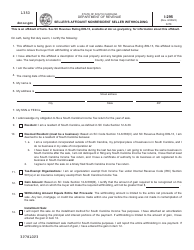

This version of the form is not currently in use and is provided for reference only. Download this version of

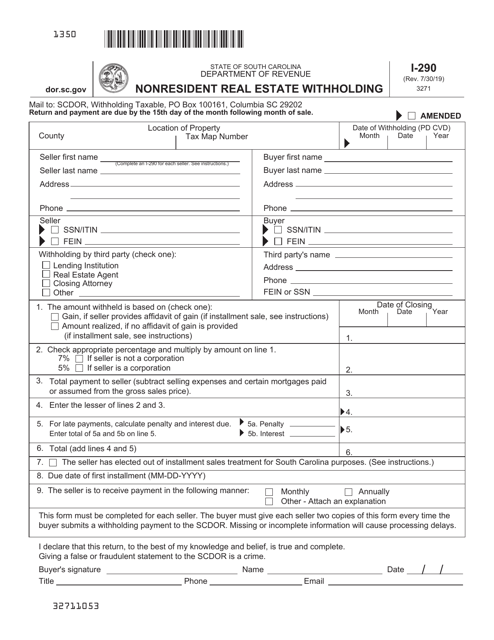

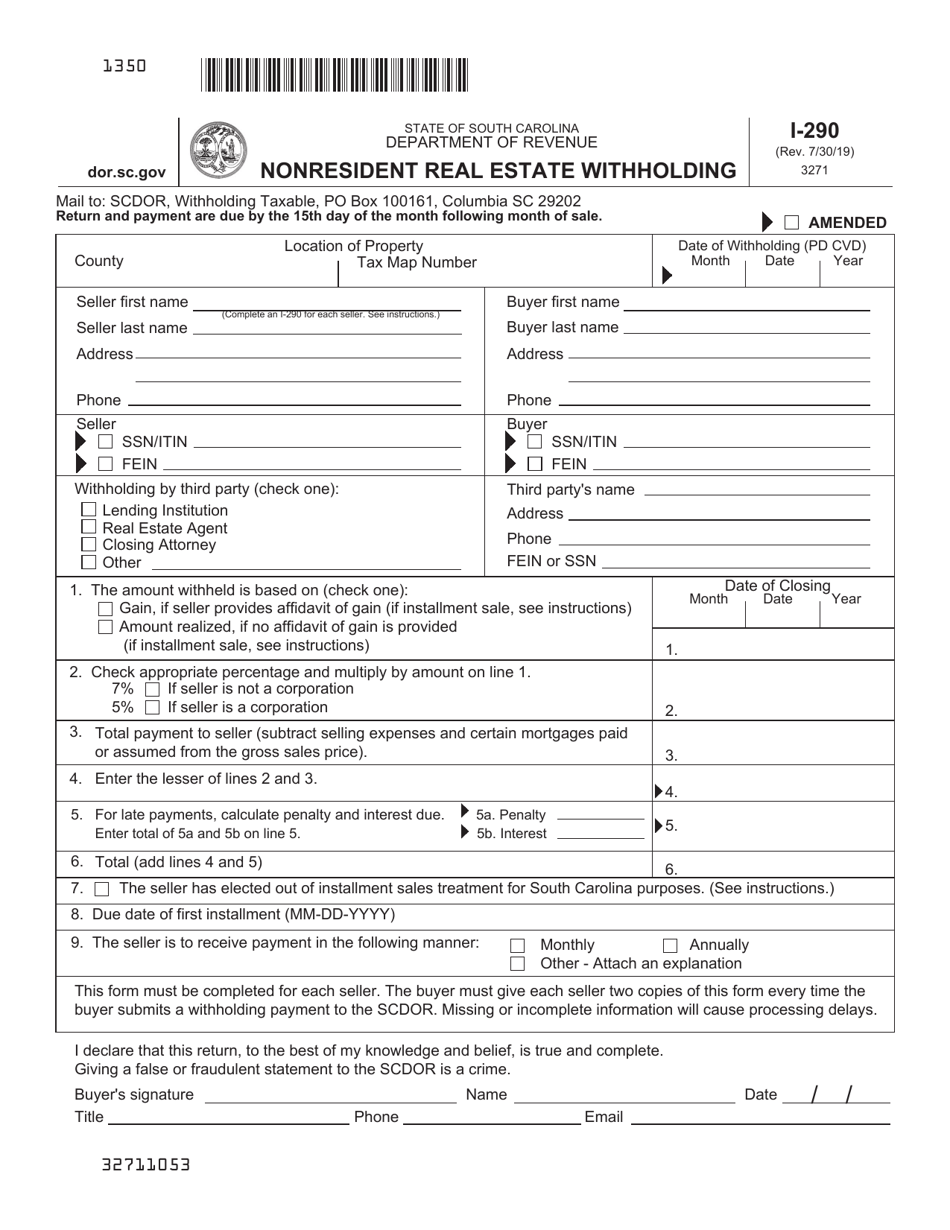

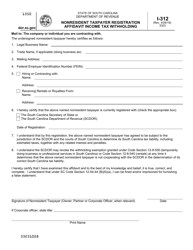

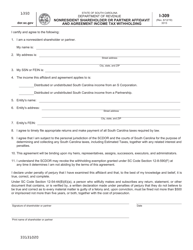

Form I-290

for the current year.

