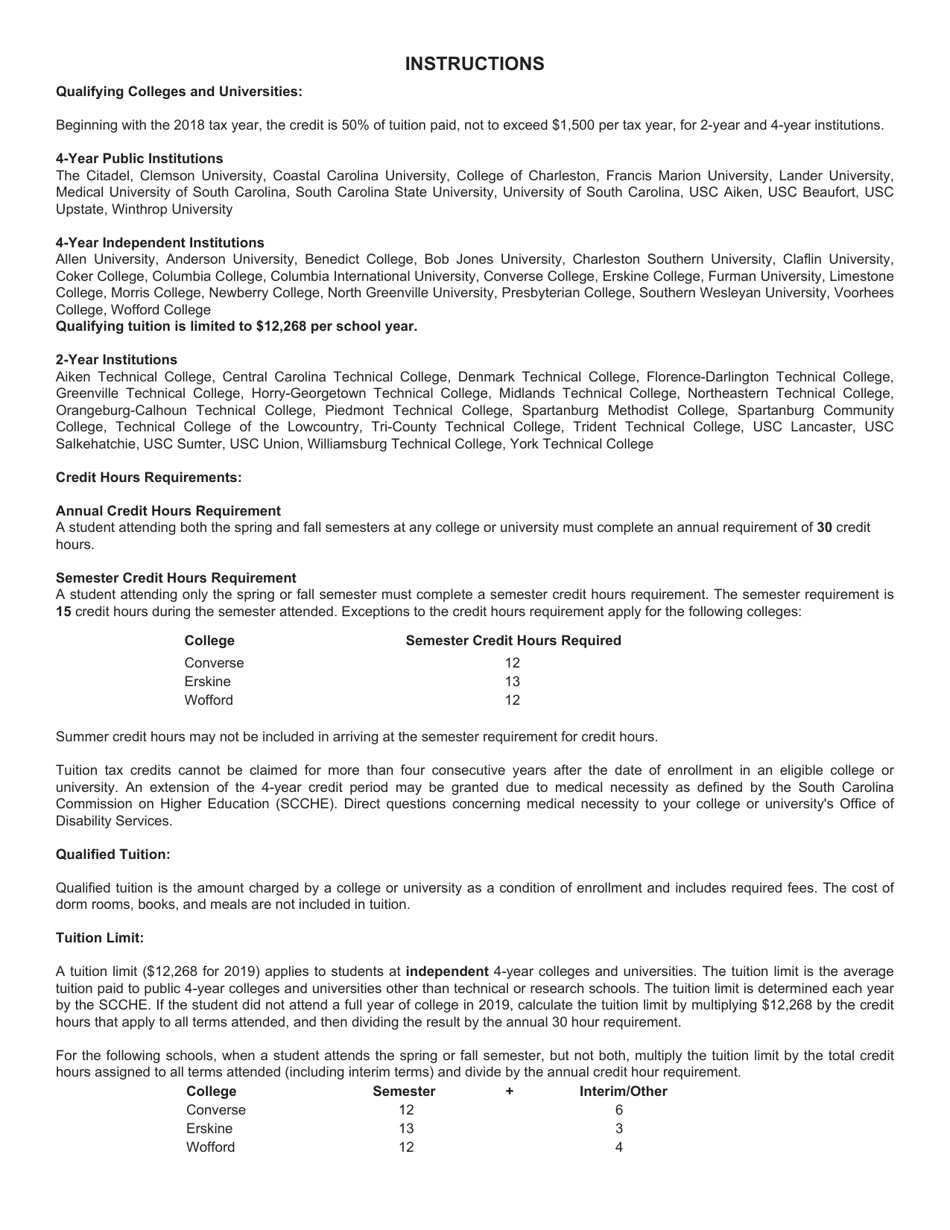

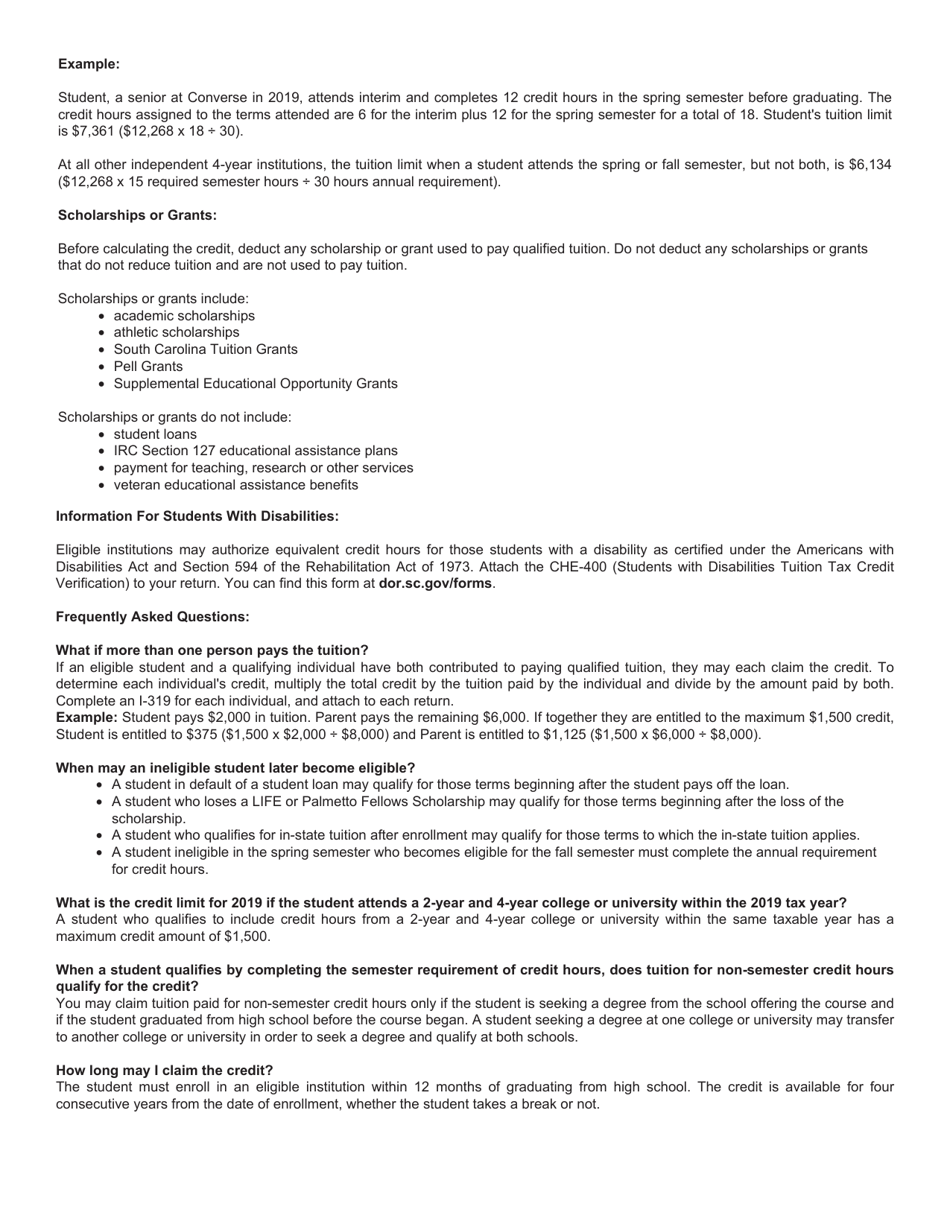

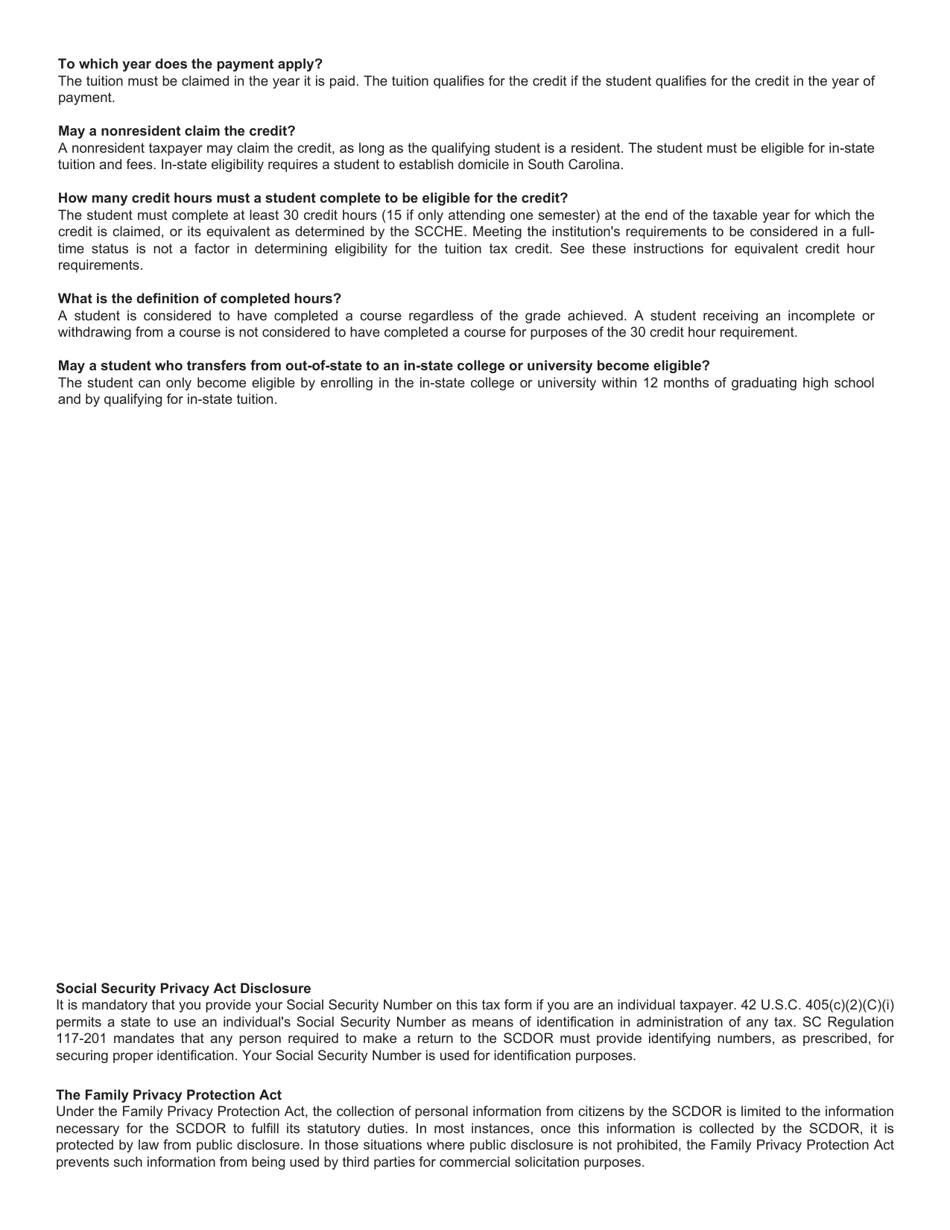

This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-319

for the current year.

