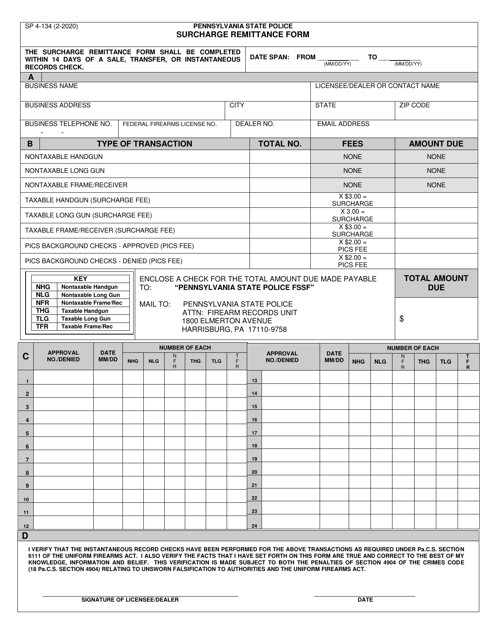

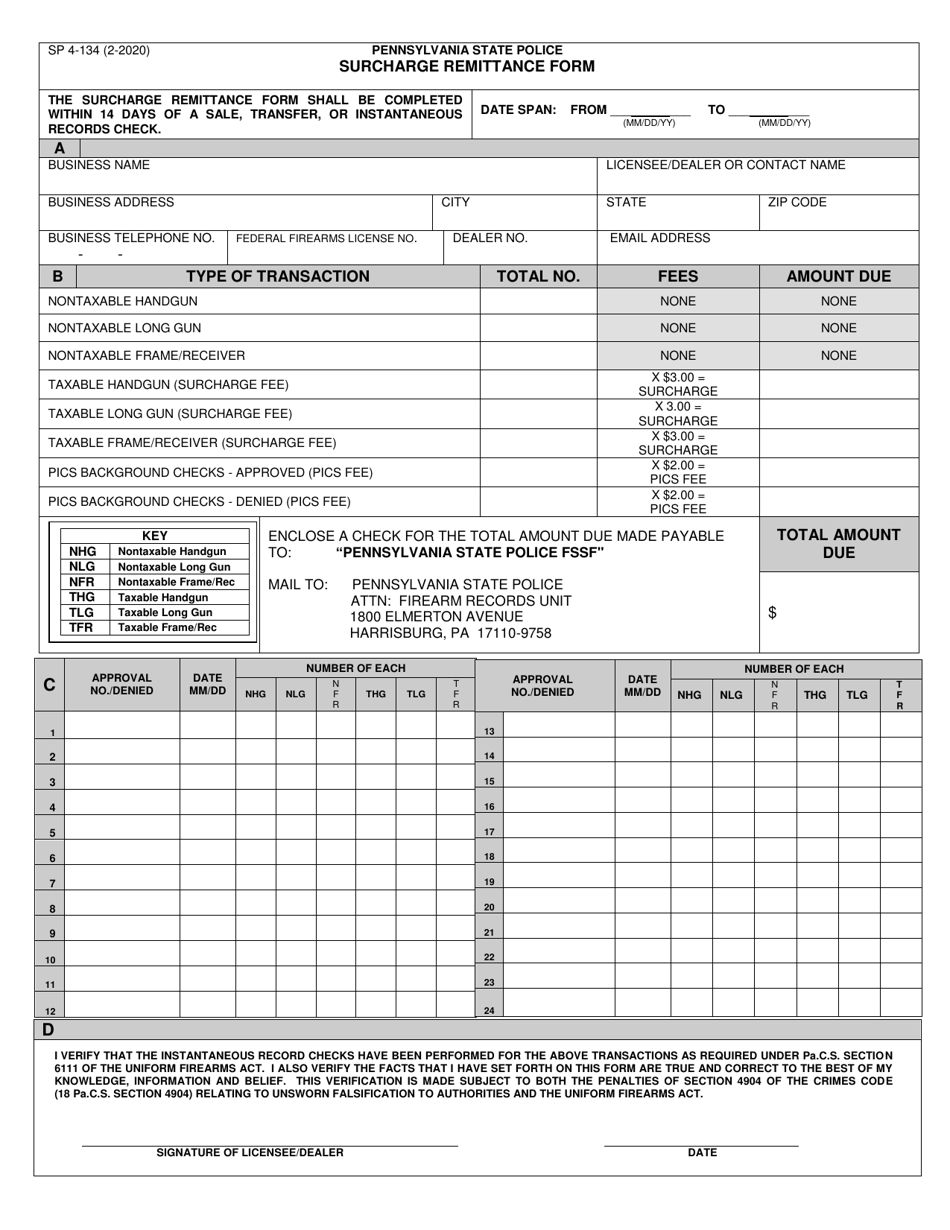

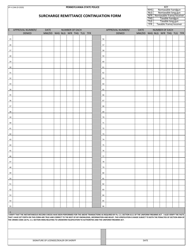

Form SP4-134 Surcharge Remittance Form - Pennsylvania

What Is Form SP4-134?

This is a legal form that was released by the Pennsylvania State Police - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SP4-134?

A: Form SP4-134 is the Surcharge Remittance Form used in Pennsylvania.

Q: What is the purpose of Form SP4-134?

A: The purpose of Form SP4-134 is to remit surcharges to the state of Pennsylvania.

Q: Who needs to file Form SP4-134?

A: Businesses that are required to collect and remit surcharges in Pennsylvania need to file Form SP4-134.

Q: What are surcharges?

A: Surcharges are additional fees or taxes imposed on certain goods or services.

Q: How often do you need to file Form SP4-134?

A: Form SP4-134 needs to be filed on a monthly basis.

Q: What information is required on Form SP4-134?

A: Form SP4-134 requires information such as the taxpayer's identification number, gross sales, and the amount of surcharges collected.

Q: When is Form SP4-134 due?

A: Form SP4-134 is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form SP4-134?

A: Yes, there may be penalties for late filing or non-compliance with the surcharge requirements.

Q: Can Form SP4-134 be filed electronically?

A: Yes, Form SP4-134 can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Pennsylvania State Police;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SP4-134 by clicking the link below or browse more documents and templates provided by the Pennsylvania State Police.