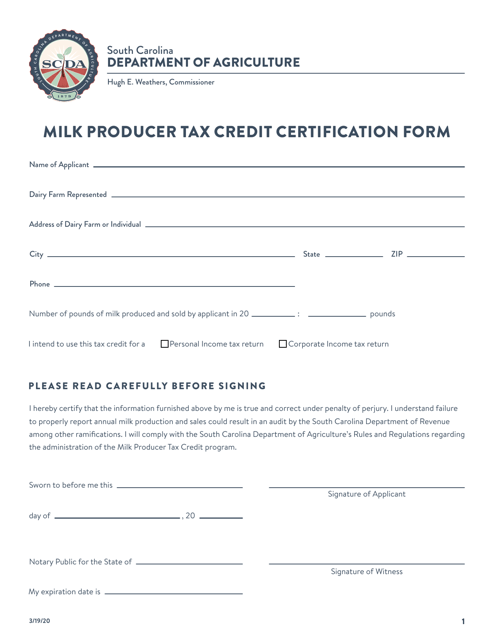

Milk Producer Tax Credit Certification Form - South Carolina

Milk Producer Tax Credit Certification Form is a legal document that was released by the South Carolina Department of Agriculture - a government authority operating within South Carolina.

FAQ

Q: What is the Milk Producer Tax Credit Certification Form?

A: The Milk Producer Tax Credit Certification Form is a document used in South Carolina to claim tax credits for milk producers.

Q: Who is eligible to use the form?

A: Milk producers in South Carolina are eligible to use the form.

Q: What is the purpose of the tax credit?

A: The tax credit aims to support and incentivize milk production in South Carolina.

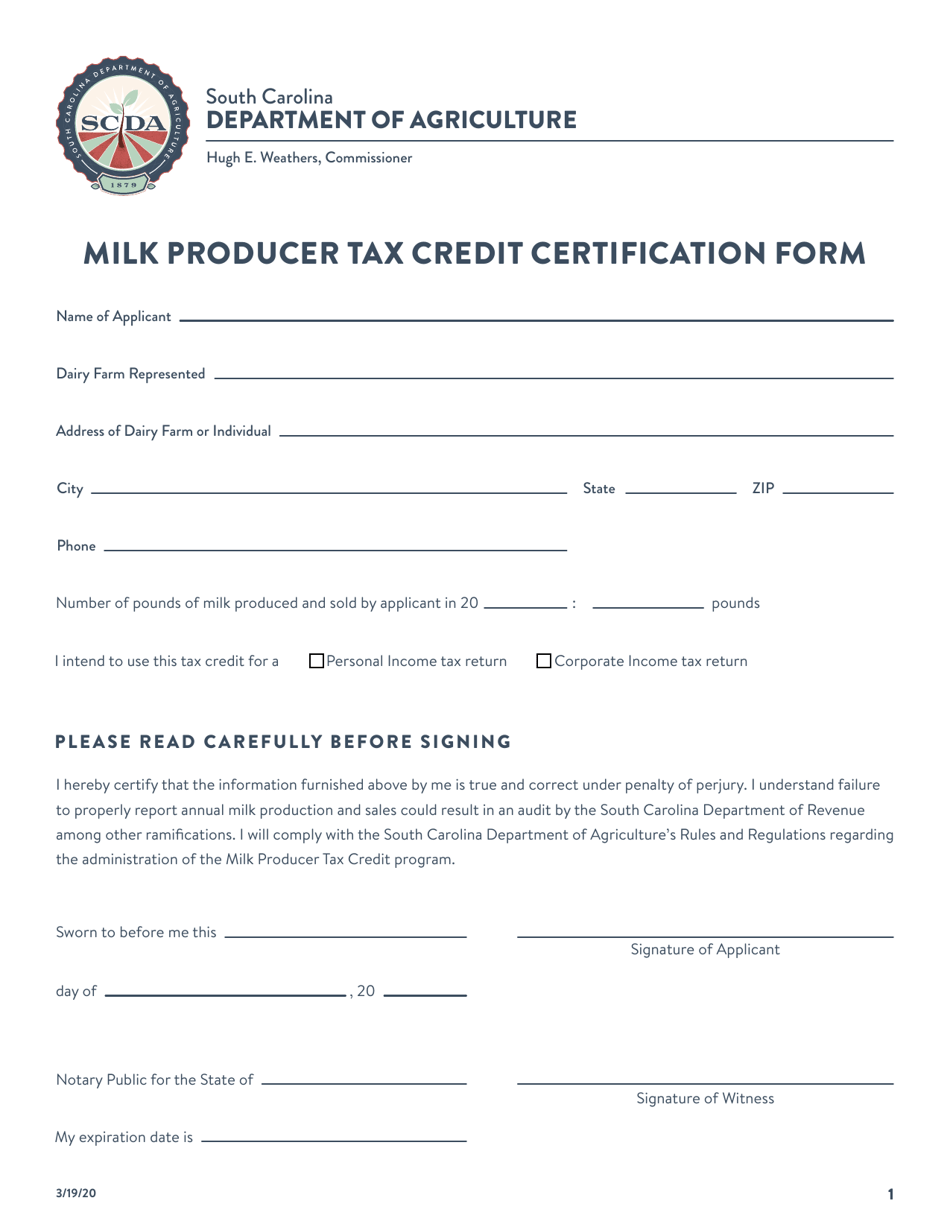

Q: What information is required on the form?

A: The form requires information such as the name and address of the milk producer, the amount and type of milk produced, and other details related to the operation.

Q: When is the deadline to submit the form?

A: The deadline to submit the Milk Producer Tax Credit Certification Form is typically specified by the South Carolina Department of Revenue.

Q: What should I do with the completed form?

A: You should submit the completed form to the South Carolina Department of Revenue along with any necessary supporting documentation.

Q: How much is the tax credit worth?

A: The amount of the tax credit can vary and is determined by the South Carolina Department of Revenue.

Form Details:

- Released on March 19, 2020;

- The latest edition currently provided by the South Carolina Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Agriculture.