This version of the form is not currently in use and is provided for reference only. Download this version of

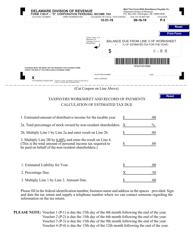

Form 1100P-1

for the current year.

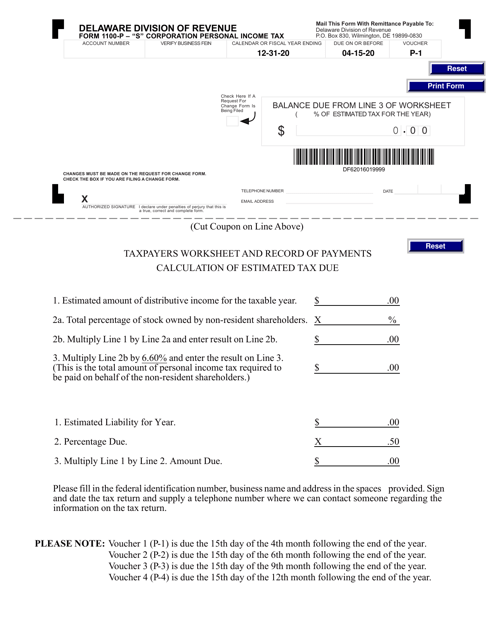

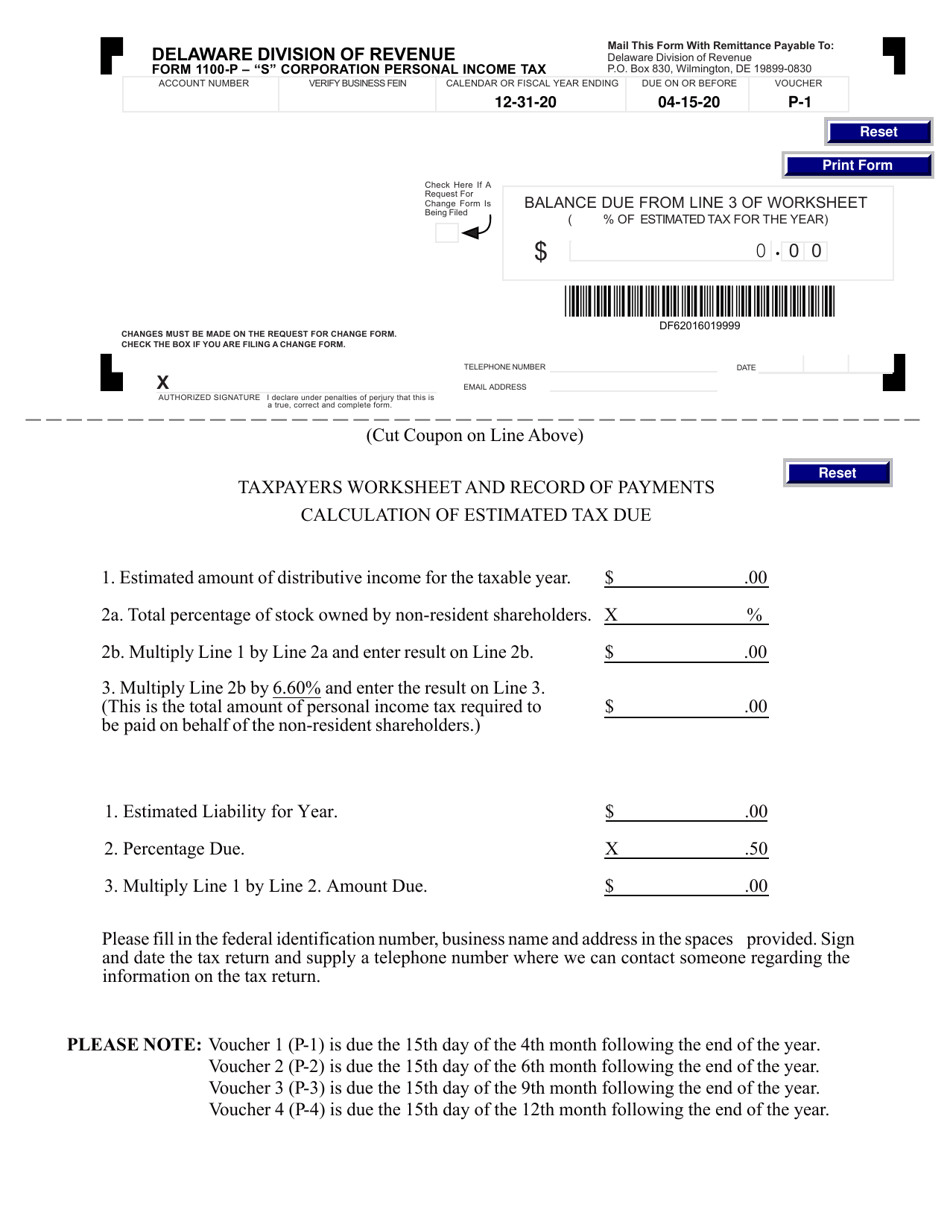

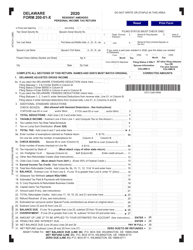

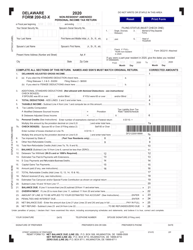

Form 1100P-1 "s" Corporation Personal Income Tax - Delaware

What Is Form 1100P-1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100P-1?

A: Form 1100P-1 is the "S" Corporation Personal Income Tax form for Delaware.

Q: Who needs to file Form 1100P-1?

A: S corporations in Delaware need to file Form 1100P-1 to report their personal income tax.

Q: What information is required on Form 1100P-1?

A: Form 1100P-1 requires information about the S corporation's income, deductions, and credits.

Q: When is the deadline to file Form 1100P-1?

A: The deadline to file Form 1100P-1 is the same as the federal income tax deadline, which is usually April 15th.

Q: Are there any filing fees for Form 1100P-1?

A: No, there are no filing fees for Form 1100P-1 in Delaware.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100P-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.