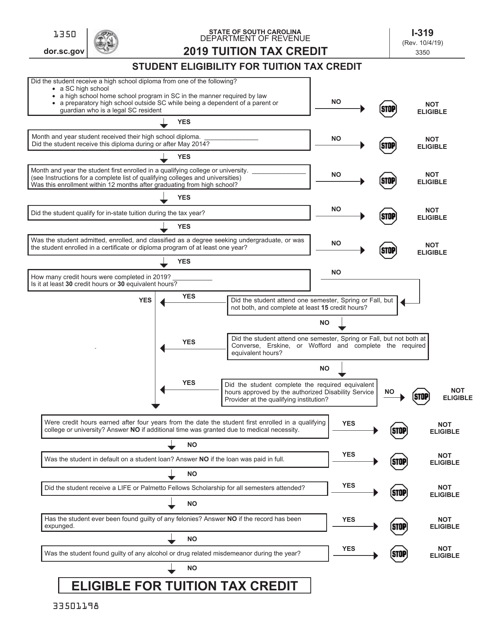

Form I-319 Tuition Tax Credit - South Carolina

What Is Form I-319?

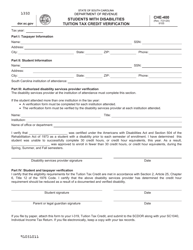

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-319?

A: Form I-319 is the Tuition Tax Credit form specific to South Carolina.

Q: What is the Tuition Tax Credit?

A: The Tuition Tax Credit is a benefit that allows residents of South Carolina to claim a credit for qualified tuition expenses paid to eligible institutions.

