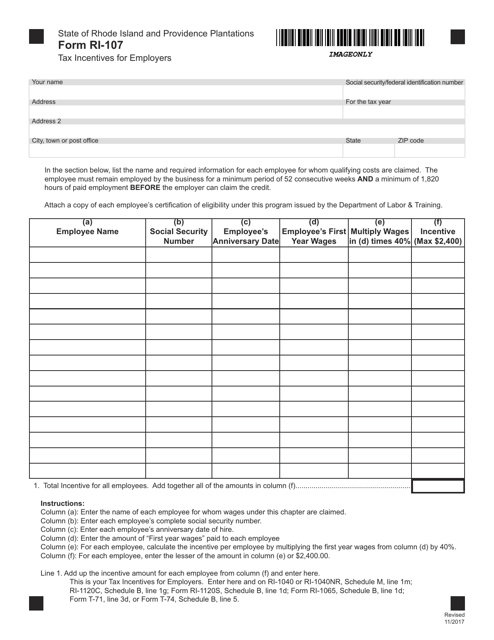

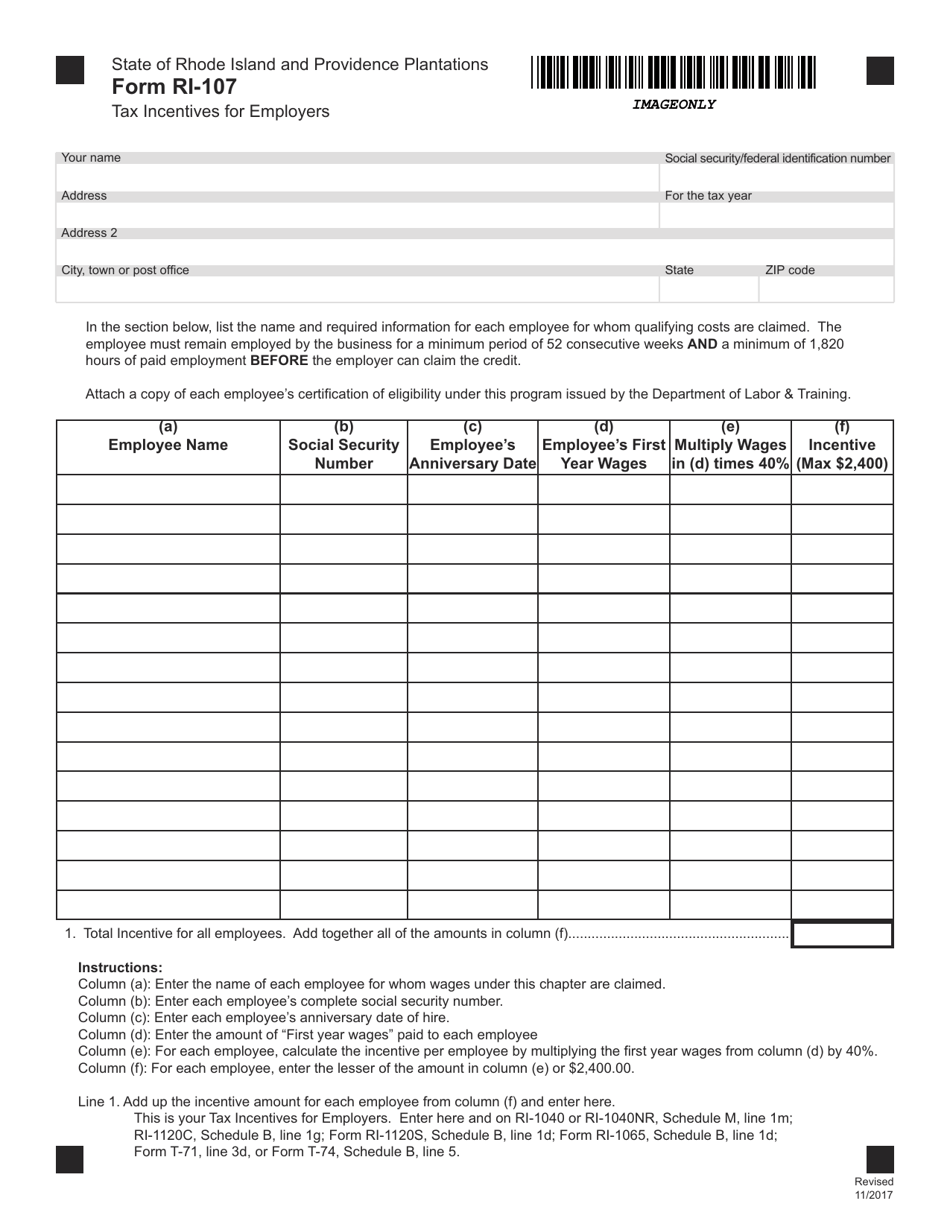

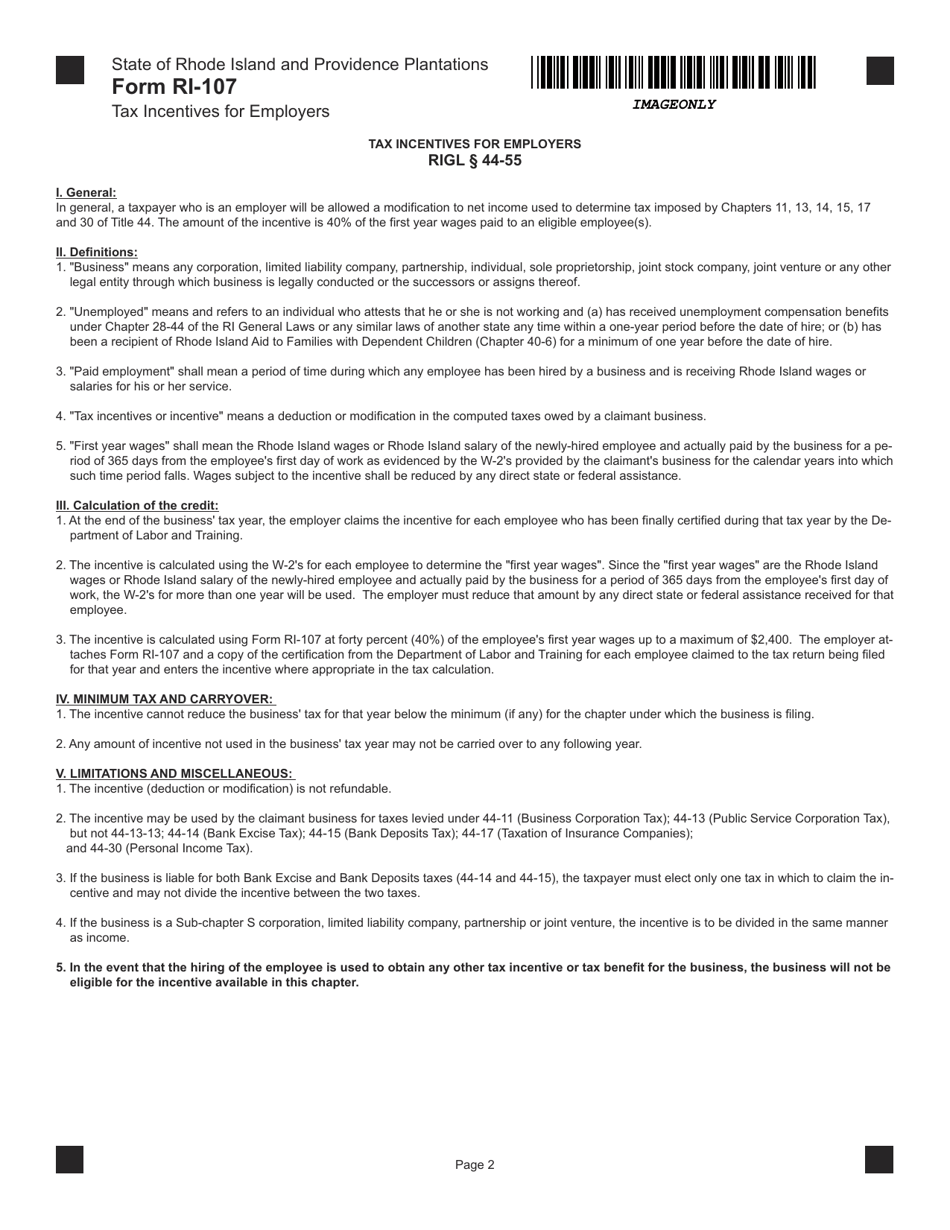

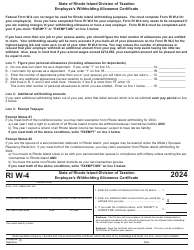

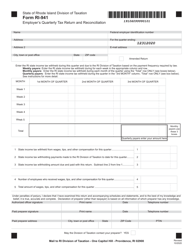

Form RI-107 Tax Incentives for Employers - Rhode Island

What Is Form RI-107?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI-107?

A: Form RI-107 is a document that contains information about tax incentives for employers in Rhode Island.

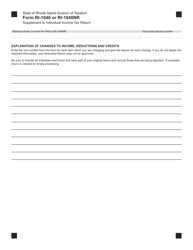

Q: What are tax incentives for employers?

A: Tax incentives are special benefits or exemptions offered by the government to encourage businesses to create jobs and invest in the local economy.

Q: Who is eligible for tax incentives?

A: Eligibility for tax incentives depends on various factors such as the number of jobs created, the type of business activity, and meeting certain criteria set by the government.

Q: How can employers benefit from tax incentives?

A: Employers can benefit from tax incentives by reducing their tax liabilities, receiving financial assistance or grants, or gaining other advantages that help them save money or grow their business.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-107 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.