This version of the form is not currently in use and is provided for reference only. Download this version of

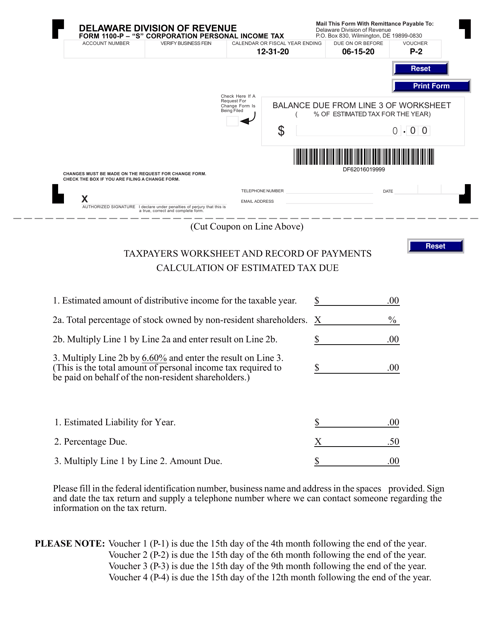

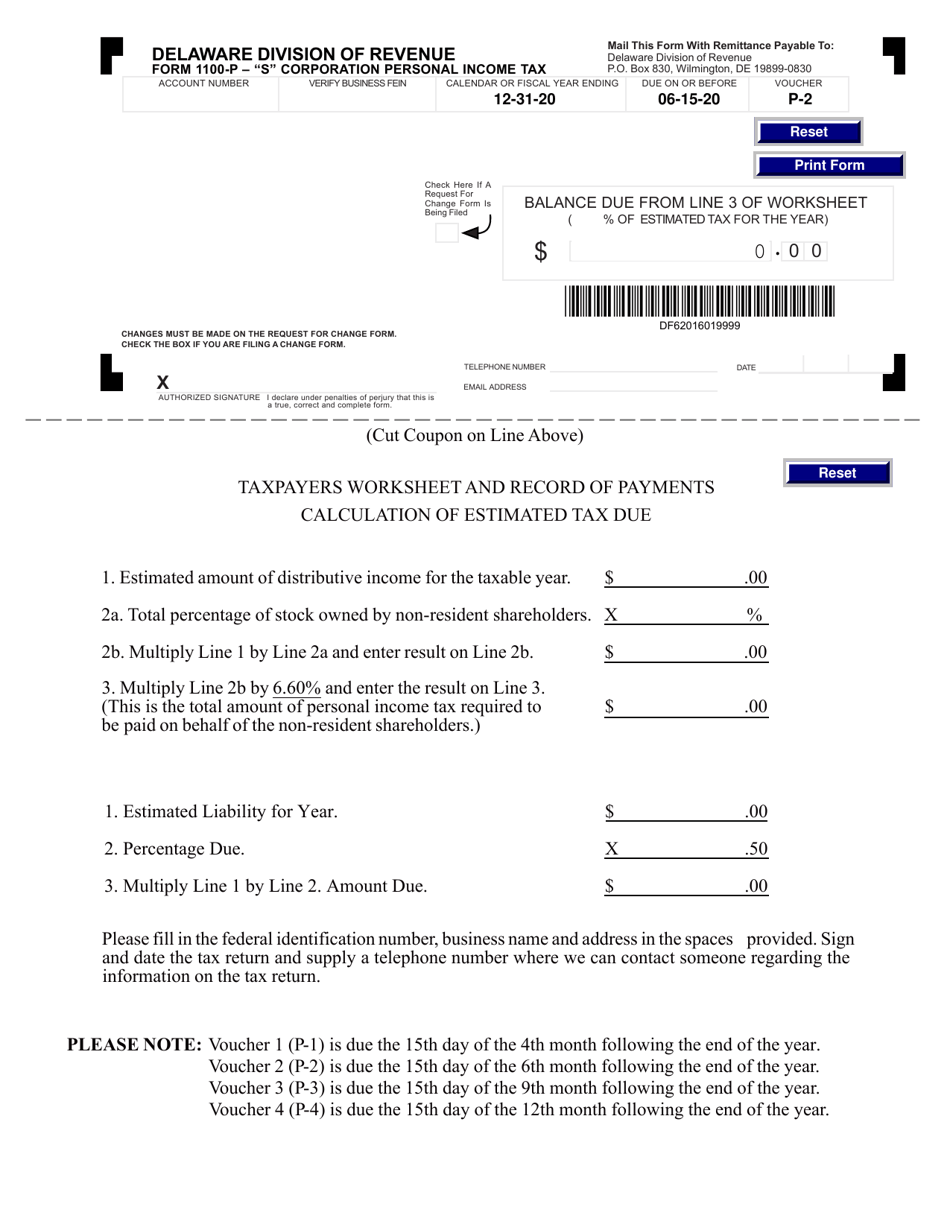

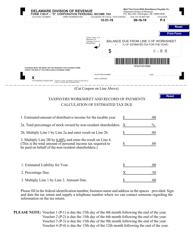

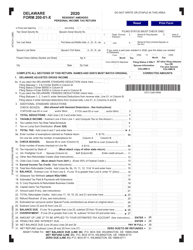

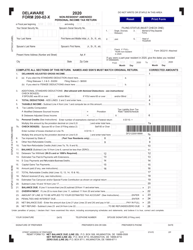

Form 1100P-2

for the current year.

Form 1100P-2 "s" Corporation Personal Income Tax - Delaware

What Is Form 1100P-2?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100P-2?

A: Form 1100P-2 is a tax form for reporting personal income tax for S corporations in Delaware.

Q: Who needs to file Form 1100P-2?

A: S corporations operating in Delaware need to file Form 1100P-2 to report their personal income tax.

Q: When is the deadline for filing Form 1100P-2?

A: The deadline for filing Form 1100P-2 is April 15th of each year, or the due date of the federal income tax return, whichever is later.

Q: What information do I need to complete Form 1100P-2?

A: To complete Form 1100P-2, you will need information on the S corporation's income, deductions, credits, and other relevant financial details.

Q: Are there any penalties for not filing Form 1100P-2?

A: Yes, there are penalties for not filing Form 1100P-2 or filing it late. It is important to file the form and pay any taxes owed on time to avoid penalties.

Q: Can I file Form 1100P-2 electronically?

A: Yes, Delaware allows S corporations to file Form 1100P-2 electronically through the Division of Revenue's e-filing system.

Q: Do I need to include any attachments with Form 1100P-2?

A: You may need to include certain attachments along with Form 1100P-2, such as a copy of the S corporation's federal income tax return and any supporting documents for deductions or credits claimed.

Q: What should I do if I have questions or need assistance with Form 1100P-2?

A: If you have questions or need assistance with Form 1100P-2, you can contact the Delaware Division of Revenue for guidance or consult with a tax professional.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100P-2 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.