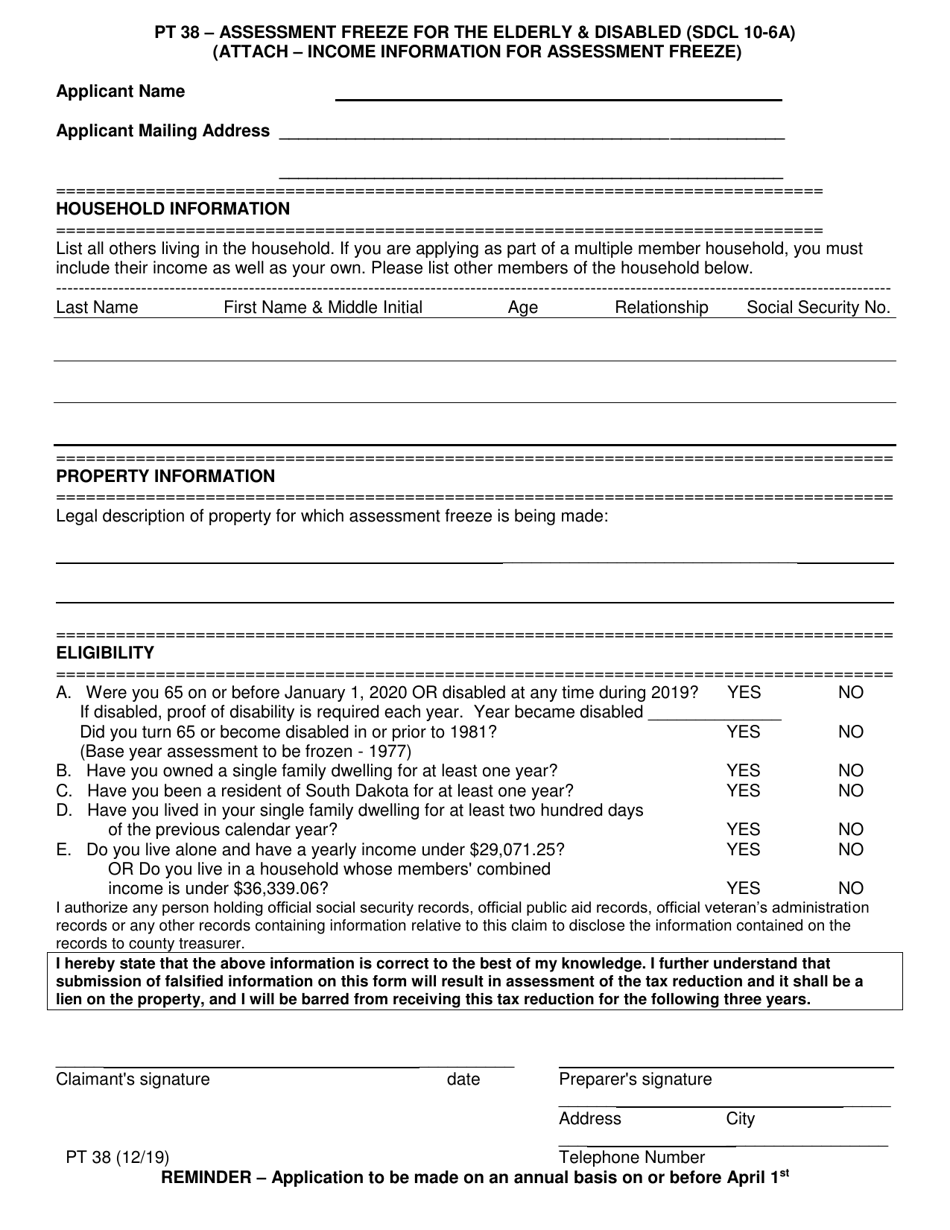

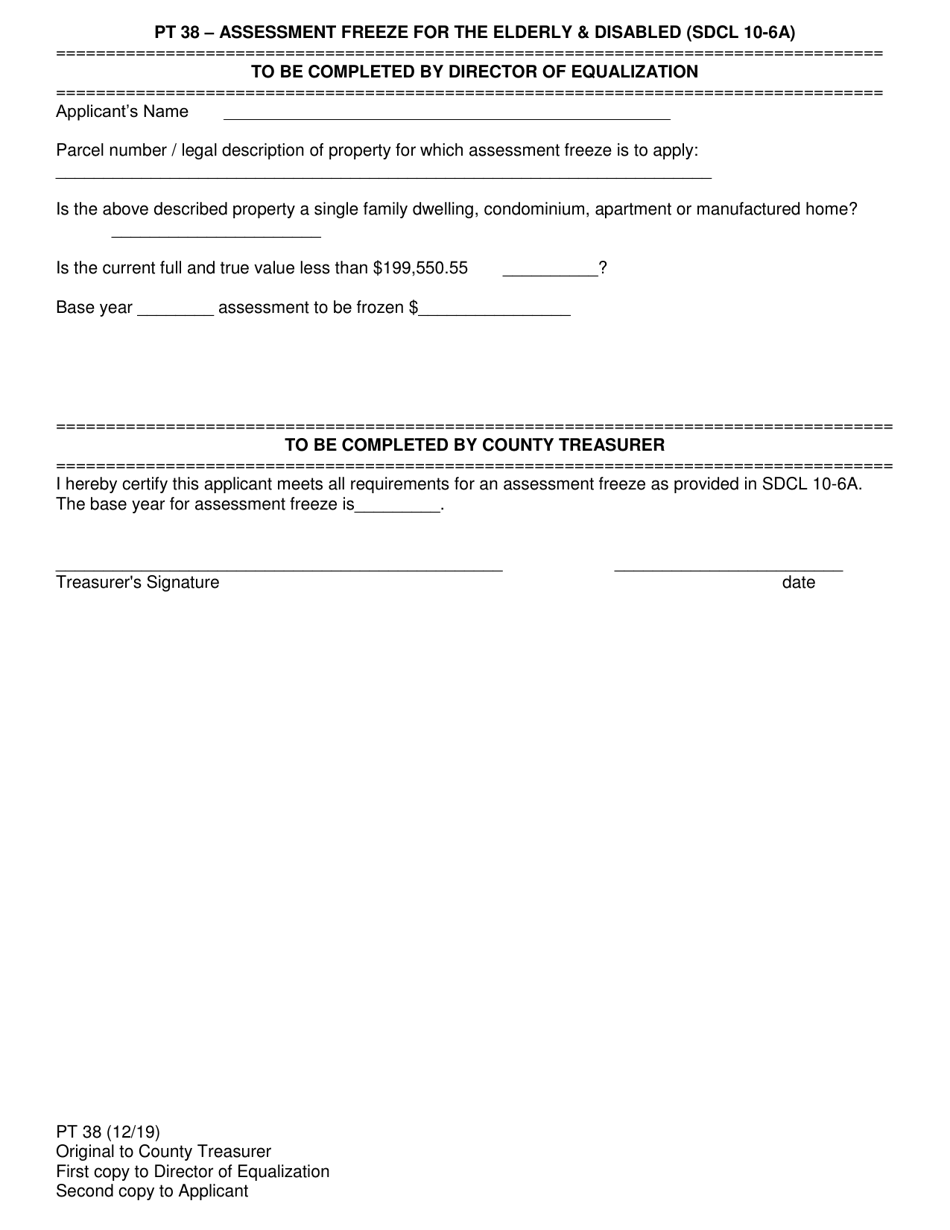

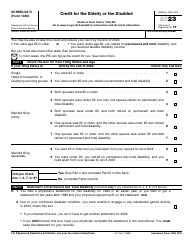

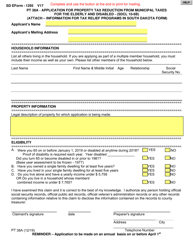

Form PT38 Assessment Freeze for the Elderly & Disabled - South Dakota

What Is Form PT38?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT38?

A: Form PT38 is an application for property tax assessment freeze for the elderly and disabled in South Dakota.

Q: Who is eligible for the assessment freeze?

A: Elderly individuals (age 65 or older) and disabled individuals who own and occupy their property in South Dakota may be eligible for the assessment freeze.

Q: What does the assessment freeze do?

A: The assessment freeze freezes the taxable value of the property for eligible individuals, preventing it from increasing due to rising property values.

Q: How can I apply for the assessment freeze?

A: You can apply for the assessment freeze by completing and submitting Form PT38 to your local county treasurer's office.

