This version of the form is not currently in use and is provided for reference only. Download this version of

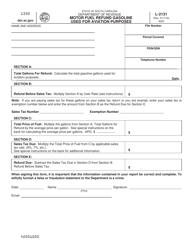

Form I-385

for the current year.

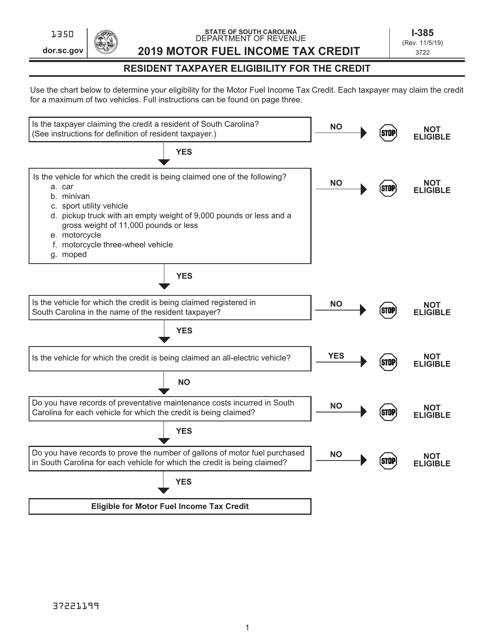

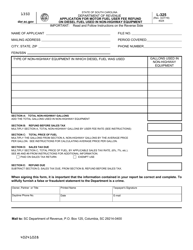

Form I-385 Motor Fuel Income Tax Credit - South Carolina

What Is Form I-385?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

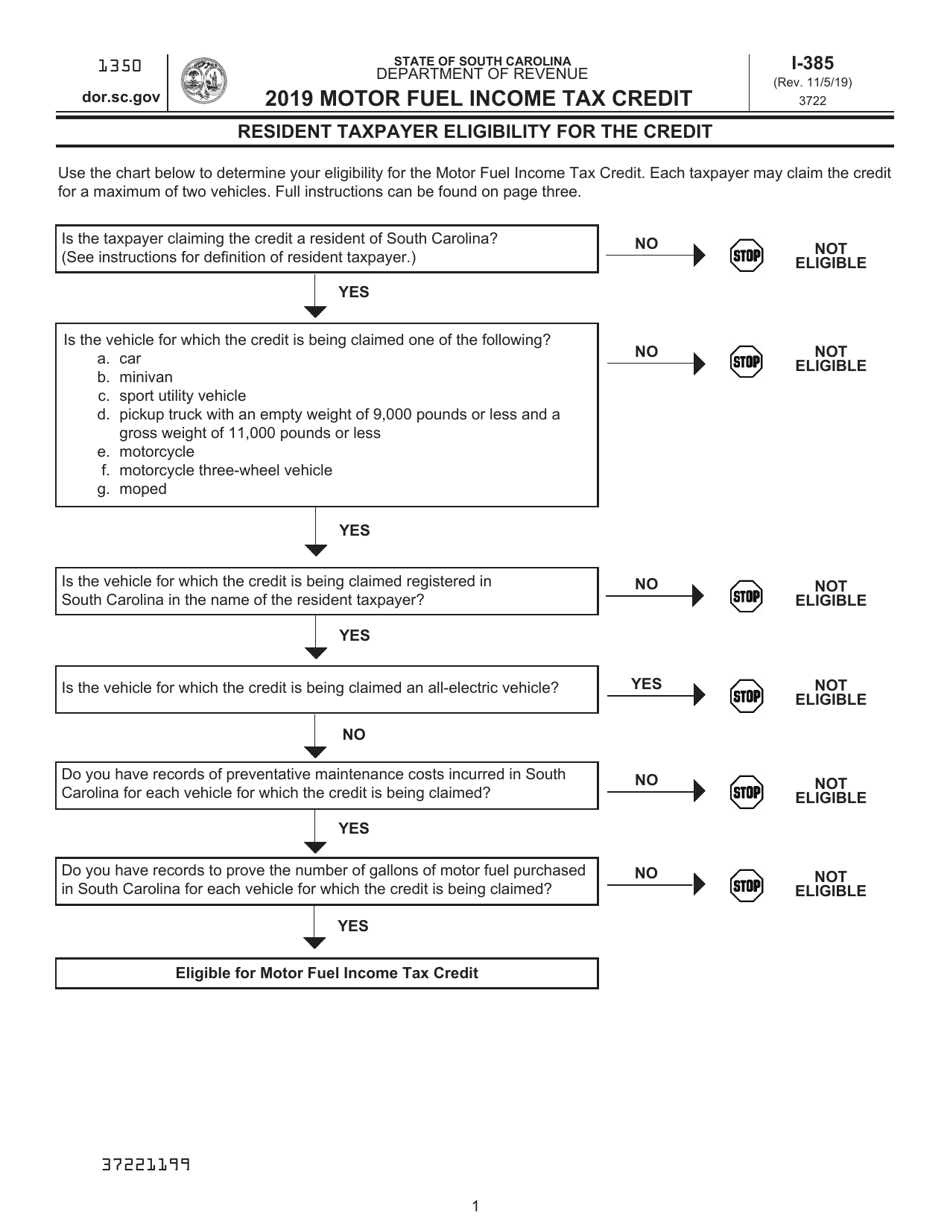

