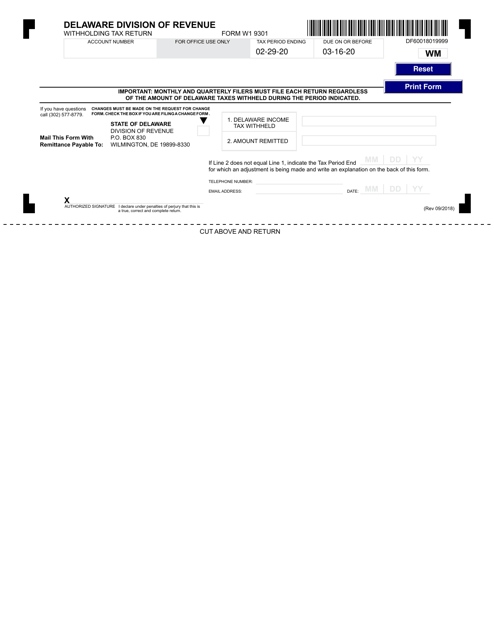

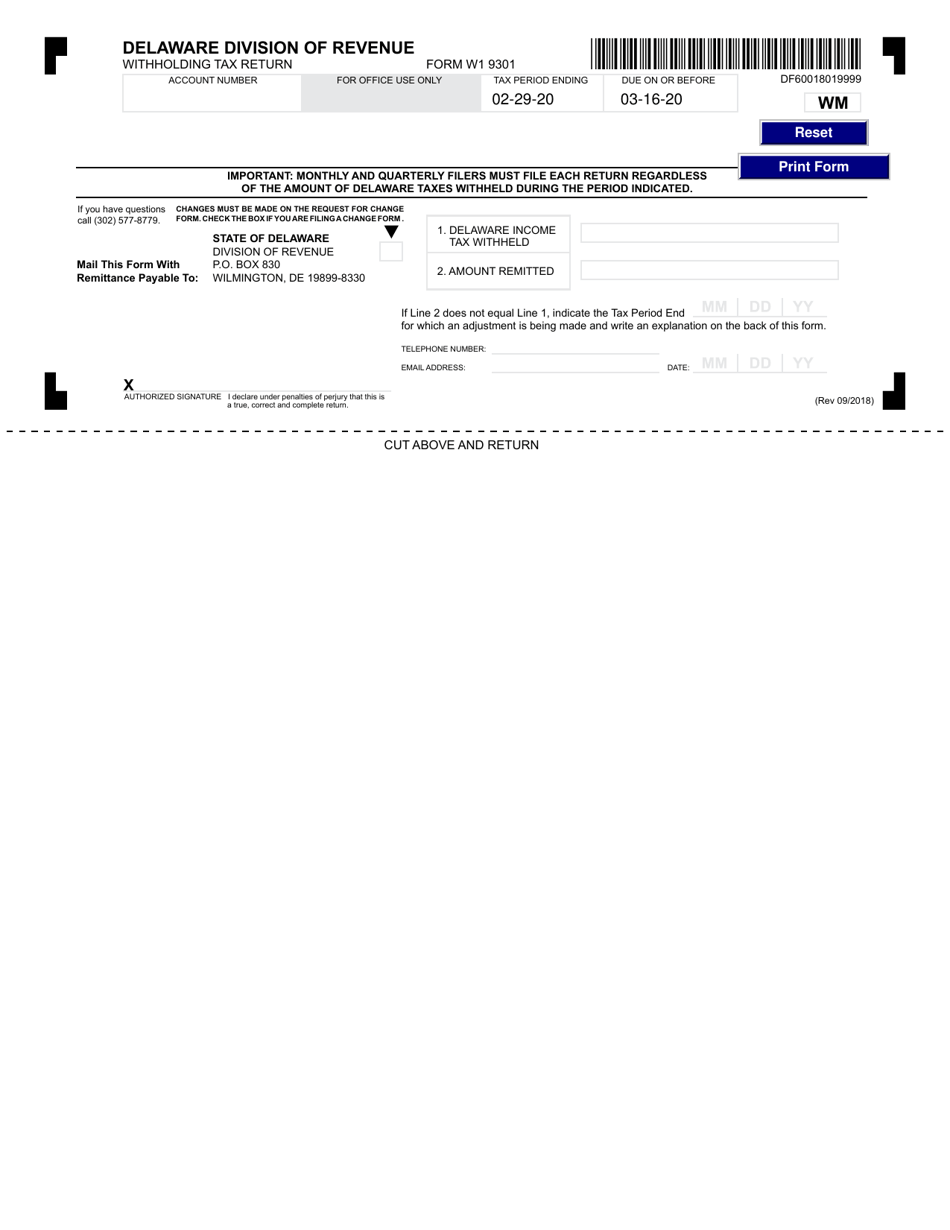

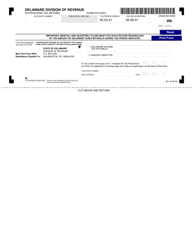

Form W1 Monthly Withholding Reporting Form - Delaware

What Is Form W1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W1?

A: Form W1 is the Monthly Withholding Reporting Form for employers in Delaware.

Q: Who needs to file Form W1?

A: Employers in Delaware who have employees subject to income tax withholding must file Form W1.

Q: What information is required on Form W1?

A: Form W1 requires employers to report the total wages paid to employees and the amount of income tax withheld.

Q: When is Form W1 due?

A: Form W1 is due on a monthly basis, with the due date being the 20th day of the following month.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.