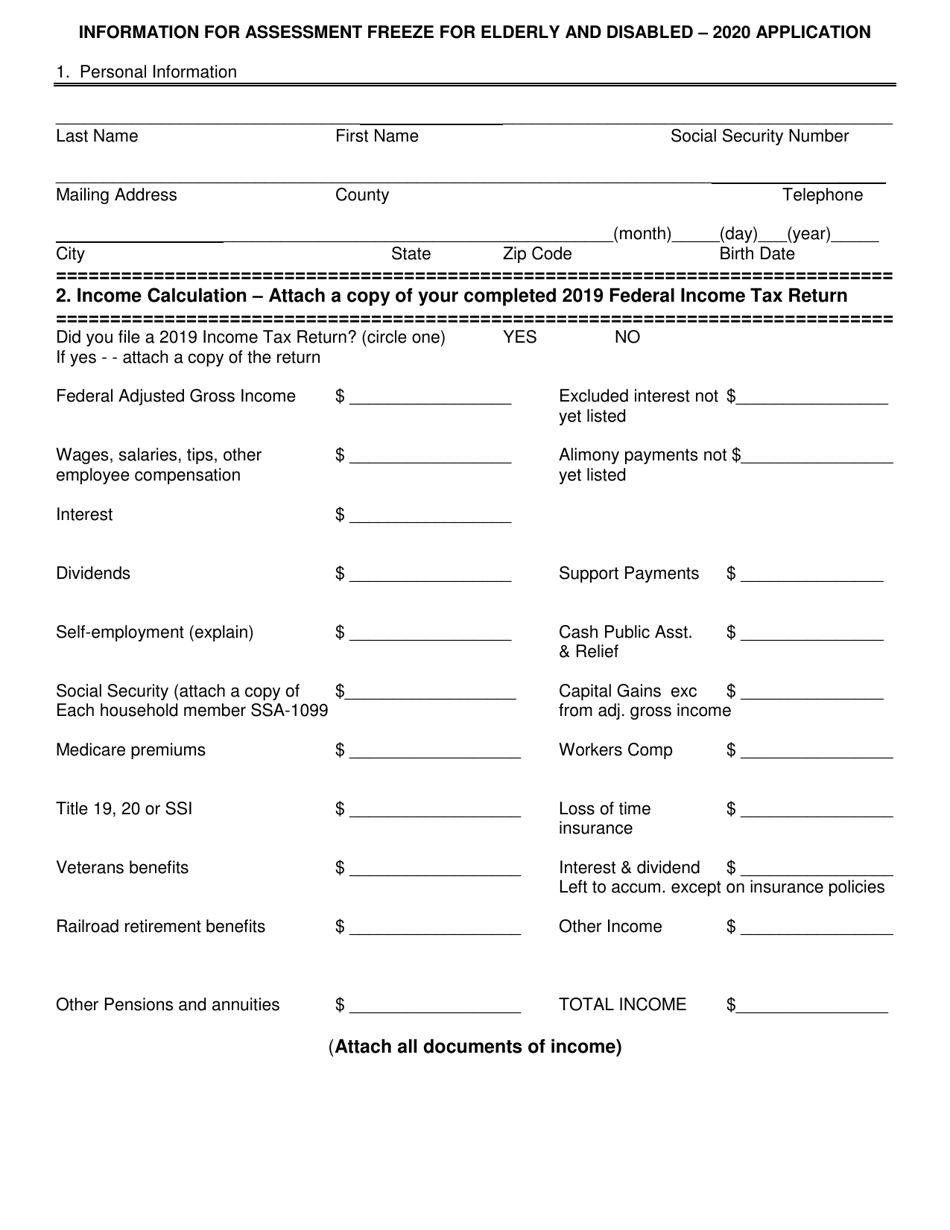

Q: What documents do I need to include with my application?

A: You will need to include proof of age or disability, such as a birth certificate, driver's license, or disability benefits letter, along with your application.

Q: Is there an income limit for eligibility?

A: No, there is no income limit for eligibility for the assessment freeze.

Q: Is there a deadline to apply?

A: Yes, the application deadline for the assessment freeze is April 1st of each year.

Q: What happens after I submit my application?

A: After submitting your application, the county treasurer's office will review it and notify you of the decision.

Q: Will my property taxes be completely waived if I qualify for the assessment freeze?

A: No, the assessment freeze only freezes the taxable value of the property and does not waive property taxes. You will still be responsible for paying any applicable taxes.

Q: Can I apply for the assessment freeze if I am a renter?

A: No, the assessment freeze is only available for individuals who own and occupy their property in South Dakota.

Q: Who can I contact for more information?

A: For more information, you can contact your local county treasurer's office or the South Dakota Department of Revenue.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT38 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.