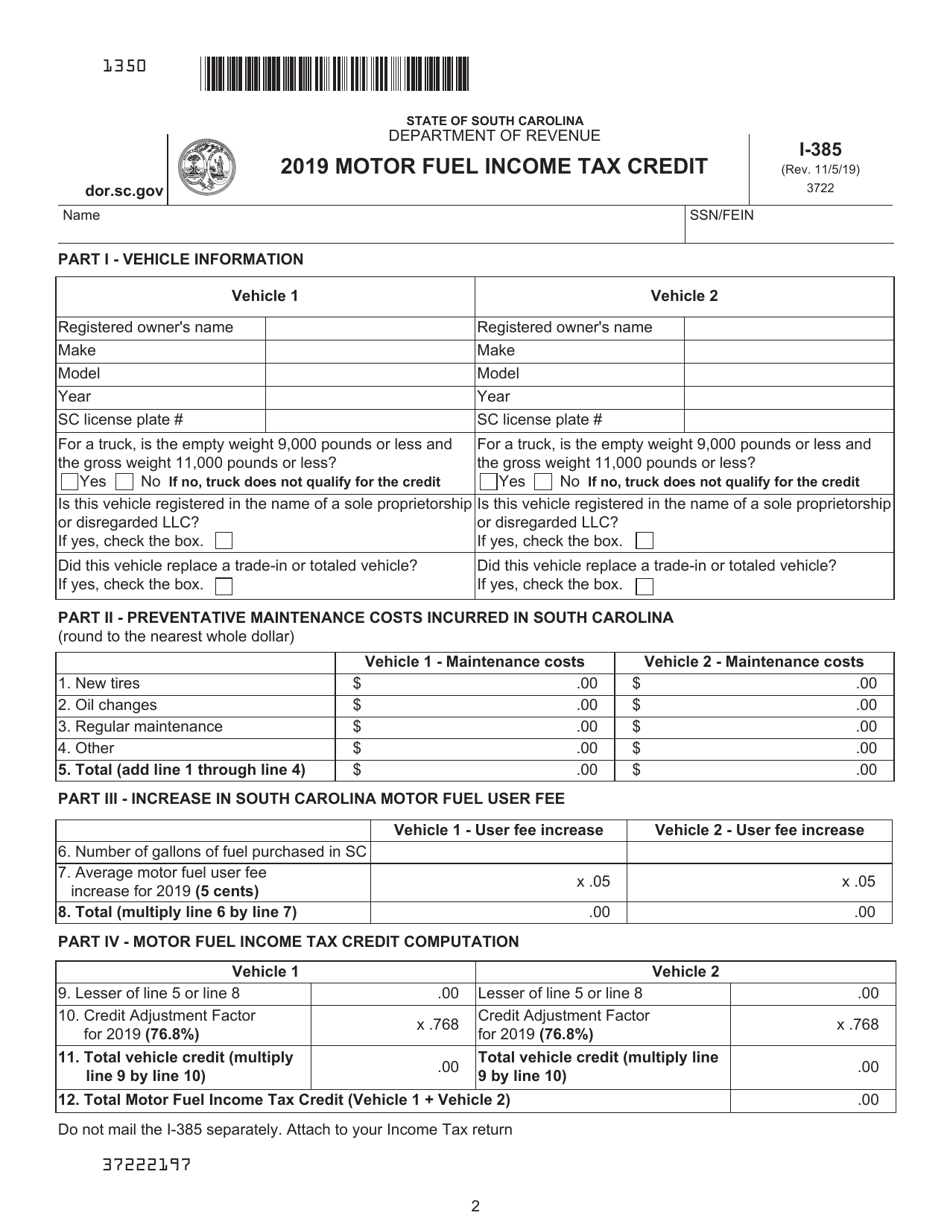

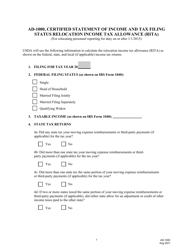

Q: What is Form I-385?

A: Form I-385 is a form used to claim the Motor FuelIncome Tax Credit in South Carolina.

Q: What is the Motor Fuel Income Tax Credit?

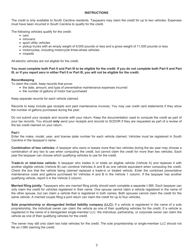

A: The Motor Fuel Income Tax Credit is a tax credit available in South Carolina for certain individuals and businesses that use motor fuel in specific activities.

