This version of the form is not currently in use and is provided for reference only. Download this version of

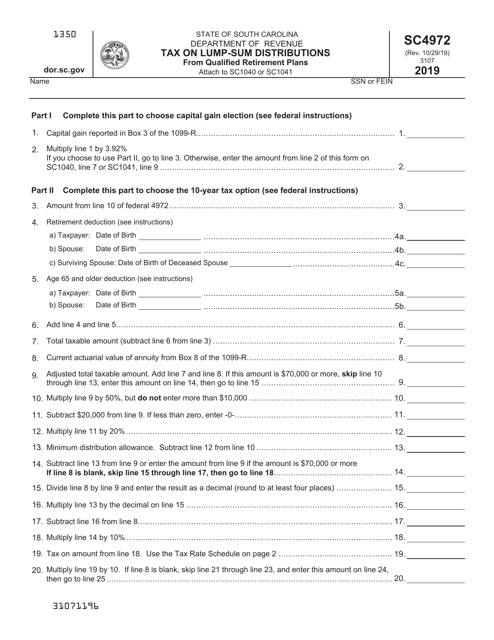

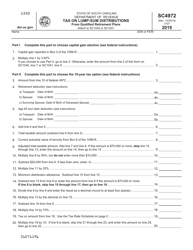

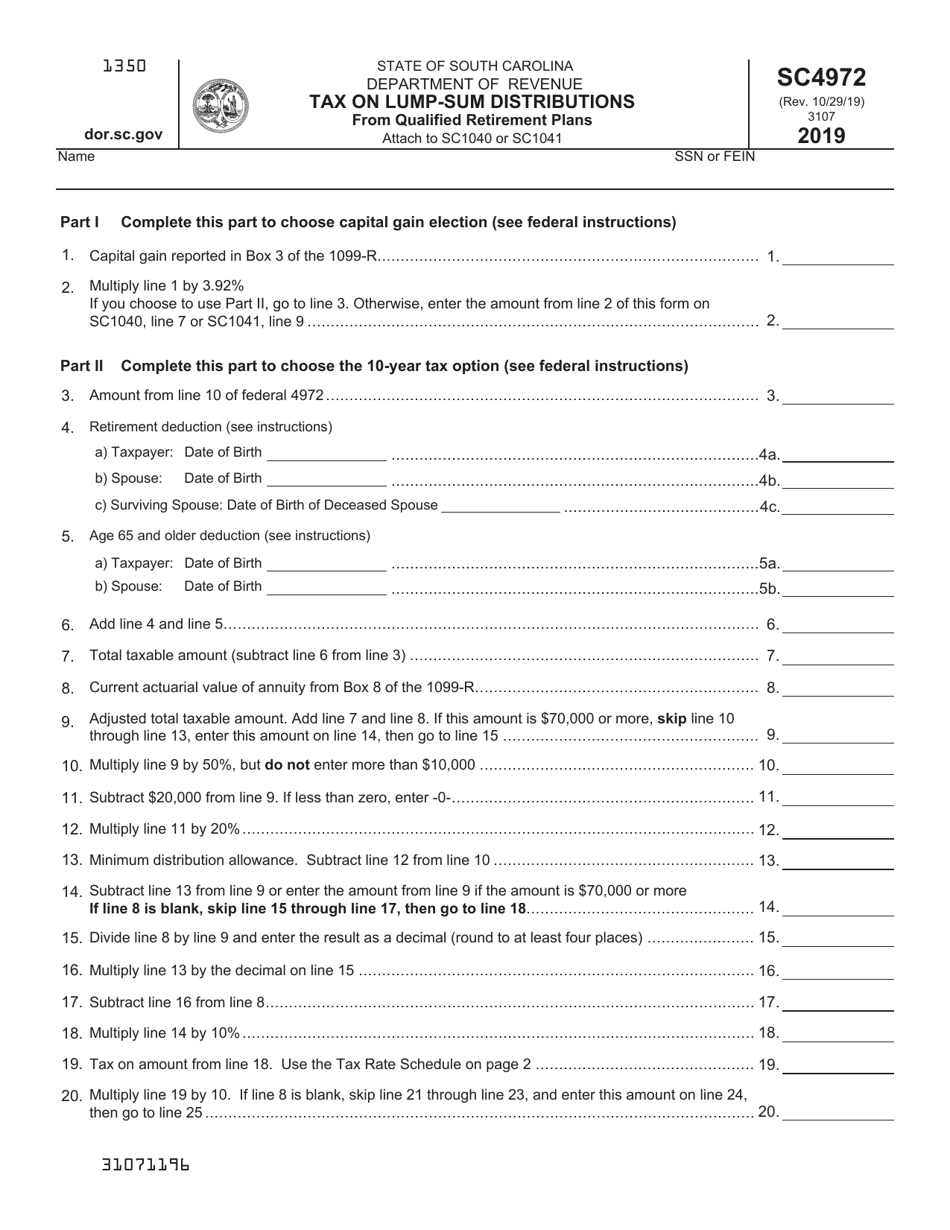

Form SC4972

for the current year.