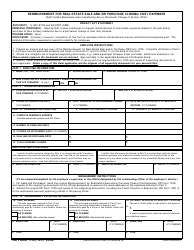

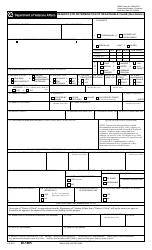

Form I-290 Nonresident Real Estate Withholding - South Carolina

What Is Form I-290?

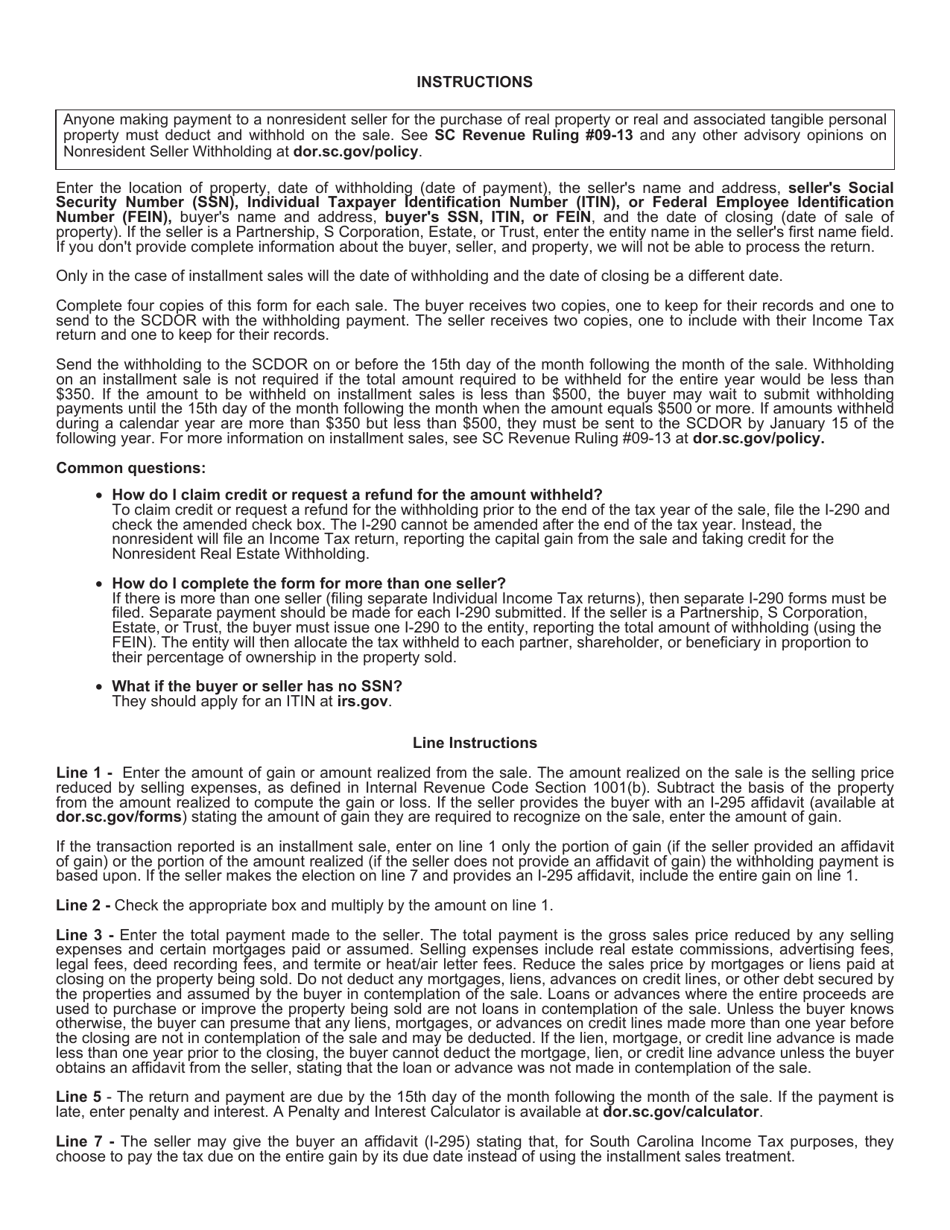

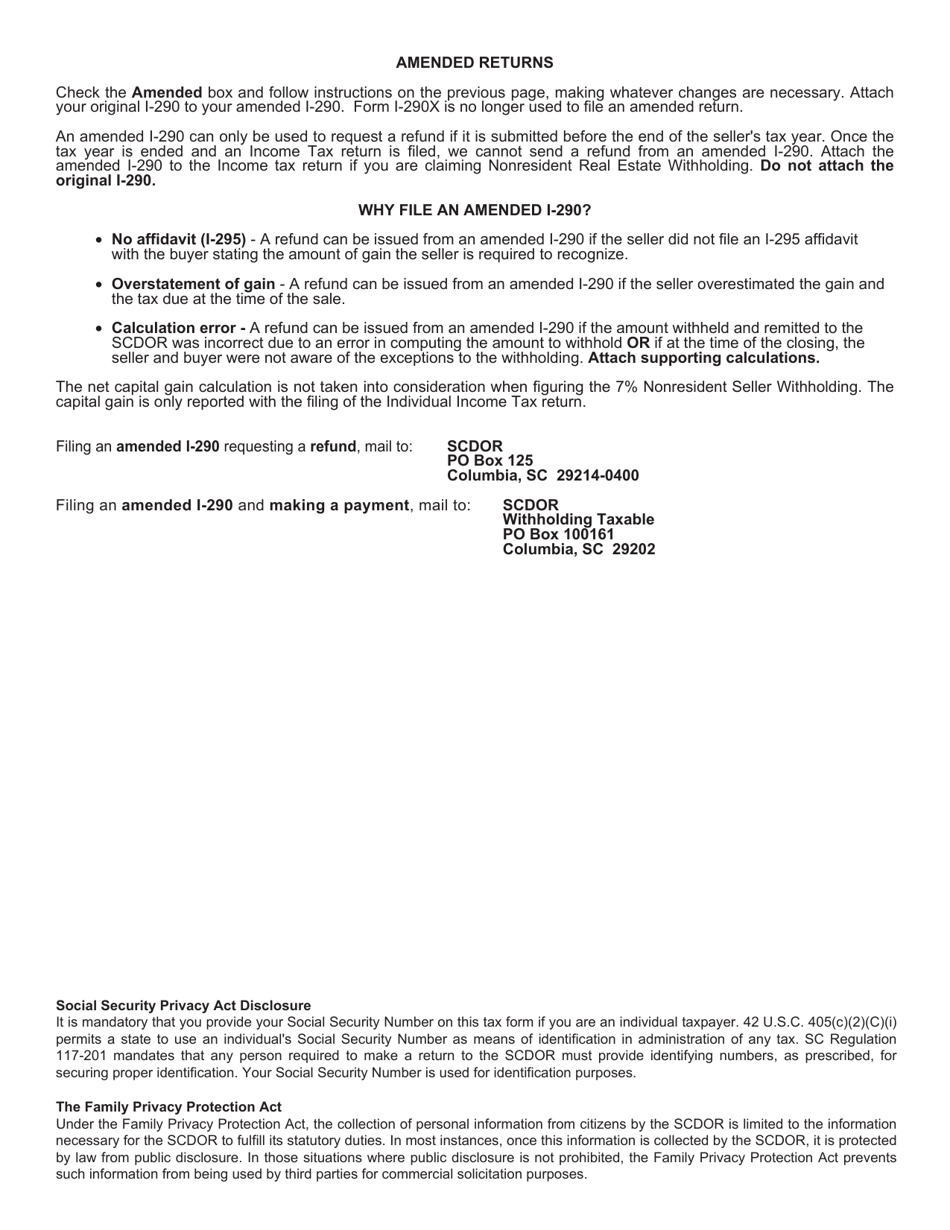

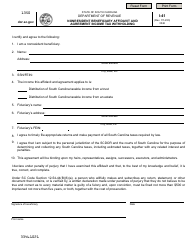

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-290?

A: Form I-290 is the Nonresident Real Estate Withholding Return.

Q: Who needs to file Form I-290?

A: Nonresident individuals or entities who are selling South Carolina real estate are required to file Form I-290.

Q: What is the purpose of Form I-290?

A: Form I-290 is used to report and remit the withholding tax on the sale of South Carolina real estate by nonresidents.

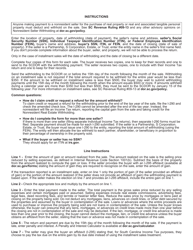

Q: What is the deadline for filing Form I-290?

A: Form I-290 must be filed within 20 days after the date of closing or completion of the sale.

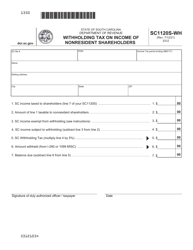

Q: What is the withholding tax rate for nonresident real estate sales in South Carolina?

A: The withholding tax rate is currently set at 7% of the total sales price.

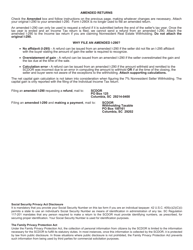

Q: Are there any exemptions from withholding?

A: Yes, certain types of transactions and entities may be exempt from withholding. Consult the instructions for Form I-290 or the South Carolina Department of Revenue for more information.

Q: What happens to the withheld amount?

A: The amount withheld will be credited toward the seller's South Carolina income tax liability.

Q: Do I still need to file a South Carolina income tax return if I have already filed Form I-290?

A: Yes, you are still required to file a South Carolina income tax return to report the sale and pay any additional tax liability.

Form Details:

- Released on July 30, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-290 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.