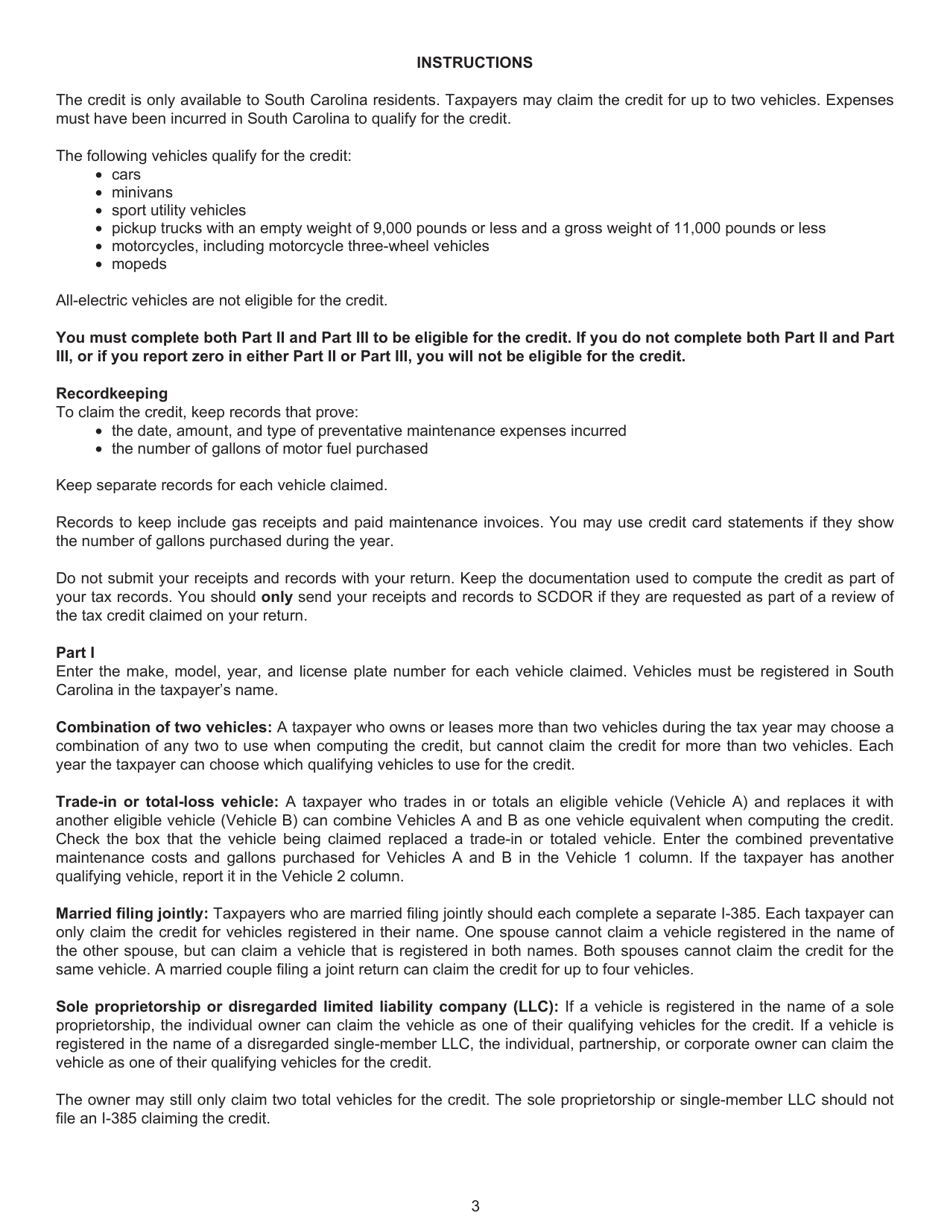

Q: Who is eligible for the Motor Fuel Income Tax Credit?

A: Eligibility for the Motor Fuel Income Tax Credit is determined based on the type of business or activity in which motor fuel is used.

Q: What activities qualify for the Motor Fuel Income Tax Credit?

A: Qualifying activities include farming, logging, rail transportation, water transportation, and certain non-highway use of motor fuel.

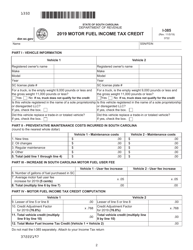

Q: How do I claim the Motor Fuel Income Tax Credit?

A: To claim the Motor Fuel Income Tax Credit, you must complete and file Form I-385 with the South Carolina Department of Revenue.

Q: Are there any limitations or restrictions on the Motor Fuel Income Tax Credit?

A: Yes, there are limitations and restrictions on the Motor Fuel Income Tax Credit, including maximum credit amounts and requirements for records and documentation.

Q: Is the Motor Fuel Income Tax Credit available in other states?

A: The Motor Fuel Income Tax Credit is specific to South Carolina and may not be available in other states.

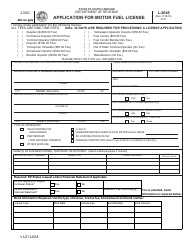

Form Details:

- Released on November 5, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-385 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.