This version of the form is not currently in use and is provided for reference only. Download this version of

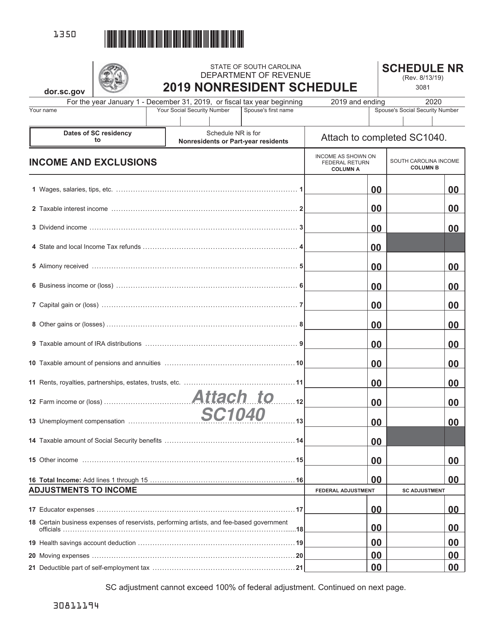

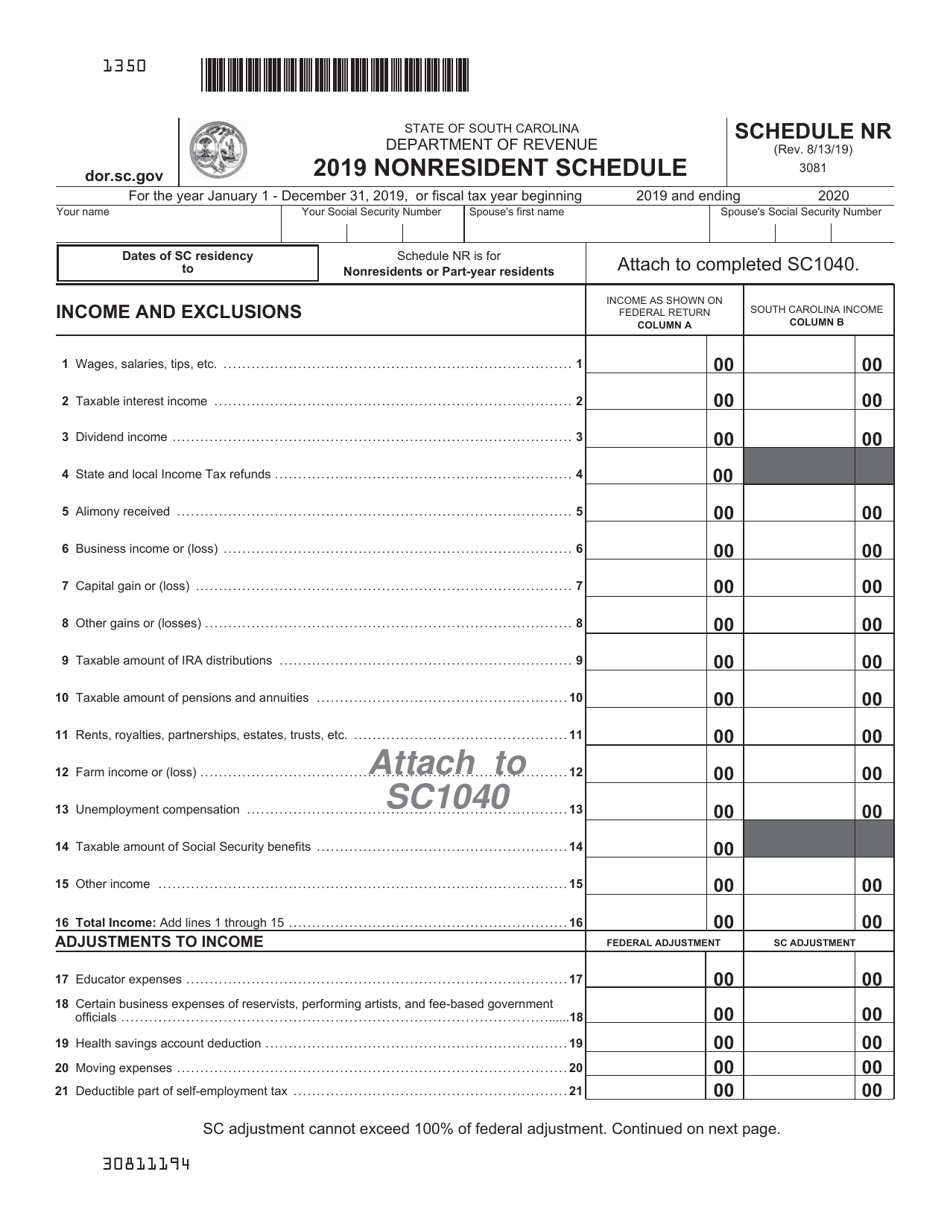

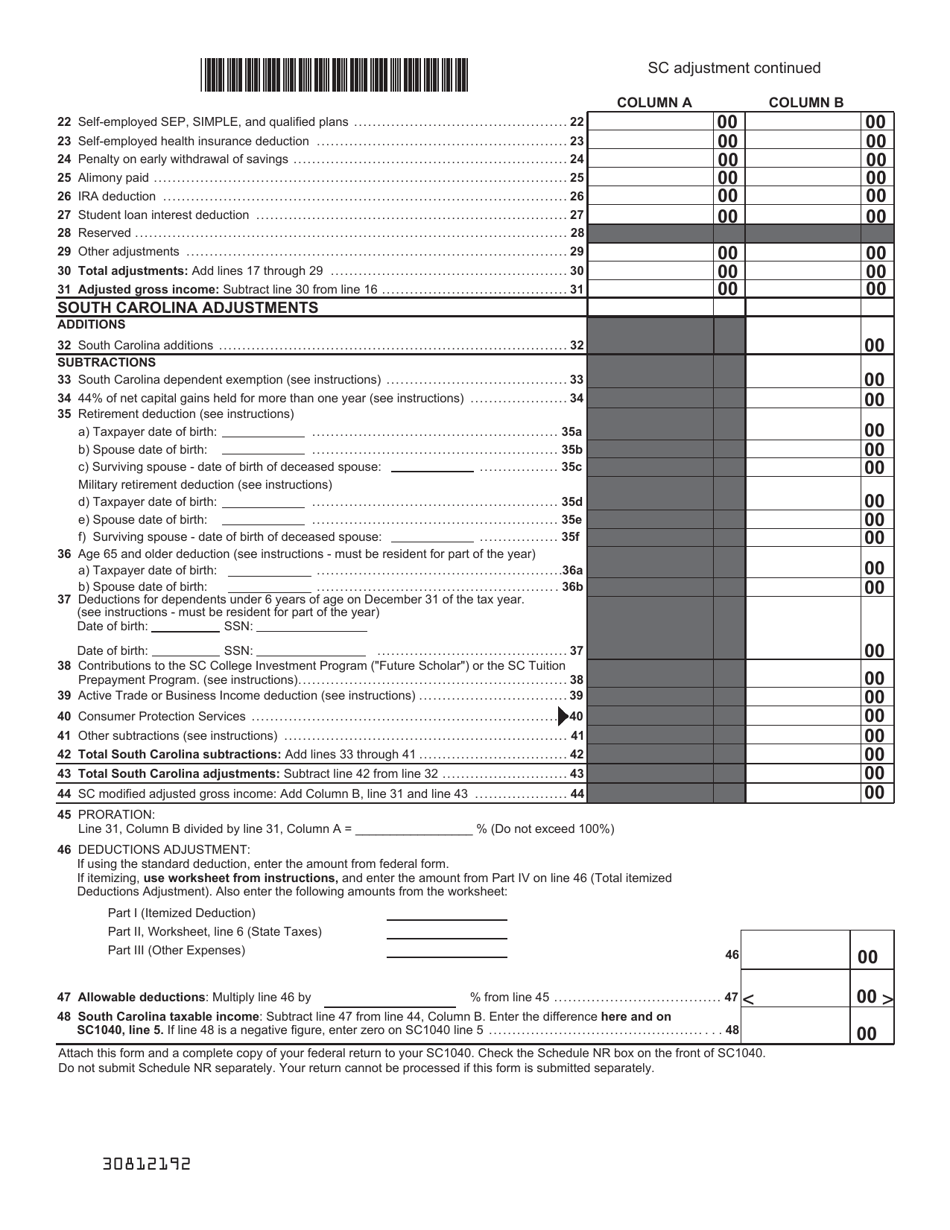

Schedule NR

for the current year.

Schedule NR Nonresident Schedule - South Carolina

What Is Schedule NR?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NR?

A: Schedule NR is the Nonresident Schedule for filing taxes in South Carolina.

Q: Who needs to file Schedule NR?

A: Nonresidents earning income in South Carolina need to file Schedule NR.

Q: What is the purpose of Schedule NR?

A: Schedule NR is used to report and calculate the tax liability for nonresident individuals in South Carolina.

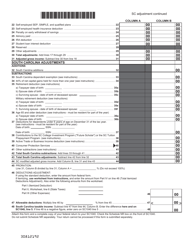

Q: What information is required to complete Schedule NR?

A: The information required for Schedule NR includes details of income earned in South Carolina, deductions, and credits.

Q: When should Schedule NR be filed?

A: Schedule NR should be filed along with the South Carolina Individual Income Tax Return, Form SC1040.

Q: Can Schedule NR be filed electronically?

A: Yes, Schedule NR can be filed electronically if you are filing your tax return electronically.

Q: What happens if Schedule NR is not filed?

A: Failure to file Schedule NR if required may result in penalties or interest charges.

Q: Can I file Schedule NR if I am a resident of South Carolina?

A: No, Schedule NR is specifically for nonresidents of South Carolina. Residents should use the regular South Carolina individual income tax form.

Q: Does filing Schedule NR make me a resident of South Carolina?

A: No, filing Schedule NR does not establish residency in South Carolina. It is only for reporting nonresident income.

Form Details:

- Released on August 13, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NR by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.