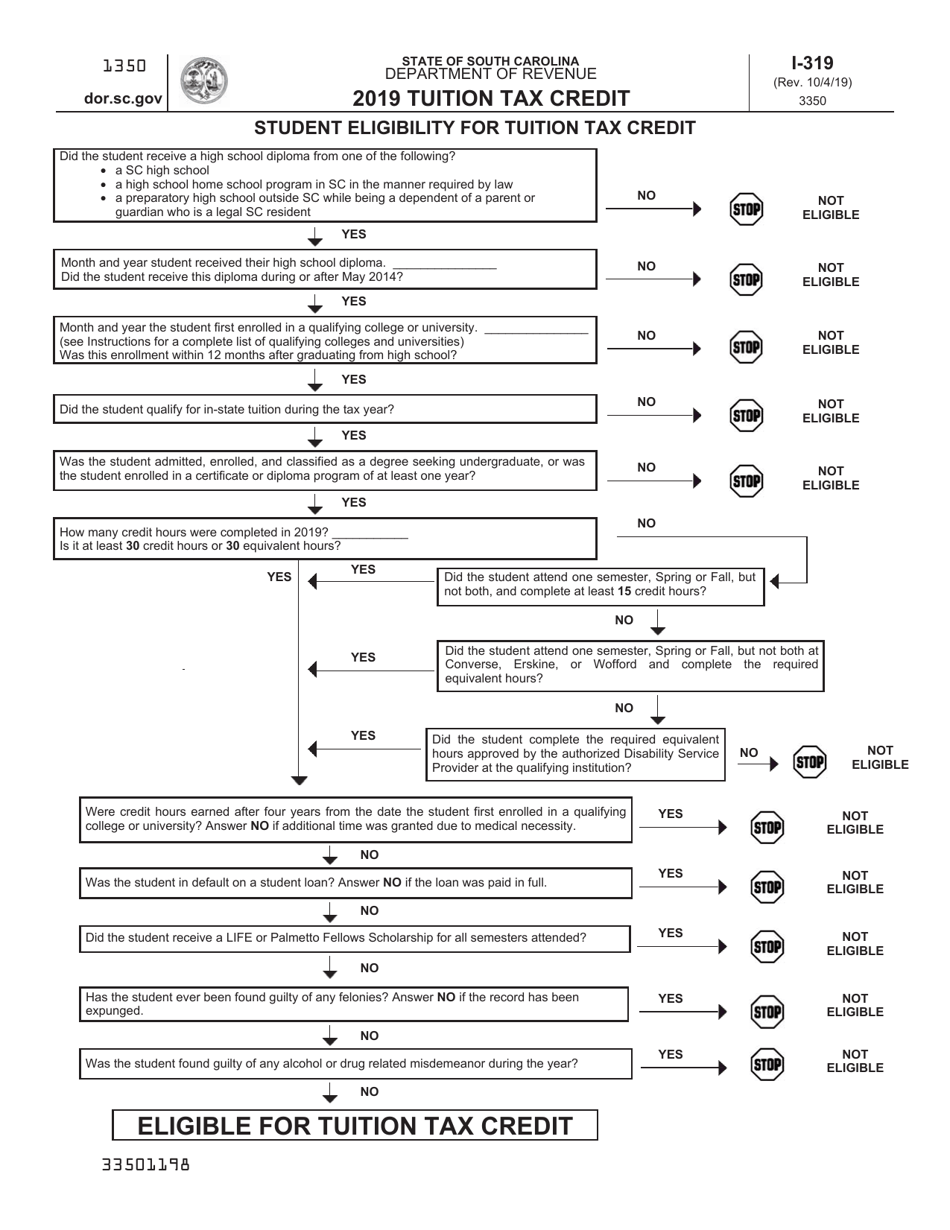

Q: Who can claim the Tuition Tax Credit in South Carolina?

A: South Carolina residents who have paid qualified tuition expenses to eligible institutions can claim the Tuition Tax Credit.