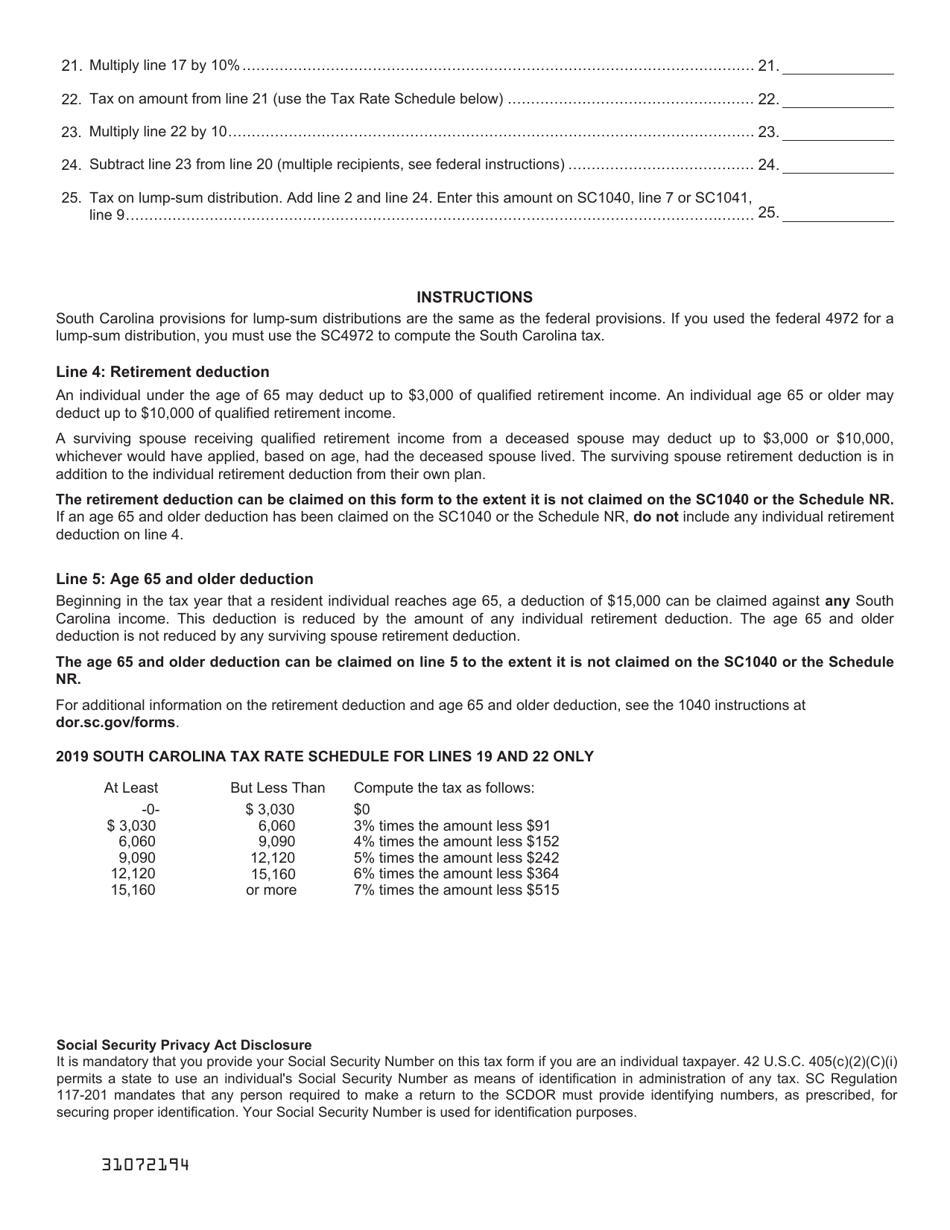

Form SC4972 Tax on Lump-Sum Distributions From Qualified Retirement Plans - South Carolina

What Is Form SC4972?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SC4972?

A: SC4972 is a tax form for reporting lump-sum distributions from qualified retirement plans in South Carolina.

Q: What is a lump-sum distribution?

A: A lump-sum distribution is a one-time payment of the entire balance in a retirement plan.

Q: What are qualified retirement plans?

A: Qualified retirement plans are employer-sponsored retirement plans that meet specific IRS requirements.

Q: Why do I need to report a lump-sum distribution?

A: You need to report a lump-sum distribution to calculate and pay any applicable taxes.

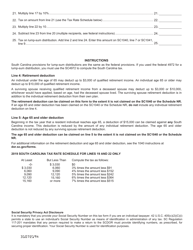

Q: How do I fill out SC4972?

A: You can fill out SC4972 by following the instructions provided with the form.

Q: Are there any exceptions or deductions for lump-sum distributions in South Carolina?

A: There may be exceptions or deductions available for lump-sum distributions in South Carolina. Check the instructions for SC4972 or consult a tax professional for more information.

Q: What if I have more questions about SC4972?

A: If you have more questions about SC4972, you can contact the South Carolina Department of Revenue or consult a tax professional for assistance.

Form Details:

- Released on October 29, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC4972 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.