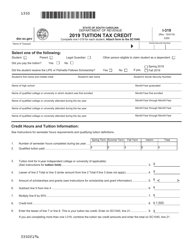

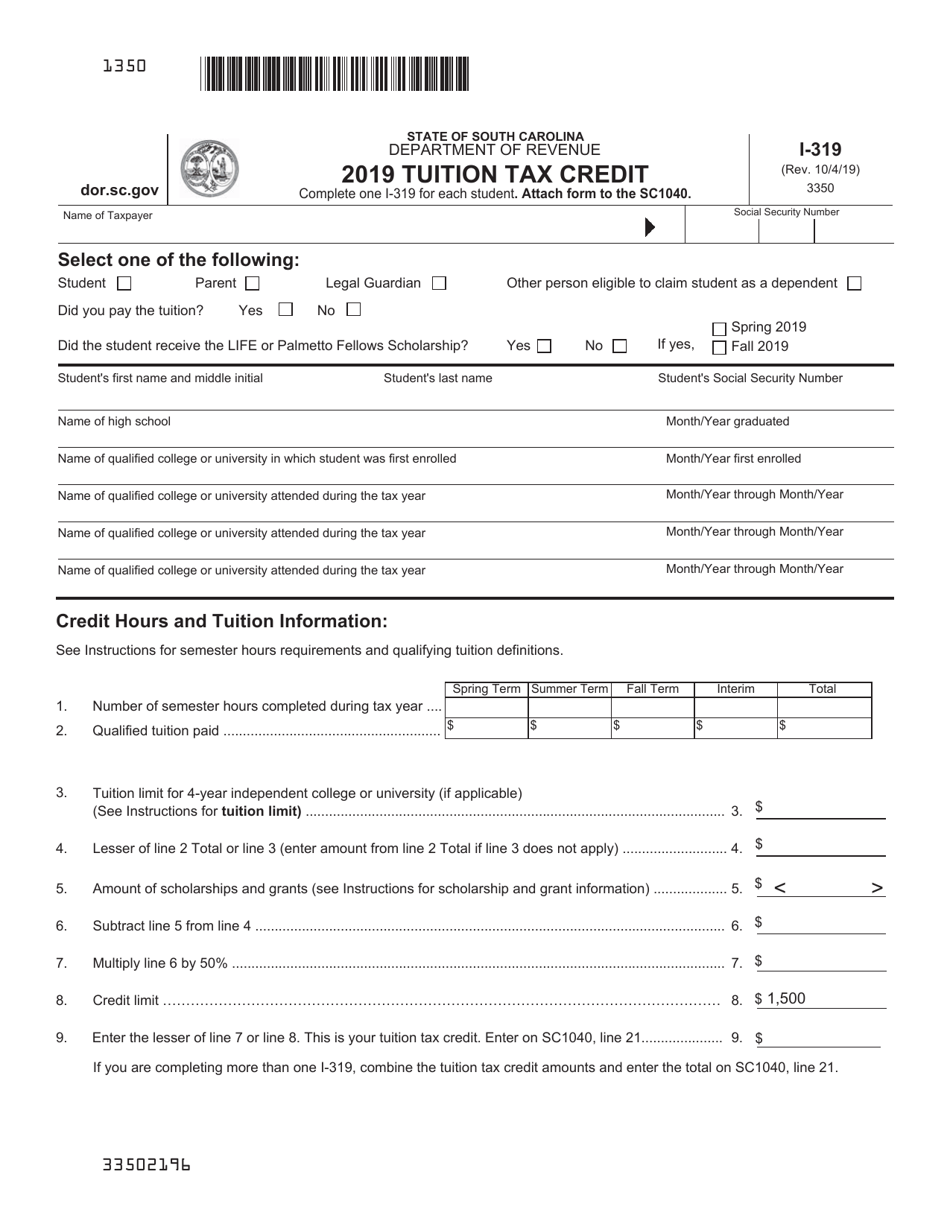

Q: What expenses are considered qualified tuition expenses?

A: Qualified tuition expenses include tuition and fees paid to eligible institutions for the education of the taxpayer, their spouse, or dependents.

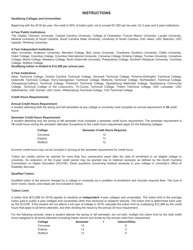

Q: What are eligible institutions for the Tuition Tax Credit?

A: Eligible institutions include colleges, universities, and other post-secondary educational institutions that are authorized to operate in South Carolina.

Q: How much is the Tuition Tax Credit in South Carolina?

A: The Tuition Tax Credit is equal to 25% of the qualified tuition expenses paid, up to a maximum credit of $1,500 per year.

Q: How can I claim the Tuition Tax Credit in South Carolina?

A: To claim the Tuition Tax Credit, you need to file Form I-319 with your South Carolina state income tax return.

Q: Is the Tuition Tax Credit refundable?

A: No, the Tuition Tax Credit in South Carolina is not refundable. It can only be used to offset your state income tax liability.

Q: Is there an income limit to claim the Tuition Tax Credit?

A: No, there is no specific income limit to claim the Tuition Tax Credit in South Carolina.

Q: Are there any residency requirements to claim the Tuition Tax Credit?

A: Yes, you must be a resident of South Carolina to claim the Tuition Tax Credit.

Q: Can I claim the Tuition Tax Credit for expenses paid to out-of-state institutions?

A: No, the Tuition Tax Credit in South Carolina can only be claimed for expenses paid to eligible institutions within the state.

Form Details:

- Released on October 4, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-319 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.